When considering long-term investments, it's crucial to look beyond short-term market fluctuations and focus on the underlying fundamentals of the investment. This includes assessing the financial health and stability of the company or asset, understanding its competitive advantage, and evaluating its growth potential over the long term. Additionally, consider the investment's risk profile, including market, credit, and liquidity risks, and ensure it aligns with your financial goals and risk tolerance. A well-rounded approach to long-term investing involves diversifying across different asset classes and sectors to mitigate risk and optimize returns.

What You'll Learn

- Risk and Return: Assess the potential risks and returns of the investment over the long term

- Market Position: Evaluate the company's market position and competitive advantage

- Management Quality: Look for strong, experienced, and transparent management teams

- Financial Health: Examine financial statements for stability, profitability, and debt management

- Growth Potential: Identify the factors driving future growth and expansion

Risk and Return: Assess the potential risks and returns of the investment over the long term

When considering long-term investments, understanding the relationship between risk and return is crucial. This assessment process involves evaluating the potential risks and returns associated with different investment options over an extended period. Here's a detailed guide to help you navigate this aspect:

Risk Assessment:

- Market Risk: Long-term investments often involve various market risks. These include economic downturns, industry-specific risks, and fluctuations in market trends. For instance, investing in the technology sector may expose you to rapid technological changes and increased competition. Assess the stability and growth potential of the market or industry you're investing in.

- Credit Risk: For debt-based investments, credit risk is a significant factor. It refers to the possibility of default by the borrower. Evaluate the creditworthiness of the issuer, such as a government, corporation, or financial institution. Higher credit ratings generally indicate lower credit risk.

- Liquidity Risk: Consider the ease of converting your investment into cash without significant loss. Some investments may have restrictions or penalties for early withdrawal, impacting your ability to access funds when needed.

- Interest Rate Risk: In the case of fixed-income investments, changes in interest rates can affect the value of your investment. Rising interest rates might reduce the value of existing bonds, while falling rates could impact future bond purchases.

Return on Investment (ROI) Analysis:

- Historical Performance: Research the historical performance of the investment or asset class you're considering. Past performance is not a guarantee of future results, but it provides valuable insights. Look for consistent growth or steady returns over an extended period.

- Dividend and Interest Income: For long-term investments, consistent income generation is essential. Analyze the dividend or interest payment history and frequency. Regular and increasing dividends or interest rates can contribute to long-term wealth accumulation.

- Capital Appreciation: Assess the potential for capital appreciation, which is the increase in the value of your investment over time. This is particularly important for assets like stocks or real estate, where the value can grow significantly.

- Risk-Adjusted Returns: Calculate the risk-adjusted returns by considering the volatility or risk associated with the investment. Metrics like the Sharpe ratio can help quantify the excess return per unit of risk.

Long-Term Investment Strategy:

- Diversification is a key strategy to manage risk and enhance returns. Spread your investments across different asset classes, sectors, and geographic regions to minimize the impact of any single investment's performance.

- Regularly review and rebalance your portfolio to maintain your desired risk level and asset allocation. Market conditions change, and adjustments may be necessary to stay aligned with your investment goals.

- Consider consulting a financial advisor who can provide personalized guidance based on your risk tolerance, financial goals, and time horizon.

By thoroughly assessing risks and understanding the potential returns, you can make informed decisions about long-term investments, ensuring a more secure and prosperous financial future. Remember, a well-diversified portfolio and a long-term perspective are essential components of a successful investment strategy.

Pepsi's Potential: A Long-Term Investment Strategy

You may want to see also

Market Position: Evaluate the company's market position and competitive advantage

When assessing a long-term investment, understanding a company's market position and competitive advantage is crucial. This analysis provides insights into the company's ability to sustain growth and profitability over time. Here's a detailed breakdown of what to look for:

Market Share and Growth Potential:

A company's market share is a key indicator of its success and future prospects. Look for businesses with a strong market position, meaning they hold a significant portion of the market. This could be due to brand recognition, product quality, or innovative offerings. Additionally, consider the growth potential within the industry. Is the market expanding, and is the company well-positioned to capitalize on this growth? Companies that can demonstrate consistent market share growth or a unique ability to capture market share from competitors are often attractive long-term investments.

Competitive Advantage:

What sets the company apart from its rivals? This is the essence of a competitive advantage. Look for companies with sustainable competitive advantages that provide a barrier to entry for new competitors. This could be a strong intellectual property position, such as patents or trademarks, that protects their products or services. Alternatively, it might be a unique business model, superior customer service, or a cost advantage that makes it difficult for others to replicate their success. A robust competitive advantage ensures that the company can maintain its market position and profitability even in the face of competition.

Industry Analysis:

Conduct a thorough analysis of the industry in which the company operates. Understand the industry's dynamics, including trends, growth rates, and potential disruptions. Is the industry growing, mature, or declining? Are there any external factors or technological advancements that could significantly impact the company's performance? For instance, a company in a rapidly evolving technology sector might have a competitive advantage due to its ability to innovate and adapt quickly. Understanding the industry landscape helps investors gauge the company's long-term viability.

Competitor Analysis:

Identify the company's direct and indirect competitors. Assess their strengths and weaknesses, and determine how the company stacks up against them. Look for companies that have successfully navigated industry challenges and maintained their market position. A company that consistently outperforms its competitors, even during economic downturns, is likely to have a strong market position and a competitive advantage. Analyzing competitors also helps investors anticipate potential threats and assess the company's ability to respond.

Management and Strategy:

The quality of a company's management team and its strategic vision are essential. Look for companies with experienced and competent leadership that has a clear understanding of the market and a well-defined strategy. Effective management ensures that the company's resources are utilized efficiently and that strategic decisions are made to maintain and enhance its market position. Additionally, consider the company's ability to adapt to changing market conditions and its capacity for innovation. A forward-thinking management team can identify new opportunities and mitigate risks, making the company more resilient in the long term.

Understanding the Role of Treadlines in Investment Strategies

You may want to see also

Management Quality: Look for strong, experienced, and transparent management teams

When considering long-term investments, one of the most critical factors to evaluate is the quality of management. A company's management team plays a pivotal role in its success and sustainability over an extended period. Here's why you should focus on management quality and what to look for:

Strong Leadership and Expertise: Effective long-term investments often thrive under the leadership of a competent and experienced management team. Look for individuals with a proven track record in their respective fields. Strong leaders can navigate challenges, make strategic decisions, and adapt to changing market conditions. Their expertise and industry knowledge contribute to the company's ability to capitalize on opportunities and mitigate risks effectively.

Strategic Vision and Execution: A good management team should possess a clear and well-defined strategic vision for the company's future. This vision should be backed by a comprehensive understanding of the industry, market trends, and competitive landscapes. Look for managers who can articulate a compelling strategy and execute it successfully. Effective execution ensures that the company's resources are allocated efficiently, and goals are achieved over the long term.

Transparency and Communication: Transparency is essential in building trust with investors and stakeholders. A management team that communicates openly and frequently demonstrates a commitment to transparency. Regular updates, financial reports, and insights into the company's performance should be provided. This transparency allows investors to make informed decisions and fosters a sense of accountability within the organization.

Experience in Diverse Roles: Management experience is crucial, but it's also beneficial to look for individuals who have held diverse roles within the company or industry. This diversity of experience can provide a well-rounded perspective and a deeper understanding of various business functions. Managers who have worked in different departments can offer valuable insights, ensuring that decisions are made with a comprehensive view of the organization's operations.

Adaptability and Innovation: The ability to adapt to changing market dynamics is a hallmark of strong management. Look for teams that embrace innovation and are open to new ideas. Effective managers should be agile, making strategic adjustments as needed without compromising the company's long-term goals. This adaptability ensures that the company remains competitive and relevant in a rapidly evolving business environment.

In summary, when evaluating long-term investments, management quality is a key differentiator. Strong, experienced, and transparent management teams are essential for navigating the complexities of the business world. By assessing their leadership, strategic vision, communication, and adaptability, investors can make more informed decisions and potentially identify companies with a higher likelihood of long-term success.

Trading vs. Long-Term Investing: Understanding the Key Differences

You may want to see also

Financial Health: Examine financial statements for stability, profitability, and debt management

When evaluating potential long-term investments, delving into the financial health of the underlying companies is crucial. This involves a thorough examination of their financial statements, which provide a comprehensive snapshot of their financial position and performance. Here's a breakdown of what to look for in these statements to assess stability, profitability, and debt management:

Stability:

- Revenue and Earnings Growth: Consistent revenue growth over time is a strong indicator of a healthy company. Look for steady increases in revenue and earnings per share (EPS) year-over-year and over multiple years. This suggests a growing business with a competitive advantage.

- Cash Flow: Positive cash flow from operations is essential for long-term sustainability. Analyze the cash flow statement to ensure the company generates enough cash to cover its expenses, invest in growth, and repay debts.

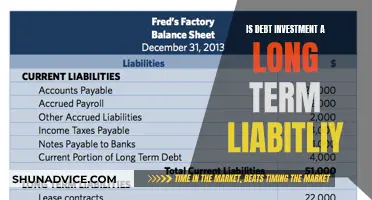

- Balance Sheet Strength: A strong balance sheet is characterized by a healthy mix of assets and liabilities. Look for a company with a low debt-to-equity ratio, indicating a reliance on equity financing rather than debt. A robust balance sheet also suggests a company capable of weathering economic downturns.

Profitability:

- Return on Investment (ROI): ROI measures how efficiently a company utilizes its assets to generate profits. Calculate ROI by dividing net income by total assets. A higher ROI indicates better profitability.

- Profit Margins: Examine gross margin, operating margin, and net profit margin. These metrics reveal how much profit a company makes from its sales, after accounting for costs. Higher profit margins suggest efficient cost management and pricing power.

- Competitive Advantage: Look for companies with a sustainable competitive advantage, such as strong brand recognition, proprietary technology, or a unique business model. This advantage allows them to maintain market share and generate higher profits over the long term.

Debt Management:

- Debt-to-Equity Ratio: As mentioned earlier, a low debt-to-equity ratio is desirable. This ratio indicates that the company relies more on equity financing than debt. A high ratio suggests a greater financial risk, as the company may struggle to service its debt during economic downturns.

- Interest Coverage Ratio: This ratio measures a company's ability to pay the interest on its debt. Calculate it by dividing earnings before interest and taxes (EBIT) by the interest expense. A higher interest coverage ratio indicates better debt management.

- Long-Term Debt Maturity: Analyze the company's debt maturity schedule. A well-diversified maturity profile with manageable repayment amounts over time is ideal. Avoid companies with a large portion of short-term debt maturing soon, as this can lead to liquidity issues.

Remember:

- Financial statements should be analyzed holistically. Look for trends and patterns across multiple periods.

- Compare the company's financial health to its industry peers to gauge its relative performance.

- Don't rely solely on financial ratios. Consider qualitative factors like management quality, market position, and competitive landscape.

By carefully examining financial statements, you can gain valuable insights into a company's stability, profitability, and debt management capabilities, enabling you to make more informed long-term investment decisions.

Understanding Short-Term Covered Calls: A Beginner's Guide to Investing

You may want to see also

Growth Potential: Identify the factors driving future growth and expansion

When considering long-term investments, understanding the factors that drive growth and expansion is crucial for making informed decisions. Here's a detailed breakdown of how to identify these key drivers:

Industry Trends and Market Dynamics:

Begin by analyzing the industry in which the investment opportunity exists. Identify the factors that are currently driving growth within that industry. This includes studying market trends, consumer behavior, technological advancements, and regulatory changes. For example, if you're looking at investments in renewable energy, explore the global shift towards sustainable practices, government incentives, and the increasing demand for clean energy solutions. Understanding these trends will help you gauge the industry's future prospects and potential for expansion.

Competitive Advantage:

Assess the company or investment vehicle's competitive advantage. What sets it apart from its competitors? Is it a strong brand reputation, innovative products or services, cost leadership, or a unique business model? A sustainable competitive advantage often translates to long-term growth potential. Look for companies that can consistently deliver value, adapt to market changes, and maintain their market position over time.

Management and Leadership:

The quality of leadership and management is a critical factor. Strong, visionary leaders who can navigate challenges and capitalize on opportunities are essential for sustained growth. Evaluate the experience, track record, and strategic vision of the company's management team. Do they have a history of making sound decisions, adapting to market changes, and driving innovation? Effective leadership can significantly impact a company's ability to expand and achieve its growth goals.

Financial Performance and Projections:

Analyze the financial health and performance of the investment. Examine historical financial data, revenue growth, profit margins, and cash flow. Look for companies with a consistent track record of financial improvement and stability. Additionally, assess the company's financial projections and assumptions. Are they realistic and supported by industry trends? Financial projections provide insight into the company's growth expectations and the potential return on investment.

Growth Strategies and Expansion Plans:

Inquire about the company's growth strategies and expansion plans. How do they intend to increase market share, diversify their product offerings, or enter new markets? Are these strategies well-defined, feasible, and aligned with industry trends? Companies with clear and realistic growth plans are more likely to achieve their expansion goals. Consider whether their strategies address potential challenges and leverage their competitive advantages.

Risk Assessment and Mitigation:

A comprehensive risk assessment is vital. Identify potential risks that could hinder growth, such as competition, regulatory changes, economic downturns, or technological disruptions. Evaluate how the company manages these risks. Do they have contingency plans and strategies to mitigate potential threats? A well-prepared company that can navigate challenges will likely demonstrate resilience and continued growth.

By carefully analyzing these factors, you can gain valuable insights into the growth potential of a long-term investment. This approach allows you to make informed decisions, considering both the industry's prospects and the specific strengths and strategies of the investment opportunity.

Navigating Loss: Strategies for Accepting and Moving On from Poor Investments

You may want to see also

Frequently asked questions

When assessing long-term investments, it's crucial to focus on factors that ensure stability, growth potential, and resilience over time. Look for companies with a strong market position, a history of consistent performance, and a competitive advantage. Analyze their financial health, including revenue growth, profitability, and debt management. Assess the industry trends and the company's ability to adapt to changing market conditions.

The management team plays a pivotal role in the success of a long-term investment. A competent and experienced leadership team with a proven track record of strategic decision-making is essential. They should demonstrate a clear vision, effective execution, and the ability to navigate challenges. Look for companies with a strong culture, transparent communication, and a commitment to ethical business practices.

Industry analysis is critical to understanding the investment landscape. It involves studying market dynamics, competitive landscapes, and growth prospects within a specific industry. Look for industries with strong growth potential, disruptive technologies, and favorable regulatory environments. Identify companies that are well-positioned to benefit from industry trends and have a unique value proposition.

Risk assessment is a vital part of the investment process. For long-term investments, consider both market and company-specific risks. Evaluate the volatility of the industry, economic cycles, and external factors that could impact the company's performance. Analyze the company's risk management strategies, including their ability to handle financial risks, operational challenges, and industry disruptions. Diversification across different sectors and asset classes can also help mitigate overall risk.

Long-term success often requires a strategic approach. Diversification is key, spreading investments across different sectors and asset classes to reduce risk. Regularly review and rebalance your portfolio to align with your investment goals. Stay informed about market trends and economic indicators. Additionally, consider investing in companies with a strong track record of dividend payments, indicating financial stability and a commitment to shareholder value.