Hedge funds are risky investments that pool money from wealthy investors and invest in securities or other types of investments. They are not as heavily regulated as mutual funds and have more freedom to pursue riskier investments and strategies. Hedge funds are managed by hedge fund managers, who are motivated by performance fees to be successful. These managers are responsible for the fund's investment decisions and level of risk.

Hedge funds are funded by a variety of sources, including high-net-worth individuals, corporations, foundations, and pension funds. They are marketed by the fund manager through networking and third-party placement agents.

Hedge funds have grown in popularity and now make up a substantial portion of the asset management industry, with assets totalling around $3.8 trillion as of 2021.

| Characteristics | Values |

|---|---|

| Investment strategies | Long and short positions in various asset classes, derivatives, short-selling, complex risk management strategies, portfolio management techniques, leveraged derivatives, quantitative analysis, mathematical and statistical methods, technical indicators, automated trading strategies, arbitrage, hedging, equity strategies, credit, quant or macroeconomics-focused approaches |

| Types | Equity hedge fund, global macro hedge funds, activist hedge fund, relative value hedge fund |

| Investors | High-net-worth individuals, pension funds, institutional investors, central banks, charitable foundations, family offices, universities, foreign governments |

| Minimum investment amount | Millions, in India: 1 crore |

| Location | United States, United Kingdom, India |

| Notable hedge funds | Bridgewater Associates, Millennium Management, Renaissance Technologies, AQR Capital Management, Two Sigma Investments, Elliott Investment Management, Farallon Capital Management, Ruffer Investment Company, Man Group, Blackrock Advisors, Citadel, Tiger Global Management, Davidson Kempner Asset Management, Lone Pine Capital Management, Baupost Group Asset Management, Point 72 Asset Management |

What You'll Learn

Hedge funds' investment in real estate

Hedge funds are a type of investment vehicle that aggregates capital from multiple investors and puts it into securities and other investments. They are different from mutual funds as they are willing to take on more risk and are not capped by regulators.

Real estate hedge funds have become increasingly popular over the past decade. They can invest in real estate in two ways:

- By investing in publicly traded real estate companies, mostly real estate investment trusts (REITs). REITs are corporate entities that invest exclusively in real estate and are given tax exemption for doing so. They are required to pay out at least 90% of their income as dividends.

- By acquiring actual properties, usually underperforming ones, at low rates. These properties can be purchased in one specific region or globally and are often up for sale due to a lack of liquidity on the seller's part.

Some key players in the real estate hedge fund market include Angelo, Gordon & Company, Cerberus Real Estate Capital Management, Cliffwood Partners LLC, and The Praedium Group.

Real estate hedge funds provide an opportunity for investors to diversify their portfolios, especially if their portfolios currently consist of low-risk, low-return investments. They can be a great way to balance a portfolio by adding higher-risk, higher-return investments.

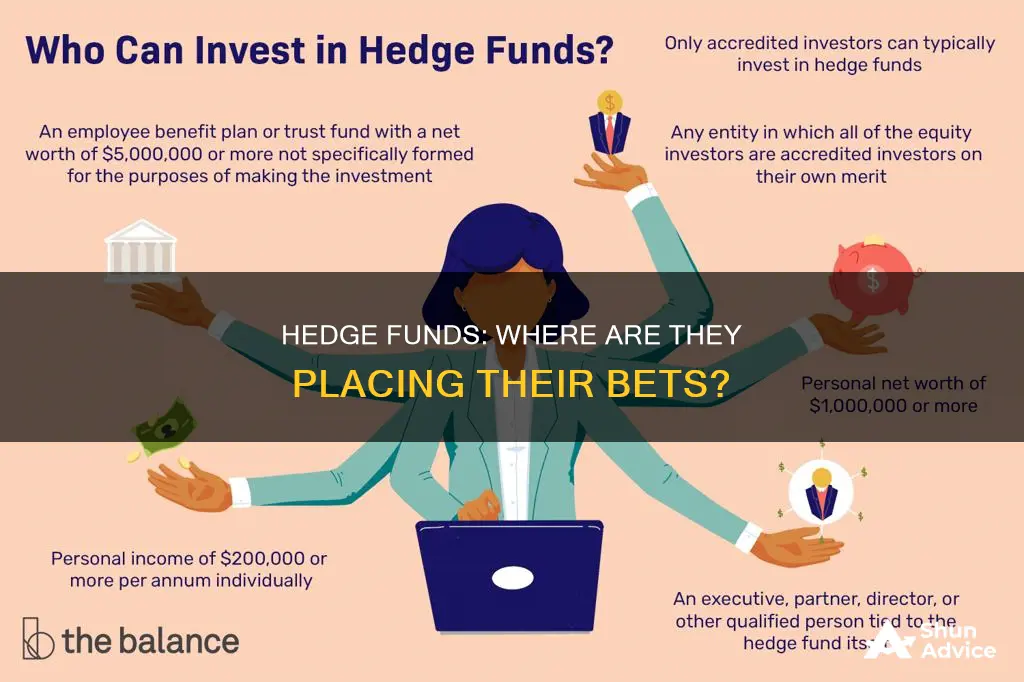

However, it is important to note that hedge funds are generally restricted to wealthier investors who can afford higher fees and are accredited investors with a minimum level of income or assets. Additionally, hedge funds are not as liquid as stocks or bonds and may have restrictions on when investors can withdraw their money. They also carry higher fees, typically including an asset management fee of 1-2% and a performance fee of 20% of the fund's profit.

Overall, while hedge funds, including those focused on real estate, can provide diversification and higher returns, they come with higher risks and fees that potential investors should carefully consider.

Index Funds: Understanding Their Typical Investment Strategies

You may want to see also

Hedge funds' investment in art

Art investment funds are privately managed art portfolios, structured like hedge funds and marketed exclusively to high-net-worth individuals. They pool investor capital to buy and sell fine art, including paintings, sculptures, photography, video, and prints.

Art funds are often regarded as the "Wild West" of the investment world: they are unpredictable, largely unregulated, and dominated by speculators. However, they have been attracting attention from wealthy investors worldwide, particularly those looking to diversify their portfolios in new growth markets such as Asia, the Middle East, and Latin America.

Art funds are managed by professional art investment management or advisory firms, which typically consult art advisors or art dealers. These firms buy, store, and sell art on behalf of investors, who then receive a portion of the profits when the artwork is sold.

Art funds employ a variety of investment strategies, including:

- Traditional "buy and hold" strategies

- "Geographic arbitrage", which aims to exploit price differences for certain artists' works in different geographic locations

- "Artwork-driven" strategies, which seek to profit from issues impacting a specific artwork's offered price (e.g. condition, provenance, title)

- "Regional art" strategies, which focus on investing in art from a particular geographic region

- "Period" strategies, which focus on investing in art from a particular period (e.g. modern, contemporary, impressionist)

- "Emerging artists" strategies, which centre around investing in artists who are not yet established and therefore may experience rapid price appreciation

Art funds can generate significant returns, with the contemporary art market delivering 14.1% average annual returns over the past 26 years. For example, investors in the Masterworks art investment fund made an estimated 32% after fees from the sale of a Banksy piece titled "Mona Lisa" in 2020.

However, investing in art funds carries several risks. There is no guarantee that artwork will sell for a profit, and the value of art can be difficult to evaluate due to the opacity of the art market. Additionally, art funds are generally only accessible to accredited investors with a high net worth or annual income.

Despite these drawbacks, art investment funds offer a gateway for individual investors to buy shares in valuable artworks, providing an opportunity to diversify their portfolios with an uncorrelated asset class that can act as an inflation hedge.

RIA Mutual Fund Investment: What's the Catch?

You may want to see also

Hedge funds' investment in currency

Currency-hedged ETFs are a common way for hedge funds to invest in currency. These funds track the values of overseas securities without exposing investors to excess currency risk. They do this by holding forward contracts for the base currency as part of their portfolio, which provides a payoff if the currency price increases.

A currency-hedged ETF provides exposure to foreign equities while reducing exposure to exchange rate risk. These funds hold currency-forward contracts that provide a payout if the exchange rate moves against the investor. This means that if the currency price increases, the fund will pay out to the investor. Conversely, if the currency price decreases, the fund will not pay out, but the investor will also not experience any losses.

There are two main types of currency-hedged ETFs: single-currency and multiple-currency. Single-currency-hedged ETFs are the more common of the two. As of April 5, 2024, there were 29 currency-hedged equities ETFs traded in the US, with individual assets managed by these funds ranging from $6.4 billion to $10 million.

The effectiveness of currency-hedged ETFs may vary depending on global economic conditions and exchange rate fluctuations. These funds tend to have higher management fees to account for the additional costs of executing the hedging strategy. Additionally, the costs of holding trading currency-forward contracts can reduce the tax efficiency of these ETFs.

Another way that hedge funds can invest in currency is through currency hedging. Currency hedging is similar to insurance, which is purchased to protect against unforeseen events. Investment managers use currency hedging to reduce the effects of currency fluctuations on investment performance. They do this by setting up a related currency investment designed to offset changes in the value of a particular currency.

One common way to hedge currency is through forward contracts. With this method, the portfolio manager enters into an agreement to exchange a fixed amount of currency at a future date and specified rate. The value of this contract will fluctuate and essentially offset the currency exposure in the underlying assets. However, it is important to note that the investment will not benefit if currency fluctuations work in its favour.

Another option for currency hedging is through options. Options give the holder the right, but not the obligation, to exchange one currency for another at a set rate for a certain period of time. This reduces the potential impact of a change in exchange rates on the return on the investment.

Vanguard Funds: Best Investment Options for Now

You may want to see also

Hedge funds' investment in distressed debt

Hedge funds are known for their aggressive investment strategies, and one such strategy is investing in distressed debt. Distressed debt is the debt of companies that have filed for bankruptcy or are likely to do so in the near future. Hedge funds that invest in distressed debt purchase the bonds of these companies at a steep discount, anticipating that the company will successfully emerge from bankruptcy. If the company turns its fortunes around, the value of its bonds will increase, allowing the hedge fund to reap substantial profits.

Hedge funds can access distressed debt through the bond market, mutual funds, or directly from the distressed company. The easiest way is through the bond markets, where debt can be easily purchased due to regulations concerning mutual fund holdings. Hedge funds can also buy directly from mutual funds, benefiting both parties as they can avoid paying exchange-generated commissions. The third option is to work directly with the distressed company, providing credit in the form of bonds or a revolving credit line. This option is often undertaken by multiple hedge funds and investment banks together to avoid overexposure to default risk.

Hedge funds that invest in distressed debt look for companies that can be successfully restructured or rejuvenated. They are attracted to the potential for high returns, despite the high risk of default. To limit their risk, hedge funds take relatively small positions in distressed companies. For example, a hedge fund might invest 1% of its capital in distressed debt, which could result in a 300% return on investment and a 3% return on its total capital if the company recovers.

Distressed debt investing offers advantages such as the potential for massive returns in a short period. However, it is a highly cyclical investment strategy, and there may be limited opportunities during times of easy access to funding. Distressed debt investing also requires in-depth technical skills and the ability to interpret complex documents and understand restructuring and bankruptcy processes.

Overall, hedge funds play a significant role in distressed investing, providing alternative sources of financing and valuable services to lenders. While it is a risky strategy, distressed debt investing can offer attractive returns and is, therefore, an important consideration for hedge funds.

Bond Fund Strategies: Dynamic Investing for Maximum Returns

You may want to see also

Hedge funds' investment in stocks

Hedge funds are pooled investment funds that hold liquid assets and employ complex trading and risk management techniques to improve investment performance. They are considered alternative investments due to their ability to use leverage and more complex investment techniques than mutual funds and ETFs. Hedge funds are also distinct from private equity funds as they invest in relatively liquid assets and are usually open-ended.

Hedge funds use a variety of investment strategies, including equity, fixed-income, and event-driven investment goals. They invest in a wide range of assets, including stocks, debt and equity securities, commodities, currencies, derivatives, and real estate.

Hedge funds are considered riskier investments than mutual funds or ETFs due to their aggressive investment strategies and the use of leverage. They also carry higher fees, typically charging an asset management fee of 1-2% and a performance fee of 20% of the fund's profit.

Hedge funds have historically underperformed stock market indices, and their returns are reduced by the high fees they charge. However, hedge funds can provide diversification and reduce overall portfolio risk for investors who already hold large quantities of equities and bonds.

Overall, hedge funds are risky and illiquid investments that require a high minimum investment or net worth. They are typically targeted at wealthy, institutional investors or accredited investors with a high net worth or annual income.

Investment Trust vs Fund: What's the Difference?

You may want to see also

Frequently asked questions

A hedge fund is a pool of money from investors that is used to invest in securities and other types of investments. Hedge funds are generally more flexible and riskier than mutual funds. They are also exclusive to wealthy investors.

Hedge funds raise money from a variety of sources, including high-net-worth individuals, corporations, foundations, and pension funds. They typically seek out investors with large amounts of capital to form limited partnerships. The fund manager's performance plays a crucial role in attracting investors.

Hedge funds typically charge a management fee of 1-2% of the assets under management and a performance fee of 20% of the fund's profits. These fees are often referred to as the "2-and-20" rule.

Hedge funds invest in a wide range of assets, including stocks, real estate, art, and currency. They employ various strategies, such as short-selling and leverage, to pursue higher profits.