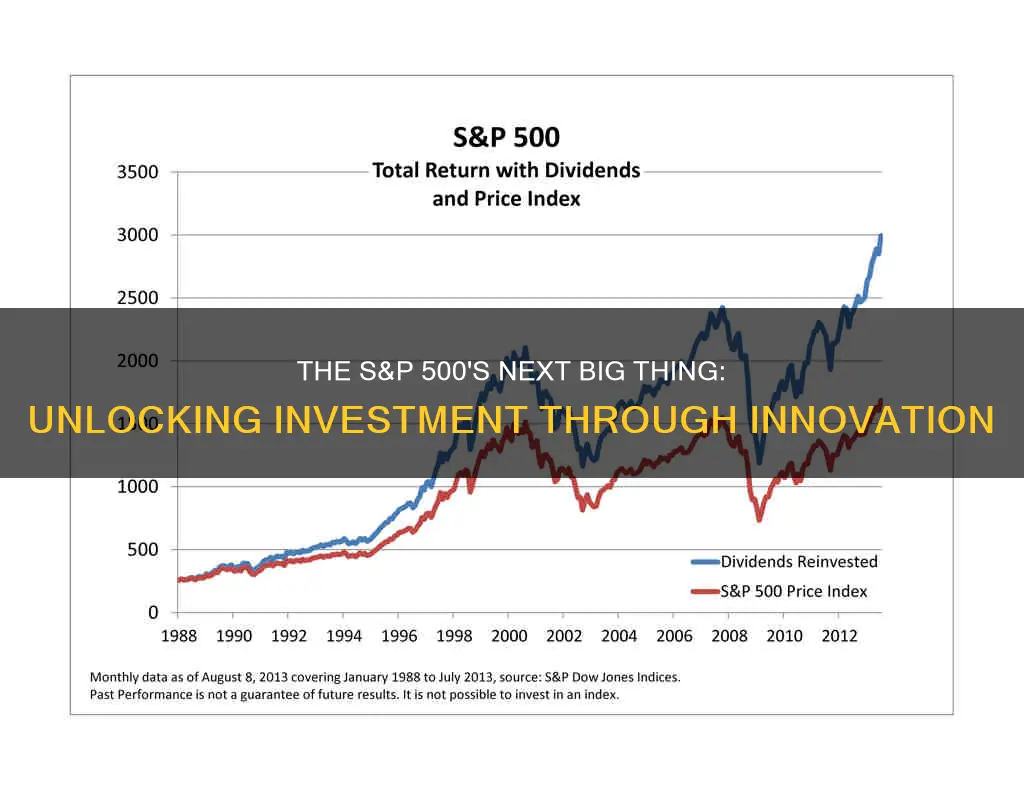

The S&P 500 is a stock market index that tracks the performance of the 500 largest U.S. public companies by market capitalisation. It is considered the best barometer for judging the performance of the U.S. stock market and a benchmark for portfolio performance. The easiest way to invest in the S&P 500 is through index funds or exchange-traded funds (ETFs) that replicate the index. These funds offer broad market exposure, diversification, and low costs. Investors can purchase these funds in a taxable brokerage account or a tax-advantaged account like a 401(k) or IRA. When choosing an S&P 500 fund, it is important to consider factors such as the expense ratio, minimum investment, and dividend yield.

| Characteristics | Values |

|---|---|

| Number of companies tracked | 500 |

| Type of companies tracked | Leading, large U.S. companies |

| Index weight | Information Technology (29.2%-32.4%), Financials (12.1%-13.1%), and Healthcare (11.7%-12.3%) |

| Index value | $39 trillion - $43.4 trillion |

| Percentage of U.S. market capitalization represented | 80% - 85% |

| Investment options | Index funds, ETFs, individual stocks |

| Investment accounts | Taxable brokerage account, 401(k), IRA, HSA, 529 plan |

| Best performing companies (as of March 2024) | Microsoft, Nvidia, Amazon, Alphabet, Meta Platforms, Berkshire Hathaway, Eli Lilly & Co, Broadcom |

S&P 500 index funds

The S&P 500 is a stock market index, and an index is a list of companies. You can't invest directly in a stock market index, but you can invest in index funds and exchange-traded funds (ETFs) that contain the same companies listed in the S&P 500.

The simplest way to invest in the S&P 500 is through S&P 500 index funds or ETFs that replicate the index. You can purchase these in a taxable brokerage account or, if you're investing for retirement, in a 401(k) or IRA, which come with added tax benefits.

- Fidelity ZERO Large Cap Index (FNILX): This mutual fund doesn't officially track the S&P 500 but the Fidelity U.S. Large Cap Index. It has no expense ratio, hence the ZERO moniker. The fund is offered by investor-friendly Fidelity, which doesn't charge a licensing fee to use the S&P name, keeping costs lower for investors. It has a 5-year annualized return of 15.3%.

- Vanguard S&P 500 ETF (VOO): This ETF tracks the S&P 500 index and is one of the largest funds on the market. It's backed by Vanguard, with hundreds of billions in the fund. It has an expense ratio of 0.03%. Its 5-year annualized return is 15.2%.

- SPDR S&P 500 ETF Trust (SPY): The SPDR S&P 500 ETF is the oldest ETF, founded in 1993. It's sponsored by State Street Global Advisors and has hundreds of billions in the fund. It has an expense ratio of 0.095%. Its 5-year annualized return is 15.2%.

- IShares Core S&P 500 ETF (IVV): This fund is sponsored by BlackRock and has been tracking the S&P 500 closely since 2000. It's one of the largest ETFs with an expense ratio of 0.03%. Its 5-year annualized return is 15.2%.

- Schwab S&P 500 Index Fund (SWPPX): This mutual fund is sponsored by Charles Schwab and has tens of billions in assets. It has a strong record dating back to 1997. Schwab is known for its investor-friendly products, as evidenced by the fund's low expense ratio of 0.02%. Its 5-year annualized return is 15.2%.

When choosing an S&P 500 index fund, consider the following:

- Expense ratio: Index funds are passively managed, which keeps expense ratios low. Since nearly all S&P 500 index funds perform similarly, it's important to pick a fund with the lowest possible expense ratio.

- Minimum investment: Index funds have different investment minimums, so make sure the fund you choose matches the amount you have to invest.

- Dividend yield: Compare the dividend yield offered by different funds as dividends can boost returns, even in down markets.

- Inception date: Consider the fund's inception date to see how it has performed over time, in both bull and bear markets.

Paycheck to Paycheck: Strategies for Investing on a Tight Budget

You may want to see also

S&P 500 ETFs

Exchange-traded funds (ETFs) are a type of investment fund that can be traded on an exchange like a stock. They are a relatively new phenomenon, with the first ETF being launched in 1993. ETFs are usually passively managed, meaning they aim to replicate the performance of a particular index, such as the S&P 500.

There are many S&P 500 ETFs available, and they can be a great way to gain instant diversification across a wide range of large-cap U.S. stocks. When choosing an S&P 500 ETF, there are several factors to consider, including:

- Expense ratio: This is the annual fee charged by the fund manager, expressed as a percentage of your investment. It is important to compare expense ratios across different ETFs, as higher fees do not always guarantee better returns.

- Liquidity: The liquidity of an ETF refers to how easily it can be bought and sold. ETFs with higher average trading volumes are more liquid, which can be important for active investors.

- Inception date: Older ETFs have been through more economic cycles and have longer performance track records, which can give you more confidence in how the fund might perform in the future.

- Dividend yield: S&P 500 ETFs pay dividends to their constituent companies, and these dividends can boost your returns. Compare the dividend yields of different ETFs to find the most attractive option.

- SPDR S&P 500 ETF Trust (SPY): This is the largest and original S&P 500 ETF, offering dependability and high liquidity. However, it has a higher expense ratio of 0.0945%.

- IShares Core S&P 500 ETF (IVV): This ETF has a much lower expense ratio of 0.03%, making it a more cost-effective option for buy-and-hold investors. However, it offers lower liquidity compared to SPY.

- Vanguard 500 Index Fund (VOO): This ETF has the same expense ratio as IVV and holds a similar portfolio of the 500 largest U.S. public companies. It is one of the largest ETFs by net assets.

- SPDR Portfolio S&P 500 ETF (SPLG): This ETF offers a slightly lower cost than IVV and VOO, but it has a smaller pool of net assets.

- Invesco S&P 500 Equal Weight ETF (RSP): This ETF offers greater diversification by equally weighting each of the 500 components of the S&P 500, rather than using a market-cap weighting. However, this more complex management strategy results in a higher expense ratio.

- Vanguard S&P 500 Value Index Fund ETF (VOOV): This ETF uses a value investing approach, screening for stocks with strong fundamentals and stable balance sheets. It has a slightly higher expense ratio of 0.10%.

Experience: Investing's X-Factor

You may want to see also

Individual stocks

The S&P 500 is a stock market index that tracks the performance of 500 of the largest U.S. public companies by market capitalization. While you cannot invest directly in the index itself, you can buy individual stocks of S&P 500 companies.

However, it is worth noting that buying individual stocks of companies in the S&P 500 is not recommended for new investors. This is because it can be costly and time-consuming to purchase stocks from all 500 companies, and it increases the risk and volatility of your investment. It also requires thoughtful research and stock performance analysis.

Instead, new investors are advised to buy a fund over individual stocks, as investing across all sectors and securities within the index diversifies your investments and your risk, minimising the effects of market volatility.

- Microsoft

- Nvidia

- Amazon

- Alphabet

- Meta Platforms

- Berkshire Hathaway

- Eli Lilly & Co

- Broadcom

Investments with Fortnightly Dividends

You may want to see also

Mutual funds

The S&P 500 is an index composed of 500 leading U.S. companies, and it powers some popular index funds. It is widely recognised to be the best measure of Wall Street performance. It is not possible to invest directly in the index itself, but you can buy individual stocks of companies in the S&P 500, or buy an S&P 500 index fund or ETF.

Index funds are a good option for investors who want to track the performance of the S&P 500 without having to research and pick individual stocks. They are also a good option for those who want instant diversification, as they provide exposure to some of the biggest companies in the U.S. across multiple sectors.

- Minimum investment: Index funds will have varying minimum investments, so be sure to choose one that aligns with your budget.

- Expense ratio: Index funds are passively managed, so the expense ratio (the ongoing cost of holding the investment) tends to be low. Compare the expense ratios of different funds to find the most cost-effective option.

- Dividend yield: Compare the dividend yields of different funds, as dividends can boost your returns.

- Inception date: If you want to see a fund's track record before investing, consider its inception date. Older funds will have a longer performance history that can give you an idea of how the fund has performed in different market conditions.

- Assets under management (AUM): A fund with a relatively high AUM may be more stable in volatile markets.

- Vanguard 500 Index Fund - Admiral Shares (VFIAX): This fund has a higher investment minimum and fee structure than some other options, but it still offers good value and has more assets than many other smaller funds.

- Schwab S&P 500 Index Fund (SWPPX): This fund is benchmarked to the S&P 500 and has no investment minimum and a very low cost structure.

- Fidelity 500 Index Fund (FXAIX): This fund is cheaper than several similar S&P 500 ETFs, making it a cost-effective option for tracking the S&P 500.

- Fidelity Zero Large Cap Index (FNILX): This fund has no expense ratio, making it a very low-cost option for investors. It technically tracks the Fidelity U.S. Large Cap Index, but this is very similar to the S&P 500.

- T. Rowe Price Equity Index 500 Fund (PREIX): This fund is known for its low costs and strong performance.

In addition to these S&P 500-specific funds, you may also want to consider more general index mutual funds, such as the Vanguard Total Stock Market ETF (VTI), which covers the entire universe of publicly traded stocks in the U.S.

Mortgage or Invest: Where Should Your Money Go?

You may want to see also

Robo-advisors

Additionally, robo-advisors offer diversification, which is an important investment strategy. By investing in the S&P 500 through a robo-advisor, you gain exposure to a diverse range of asset classes, including domestic and international equities, bonds, commodities, and real estate. This diversification can help reduce risk and smooth out returns over time.

Furthermore, robo-advisors use algorithms to monitor and rebalance portfolios, ensuring that they maintain the desired asset mix. This automated process can save investors time and effort in managing their investments.

However, it is important to note that the performance of robo-advisors compared to the S&P 500 depends on various factors, including market conditions, investment strategy, and individual risk tolerance. While robo-advisors offer diversification and low fees, investing directly in the S&P 500 through an index fund or ETF provides a straightforward and low-cost way to gain exposure to the US stock market's growth potential.

Ultimately, the decision between using a robo-advisor or investing directly in the S&P 500 depends on personal financial goals, risk tolerance, and investment style. Robo-advisors can be a great option for those seeking a more accessible, automated, and diversified investment approach, while investing directly in the S&P 500 may be preferable for those seeking a more straightforward and low-cost strategy.

Funding Strategies for Your Investment Property Empire

You may want to see also

Frequently asked questions

The S&P 500 (Standard & Poor's 500) is a stock market index composed of 500 large public U.S. companies. It is considered the best indicator of how U.S. stocks are performing overall. The index is weighted by market capitalization, giving larger companies greater influence on the index's performance.

Investing in the S&P 500 provides exposure to some of the world's most dynamic and prominent companies, such as Apple, Amazon, Microsoft, and Johnson & Johnson. It offers consistent long-term returns, instant diversification, and does not require intricate analysis or stock-picking.

You can invest in the S&P 500 through index funds or exchange-traded funds (ETFs) that replicate the index. You can purchase these through a taxable brokerage account or a tax-advantaged retirement account like a 401(k) or IRA. Alternatively, you can buy individual stocks of companies within the S&P 500, but this carries more risk.