When it comes to investing in a traditional IRA, Vanguard offers a variety of funds to choose from. A traditional IRA is a type of individual retirement account that allows your earnings to grow tax-deferred. This means that you only pay taxes on your investment gains when you make withdrawals during retirement. There are several factors to consider when choosing a Vanguard fund for your traditional IRA, including your age, risk tolerance, and investment goals. Here are some recommended Vanguard funds for traditional IRAs:

1. Vanguard Target Retirement Funds: These funds automatically adjust their asset allocation, becoming more conservative as your retirement date approaches. They offer a simple, all-in-one solution for investors.

2. Vanguard LifeStrategy Funds: These funds maintain a fixed allocation and are designed for different time horizons. For example, the Vanguard LifeStrategy Growth Fund (VASGX) is ideal for investors with a long-term horizon, while the Vanguard LifeStrategy Income Fund (VASIX) is suitable for those closer to retirement.

3. Vanguard 500 Index Admiral Shares (VFIAX): This fund offers low-cost exposure to the S&P 500 index, providing diversification within the large-capitalization market. It has a low expense ratio of 0.04%.

4. Vanguard Intermediate-Term Bond Index Admiral Shares (VBILX): This fund invests in corporate and government bonds with moderate risk and a 4.22% 30-day SEC yield. It has a low expense ratio of 0.07%.

5. Vanguard Dividend Appreciation Index Fund (VDADX): This fund focuses on high-quality companies with growing dividends, including well-known names like Apple and Microsoft. It offers long-term growth potential and an income stream for retirees.

| Characteristics | Values |

|---|---|

| Type | Individual retirement account (IRA) |

| Tax | Postpones taxes; tax-deductible contributions |

| Income limitations | No maximum income limit |

| Age limit | No age limit for contributions |

| Mandatory RMDs | Required minimum distributions (RMDs) must begin by April 1 of the calendar year following the year the holder reaches age 73 |

| Withdrawals | Withdrawals may be subject to federal income tax |

| Investment options | "All in one" fund; custom portfolio |

| Investment types | Mutual funds, ETFs, stocks, bonds |

| Investment funds | Vanguard Total Stock Market ETF (VTI); Vanguard Total Bond Market ETF (BND); Vanguard REIT Index ETF (VNQ) |

| Investment fund expense ratios | VTI: 0.03%; BND: 0.03%; VNQ: 0.12% |

| Investment fund yields | VTI: 1.59%; BND: 2.57%; VNQ: 3.98% |

| Investment fund total returns | VTI: -8.23%; BND: -9.76%; VNQ: -13.25% |

| Investment fund inception dates | VTI: May 24, 2001; BND: April 3, 2007; VNQ: Sept. 23, 2004 |

What You'll Learn

Vanguard's low fees and reasonable expenses

When it comes to investing for retirement, one of the most important things to consider is the fees you'll be paying. High fees can eat into your returns over time, so it's crucial to choose an investment option with low fees and reasonable expenses. That's where Vanguard comes in.

Vanguard is known for its low-cost approach to investing, which means more of your money stays in your pocket. The average Vanguard mutual fund and ETF (exchange-traded fund) expense ratio is an impressive 82% lower than the industry average. This means you'll be paying significantly less in fees compared to other investment options. For example, the Vanguard average expense ratio is 0.08% or 0.09%, while the industry average is 0.44% or 0.50%.

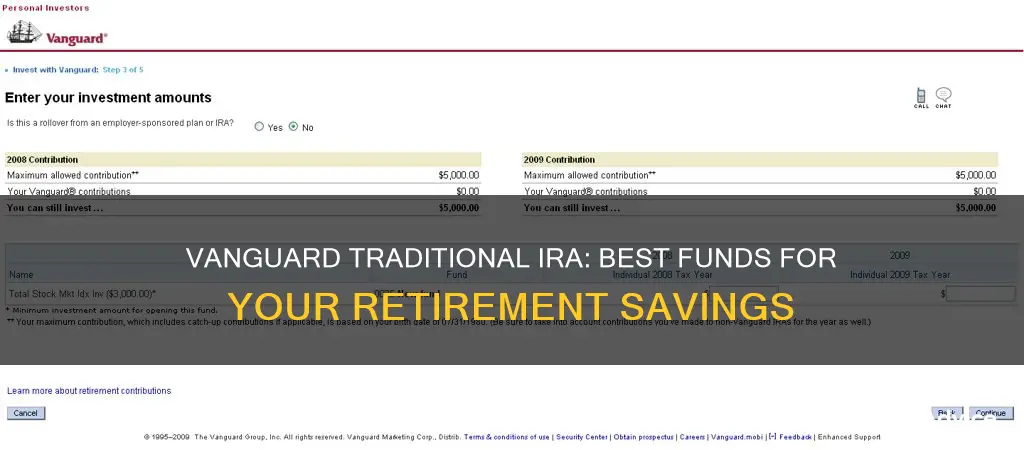

But how do they keep their fees so low? One reason is that when you buy or sell Vanguard mutual funds and ETFs online in your Vanguard account, you don't pay any commissions. You also won't pay a commission when trading stocks, ETFs, and Vanguard mutual funds online through their platform. Additionally, Vanguard offers a wide range of funds with different minimum investment requirements, starting as low as $1,000 for Vanguard Target Retirement Funds and $3,000 for most actively managed Vanguard funds.

Another way Vanguard keeps costs low is by offering funds with purchase and redemption fees. These fees are designed to cover higher transaction costs and protect long-term investors by discouraging short-term, speculative trading. While not all Vanguard funds charge these fees, they are generally lower than similar fees charged by other companies.

It's important to note that while Vanguard's fees are low, investing does come with risks. There is always the possibility of losing the money you invest, and fluctuations in financial markets can impact the value of your account. However, Vanguard provides expert help at a low cost, so you can feel confident in your investment choices.

In summary, Vanguard's low-fee structure means you keep more of your money, maximizing your returns over time. With their wide range of investment options, you can choose the funds that fit your financial goals and comfort level. So, if you're looking for a traditional IRA to save for retirement, Vanguard's low fees and reasonable expenses make it a compelling choice.

Investing Now: Choosing the Right Funds for Your Portfolio

You may want to see also

Tax-deductible contributions

A traditional IRA is a type of individual retirement account that allows your earnings to grow tax-deferred. This means that you can postpone paying taxes on your investment gains until you make withdrawals in retirement. One of the advantages of a traditional IRA is that contributions may be tax-deductible.

The tax-deductibility of your contributions depends on whether you or your spouse are covered by a retirement plan at work. If neither you nor your spouse is covered by an employer's retirement plan, your traditional IRA contributions are fully tax-deductible. In this case, you can deduct the entire amount of your IRA contribution from your income tax return. For the 2023 tax year, this would be up to $6,500 annually, or $7,500 if you're 50 or older. For the 2024 tax year, the limits are increased to $7,000 and $8,000, respectively. It is important to note that these limits are for total contributions across all your traditional IRAs, and you cannot contribute the maximum amount to each account separately.

On the other hand, if you or your spouse is covered by an employer's retirement plan, your traditional IRA contributions may still be partially tax-deductible or totally non-tax-deductible, depending on your income. In this case, the deductible amount may be reduced or eliminated.

It is worth mentioning that there is no maximum income limit for contributing to a traditional IRA, and you can invest regardless of how much you earn. Additionally, there is no longer an age limit for contributing to a traditional IRA, allowing you to make contributions for 2020 and beyond regardless of your age.

When considering tax-deductible contributions, it is important to remember that the limits on the amount you can deduct do not affect the annual amount you can contribute. However, you can never claim a tax deduction for more than what you contributed to your IRA in a given year. While tax-deductibility is an important factor, it should not be the only consideration when choosing an IRA. Other factors, such as required minimum distributions (RMDs) and taxes on withdrawals, should also be taken into account.

Mutual Funds: A Smart Investment Choice for Beginners

You may want to see also

No maximum income limit

When it comes to investing in a traditional IRA, Vanguard offers a range of options and advantages. Firstly, it's important to understand that a traditional IRA is a type of individual retirement account that allows your earnings to grow tax-deferred. This means you can postpone paying taxes until you make withdrawals in retirement. One of the key benefits of investing in a traditional IRA with Vanguard is that there is no maximum income limit. Regardless of your income level, you can invest in a traditional IRA and take advantage of tax-deductible contributions.

For the 2024 tax year, the contribution limit for a traditional IRA is $7,000 annually, or $8,000 if you're 50 or older. This annual contribution may not seem like much, but it can add up to significant savings over time, especially with the power of compounding. The earlier you start, the more your savings can grow, as your earnings generate even more earnings through interest, dividends, and capital gains.

When choosing a Vanguard fund for your traditional IRA, you have the flexibility to select investments that match your retirement goals and risk tolerance. You can keep it simple with an "all-in-one" fund, such as the Vanguard Target Retirement Fund, which is professionally managed and automatically adjusts to become more conservative as you approach retirement. Alternatively, you can customise your own portfolio by choosing from a range of Vanguard mutual funds, ETFs, stocks, and bonds.

It's important to consider your time horizon and comfort with risk when making investment choices. If you're not sure where to start, Vanguard offers expert advice at a low cost. Their investment professionals can review your options, discuss your retirement goals, and provide guidance tailored to your needs. Remember, investing involves risk, and there are no guarantees, but with Vanguard's low-cost funds and flexible options, you can take control of your retirement savings journey.

The Mindset of Investment Fund Managers: Traits and Insights

You may want to see also

Mandatory RMDs

When it comes to a traditional IRA, there are some mandatory requirements you need to be aware of regarding Required Minimum Distributions (RMDs). RMDs are mandatory withdrawals from your traditional IRA that you must make after reaching a certain age. The purpose of RMDs is to ensure that investments in IRAs are eventually subject to taxation.

- Age Requirement: The age at which you must begin taking RMDs depends on your birth year. If you turned 72 years old on or before December 31, 2022, you are required to take your first RMD by April 1 of the year after reaching that age and continue doing so annually. If your 72nd birthday was after December 31, 2022, then your first RMD must be taken by April 1 of the year after you turn 73 years old.

- Timing and Frequency: Your first RMD can be delayed until April 1 of the year after you reach the mandatory age (either 72 or 73, as mentioned above). For subsequent years, the annual deadline for taking your RMD is usually December 31.

- Consequences of Missing Deadlines: If you fail to meet the RMD deadlines, you may be subject to a tax penalty.

- Calculation of RMD Amount: The amount of your RMD is based on your life expectancy and the prior year-end balance of your retirement account. Vanguard offers resources and tools, such as their RMD Service and online calculators, to help you determine the appropriate RMD amount.

- Exemptions: It's important to note that Roth IRAs are exempt from RMDs during the owner's lifetime. However, beneficiaries who inherit Roth IRAs may have an annual RMD obligation, depending on various factors.

Best TSP Funds to Invest in Now

You may want to see also

Taxable withdrawals

A traditional IRA is a type of individual retirement account that allows your earnings to grow tax-deferred. This means that you can postpone paying taxes on your investment gains until you make withdrawals in retirement.

When you make withdrawals from a traditional IRA, they may be subject to federal income tax. Withdrawals of your traditional IRA contributions before you turn 59 1/2 years old will result in regular income tax on the taxable amount of your withdrawal plus a 10% federal penalty tax. There are some exceptions to this rule, including if the account owner is totally and permanently disabled, the withdrawal is made to a beneficiary after the owner's death, or the withdrawal is used for a first-time home purchase (up to a $10,000 lifetime limit).

If you are 59 1/2 years or older, you can withdraw from a traditional IRA penalty-free. However, you will owe taxes on the withdrawals of all earnings and any contributions you originally deducted from your taxes.

The age of 73 is also an important milestone for traditional IRAs. By April 1 of the calendar year following the year you turn 73, you must begin taking required minimum distributions (RMDs) from your account. RMDs are mandatory annual withdrawals required by the IRS to ensure that the assets in these accounts are eventually subject to taxation. If you withdraw less than your RMD, you may be subject to a 50% penalty tax on the difference.

It is important to note that the rules and regulations regarding traditional IRAs and taxable withdrawals can change over time. Therefore, it is always a good idea to consult a qualified tax professional or financial advisor for the most up-to-date information and to determine the best course of action for your specific situation.

Key Factors for Choosing the Right Mutual Fund Investments

You may want to see also

Frequently asked questions

A traditional IRA is a type of individual retirement account that lets your earnings grow tax-deferred. You pay taxes on your investment gains only when you make withdrawals in retirement.

The advantages of a traditional IRA include tax-deductible contributions, no maximum income limit, and the ability to postpone taxes.

When choosing a Vanguard fund for your traditional IRA, consider your age, investment goals, and risk tolerance. Vanguard offers a variety of funds, including target-date funds, life strategy funds, and index funds. Compare the fees, investment minimums, and investment strategies of each fund to determine which one best aligns with your needs.

Some specific Vanguard funds that you may consider for your traditional IRA include:

- Vanguard Target Retirement 2050 Fund (VFIFX)

- Vanguard LifeStrategy Growth Fund (VASGX)

- Vanguard 500 Index Admiral Shares (VFIAX)

- Vanguard Intermediate-Term Bond Index Admiral Shares (VBILX)