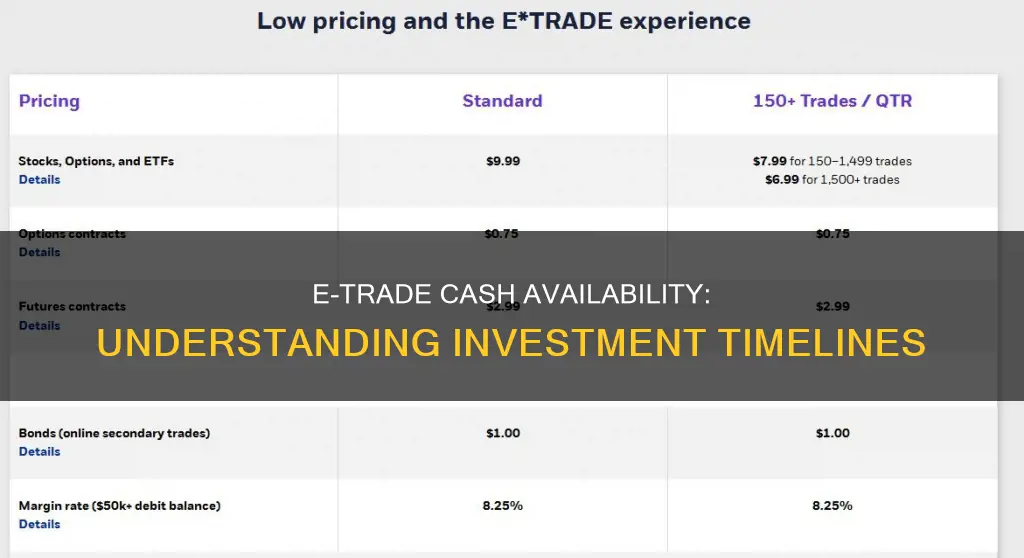

E*TRADE offers a range of investment options, including stocks, bonds, mutual funds, and ETFs. When investing with E*TRADE, it's important to understand the settlement period, which is the time between the trade date and the settlement date when the payment is made and the ownership of securities is transferred. For stocks, the settlement period is typically T+1, meaning trade date plus one business day. However, it's important to note that banking holidays are non-settlement days, and while trading is allowed, they are not included in the settlement period.

To fund your E*TRADE account, you can use the Transfer Money service, which allows you to move money between your accounts and from external financial institutions. Wire transfers are also available for electronic fund transfers. Depositing cheques into your account can be done through the E*TRADE Mobile app or by mail, and these funds are typically available within five business days. It's important to note that funds deposited into your brokerage account will be available for investment or withdrawal after the settlement period, which is usually a few business days.

| Characteristics | Values |

|---|---|

| Cash account requirements | All stock purchases must be paid in full, on or before the settlement date |

| Settlement period | The time between the trade date and the settlement date (when the payment is made and ownership is transferred) |

| Stock settlement period | T+1 (trade date plus one business day) |

| Options trade settlement period | T+1 (trade date plus one business day) |

| Good faith violation | Issued when a position is opened using unsettled funds and then closed before the funds used to make the opening trade have settled |

| Freeride violation | Issued when a position is opened without sufficient funds and then closed before funds are deposited into the account |

| ACH and check deposits availability for trading | Third business day after being received |

| Transfer Money service | Free online service to move money between E*TRADE, Morgan Stanley Private Bank accounts, and outside financial institutions |

| Wire transfer | An electronic transfer of money between accounts, including those at different financial institutions |

| Check deposits | Mobile check deposit using the E*TRADE Mobile app or by mail |

| Check deposits availability for investing or withdrawal | Fourth business day after the date of deposit |

| First $225 of funds deposited to a bank account availability | First business day after the date of deposit |

| Additional $5,300 of funds deposited to a bank account availability | Second business day after the date of deposit |

| Remaining funds deposited to a bank account availability | Fourth business day after the date of deposit |

What You'll Learn

Cash accounts and their benefits

A cash account is a type of financial account held with a bank or other financial institution, such as E*TRADE, that is used to hold and manage an individual's or business's liquid assets, such as cash and cash equivalents. They are beneficial for several reasons.

Firstly, cash accounts offer the ability to deposit and withdraw funds as needed, providing access to funds when required while also allowing for savings. This can be particularly useful for managing short-term financial needs, such as paying bills and making purchases. Cash accounts also enable improved financial management by allowing individuals and businesses to track their income and expenses, helping them to identify areas where they may be overspending or under-saving, and make more effective financial decisions. This can lead to increased savings and better control over spending.

Another benefit of cash accounts is that they provide a clear picture of the account holder's financial situation, helping to build financial stability and improve credit scores. This is because a cash account shows exactly how much money is available at any given time, providing valuable information about liquidity and the ability to meet financial obligations.

Additionally, cash accounts are straightforward to set up and manage. They can be opened at most financial institutions, and the account holder is not required to track receivables or payables, reducing the amount of accounting expertise and administrative work needed.

In terms of investing, cash accounts can be beneficial because they allow individuals to buy stocks, bonds, or mutual funds, and these securities are owned by the account holder. However, it is important to note that certain rules apply to cash accounts when trading, such as the requirement to fully pay for securities on or before the settlement date to avoid violations.

Oil Investing: Smart Move?

You may want to see also

Transferring money to your E*TRADE account

Electronic Transfer

The E*TRADE website and smartphone app offer a convenient way to transfer money electronically between your accounts and from outside financial institutions. Here are the steps to follow:

- Log in to your ETRADE brokerage account.

- On your account home screen, select "Transfer In."

- Enter your bank account information, including the routing number and account number. You can save this information for future transfers.

- Specify the amount of money and the date you want to make the transfer.

- Submit the transfer request. Transfers typically take up to three business days to complete.

Wire Transfer

Wire transfers are another fast and secure option for transferring funds to your E*TRADE account. Here's how to do it:

- Complete the ETRADE from Morgan Stanley Wire Transfer Form.

- Send the completed form to your financial institution and request them to wire funds to ETRADE.

- Provide the receiving institution information: Morgan Stanley Smith Barney LLC, along with the address, ABA routing number, your ETRADE account number, name, and address.

- Specify the amount you want to wire.

- Wire transfers received before 6 p.m. ET will be processed on the same business day.

Mobile Check Deposit

The E*TRADE Mobile app provides a convenient way to deposit checks directly into your account. Here's the process:

- Launch the ETRADE Mobile app and go to the Check Deposit section.

- Enter the amount and select your account.

- Sign the back of the check, endorsing it for electronic deposit.

- Take a clear picture of the front and back of the endorsed check.

- Submit the check images through the app.

- Ensure that the payee name on the check matches the account owner's name.

- Deposited funds will be available for investing or withdrawal on the fourth business day after the deposit.

Transferring an Account

If you want to transfer all your assets (cash and securities) from an external financial institution to your E*TRADE account, you can use the Transfer an Account feature. Here's an overview:

- Log in to your ETRADE account and access the Transfer an Account feature.

- Provide the required information, including the name of the delivering financial institution, your account number, and registration details.

- Alternatively, you can complete and mail the Account Transfer Form to the provided address.

- The transfer process typically takes 10+ business days to 3-6 weeks for completion.

Retirement Reinvented: Exploring Wise Investment Strategies for a Secure Future

You may want to see also

Settlement periods and how they work

Settlement periods refer to the time between the trade date and the settlement date. The trade date is the month, day, and year that an order is executed in the market, while the settlement date is when the trade is final and the security changes hands. During the settlement period, the buyer must pay for the shares, and the seller must deliver them.

Different types of securities have different settlement periods, which can range from one to three trading days since the trade date. In the past, the settlement period was much longer, as transactions were done manually. Buyers would have to wait for the delivery of a particular security in actual certificate form and would not pay until they received it.

In 1975, the Securities and Exchange Commission (SEC) was granted the power to establish a national clearance and settlement system to facilitate securities transactions. The SEC created rules to govern the trading process, including outlines for the settlement date. The settlement period was originally set at five business days (T+5). This was revised in 1993 to three business days (T+3), and in 2017, it was changed to two business days (T+2).

In February 2023, the SEC voted to further reduce the settlement cycle to one business day (T+1) for most securities, which came into effect on May 28, 2024. This shortened cycle aims to increase market efficiency and reduce risk, providing quicker access to funds and securities for traders.

It is important to note that weekends and holidays can cause a substantial increase in the time between the transaction and settlement dates, especially during holiday seasons. Additionally, in the context of E*TRADE, it is worth mentioning that banking holidays like Columbus Day and Veterans Day are non-settlement days, even though trading is allowed on those days.

Investor Influx: Impacting Markets

You may want to see also

Using cash in your account

Using cash in your E*TRADE account

E*TRADE offers a variety of cash management features that allow you to access, move, and manage the cash in your bank and brokerage accounts. You can access the cash in your account 24/7, anywhere, with no minimum amount required. You can also use your account to pay for purchases and get cash from any ATM nationwide.

There are several ways to fund your E*TRADE account. You can transfer money from your other E*TRADE or Morgan Stanley Private Bank accounts, or from external accounts. You can also deposit cheques into your account using the E*TRADE Mobile app or by mail. Wire transfers are also accepted.

Funds deposited into your brokerage account will be available for investment or withdrawal on the third business day after the date of deposit. For funds deposited into your bank account, $225 will be available on the first business day, an additional $5,300 will be available on the second business day, and the remaining amount will be available on the fourth business day.

It's important to note that there are rules regarding cash accounts. For example, when you buy securities, you must pay in full on or before the settlement date, which is the date when the payment is made and the ownership of the securities is transferred. The settlement period is the time between the trade date and the settlement date. Stocks typically settle on T+1, which means trade date plus one business day. However, banking holidays are non-settlement days, so it's important to plan accordingly.

Additionally, selling stock short and selling uncovered options are not permitted in cash accounts.

Retirement Funds: The Investment Conundrum

You may want to see also

Trading options

- Assess Your Readiness: Trading options can be more complex and riskier than stock trading. It requires a good grasp of market trends, the ability to interpret data and indicators, and an understanding of volatility. You need to be honest about your risk tolerance, investment goals, and the time you can dedicate to this activity.

- Choose a Broker and Get Approved to Trade Options: Look for a broker that supports options trading and suits your needs in terms of fees, platform usability, customer service, and educational resources. Most brokers require you to fill out an options approval form, disclosing your financial situation, trading experience, and understanding of the risks involved.

- Create a Trading Plan: Define your trading strategy, including the types of options strategies you plan to execute, your entry and exit criteria, and how you will manage risk. Paper trading, or simulated trading, can help you test your strategies without financial risk.

- Understand the Tax Implications: Options trading has unique tax considerations. Consult a tax professional to understand the implications for your specific situation.

- Keep Learning and Managing Risk: The options market is constantly evolving, so continuous education is key. Stay informed about the risks involved in options trading and use risk management techniques to protect your capital.

- Options are a type of contract that gives the buyer the right to buy or sell a security (such as equities, indices, or ETFs) at a specified price within a certain timeframe.

- The value of an option is "derived" from the underlying asset, which is why they are called "derivatives".

- Options trading can provide the ability to implement strategies such as hedging against price declines, generating income, and speculating on price changes.

- There are risks, costs, and trade-offs associated with options strategies, so it is important to fully understand these aspects before trading options.

- Options trading also requires a brokerage account that is approved for options trading, and the types of trades you can place will depend on your specific options approval level.

Uninvested: The Emotional Impact

You may want to see also

Frequently asked questions

There is a settlement period of up to two days for most stocks. If you sell a stock on Monday, the cash will be available on Wednesday. If you sell it on Thursday, it will settle on the following Monday.

You can use the free Transfer Money service to move money between your accounts and from outside financial institutions. You can also use a wire transfer, which is an electronic transfer of money between accounts, including accounts at different financial institutions.

If you submit a Transfer Money request before 4 pm ET, the money will be transferred to your eTrade account on the third business day.

Yes, as long as you have cash in your account. You can check your account's cash balance at any time.