When it comes to investing, one of the most basic principles is to reduce your risk as you get older. This is because retirees don't have the luxury of time to wait for the market to recover after a dip. So, what should your investment portfolio look like at 35? At this age, you should be focused primarily on the growth potential of stocks in your retirement savings. With several decades until retirement, you have enough time to benefit from the long-term growth potential of stocks while riding out any short-term volatility. It's also important to start saving for retirement as early as possible to take full advantage of the power of compounding over several decades. While there is no one-size-fits-all answer, and individual circumstances vary, a general rule of thumb is to subtract your age from 100, 110 or 120 to determine the percentage of your portfolio that should be in stocks. So, if you're 35, that would equate to 65%, 75% or 85% in stocks.

| Characteristics | Values |

|---|---|

| Age | 35 |

| Investment portfolio | Should be focused on stocks, with some allocation to bonds and cash |

| Stocks | 42% US stocks, 8% international stocks |

| Bonds | Less than 5% |

| Cash | $62,449 (26.9%) |

| Emergency fund | 3-6 months' worth of living expenses |

| Savings target | 15% of annual income |

| Retirement savings | 11 times ending salary |

| Retirement age | 65 |

Stocks vs bonds

When it comes to investing, there is no one-size-fits-all approach, and the "right" mix of stocks and bonds in your investment portfolio at 35 will depend on various factors, including your financial goals, risk tolerance, and investment horizon. Here are some insights and considerations to help you make informed decisions about your portfolio's asset allocation:

Stocks and bonds are two primary asset classes that offer different risk and return profiles.

Stocks (also known as equities) represent ownership in a company and are considered growth investments. They tend to provide higher returns over the long term but come with higher risk and volatility. Stock prices can fluctuate significantly, and there is a chance of losing your entire investment if a company goes bankrupt. However, historically, the stock market has trended upward, rewarding long-term investors with solid returns.

Bonds, on the other hand, are a type of fixed-income security. When you buy a bond, you essentially lend money to a company or government in exchange for periodic interest payments and the return of your principal at maturity. Bonds are often seen as more defensive investments, as they are less volatile than stocks and can provide a steady income stream. However, their returns are typically lower than stocks, and they may not offer much capital appreciation.

Factors to Consider for Your Portfolio:

At 35, you likely have a longer investment horizon and can tolerate more risk. Here are some factors to consider when deciding on the stocks-bonds mix in your portfolio:

- Financial Goals and Risk Tolerance: The first step is to define your financial objectives and risk tolerance. Are you saving for retirement, a down payment on a house, or some other financial goal? How comfortable are you with market volatility and potential losses? These factors will guide your asset allocation.

- Time Horizon: Your investment horizon matters. If you're investing for the long term (e.g., for retirement), you can typically tolerate more risk and allocate a larger portion of your portfolio to stocks. If you're saving for a shorter-term goal, you may want to reduce risk by allocating more to bonds.

- Diversification: Diversification is a key principle in investing. It involves spreading your investments across various asset classes, sectors, and individual securities to reduce risk. Instead of putting all your money in a few stocks or bonds, consider diversifying across multiple investments. This way, if one investment performs poorly, others may offset those losses.

- Historical Performance: While past performance doesn't guarantee future results, it's worth considering historical trends. Historically, stocks have generally outperformed bonds over the long term, but they also come with higher volatility.

- Your Overall Financial Situation: Your overall financial situation, including your income, expenses, and other investments, will influence your portfolio allocation. If you have stable income and can tolerate volatility, you may tilt more towards stocks. If you have other income streams or investments, you may be able to take on more risk in your portfolio.

Sample Allocation Strategies:

- Conventional Asset Allocation Model: This model suggests subtracting your age from 100 to determine the percentage of your portfolio allocated to stocks. For a 35-year-old, this would mean 65% in stocks and 35% in bonds.

- New Life Asset Allocation Model: This model is based on the idea that people are living longer. It recommends subtracting your age from 120. For a 35-year-old, this would suggest a 85% allocation to stocks and 15% to bonds.

- Survival Asset Allocation Model: This model is for risk-averse individuals. It recommends a 50/50 split between stocks and bonds to reduce the impact of a potential stock market collapse, as bonds often increase in value during such periods.

- Nothing-To-Lose Asset Allocation Model: This model is for those who want to take on more risk and are confident in their ability to withstand market fluctuations. It suggests going all-in on stocks, especially if you have a long investment horizon and/or other income streams.

Final Thoughts:

Remember, there is no one-size-fits-all approach to investing, and your portfolio should be tailored to your specific circumstances and goals. It's essential to periodically review and rebalance your portfolio to ensure it aligns with your objectives. Consider seeking advice from a financial professional to help create a personalised investment strategy.

Additionally, keep in mind that investing involves risk, and there is always the potential for loss. Diversification and a long-term perspective can help mitigate some of these risks but do not guarantee profit or protect against losses.

Invest Your Savings Wisely: A California Guide

You may want to see also

Risk tolerance

An investor with a high-risk tolerance is often described as an aggressive investor. These investors are willing to risk losing money in pursuit of potentially better results. Their portfolios typically emphasise capital appreciation and include stocks, with little to no allocation to bonds or cash. Aggressive investors tend to be market-savvy and follow strategies aimed at achieving higher-than-average returns.

On the other hand, conservative investors have a lower risk tolerance and seek investments with guaranteed returns. They prefer investments with low volatility and are often close to retirement age. Their portfolios may include bank certificates of deposit (CDs), money markets, or US Treasuries, which offer income and preservation of capital.

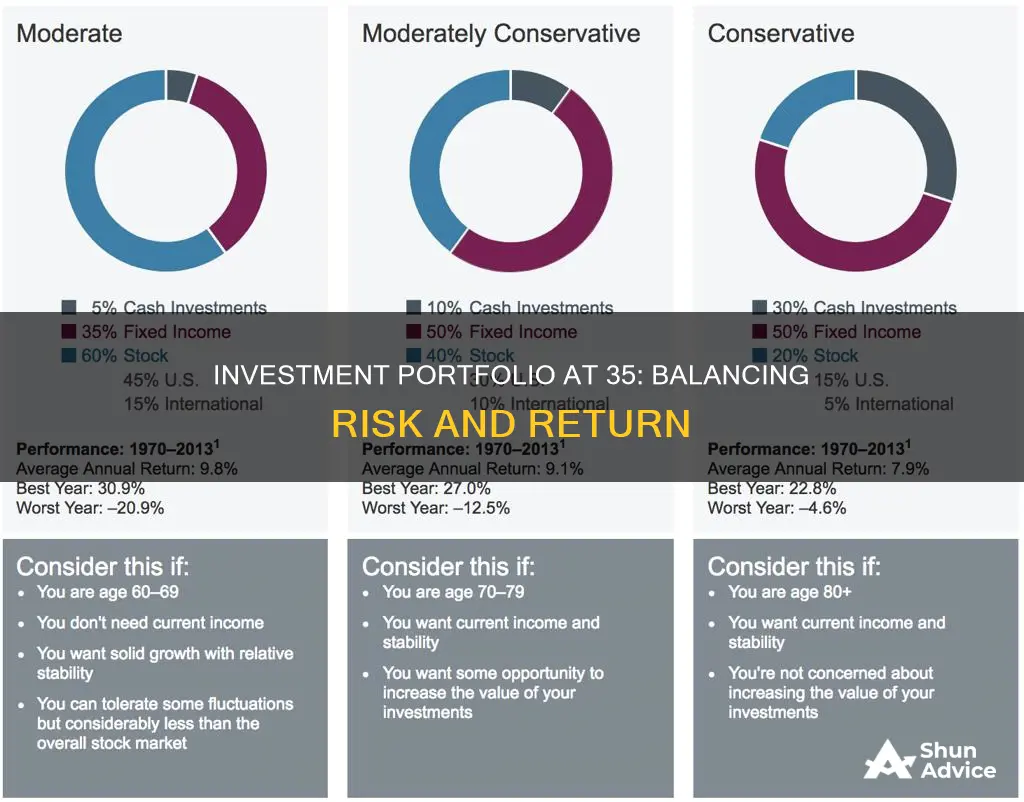

Moderate investors, as the name suggests, take a balanced approach. They aim to grow their money while minimising losses. Their portfolios typically include a mix of stocks and bonds, such as a 50/50 or 60/40 structure.

It's important to note that risk tolerance can change over time, as investors' circumstances and goals evolve. Additionally, risk tolerance is just one factor in investment planning, and it's essential to consider it alongside other factors such as financial goals, time horizon, and investment experience.

To determine your risk tolerance, ask yourself the following questions:

- What are your investment objectives? Are you aiming to grow your nest egg, or preserve and generate income from it?

- When do you need the money? The time horizon for your investments will impact your risk tolerance. Shorter-term goals typically require lower risk.

- How would you react to a significant loss in your portfolio? Consider how you would respond to hypothetical challenges and worst-case scenarios.

- What is your level of investment experience? Be honest about your knowledge of the investing landscape and expand your financial literacy if needed.

Maximizing Your HSA Savings: Is Investing Right For You?

You may want to see also

Retirement goals

Retirement planning can be intimidating, especially when retirement seems far off in the future. However, it is important to make steady progress toward saving for retirement, no matter your age. Here are some retirement goals to consider as you plan your investment portfolio at 35:

Savings Benchmarks

It is recommended that by age 35, you should aim to save one to one-and-a-half times your current salary for retirement. This is an attainable target if you start saving from age 25. By age 50, the goal is to have saved three-and-a-half to six times your salary, and by age 60, your retirement savings goal should be six to 11 times your salary. These ranges increase with age to account for varying incomes and situations.

Percentage of Income

Saving 15% of your income per year (including any employer contributions) is considered an appropriate savings level for retirement. If you are a higher earner, you may want to aim beyond 15%.

Investments

When it comes to investments, the old rule of thumb was to subtract your age from 100 to determine the percentage of your portfolio to keep in stocks. For example, if you are 30, you should keep 70% of your portfolio in stocks. However, with increased life expectancy, some financial planners now recommend subtracting your age from 110 or 120 instead, as you will need the extra growth that stocks can provide to make your money last longer.

Emergency Fund

It is important to have an emergency fund to cover at least three months' worth of net income for unplanned expenses. This fund will help you stay financially secure and avoid touching your retirement savings in case of a crisis.

Insurance

Ensure that you have adequate insurance coverage, including health, disability, property, and casualty insurance. Disability insurance is particularly important to protect your income-earning ability in the event of an accident or illness. If you have dependents, life insurance is also crucial.

Debt Management

Focus on paying off any "bad" debt, such as credit cards or personal loans with interest rates greater than 7%. Make sure that any "good" debt, like student loans or mortgages with interest rates below 7%manageable and fits comfortably within your budget.

Budgeting

Learn how to budget effectively and find a system that works for you. This may involve tracking every penny or simply ensuring that you take care of your bills, contribute to savings, and spend any surplus freely.

Salary and Raises

If you have been with your employer for a while and have proven your value, consider asking for a raise. This can help boost your income and accelerate your retirement savings.

Financial Planning

Consider connecting with a financial planner or advisor to help you navigate the complexities of retirement planning and ensure that you are on track to meet your goals. They can provide personalized advice based on your unique circumstances.

Visualizing Your Investment Portfolio: A Graphical Guide

You may want to see also

Emergency funds

Amount

It is generally recommended to have three to six months' worth of necessary expenses set aside as an emergency fund. This amount can vary depending on your personal circumstances, financial obligations, and risk factors. For example, if you have children or a long commute, you may want to save towards the higher end of this range.

Accessibility

Investment Options

If you want to invest your emergency fund to earn higher returns, there are several options available. You can consider placing your emergency fund in a money market account, high-yield savings account, or certificate of deposit (CD). These options generally provide higher interest rates than traditional savings accounts while still offering relatively low risk and liquidity.

Money market accounts, offered by banks or credit unions, often provide APYs of around 3% to 4%. They are considered low-risk and may come with debit card or check-writing privileges. High-yield savings accounts, often found at online banks, can offer similar interest rates, but be aware that accessing funds through an online-only account may take several days.

CDs can provide even higher interest rates, especially those with longer maturities. However, withdrawing money from a CD before it matures usually incurs a penalty, making it a less liquid option. To balance this, you can create a CD ladder by purchasing multiple smaller CDs with different maturity dates. This increases liquidity and helps avoid early withdrawal penalties.

Risk Considerations

When investing your emergency fund, it is essential to consider your risk tolerance and time horizon. While investing in stocks may provide higher returns, they are generally not recommended for emergency funds due to their volatility. If you need to sell stocks during a market downturn, you may be forced to accept significant losses. Bonds are generally less volatile, but they may still take time to sell.

A well-diversified portfolio of low-risk assets, such as short-term treasury bonds, can be a suitable option for investing your emergency fund. This helps minimize volatility and maximize diversification. Additionally, consider overfunding your emergency fund by 10-30% to account for potential market corrections.

Peace of Mind

Remember that the primary purpose of an emergency fund is to provide financial security and peace of mind. If you have a low-risk tolerance, it may be preferable to keep your emergency fund in a safe, low-interest savings account rather than investing it. The emotional aspect of investing is crucial, and the potential loss to inflation may be worth avoiding.

Fidelity OTC Portfolio: Is It a Smart Investment Move?

You may want to see also

Asset allocation

- Time Horizon: Your investment horizon is the amount of time you have to invest and achieve your financial goals. If you're investing for the long term, such as for retirement, you may be able to take on more risk and allocate a larger portion of your portfolio to stocks. If your investment horizon is shorter, you may want to focus on more conservative investments to preserve your capital.

- Risk Tolerance: Different asset classes carry different levels of risk. Stocks are typically considered riskier but offer higher potential returns, while bonds are less risky and provide more stable returns. Your risk tolerance depends on your financial goals, investment horizon, and personal comfort with volatility.

- Diversification: Diversifying your portfolio across different asset classes, such as stocks, bonds, and cash, can help manage risk. By spreading your investments across various assets, you reduce the impact of any single investment on your overall portfolio.

- Rebalancing: Over time, the performance of different assets in your portfolio may cause your original asset allocation to shift. Rebalancing involves periodically adjusting your portfolio back to your desired allocation. For example, if stocks have performed well and exceed your desired allocation, you may sell some stocks and buy bonds to return to your target allocation.

Now, let's look at how asset allocation may change over time, specifically by the time you are 35:

By your mid-30s, it's crucial to have established a habit of putting money away for retirement and other financial goals. While you may still be focused on your career and managing various financial obligations, it's important to prioritize consistent contributions to your retirement accounts.

At this stage, you may want to maintain a higher allocation of stocks in your portfolio, as you have time to ride out short-term volatility and take advantage of the long-term growth potential. However, you might also consider introducing a small allocation of bonds to your portfolio to add stability.

- Focus on Growth: With several decades until retirement, prioritize the growth potential of stocks in your portfolio. You have time to recover from market downturns, so allocating a larger portion of your portfolio to stocks can potentially maximize your returns over the long term.

- Start Introducing Bonds: While stocks should still be a significant portion of your portfolio, consider adding a small allocation of bonds to introduce more stability. This can help manage the overall risk of your portfolio as you approach your 40s and get closer to retirement.

- Take Advantage of Compound Interest: Compound interest has a more significant impact the earlier you start investing. By consistently contributing to your retirement accounts in your 30s, you can benefit from the effects of compound interest over the long term.

- Utilize Employer Matching: If your employer offers matching contributions to your retirement plan, be sure to contribute enough to take full advantage of this benefit. It's essentially free money that can boost your retirement savings.

- Consider Target-Date Funds: Target-date funds automatically adjust their asset allocation based on your estimated retirement year. They can be a hands-off way to manage your asset allocation over time, gradually shifting from more aggressive to more conservative investments as you get closer to retirement.

Remember, these are general guidelines, and your specific circumstances may vary. It's always a good idea to consult a financial professional to help you create a personalized investment plan that considers your risk tolerance, time horizon, and financial goals.

Effective Yield: Understanding Your Investment Portfolio's Performance

You may want to see also

Frequently asked questions

A commonly cited rule of thumb is that the percentage of stocks in your portfolio should equal 100 minus your age. However, with people living longer, many financial planners are now recommending that the rule should be closer to 110 or 120 minus your age.

Other types of assets to invest in include bonds, cash and cash equivalents, commodities, real estate, futures, and other derivatives. Each asset class has a different level of risk and reward and behaves differently over time, depending on what's happening in the overall economy and other factors.

It's important to regularly monitor the performance of your portfolio holdings. Be sure to assess your risk tolerance, consider your target asset allocation based on that risk level, and compare your current portfolio to your target.