When it comes to investing, one of the most important questions to consider is how to balance risk and reward. A key aspect of this is determining the percentage of your portfolio that should be invested in safe assets, such as bonds or cash equivalents. This allocation can vary depending on your investment goals, risk tolerance, and time horizon. Generally, a higher percentage of safe assets is recommended for those who are more risk-averse or have a longer investment period, as it provides a buffer against market volatility. Understanding this balance is crucial for investors to make informed decisions and build a well-diversified portfolio that aligns with their financial objectives.

What You'll Learn

- Risk Tolerance: Understand your risk profile to determine safe stock allocation

- Asset Allocation: Diversify with a mix of safe and risky investments

- Long-Term Goals: Prioritize safe stocks for long-term financial stability

- Market Volatility: Safe stocks offer stability during market downturns

- Investment Horizon: Longer horizons may allow for more aggressive safe stock investments

Risk Tolerance: Understand your risk profile to determine safe stock allocation

Understanding your risk tolerance is a crucial step in determining the appropriate allocation of safe stocks in your investment portfolio. It involves assessing your financial goals, time horizon, and emotional comfort with market volatility. This self-evaluation is essential because it directly impacts the types of investments you make and, consequently, the potential returns and risks associated with your portfolio.

Risk tolerance is a measure of an individual's ability to withstand market fluctuations and potential losses. It is influenced by personal factors such as age, income, financial obligations, and investment experience. Younger investors, for instance, often have a higher risk tolerance due to their longer investment time horizons and a greater capacity to recover from potential losses. In contrast, older investors might prefer a more conservative approach to minimize the impact of market downturns.

To determine your risk tolerance, consider the following questions: What is your investment goal? Are you saving for retirement, a child's education, or a specific financial objective? How long do you plan to invest for? The answers to these questions will help you understand the level of risk you can afford to take. For long-term goals, such as retirement, a higher allocation of safe stocks might be appropriate, as you have more time to recover from potential market declines.

Additionally, evaluate your emotional response to market volatility. Do you become anxious or stressed during market downturns? If so, you may have a lower risk tolerance and should consider a more conservative investment strategy. On the other hand, if you remain calm and confident during market fluctuations, you might be more comfortable with a higher allocation of riskier assets.

Once you have a clear understanding of your risk tolerance, you can make informed decisions about the percentage of your investments that should be in safe stocks. Safe stocks, often referred to as defensive stocks, tend to be less volatile and provide a more stable source of income and capital appreciation. Examples include utilities, consumer staples, and healthcare companies. By allocating a portion of your portfolio to these safe stocks, you can balance risk and potentially enhance your overall investment returns over the long term.

Sahara India Investment: Navigating Risks and Rewards

You may want to see also

Asset Allocation: Diversify with a mix of safe and risky investments

Asset allocation is a fundamental concept in investing, and it involves dividing your investment portfolio across different asset classes to achieve a balance between risk and return. When it comes to determining the percentage of your investments that should be in safe assets, it's essential to consider your financial goals, risk tolerance, and investment horizon.

The idea of allocating a portion of your portfolio to safe investments is to provide a stable foundation for your overall strategy. Safe assets, such as government bonds, high-quality corporate bonds, and money market instruments, offer lower risk and more predictable returns. These investments are typically considered a hedge against market volatility and can provide a sense of security, especially for those approaching retirement or seeking long-term capital preservation. By including safe assets, investors can ensure that a portion of their capital is protected, even during turbulent market conditions.

The percentage of your portfolio that should be allocated to safe investments can vary depending on various factors. Generally, it is recommended to have a higher allocation of safe assets for more conservative investors or those with a lower risk tolerance. For instance, an individual approaching retirement age might consider having a larger portion of their portfolio in safe investments to ensure a steady income stream and principal preservation. On the other hand, younger investors with a longer investment horizon may opt for a more aggressive approach, with a higher percentage of their portfolio in risky assets, allowing for potential higher returns over time.

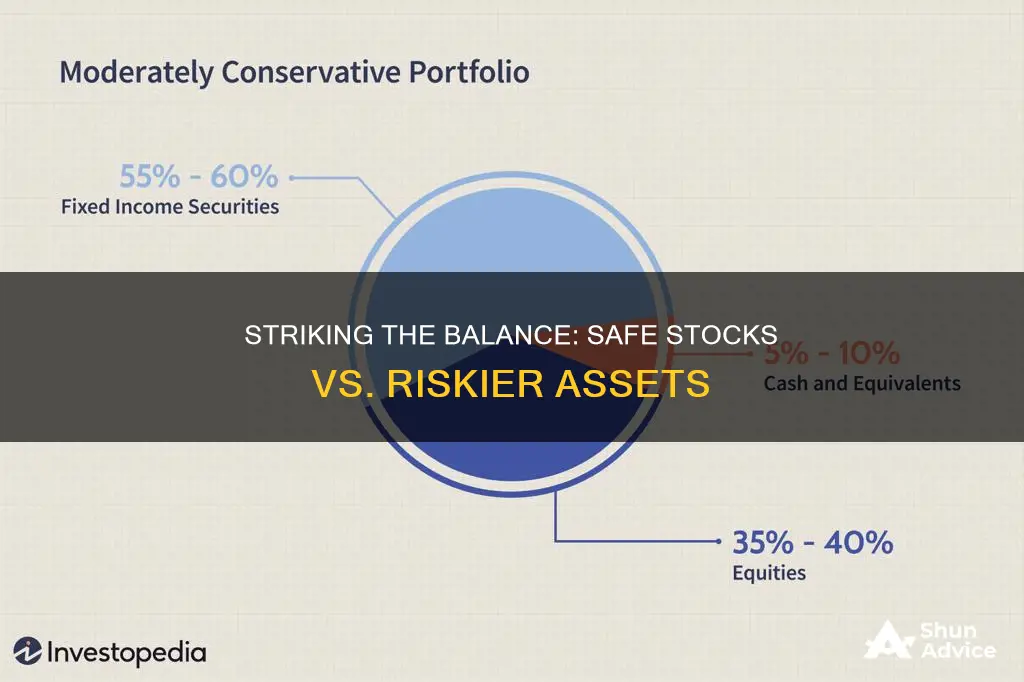

A common rule of thumb often cited is the 60/40 rule, which suggests allocating 60% of your portfolio to stocks (risky assets) and 40% to bonds or other fixed-income securities (safe assets). However, this allocation can be adjusted based on individual circumstances. For example, if you have a higher risk tolerance and are willing to accept more volatility in exchange for potentially higher returns, you might allocate a larger percentage to stocks. Conversely, if you prioritize capital preservation and are more risk-averse, you may increase your allocation to safe investments.

It's important to remember that asset allocation is not a static decision but rather a dynamic process that should be regularly reviewed and rebalanced. Market conditions, economic trends, and personal financial goals can all influence the optimal allocation of your investments. By periodically assessing your portfolio's performance and making adjustments, you can ensure that your asset allocation remains aligned with your risk tolerance and investment objectives. Diversifying your portfolio with a mix of safe and risky investments is a strategic approach that can help manage risk, optimize returns, and provide a well-rounded investment strategy.

Understanding the Portfolio Investment Scheme: A Guide

You may want to see also

Long-Term Goals: Prioritize safe stocks for long-term financial stability

When it comes to long-term financial planning, prioritizing safe stocks is a prudent strategy that can significantly contribute to your overall financial stability. While the idea of investing in safe stocks might seem counterintuitive to some, especially those seeking high returns, it is a fundamental aspect of a well-rounded investment portfolio. The primary goal of long-term investing is to build wealth over an extended period, and this approach can help achieve that while minimizing risks.

Safe stocks, often associated with blue-chip companies, are typically those of established, financially stable corporations with a long history of consistent performance. These companies usually have a strong market presence, a solid balance sheet, and a history of paying dividends. Investing in such stocks can provide a sense of security, knowing that your capital is relatively protected, and the risk of sudden, significant losses is reduced. This is particularly important for long-term goals, as it allows investors to focus on the bigger picture without constantly worrying about short-term market fluctuations.

Determining the ideal percentage of your portfolio dedicated to safe stocks depends on various factors, including your risk tolerance, investment horizon, and financial objectives. Generally, a higher allocation to safe stocks is recommended for those in the early stages of their investment journey or those seeking a more conservative approach. For instance, a young investor with a long-term investment horizon might allocate a larger portion, say 60-70%, to safe stocks, while still maintaining a smaller allocation for riskier, high-growth investments. This balanced approach ensures that the portfolio benefits from the stability of safe stocks while also capturing potential growth opportunities.

Diversification is key when incorporating safe stocks into your portfolio. It involves spreading your investments across various sectors and industries to reduce the impact of any single stock's performance on your overall portfolio. By diversifying, you can still benefit from the long-term growth potential of the market while minimizing the risks associated with individual stock volatility. This strategy is particularly effective when combined with a well-researched and carefully selected list of safe stocks.

In summary, prioritizing safe stocks in your long-term investment strategy is a sound decision that can contribute to financial security and peace of mind. It allows investors to build a robust foundation for their financial future, providing stability and a solid starting point for wealth accumulation. While it may not offer the highest potential returns, it is a crucial component of a comprehensive investment plan, especially for those seeking a more conservative and secure approach to long-term financial goals.

Strategies for Allocating Your Investment Portfolio Wisely

You may want to see also

Market Volatility: Safe stocks offer stability during market downturns

Market volatility is an inherent aspect of the financial markets, and it can be a significant concern for investors, especially those seeking long-term wealth accumulation. During periods of market downturns, the performance of investments can vary widely, and many investors wonder how to navigate these turbulent waters. One strategy that has gained prominence is the focus on safe stocks, which can provide stability and act as a hedge against market volatility.

Safe stocks, often referred to as defensive stocks, are typically associated with companies that operate in essential sectors and have a history of consistent performance, even during economic recessions. These companies often provide goods and services that are considered necessities, such as healthcare, utilities, consumer staples, and consumer durables. For example, pharmaceutical companies, electric utility providers, and food manufacturers are often considered safe bets because their products and services are relatively immune to the ebb and flow of consumer sentiment and economic cycles.

The appeal of safe stocks lies in their ability to generate steady income and maintain their value when other investments are underperforming. During market downturns, these stocks tend to be less affected by the panic selling and negative sentiment that can drive prices lower. As a result, they can provide a much-needed anchor for an investment portfolio, ensuring that a significant portion of the capital remains intact and continues to grow. This is particularly important for long-term investors who aim to weather market storms and build wealth over extended periods.

When considering the allocation of your investments, it is generally recommended to have a portion dedicated to safe stocks, especially if you are risk-averse or in a stage of your investment journey where capital preservation is a priority. The exact percentage can vary depending on individual circumstances and risk tolerance. Some financial advisors suggest a range of 20% to 40% of your portfolio should be allocated to safe, defensive stocks, while others may recommend a higher percentage for those seeking a more conservative approach.

In conclusion, market volatility can be a challenging aspect of investing, but incorporating safe stocks into your portfolio can provide a sense of stability and security. These stocks have a proven track record of withstanding economic downturns and can serve as a valuable tool for investors looking to protect their capital and generate consistent returns. By carefully selecting companies in essential sectors, investors can build a robust and resilient investment strategy that is better equipped to handle the uncertainties of the market.

Equity Investment: Legal Fees and Their Place in the Process

You may want to see also

Investment Horizon: Longer horizons may allow for more aggressive safe stock investments

When considering the allocation of your investments, the investment horizon plays a crucial role in determining the appropriate percentage of your portfolio that should be invested in safe stocks. For those with a longer investment horizon, a more aggressive approach towards safe stock investments can be justified.

A longer investment horizon typically refers to a time frame that extends beyond the short-term market fluctuations and economic cycles. This could mean investing for a period of 10 years or more. During this extended timeframe, investors can take advantage of the power of compounding and the potential for long-term growth. Safe stocks, often associated with stable and established companies, can provide a solid foundation for such long-term strategies.

In this context, 'safe stocks' generally refer to investments in well-established, blue-chip companies with a history of consistent performance and a strong balance sheet. These companies often pay stable dividends and have a low risk of bankruptcy. By investing in such safe stocks, investors can benefit from the stability and predictability they offer, especially when combined with a long-term investment strategy.

For investors with a longer horizon, the focus can be on building a robust and diversified portfolio that includes a significant portion of safe stocks. This approach allows for a more aggressive allocation to these safe investments, as the long-term nature of the strategy mitigates the immediate risks associated with individual stock volatility. Over time, the compounding effect of reinvesting dividends and the potential for capital appreciation can lead to substantial growth.

However, it is essential to strike a balance. While a longer horizon allows for more aggressive safe stock investments, it is still crucial to maintain a well-diversified portfolio. This diversification can be achieved by including a mix of safe stocks, growth-oriented investments, and potentially some higher-risk, higher-reward assets. Regular reviews and adjustments to the portfolio should be made to ensure it aligns with the investor's goals and risk tolerance.

Starbucks' Investment Risk: What's the Coffee Giant's Gamble?

You may want to see also

Frequently asked questions

A common strategy is to allocate a portion of your portfolio to safe investments, typically considered low-risk or fixed-income securities. The percentage can vary depending on your risk tolerance, investment goals, and time horizon. A popular rule of thumb is the 60/40 model, where 60% of your portfolio is in stocks or aggressive investments, and 40% is in safe investments like bonds, treasury bills, or high-quality fixed-income securities. This allocation provides a balance between potential growth and capital preservation.

The allocation of safe investments depends on your personal financial situation and objectives. Younger investors with longer investment horizons might opt for a higher percentage of stocks to maximize growth potential. In contrast, older investors or those approaching retirement may prefer a larger portion of safe investments to ensure capital stability and income generation. It's essential to regularly review and rebalance your portfolio to align with your changing circumstances and goals.

While having all your investments in safe assets can provide a sense of security, it may also limit potential returns. Safe investments generally offer lower yields compared to riskier assets. Diversifying your portfolio with a mix of safe and aggressive investments can help manage risk and provide a more balanced approach. This strategy allows you to benefit from potential growth while also having a safety net during market downturns.

Safe investments include government bonds, municipal bonds, treasury bills, certificates of deposit (CDs), and high-quality corporate bonds. These assets are generally considered low-risk because they are backed by governments or highly creditworthy entities. Additionally, money market funds and savings accounts can also be considered safe investments, offering liquidity and minimal risk. It's important to research and understand the specific risks and returns associated with each safe investment option.