Investment appraisal is a collection of techniques used to assess the profitability and attractiveness of an investment opportunity. It is a form of fundamental analysis that helps identify long-term trends and a company's perceived profitability. Investment appraisal is particularly useful when the investment involves a large sum of money, scarce resources, or other critical factors such as legal considerations, environmental impact, social impact, operational benefits, and risk elements. It provides a financial analysis of the costs and benefits of a particular course of action, helping businesses and investors make informed decisions about whether to pursue an investment or not.

| Characteristics | Values |

|---|---|

| Purpose | To analyse whether an investment project is worthwhile or not |

| Use Cases | When a firm has to decide on whether to take on a project or not; when a firm has to decide on which project to choose; when there is a largely irreversible commitment of resources associated with a project; when a project is associated with a significant degree of risk |

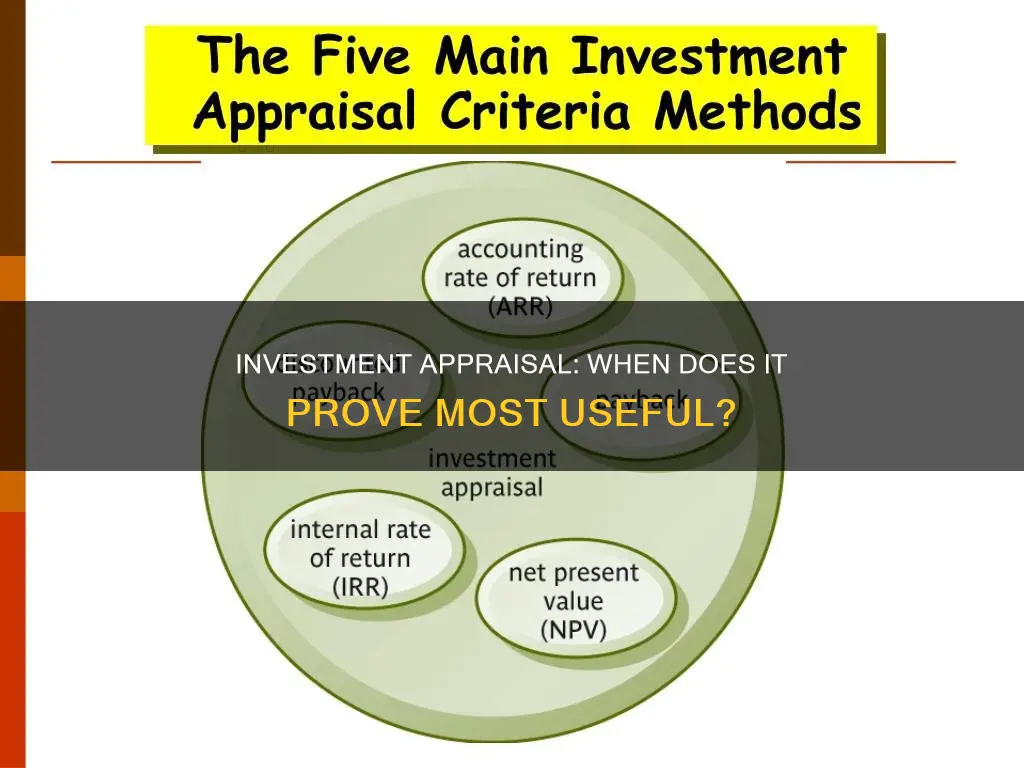

| Techniques | Payback period; average rate of return; net present value; internal rate of return; profitability index; discounted payback period; accounting rate of return |

| Benefits | Provides rationale and justification for spending limited resources; helps identify long-term trends and a company's perceived profitability; helps determine the best option based on financial benefits |

What You'll Learn

Assessing the profitability of an investment

Investment appraisal is a way for businesses to assess the profitability of an investment over the life of an asset. It is a form of fundamental analysis that helps identify long-term trends and a company's perceived profitability. It is a collection of techniques used to identify the attractiveness of an investment and is very focused on the early phases of a project.

There are numerous ways through which a business can carry out investment appraisals, but here are some of the most common techniques:

Payback Period

The payback period is the length of time between making an investment and the time that investment breaks even. It is calculated by taking the cost of the investment and dividing it by the annual cash flow. A shorter payback period is more desirable because it will take less time for an investor to receive back their capital.

Net Present Value (NPV)

NPV is the difference between the current value of cash inflows and the current value of cash outflows over a determined length of time. It is used to calculate the estimated profitability of a project and accounts for the time value of money. NPV determines whether it is more financially prudent to invest in a project or to accept a different rate of return elsewhere based on projected future returns. A positive NPV indicates that a project's predicted earnings are greater than the anticipated costs, while a negative NPV indicates the opposite.

Accounting Rate of Return (ARR)

ARR is a ratio used in capital budgeting to calculate an investment's expected return compared to the initial cost. It does not account for the time value of money. If the ARR is equal to or greater than the required rate of return, the project is deemed profitable. ARR is presented as a percentage return, so an ARR of 20% means the project is forecast to return 20p for every 100p invested over a one-year period.

Internal Rate of Return (IRR)

The IRR is the discount rate that gives a net present value of zero. It is one of the discounted cash flow methods used to determine the profitability of an investment.

Profitability Index (PI)

The profitability index technique calculates the present value of future cash flows divided by the initial investment.

Discounted Payback Period

The discounted payback period is another discounted cash flow technique that accounts for the time value of money.

Non-discounted Techniques

Non-discounted techniques, such as the payback period and ARR, do not incorporate the time value of money and may be less accurate. However, they can still provide valuable insights, and using multiple methods together can give a better understanding of an investment opportunity.

Maybank Investment Guide: Strategies for Smart Investing

You may want to see also

Assessing the viability of achieving objectives

Investment appraisal is a collection of techniques used to assess the viability of achieving objectives and determine whether an investment is profit-making or not. It is an important element of fundamental analysis for many businesses and investors, helping them make rational choices based on expected outcomes.

The process is especially crucial when the investment involves a large sum of money, scarce resources, etc. In such cases, entities cannot rely on subjective data; they need a combination of quantitative and qualitative aspects to analyse the return on investment and risk. For example, management should not decide to construct a new plant, buy machinery, or invest in research and development without evidence that their initial outlay will produce good future cash inflows.

The projected future cash flows and discount rate are the two key inputs to the appraisal technique. Other essential factors to be considered include the investment's environmental impact, social impact, operational benefits, risk elements, and legal considerations.

There are several techniques used for investment appraisals, including:

- Payback period: This calculates the time taken for the value attributable to benefits to equal the cost of the work.

- Accounting Rate of Return (ARR): This expresses the 'profit' as a percentage of the costs but does not take into account the timing of income and expenditure.

- Net Present Value (NPV): This calculates the present value of all cash flows associated with an investment, taking into account the time value of money. A positive NPV indicates that the investment is profitable, while a negative NPV suggests it is not.

By using these techniques, businesses can assess the viability of achieving their objectives and make informed decisions about their investments.

Cash Investment Strategies: Your Guide to Profitable Opportunities

You may want to see also

Supporting the production of a business case

Investment appraisal is a collection of techniques used to identify the attractiveness of an investment. It is a process of analysing whether an investment project is worthwhile or not. It is usually the final stage of putting together a business case and can be useful to determine the best option based on the financial benefits.

The business case brings together the investment appraisal for the project, programme or portfolio, with a wider evidence-based narrative of how the investment is intended to lead to the realisation of the intended qualitative and quantitative benefits. The investment appraisal helps support the production of a business case by providing the rationale and justification for spending limited resources. It relies on a robust investment appraisal to balance a number of elements including affordability, return on investment, and portfolio effect.

The investment appraisal considers the financial aspects of the change by looking at the tangible costs and benefits. It can be challenging and requires creativity and analytical skills from those involved. There are two main measuring methods used in producing an investment appraisal: the Payback Calculation and Net Present Value (NPV)/Discounted Cash Flow (DCF).

The Payback Calculation is the simplest method and is often used to provide a cash-flow forecast for a change or development project. It calculates the payback period, which is the length of time between making an investment and when that investment has broken even. The shorter the payback period, the more desirable the investment as it will take less time for an investor to receive back their capital.

The NPV/DCF method takes into account the time value of money, adjusting all cash flows for inflation and other factors. This method can show whether it is more financially prudent to invest in a project or to accept a different rate of return elsewhere based on projected future returns. A positive NPV indicates that a project's predicted earnings or profits are greater than the anticipated costs, while a negative NPV suggests the project might not be pursued.

By using these methods, analysts and senior management can gain a better understanding of the finances involved for each option within the business case and determine whether it is worth pursuing. This information can then be used to seek approval from senior management and establish requirements for the approved change or development project.

Cash Investments: What Are They?

You may want to see also

Determining the best option based on financial benefits

Investment appraisal is a way for businesses to assess the attractiveness of potential investments or projects. It is a form of fundamental analysis that helps identify long-term trends and a company's perceived profitability. This process is crucial when dealing with large sums of money, scarce resources, or other significant investments.

When determining the best option based on financial benefits, investment appraisal techniques provide valuable insights. Here are some paragraphs explaining this in more detail:

Understanding Financial Benefits

Financial benefits are a critical aspect of investment appraisal, as they help determine the profitability and financial attractiveness of an investment opportunity. These benefits are typically assessed over the life of an asset, considering both short-term and long-term gains. By evaluating the potential financial upside, businesses can make informed decisions about allocating their limited resources effectively.

Payback Period

The payback period is a fundamental concept in investment appraisal, representing the time it takes for a project to recover its investment cost. Investors generally prefer shorter payback periods as they indicate faster cash inflows, sustainability, and investment attractiveness. This technique provides a simple yet effective way to screen investment options and assess their financial viability.

Net Present Value (NPV)

NPV is a powerful tool that accounts for the time value of money. It calculates the difference between the current value of cash inflows and outflows over a specific period. A positive NPV indicates that the project is expected to generate profits, making it financially prudent to pursue. NPV helps businesses determine if an investment is the best way to achieve a return on their funds.

Accounting Rate of Return (ARR)

ARR expresses the profit as a percentage of the investment cost. It is a useful metric for comparing projects, with a higher ARR indicating a more desirable option. Unlike NPV, ARR does not consider the timing of income and expenditure, making it more suitable for short-term and highly capital-intensive projects.

Discounted Cash Flow Techniques

When there is a significant time difference between expenditure and financial returns, discounted cash flow techniques are applied. These techniques adjust for inflation and other factors, ensuring that all cash flows are evaluated accurately. The discount rate used reflects how the value of money decreases over time, providing a more realistic assessment of the investment's profitability.

Return on Investment (ROI)

ROI is a critical consideration in investment appraisal, evaluating whether an investment delivers suitable returns. It takes into account the forecasted capital and operational costs, benefits, and the economic life of the product. By assessing ROI, businesses can determine if an investment aligns with their financial goals and strategic objectives.

In conclusion, investment appraisal provides a comprehensive framework for determining the best option based on financial benefits. By utilizing techniques such as payback period, NPV, ARR, discounted cash flow, and ROI analysis, businesses can make well-informed decisions about their investments, ensuring optimal allocation of resources and maximizing financial gains.

What is Levered Free Cash Flow?

You may want to see also

Evaluating the strategic fit of an investment

Investment appraisal is a collection of techniques used to determine the profitability and attractiveness of an investment. It is an important step in the decision-making process, providing a rationale for spending limited resources.

When evaluating the strategic fit of an investment, it is crucial to consider the following factors:

Affordability

This involves assessing whether the investment is within the financial means of the organisation. Can the benefits be delivered within the available funds, considering the wider portfolio of operational and change activities? This is a crucial aspect of the investment decision, ensuring that the investment is feasible and does not exceed the organisation's financial capabilities.

Return on Investment (ROI)

ROI analysis evaluates whether the investment generates a suitable return, taking into account the forecasted capital and operational costs, benefits, and the economic life of the product. It answers the question, "Is this the best way to get a return on the investment of funds?" By comparing the expected returns with the initial investment, organisations can make informed decisions about the strategic fit of the investment.

Portfolio Effect

The portfolio effect considers the compatibility of the investment with the organisation's existing investments and overall strategic objectives. It evaluates whether the new investment aligns with the wider set of investments in operational and change activities. This analysis ensures that the investment complements the organisation's existing strategies and does not create conflicts or redundancies.

Time Value of Money

When investments span multiple years, the time value of money becomes a critical consideration. Money today is worth more than the same amount in the future due to its potential to earn interest or be invested elsewhere. Therefore, organisations must assess the timing of cash flows and consider the impact of inflation and discount rates on the investment's profitability.

Legal Considerations

Legal compliance is an essential aspect of strategic fit. Organisations must ensure that their investments conform to relevant legislation and regulations. In some cases, investments may be necessary to comply with new laws or regulations to continue operations. Appraisals based solely on financial returns may not be appropriate when legal considerations are a significant factor.

Environmental and Social Impact

The environmental and social impacts of investments are gaining prominence in the decision-making process. Organisations increasingly consider the effects of their investments on the natural environment and incorporate environmental impact analyses into their evaluations. For charitable organisations, the return on investment may be measured in non-financial terms, such as "quality of life" or "lives saved," reflecting the social impact of the investment.

Operational Benefits

Operational benefits refer to the less tangible advantages that an investment may bring. These include factors such as increased customer satisfaction, higher staff morale, or gaining a competitive advantage. While challenging to quantify, these benefits can significantly impact the strategic fit of an investment and should not be overlooked.

Risk

All organisations face business and operational risks. Investments that reduce risk or mitigate potential threats may be strategically advantageous. Evaluating the risk associated with an investment and its potential impact on the organisation's overall risk profile is crucial in determining its strategic fit.

In conclusion, evaluating the strategic fit of an investment involves a comprehensive analysis of financial, operational, legal, and environmental factors. By considering these aspects, organisations can make informed decisions about the compatibility and attractiveness of an investment, ensuring that it aligns with their strategic objectives and contributes positively to their overall performance.

How SEI Technology is Transforming Investment Advisors' Practices

You may want to see also

Frequently asked questions

Investment appraisal is a way for a business to assess the attractiveness of a possible investment or project. It is a form of fundamental analysis that can help identify long-term trends and a company's perceived profitability.

There are two main types of investment appraisal: discounted and non-discounted techniques. Examples of discounted techniques include net present value (NPV), internal rate of return (IRR), profitability index (PI), and discounted payback period. Non-discounted techniques include payback period and accounting rate of return (ARR).

Investment appraisal is useful because it provides a financial analysis of a project or investment opportunity, helping businesses and investors make informed decisions about whether to pursue it or not. It also helps determine the best option based on financial benefits and the trade-off between whole-life costs, benefits, and deployment risks.

Investment appraisal is useful when a business or investor is considering a new investment or project, particularly when it involves a large sum of money, scarce resources, or long-term commitments. It is also useful when there are multiple investment options to choose from and a financial analysis is needed to determine the most attractive or profitable option.