Mutual funds are a popular investment tool for both individual and professional investors. They are a type of investment product where the funds of many investors are pooled into a diversified portfolio of stocks, bonds, or other securities. This provides investors with access to a wide range of assets and the benefits of professional management, making it a relatively hands-off way to invest.

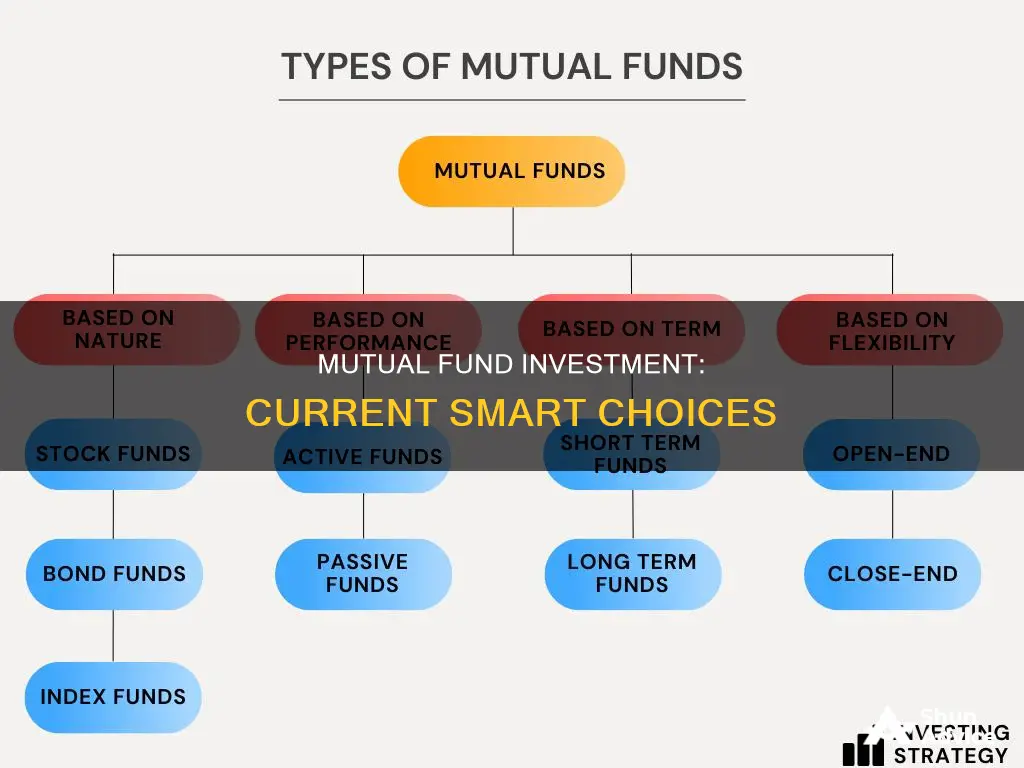

There are many different types of mutual funds available, including stock, bond, money market, and target-date funds, each with its own investment strategy, risk level, and fees. When choosing a mutual fund to invest in, it is important to consider your financial goals, risk tolerance, and the fund's performance and fees.

Some of the best-performing mutual funds for September 2024 include the Fidelity International Index Fund, Schwab S&P 500 Index Fund, and Vanguard Long-Term Investment-Grade Fund Investor Shares. These funds offer diversified portfolios with low fees, providing investors with the potential for strong returns.

With thousands of mutual funds available on the market, understanding your financial goals and risk tolerance is crucial to choosing the right fund for your needs.

| Characteristics | Values |

|---|---|

| Investment type | Stocks, bonds, real estate, commodities, money market, international, regional, sector, theme, socially responsible, target-date, equity, debt, fixed-income, index, balanced, income, etc. |

| Investment objective | Long-term capital gains, current income, retirement, etc. |

| Risk tolerance | High, medium, low |

| Investment horizon | Short-term, long-term |

| Investment style | Active, passive |

| Investment amount | Minimum investment amount, lump sum, SIP |

| Fees | Expense ratio, sales load, redemption fees, account fees, etc. |

| Returns | Dividends, portfolio distributions, capital gains distribution |

What You'll Learn

Stock mutual funds

There are several types of stock mutual funds, including:

- Large-cap equity funds, which invest in large-cap company shares.

- Mid-cap equity funds, which invest in mid-cap companies.

- Small-cap equity funds, which invest in small-cap companies.

- Sector or theme funds, which aim to profit from the performance of specific sectors of the economy, such as finance, technology, or healthcare.

When investing in stock mutual funds, it is important to consider the fees associated with the funds, as these can significantly impact your overall returns. Some common fees include expense ratios, sales charges or loads, redemption fees, and other account fees.

Additionally, it is worth noting that stock mutual funds are considered riskier than other types of funds, such as bond funds or money market funds. The performance of large-cap, high-growth funds, for example, is typically more volatile than stock index funds that seek to match the returns of a benchmark index.

When deciding how many stock mutual funds to invest in, it is important to consider the level of diversification you want in your portfolio. While diversification can help reduce risk, over-diversification can prevent you from making good gains. A good rule of thumb is to own up to 2 or 3 large-cap mutual funds, up to 2 mid-cap mutual funds, and up to 2 small-cap mutual funds.

Savings Strategy: Mutual Funds Investment Allocation

You may want to see also

Bond mutual funds

Types of Bond Funds

Taxable-bond funds can be further divided into different types, such as domestic taxable-bond funds, flexible-bond funds, government-bond funds, corporate-credit funds, world- and emerging-markets bond funds, and inflation-protected bond funds.

Factors to Consider

When choosing a bond mutual fund, it is essential to consider factors such as your investment goals, risk tolerance, and time horizon. It is also important to look at the fund's expense ratio, which can impact your returns. Other fees to consider include sales fees or load fees, which may be charged at the time of purchase or sale.

Additionally, you should evaluate the fund's past performance and the portfolio manager's track record. It is also beneficial to review the fund's prospectus and research the general industry and market trends that may affect its performance.

Recommendations

According to Morningstar, some of the best bond mutual funds for 2024 include:

- American Funds Bond Fund of America (ABNDX)

- American Funds Limited-Term Tax-Exempt Bond (FLTEX)

- Dodge & Cox Income (DODIX)

- Fidelity Floating Rate High Income (FFRHX)

- Vanguard Long-Term Corporate Bond Index/ETF (VCLT)

- Schwab Short-Term US Treasury ETF (SCHO)

- PGIM Short-Term Corporate Bond (PSTQX)

In addition, Forbes Advisor recommends the following total bond market index funds:

- TIAA-CREF Bond Index Advisor (TBIAX)

- Northern Bond Index (NOBOX)

- Vanguard Total Bond Market Index Fund (VBTLX)

- Schwab U.S. Aggregate Bond Index Fund (SWAGX)

- Fidelity Sustainability Bond Index Fund (FNDSX)

- Fidelity U.S. Bond Index Fund (FXNAX)

- Fidelity Flex U.S. Bond Index Fund (FIBUX)

Mutual Fund Investing: What You Need to Know

You may want to see also

Money market mutual funds

Money market funds are not the same as money market accounts (MMAs). Money market funds are investment vehicles that are sponsored by an investment fund company and carry no guarantee of principal. On the other hand, money market accounts are a type of interest-earning savings account offered by financial institutions and are insured by the Federal Deposit Insurance Corporation (FDIC).

Money market funds are classified into various types depending on the class of invested assets, the maturity period, and other attributes. The three main types are:

- Government money market funds: These funds invest at least 99.5% of their money into highly liquid, government-backed assets such as cash, short-term U.S. government debt, and repurchase agreements backed by government debt. Income from these funds is subject to federal income tax unless held in a tax-advantaged account.

- Municipal money market funds: These funds, also known as tax-exempt or tax-free money market funds, invest in short-term municipal debt. The income generated by these funds is exempt from federal income taxes and, in some cases, state income taxes as well.

- Prime money market funds: These funds invest in short-term corporate debt rather than government debt. The income generated by prime money market funds is fully taxable unless held in a tax-advantaged account.

Money market funds are regulated by the Securities and Exchange Commission (SEC) and are protected by the Securities Investor Protection Corporation (SIPC). However, they are not insured by the Federal Deposit Insurance Corporation (FDIC).

When choosing a money market fund, it is important to consider factors such as fund availability, fund type, yields, fees, and expense ratios.

Skills for Investment Fund Managers: Expertise for Success

You may want to see also

Target-date funds

These funds are designed to invest heavily in riskier growth stocks in the early years, with the aim of racking up gains while the investor has plenty of time to recover from any short-term losses. In later years, the investment choices lean towards more conservative options to consolidate gains and avoid untimely losses. The asset allocation of a target-date fund gradually shifts to more conservative investment choices, reducing the risk of losses as the target date approaches.

Some target-date funds, known as "'through' funds", will continue to adjust the asset allocation for a specified period after the target date. Others, known as "'to' funds", will cease any modifications to the asset allocation once the target date is reached.

Index Funds vs Roth IRA: Where Should You Invest?

You may want to see also

International mutual funds

When considering investing in an international mutual fund, it is important to remember that risks and returns can vary significantly from country to country. Shifts in foreign exchange rates, political upheaval, financial troubles, and natural disasters can all impact the performance of international mutual funds.

- Wasatch International Growth Fund Institutional Class (MUTF: WIIGX): This fund seeks long-term capital growth by investing in high-quality, small-cap growth companies outside the U.S. It uses an active, collaborative, fundamental, bottom-up approach to selecting its investments. The fund's criteria for investing in foreign companies include a capitalization under $5 billion, strong financials, a sustainable competitive advantage, and earnings growth that outperforms its relevant sector or industry.

- American Funds New World Fund Class A (MUTF: NEWFX): This fund is managed by the Capital Research and Management Company and co-managed by Capital World Investors, Capital Research Global Investors, Capital Fixed Income Investors, and Capital International Investors. It invests in the fixed-income and public equity markets of emerging nations worldwide, with a focus on diversified sectors and growth and value stocks of companies of all market capitalizations.

- Templeton China World Fund Class A (MUTF: TCWAX): This equity mutual fund seeks long-term capital appreciation by investing at least 80% of its funds in Chinese companies. The fund's largest holdings include Tencent Holdings ADR, Alibaba Group, and Meituan.

- T. Rowe Price European Stock Fund (MUTF: PRESX): This fund seeks long-term capital growth by investing in the common stock of companies located in Europe, with a focus on quality management, strong franchises, strong cash flows, and reasonable valuations. Its investments are concentrated in Austria, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom.

When choosing an international mutual fund, you can also consider whether you want to invest in a global or world fund (which combines investments in foreign markets and the U.S.) or a regional fund (which focuses on a specific part of the world, like Europe or the Pacific region). You can also choose between developed markets funds (which invest in countries with proven economies, like Japan, France, and the U.K.) and emerging markets funds (which target developing economies, like India, Brazil, and Taiwan).

It is recommended that at least 20% of your portfolio be invested in international stocks and bonds. International mutual funds can provide broad exposure to international markets, allowing you to invest overseas with just a few funds.

When deciding whether to invest in international mutual funds, it is important to consider your investment goals and risk tolerance. Remember that international funds can be subject to country/regional risk and currency risk, especially in emerging markets.

Mutual Fund Investment Strategies: Where to Invest?

You may want to see also

Frequently asked questions

There are many types of mutual funds, with most falling into four main categories: stock, money market, bond, and target-date funds. Each of these funds has different investment profiles, risk levels, performance results, and fees.

Mutual funds offer several advantages, including:

- Diversification: Mutual funds provide access to a diversified portfolio of stocks, bonds, and other securities, reducing investment risk.

- Professional management: Mutual funds are managed by professionals who have the expertise to make informed investment decisions.

- Liquidity: Mutual funds offer superior liquidity compared to other investment instruments, allowing investors to buy and sell anytime.

- High returns: Historically, mutual funds have generated higher returns than traditional investment options like bank FDs, RDs, and PPF.

- Low minimum investment: Mutual funds have low minimum investment requirements, making them accessible to a wide range of investors.

- Regulation: Mutual funds are regulated by authorities like the SEBI, ensuring transparent processes and protecting investors' interests.

Choosing a mutual fund depends on your risk tolerance, investment horizon, and financial goals. Consider factors such as the fund's risk-return profile, fees, past performance, and the expertise of the fund manager. Diversification is key—balance your risk tolerance with the risk of the fund.

Mutual fund withdrawals are taxed based on whether the gains are classified as short-term or long-term capital gains. For equity funds, gains are short-term if the investment is held for less than a year, otherwise, they are long-term. For debt mutual funds, gains are short-term if held for less than three years and long-term if held for more than three years.