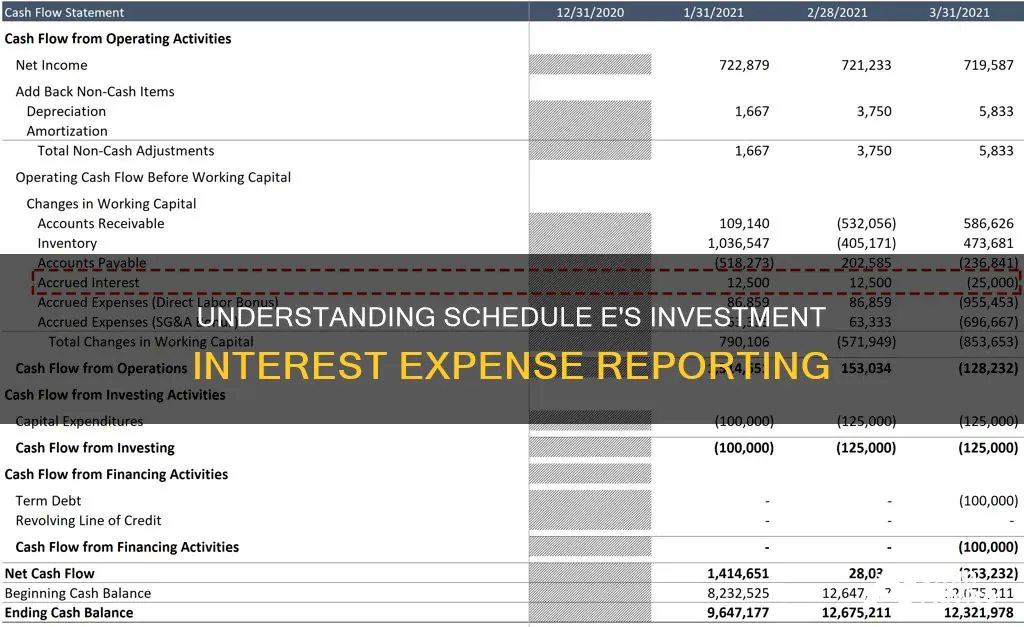

Investment interest expense is reported on Schedule E, Supplemental Income and Loss. This is a form used to report income and losses from sources other than employment. Investment interest expenses are typically associated with private investment partnerships, such as hedge funds, that engage in active portfolio management and trading activities. The interest expense attributable to these activities is subject to the Sec. 163(d) investment interest limitation, and the allowable ordinary loss should be reported as nonpassive on Schedule E, Part II.

| Characteristics | Values |

|---|---|

| When to report investment interest expense | On Schedule E, Supplemental Income and Loss |

| Where to report investment interest expense | On a separate line in Part II, Line 28, column (a) |

| What to report investment interest expense as | "Investment interest" followed by the name of the partnership |

| Where to enter the amount | Column (h) |

| What is investment interest expense? | The application of proceeds from a margin loan, taken out with a brokerage, in order to purchase stock |

What You'll Learn

Investment interest expense and partnerships

Investment interest expenses are reported on Schedule E, Supplemental Income and Loss. This is the case for both personal investment interest expenses and those allocable to partnerships trading activity.

For partnerships, the interest expense attributable to the partnership's trading activities is subject to the Sec. 163(d) investment interest limitation. This means that the allowable ordinary loss should be reported as nonpassive on Schedule E, Part II.

The interest deduction should be specifically identified on a separate line in Part II, Line 28, column (a) as "investment interest," followed by the name of the partnership, and the amount should be entered in column (h).

For personal investment interest expenses, these are reported on Schedule A of Form 1040. This includes property that produces a gain or a loss, as well as interest, dividends, and royalties that were not derived from the ordinary course of trade or business.

Car Loan Interest: Deductible Investment or Not?

You may want to see also

Investment interest expense and ordinary business income or loss

The allowable amount of a limited partner's distributive share of the trading partnership's interest expense is reported on Schedule E. This should be specifically identified on a separate line in Part II, Line 28, column (a) as 'investment interest', followed by the name of the partnership, and the amount should be entered in column (h).

Hedge funds are private investment partnerships that seek to maximise returns through active portfolio management rather than long-term capital appreciation. Their activities go beyond mere investing and constitute trading. The typical hedge fund Schedule K-1 discloses that the partnership's trading activities constitute a trade or business, and the distributive share items are not considered to be derived from a passive activity. The K-1 will also instruct partners who do not materially participate in the partnership that the interest expense attributable to the partnership's trading activities is subject to the Sec. 163(d) investment interest limitation, and the allowable ordinary loss should be reported as nonpassive on Schedule E, Part II.

Personal investment interest expense is reported on Schedule A of 1040. A common example of this type of expense is the application of proceeds from a margin loan, taken out with a brokerage, in order to purchase stock. A key aspect of investment interest expense is the property held for investment, which the proceeds from the loan were used to purchase. According to the tax code, this includes property that produces a gain or a loss.

Trump's Dakota Pipeline Interest: Conflict or Investment?

You may want to see also

Investment interest expense and hedge funds

Investment interest expense is reported on Schedule E, Supplemental Income and Loss. This is the case when the interest deduction is specifically identified on a separate line in Part II, Line 28, column (a) as "investment interest," followed by the name of the partnership, and the amount should be entered in column (h).

Hedge funds are private investment partnerships that seek to maximise returns through active portfolio management rather than long-term capital appreciation. Their activities go beyond mere investing and constitute trading. The typical hedge fund Schedule K-1 discloses that the partnership's trading activities constitute a trade or business, and the distributive share items are not considered to be derived from a passive activity. The K-1 will also instruct partners who do not materially participate in the partnership that the interest expense attributable to the partnership's trading activities is subject to the investment interest limitation, and the allowable ordinary loss should be reported as nonpassive on Schedule E, Part II.

The treatment of investment interest expense allocable to partnerships trading activity is a complex issue. In the case of a limited partner described in Rev. Rul. 2008-12, the allowable amount of his or her distributive share of the trading partnership's interest expense would be properly reported on Schedule E. This is in contrast to the treatment of investment interest expense for an individual, which is reported on Schedule A of Form 1040.

There are a variety of limitations on the deductions that can be claimed on investment interest expenses. For example, personal investment interest expense is reported on Schedule A of Form 1040. A common example of this type of expense is the application of proceeds from a margin loan, taken out with a brokerage, in order to purchase stock. A key aspect of investment interest expense is the property held for investment, which the proceeds from the loan were used to purchase.

Understanding Investment Interest Charges: Strategies for Success

You may want to see also

Investment interest expense and property

The interest deduction should be specifically identified on a separate line in Part II, Line 28, column (a) as "investment interest," followed by the name of the partnership, and the amount should be entered in column (h).

Personal investment interest expense is reported on Schedule A of Form 1040. This includes property that produces a gain or a loss, as well as interest, dividends, and royalties that were not derived from the ordinary course of trade or business.

Hedge funds, which are private investment partnerships, report their interest expenses on Schedule K-1. The partnership's trading activities constitute a trade or business, and the distributive share items are not considered to be derived from a passive activity.

Understanding Interest: Investment Strategies Simplified

You may want to see also

Investment interest expense and deductions

The typical hedge fund Schedule K-1 discloses that the partnership's trading activities constitute a trade or business, and the distributive share items are not considered to be derived from a passive activity under Temp. Regs. Sec. 1.469-1T(e)(6). The K-1 will also instruct partners who do not materially participate in the partnership that the interest expense attributable to the partnership's trading activities is subject to the Sec. 163(d) investment interest limitation, and the allowable ordinary loss should be reported as nonpassive on Schedule E, Part II.

Personal investment interest expense is reported on Schedule A of 1040. A common example of this type of expense is the application of proceeds from a margin loan, taken out with a brokerage, in order to purchase stock. A key aspect of investment interest expense is the property held for investment, which the proceeds from the loan were used to purchase. According to the tax code, this includes property that produces a gain or a loss. In addition to interest and dividends, this can also include royalties that were not derived from the ordinary course of trade or business. There are a variety of limitations on the deductions that can be claimed on investment interest expenses.

Best Investment Vehicles: Highest Interest, Maximum Returns

You may want to see also

Frequently asked questions

Investment interest expense is money spent on interest for investments.

Investment interest expense is reported on Schedule E when it is considered to be a nonpassive activity.

A nonpassive activity is an activity that goes beyond mere investing and constitutes trading.

Schedule E is a form used to report supplemental income and loss.

Schedule E is used to report supplemental income and loss, while Schedule A is used to report itemized deductions.