The profitability index (PI) is a useful tool for ranking competing investment projects and making decisions about whether to proceed with a project. It measures the ratio between the present value of future cash flows and the initial investment, indicating the value created per unit of investment. A higher PI indicates a more attractive and profitable investment opportunity, with a PI greater than 1 suggesting that the project generates value. Conversely, a PI less than 1 indicates that the project destroys value and should be rejected. The PI is calculated by dividing the present value of future cash flows by the initial investment amount. This metric helps investors compare and contrast investments, especially when resources are limited, and aids in capital budgeting decisions.

| Characteristics | Values |

|---|---|

| Formula | PI = Present value of future cash flows / Initial investment |

| Interpretation | A higher PI means a project is more profitable and has a higher return on investment |

| Use for project ranking | Can be used to rank projects from highest to lowest PI and select the one with the highest PI |

| Decision-making | If PI is greater than 1, the project generates value and the company may want to proceed. If PI is less than 1, the project destroys value and the company should not proceed. If PI is equal to 1, the project breaks even and the company is indifferent. |

| Advantages | Indicates whether an investment should create or destroy company value; takes into consideration the time value of money and the risk of future cash flows through the cost of capital; useful for ranking and choosing between projects when capital is rationed |

| Disadvantages | Requires an estimate of the cost of capital to calculate; in mutually exclusive projects where the initial investments are different, it may not indicate the correct decision |

What You'll Learn

- The higher the profitability index, the more attractive the investment

- A profitability index of 1.0 is the lowest acceptable measure

- The profitability index is useful for ranking and choosing between projects when capital is rationed

- The profitability index is generally considered the most dependable method of ranking competing projects

- The profitability index is a variation on the net present value concept

The higher the profitability index, the more attractive the investment

The profitability index (PI) is a crucial tool for evaluating and ranking potential investments or projects. It measures the relationship between the present value of future expected cash flows and the initial investment amount. By calculating the PI, investors can determine how attractive or desirable an investment opportunity is.

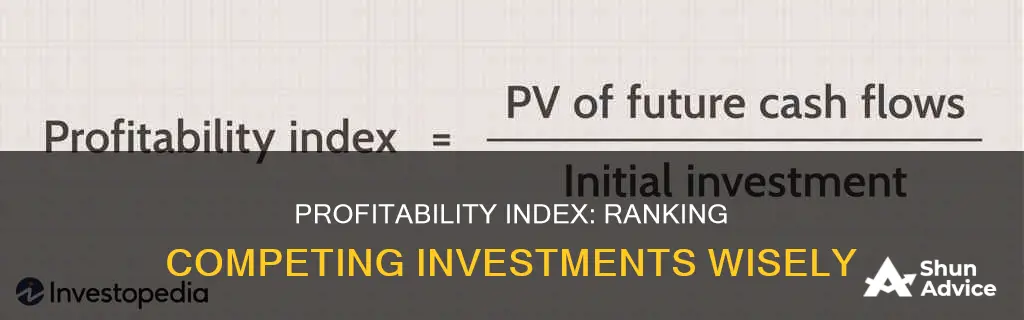

The formula for calculating the PI is:

PI = Present Value of Future Cash Flows / Initial Investment

When assessing potential investments, a higher PI indicates a more attractive investment proposition. This is because a higher PI suggests that the investment will generate greater value per unit of investment. In other words, for every dollar invested, the project will yield a higher return. This makes the PI a valuable metric for investors when deciding how to allocate their funds, especially when resources are limited.

For example, consider two competing investment projects, A and B. Project A has a PI of 1.2, while Project B has a PI of 1.5. By applying the rule "the higher the profitability index, the more attractive the investment", an investor would choose Project B as it indicates a higher potential return on investment.

The PI also provides a threshold for determining whether to proceed with an investment. If the PI is greater than 1, the project is considered to generate value, and the company may decide to move forward. If the PI is less than 1, the project is deemed to destroy value, and the company should reject it. A PI equal to 1 indicates a break-even point, where the company is indifferent about proceeding.

In summary, the profitability index is a powerful tool for ranking competing investments. By comparing the present value of future cash flows to the initial investment, investors can identify the most attractive opportunities with the highest potential returns. The higher the profitability index, the more favourable the investment.

Strategic Scheduling for Investment Expenses: A Guide

You may want to see also

A profitability index of 1.0 is the lowest acceptable measure

When using the profitability index to rank competing investments, a score of 1.0 is the lowest acceptable measure. This is because a score of 1.0 or above indicates that the net present value is greater than the initial investment, suggesting the project may be viable and could be a good investment.

The profitability index is calculated by dividing the present value of future cash flows by the initial investment. A score of less than 1.0 indicates that the project's present value is less than the initial investment, and the project should be discarded.

The profitability index is a useful tool for ranking potential projects, as it allows investors to quantify the value created per investment unit. It is an appraisal technique for potential capital outlays, and the higher the score, the more financially attractive the project.

The profitability index is also known as the benefit-cost ratio, and it is a good indicator of whether a project will be profitable. A score of greater than 1.0 indicates that the project will generate value, while a score of less than 1.0 indicates that the project will destroy value.

The profitability index is a useful tool for businesses to determine the costs and benefits of a potential project or investment. It is a good way to measure the attractiveness of a project, and it can be used alongside other metrics to determine the best investment.

Deferred Revenue Cash: Invest or Not?

You may want to see also

The profitability index is useful for ranking and choosing between projects when capital is rationed

The profitability index (PI) is a valuable tool for ranking and selecting projects when capital is limited. It measures the ratio between the present value of future cash flows and the initial investment, indicating the value created per unit of investment. A higher PI signifies a more attractive and profitable project.

When capital is rationed, the PI helps in making preference decisions by comparing competing investment opportunities. It allows for the ranking of projects based on their potential profitability, with a higher PI indicating a higher return on investment. This is especially useful when a company has limited resources and must choose between various profitable investment opportunities.

The formula for calculating the PI is:

PI = Present Value of Future Cash Flows / Initial Investment

By applying this formula, companies can determine which projects to pursue. If the PI is greater than 1, the project is considered value-generating and worth considering. If the PI is less than 1, it indicates that the project will likely result in value destruction, and the company should reject it. A PI equal to 1 suggests that the project will break even.

For example, consider Company A, which is evaluating two projects: Project A and Project B. Project A requires an initial investment of $1,500,000 and is expected to generate positive cash flows. Project B requires an initial investment of $3,000,000 and is also expected to yield positive cash flows. Using the PI formula, Company A calculates a PI of 1.0684 for Project A and 0.96 for Project B. Based on these calculations, Company A should choose Project A as it creates value, with each $1 invested generating additional value.

The PI is a useful metric, but it has its limitations. It requires estimates and assumptions, such as the cost of capital, which can vary. Additionally, it may favor smaller projects over larger ones with higher net present values due to its scale. Therefore, it should be used alongside other criteria, such as net present value and internal rate of return, to make well-informed investment decisions.

Mastering Investing.com's Technical Analysis Tools for Beginners

You may want to see also

The profitability index is generally considered the most dependable method of ranking competing projects

The profitability index (PI) is a powerful tool for evaluating and ranking competing investment projects. It is a ratio that measures the present value of future expected cash flows against the initial investment required for a project. By comparing the PI values of different projects, investors can make informed decisions about which projects to pursue.

The formula for calculating the PI is:

PI = Present Value of Future Cash Flows / Initial Investment

A PI greater than 1 indicates that the project is expected to generate value, with higher values signifying increased financial attractiveness. A PI less than 1 suggests that the project will destroy value, and the company should not proceed. When the PI is equal to 1, the project is expected to break even, leaving the company indifferent about whether to proceed.

The PI is particularly useful when a company has limited resources and must choose between multiple attractive investment opportunities. By ranking projects based on their PI, companies can select the most financially attractive options and maximise their value creation.

The PI also takes into account the time value of money, allowing companies to compare projects with different lifespans. Additionally, it helps quantify the value created per unit of investment, making it a dependable method for ranking competing projects.

However, it is important to note that the PI has some limitations. It requires an estimate of the cost of capital, and it may not be suitable for comparing projects of different sizes or durations. Nonetheless, when used in conjunction with other criteria, the PI is a valuable tool for making informed investment decisions.

CDs: Cash or Investment?

You may want to see also

The profitability index is a variation on the net present value concept

The profitability index (PI) is a financial tool that helps determine the value a project can generate. It is a ratio that measures the present value of future expected cash flows against the initial investment amount. The formula for PI is:

PI = Present Value of Future Cash Flows / Initial Investment

The PI is a variation of the Net Present Value (NPV) rule, which assesses the profitability of a project or investment. While NPV provides the dollar difference between cash inflows and outflows, PI is a ratio that represents the proportion of dollars returned to dollars invested. This means that PI does not provide the amount of actual cash flows, but rather the relationship between the costs and benefits of a project.

A PI greater than 1.0 indicates that the project's discounted cash inflows exceed its outflows, suggesting profitability. In this case, the project should proceed. Conversely, a PI less than 1.0 shows that the costs are greater than the benefits, indicating that the project will likely fail and should be abandoned. A PI of exactly 1.0 implies a break-even situation, where the project neither gains nor loses money.

The PI is particularly useful when comparing competing investment projects, especially when capital is limited. In such cases, the project with the highest PI is often preferred as it promises the most efficient use of capital. For example, consider two projects with the same NPV, but one requires twice the investment of the other. The PI provides a clearer comparison by reflecting the relative efficiency of each investment.

The PI is also valuable for smaller projects, which may be overlooked by broader metrics like NPV. It allows for the effective comparison of projects of different sizes and helps prioritize those that yield the highest returns relative to their costs.

Smart Ways to Generate Cash Flow with a $5000 Investment

You may want to see also

Frequently asked questions

The Project Profitability Index (PI) is a tool used to measure the ratio between the present value of future cash flows and the initial investment. It helps to rank investment projects and determine the value created per unit of investment.

The formula for the Project Profitability Index is: PI = Present Value of Future Cash Flows / Initial Investment. The present value of future cash flows is calculated by discounting them using the appropriate discount rate, usually the firm's cost of capital or minimum required rate of return.

A higher PI indicates a more profitable project with a higher return on investment. A PI greater than 1 means the project generates value, and the company may want to proceed. A PI less than 1 means the project destroys value, and the company should not proceed. A PI of 1 indicates the project breaks even.

The Project Profitability Index may favour smaller projects over larger, more profitable ones. It also assumes that intermediate cash flows can be reinvested at the same discount rate, which may not always be feasible. It should be used alongside other criteria such as Net Present Value and Internal Rate of Return.