When $1000 is invested at 5% simple interest, the amount grows by $50 each year. This is known as simple interest, where the interest is calculated based on the principal amount only. In this case, the interest is 5% of $1000, which is $50. Each year, the investment will grow by this amount. This is in contrast to compound interest, where the interest is calculated based on the principal amount plus any accumulated interest.

| Characteristics | Values |

|---|---|

| Amount invested | $1000 |

| Interest rate | 5% |

| Interest added to principle | Every 10 years |

| Amount after 20 years | $2000 |

| Amount after 1 year | $1050 |

| Amount after 1 year (compounded annually) | $1052.50 |

What You'll Learn

The amount grows by $50 each year

If $1000 is invested at 5% simple interest, the amount grows by $50 each year. This is because when money is invested at 5% compounded annually, the amount at the end of the year is 1.05 times the amount at the beginning of that year.

For example, if you invest $1000 at 5% simple interest, at the end of the first year, you will have $1050. At the end of the second year, you will have $1100, and so on. This means that every year, your investment grows by $50.

This type of investment is known as simple interest because the interest is calculated based on the initial principal amount only. In this case, the interest is calculated as 5% of $1000, which is $50. This $50 is added to the principal amount each year, resulting in a total growth of $50 per year.

If you are interested in calculating the total amount of money you would have after a certain number of years, you can use a simple formula. The formula for calculating the total amount (A) after a certain number of years (t) is: A = P(1 + rt), where P is the principal amount, r is the interest rate, and t is the number of years. For example, if you invest $1000 at 5% simple interest for 5 years, the total amount would be: A = $1000(1 + 0.05*5) = $1250.

Understanding Investment Interest Rates: Current Trends and Opportunities

You may want to see also

The amount at the end of the year is 1.05 times the amount at the beginning of the year

If you invest $1000 at 5% simple interest, the amount grows by $50 each year. This means that the amount at the end of the year is 1.05 times the amount at the beginning of the year. For example, if you invest $1000 at 5% simple interest, you will have $1050 at the end of the year. This is because the interest is calculated as a percentage of the initial amount, so the amount at the end of the year is always 1.05 times the amount at the beginning of the year.

This can also be calculated for other currencies. For example, if you invest Rs. 1000 at 5% simple interest, the amount will become Rs. 2000 after 20 years. This is because the interest is added to the principal every 10 years, so the amount grows by Rs. 500 each time.

Investing $1 Million for Monthly Interest: Strategies for Success

You may want to see also

The interest is added to the principle after every 10 years

If you invest Rs.1000 or $1000 at 5% simple interest, the amount will grow by Rs.50 or $50 each year. If the interest is added to the principal amount every 10 years, the total amount will become Rs.2000 or $2000 after 20 years.

When money is invested at 5% compounded annually, the amount at the end of the year is 1.05 times the amount at the beginning of that year. This means that the investment will grow by 5% each year.

For example, if you invest $1000 at the beginning of the year, you will have $1050 at the end of the year. The next year, you will start with $1050 and earn 5% interest on that amount, giving you a total of $1102.50 at the end of the second year. This process continues each year, with the investment growing by 5% of the previous year's total.

You can use a calculator or a spreadsheet to determine the future value of an investment at a given interest rate.

Exploring My Intriguing Investment Interests

You may want to see also

The amount will become Rs. 2000 after 20 years

If you invest Rs. 1000 at 5% simple interest, the amount will grow by Rs. 50 each year. This means that after 20 years, the amount will become Rs. 2000.

To calculate the amount of money you will have after investing Rs. 1000 at 5% simple interest for 20 years, you can use the formula for simple interest:

> A = P(1 + rt)

Where:

- A is the final amount

- P is the principal amount (the initial investment)

- R is the interest rate (expressed as a decimal)

- T is the time in years

Plugging in the values, we get:

> A = Rs. 1000 * (1 + 0.05 * 20) = Rs. 2000

This calculation assumes that the interest is compounded annually. If the interest is compounded more frequently (e.g., semi-annually or quarterly), the final amount may be slightly higher.

It's important to note that simple interest is calculated only on the initial principal amount, and the interest earned is not added back to the principal. This is in contrast to compound interest, where the interest earned is added back to the principal, leading to exponential growth over time.

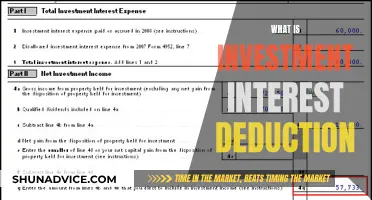

Understanding Schedule E: Investment Interest Expense Limitations

You may want to see also

The user interface should be attractive and self-explanatory

When $1000 is invested at 5% simple interest, the amount grows by $50 each year. When money is invested at 5% compounded annually, the amount at the end of the year is 1.05 times the amount at the beginning of that year.

The interface should have a consistent look and feel throughout, with a well-organized layout that is easy to understand. The use of graphics, icons, and other visual elements can help to enhance the attractiveness of the interface. The interface should also be responsive, with quick load times and smooth transitions between screens.

It is important to use clear and concise language in the interface, avoiding jargon or technical terms that may be confusing for the user. The use of appropriate fonts, colours, and spacing can also improve the readability and understandability of the interface. The interface should also be designed with accessibility in mind, ensuring that it can be used by people with different abilities and on different devices.

Overall, an attractive and self-explanatory user interface should be designed with the user's needs and preferences in mind, providing a positive and enjoyable experience for the user.

How Much Interest Did My Investment Earn?

You may want to see also

Frequently asked questions

You will have Rs. 2000.

You will have Rs. 1500.

You will have Rs. 2000.

You will have Rs. 2500.