The lives of investment bankers are often shrouded in mystique, with their high-paying jobs and glamorous lifestyles. However, beneath the surface, the reality of their work-life balance is a complex and often challenging issue. In this paragraph, we will explore the various factors that influence the work-life balance of investment bankers, including the demanding nature of their jobs, the pressure to meet deadlines, and the impact of long hours on personal relationships and well-being. We will also delve into the strategies that some investment bankers employ to maintain a healthier balance, such as setting boundaries, prioritizing self-care, and seeking support from colleagues and mentors. By understanding the challenges and potential solutions, we can gain a deeper appreciation for the complexities of this profession and the importance of finding a sustainable work-life balance.

What You'll Learn

- Compensation and Benefits: High earnings, bonuses, and comprehensive benefits packages

- Job Security: Stable careers with less risk of unemployment

- Work Culture: Often demanding, with long hours and high expectations

- Flexibility: Some firms offer flexible work arrangements, but it varies

- Impact: Investment banking can offer significant career advancement and influence

Compensation and Benefits: High earnings, bonuses, and comprehensive benefits packages

Investment banking is renowned for offering lucrative compensation packages, which can significantly contribute to a positive work-life balance. The high earnings in this field are often a major draw for professionals, as they can provide financial security and a sense of achievement. Investment bankers typically earn competitive salaries, with base pay varying depending on factors such as experience, role, and the bank's size and location. These salaries can range from substantial figures, especially for those in senior positions, to more modest amounts for junior analysts.

Bonuses are a significant aspect of investment banking compensation. Annual bonuses, which can be substantial, are a common feature, and they often make up a substantial portion of an investment banker's total earnings. These bonuses are usually performance-based and can be influenced by individual and team achievements, as well as the overall success of the bank. In some cases, bonuses can even exceed base salaries, providing an additional financial incentive and a sense of motivation for employees.

The benefits packages offered by investment banks are also comprehensive and designed to support employees' well-being and long-term financial goals. These benefits often include health insurance, retirement plans, and paid time off. Health insurance is a critical component, ensuring that investment bankers have access to quality healthcare, which is essential for maintaining a healthy work-life balance. Retirement plans, such as 401(k)s or pension schemes, enable bankers to plan for their future and provide financial security during their non-working years.

Additionally, investment banks often provide generous paid time off, including vacation days, sick leave, and personal days. This flexibility allows employees to manage their personal commitments and take breaks when needed, promoting a healthier and more balanced lifestyle. Some banks also offer additional benefits like gym memberships, wellness programs, or even financial planning services, further enhancing the overall employee experience and satisfaction.

In summary, investment banking offers a compelling compensation structure with high earnings, substantial bonuses, and comprehensive benefits. These factors can contribute to a positive work-life balance, allowing professionals to enjoy financial security, motivation, and a supportive environment for their overall well-being. While the demanding nature of the job may persist, the attractive compensation package can provide a strong incentive for individuals to pursue careers in this field, ultimately impacting their work-life satisfaction.

Unlocking Wealth: Understanding Ownership and Investment Strategies

You may want to see also

Job Security: Stable careers with less risk of unemployment

The concept of job security in the investment banking industry is often a complex and multifaceted topic. While investment banking is renowned for its high-paying jobs and lucrative bonuses, it is also known for its demanding nature and intense work culture. However, there are certain aspects of this profession that contribute to a relatively stable career path with less risk of unemployment.

One of the primary factors ensuring job security in investment banking is the critical role these professionals play in the financial ecosystem. Investment bankers are essential for facilitating capital raising, mergers and acquisitions, and providing financial advisory services. Their expertise is highly sought after by corporations, governments, and institutional investors. As such, the demand for skilled investment bankers remains consistently high, even during economic downturns. This demand often translates to a reduced risk of unemployment, as companies are willing to invest in retaining their top talent.

Additionally, investment banking firms often provide a level of job security through their compensation structures. These firms typically offer base salaries, bonuses, and various benefits packages. While the industry is known for its variable compensation, which can be significantly influenced by performance and market conditions, the overall compensation structure provides a stable income. This stability is further enhanced by the fact that investment banking careers often progress through clear career paths, with opportunities for advancement and increased responsibilities over time.

Another aspect contributing to job security is the specialized nature of the skills investment bankers possess. This profession requires a unique combination of financial expertise, analytical abilities, and strong communication skills. Acquiring and maintaining these skills is a significant investment for individuals, and as a result, they become highly specialized professionals. This specialization makes it challenging for individuals to transition into other industries, thus providing a certain level of protection against unemployment.

Furthermore, the industry's focus on networking and relationships can also impact job security. Investment bankers often build extensive professional networks, which can provide opportunities for career advancement and job referrals. These connections can be invaluable, especially during periods of economic uncertainty, as they may lead to new business opportunities or internal promotions within the same firm.

In summary, while investment banking may be associated with long hours and a demanding work environment, the industry offers a degree of job security. The critical role of investment bankers, their specialized skills, and the structured compensation and career progression paths contribute to stable careers with reduced risks of unemployment. Understanding these factors can provide valuable insights for individuals considering a career in investment banking or those seeking to enhance their job security within the industry.

Federal Retirement Thrift Investment Savings Plan: Maximizing Your Retirement Benefits

You may want to see also

Work Culture: Often demanding, with long hours and high expectations

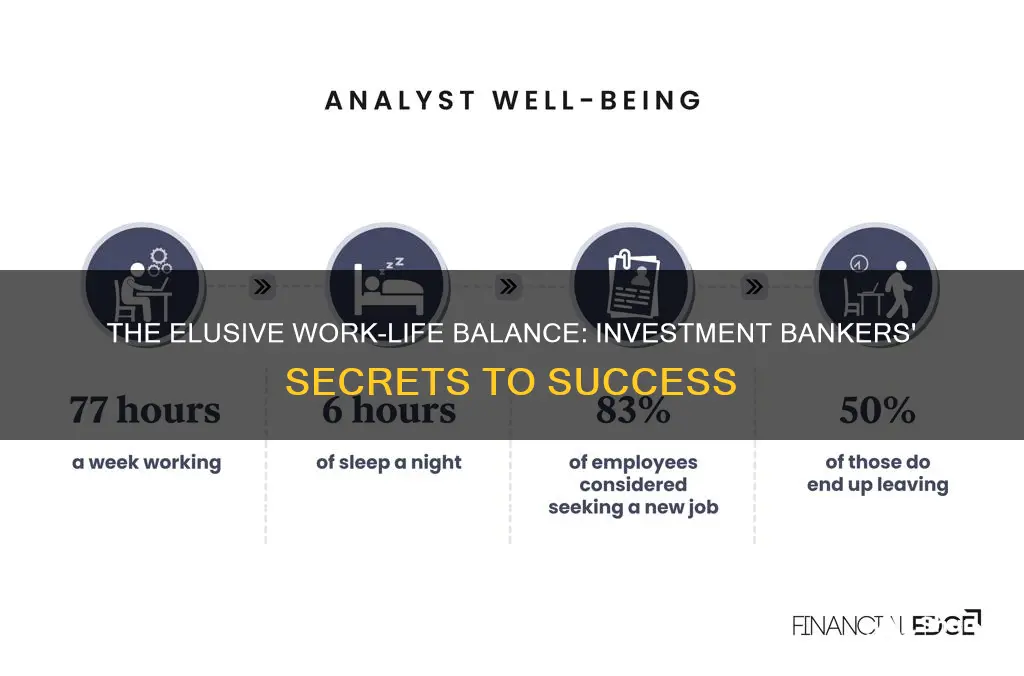

The work culture in investment banking is renowned for its demanding nature, often requiring long hours and a relentless drive for success. This high-pressure environment is a significant factor that contributes to the challenge of maintaining a healthy work-life balance. Investment bankers frequently find themselves immersed in a culture of intense competition and a strong emphasis on performance, which can lead to a blurring of boundaries between personal and professional lives.

Long working hours are a common occurrence, with bankers often required to work late into the night and over the weekend. This demanding schedule can quickly lead to burnout and fatigue, affecting not only physical health but also mental well-being. The culture often expects individuals to be constantly available, responsive, and ready to tackle new challenges, leaving little room for personal time or relaxation.

High expectations are a critical aspect of this work culture. Investment bankers are expected to deliver exceptional results, provide innovative solutions, and maintain a high level of expertise. This can create a sense of pressure and stress, as individuals strive to meet and exceed the expectations set by their employers and clients. The fear of falling short or not living up to these high standards can be a constant source of anxiety and stress, impacting overall job satisfaction and personal happiness.

The demanding nature of the job also extends to the competitive nature of the industry. Investment banking is a highly competitive field, with a constant drive to outperform peers and secure new business. This competitive spirit can foster a sense of camaraderie and motivation, but it can also lead to a toxic work environment where individuals feel the need to constantly prove themselves. The pressure to succeed can be overwhelming, leading to a lack of work-life balance as individuals struggle to find time for personal pursuits and well-being.

Maintaining a healthy work-life balance in investment banking requires a conscious effort. It involves setting clear boundaries, prioritizing self-care, and managing time effectively. While the industry demands dedication and long hours, it is essential to recognize the potential negative impacts on personal life and take proactive steps to mitigate them. This may include seeking support from colleagues or mentors, engaging in regular exercise or hobbies, and ensuring adequate rest and relaxation to prevent burnout and maintain overall well-being.

MLP Investments: Navigating the Buying Process

You may want to see also

Flexibility: Some firms offer flexible work arrangements, but it varies

In the fast-paced world of investment banking, the concept of work-life balance often takes a backseat, with long hours and demanding workloads being the norm. However, some firms are recognizing the importance of employee well-being and are implementing flexible work arrangements to address this issue. This flexibility can vary widely depending on the company, the role, and the individual's position within the organization.

One common flexible work arrangement is remote work or a hybrid model, where employees can work from home or a combination of home and office. This option provides investment bankers with the autonomy to manage their time and choose their working hours, especially during non-critical periods. For instance, a junior analyst might be allowed to start their day earlier to accommodate personal commitments, while a senior director could have more flexibility to adjust their schedule based on client meetings or project deadlines. Such flexibility can significantly improve work-life balance, allowing individuals to spend more time with family, pursue hobbies, or attend to personal matters without compromising their professional responsibilities.

Additionally, some firms offer compressed workweeks, where employees work longer hours over fewer days. This arrangement can be particularly beneficial for those with caregiving responsibilities or personal commitments that require reduced hours. For example, a four-day workweek could mean working 10-hour days instead of the traditional 8-hour shift, providing an extra day for personal activities or family time. However, it's important to note that not all investment banking firms adopt this approach, and the availability of such arrangements may depend on the specific company culture and policies.

Furthermore, flexibility can also extend to the timing of work. Many firms allow for flexible start and end times, enabling employees to align their schedules with personal needs. This can be especially useful for those who require early mornings or late afternoons to accommodate transportation constraints or personal preferences. For instance, an investment banker living in a rural area might appreciate the flexibility to start work earlier to avoid long commutes, thus improving their overall work-life balance.

Despite these flexible options, it's crucial to understand that the perception of flexibility can vary. Some investment bankers might view these arrangements as a privilege rather than a right, especially if they feel their colleagues or competitors are not afforded the same opportunities. This perception can influence an individual's decision to utilize flexible work arrangements and their overall satisfaction with the firm's policies. Ultimately, the success of flexible work arrangements in investment banking depends on a company's ability to foster a culture that values both productivity and employee well-being.

Options: Why Investors Are Wary

You may want to see also

Impact: Investment banking can offer significant career advancement and influence

Investment banking is a highly competitive and demanding industry, often associated with long hours, intense work cultures, and a fast-paced environment. However, it also presents numerous opportunities for career advancement and a significant impact on an individual's professional journey. Here's an exploration of how investment banking can offer substantial career growth and influence:

Rapid Career Progression: Investment banking provides a unique platform for rapid career advancement. The industry is known for its steep learning curves, where professionals are exposed to complex financial products, market dynamics, and client interactions. Investment bankers often take on diverse roles, including financial analysis, research, sales, trading, and advisory services. This exposure allows individuals to develop a comprehensive skill set, gain expertise in various areas, and quickly move up the corporate ladder. The industry's hierarchical structure means that high performance and results can lead to promotions and leadership positions at a relatively early stage in one's career.

Global Network and Connections: Working in investment banking provides access to a vast global network of professionals, clients, and industry leaders. Investment bankers frequently interact with high-profile executives, entrepreneurs, and investors, fostering valuable connections. These connections can open doors to new business opportunities, mentorship, and industry insights. The ability to influence and advise clients on significant financial decisions can be incredibly rewarding. Moreover, the global nature of the industry means that professionals can work on international projects, gain cross-cultural experience, and contribute to diverse teams, further enhancing their career prospects.

Impactful Roles and Projects: Investment banking offers a wide range of impactful roles and projects. Investment bankers play a crucial role in facilitating mergers and acquisitions, initial public offerings (IPOs), debt and equity offerings, and strategic advisory services. These roles directly influence the success of companies, shape market trends, and contribute to economic growth. For instance, an investment banker might advise a tech startup on its funding strategy, helping it secure the capital needed for rapid expansion. Such projects can be intellectually stimulating and provide a sense of accomplishment, knowing that one's work has a tangible impact on the market and clients' success.

Continuous Learning and Development: The investment banking industry demands a strong commitment to continuous learning and professional development. Professionals are encouraged to stay updated with market trends, regulatory changes, and emerging financial products. This culture of learning fosters a growth mindset, where individuals are motivated to enhance their skills and knowledge. Investment banks often provide extensive training programs, mentorship schemes, and access to industry research, ensuring that employees are equipped with the tools to excel. This commitment to development not only benefits the individual but also contributes to the overall success and reputation of the firm.

Leadership and Management Opportunities: Investment banking provides a clear path to leadership and management positions. As professionals gain experience and expertise, they can take on more significant responsibilities, such as leading teams, managing client relationships, and overseeing complex projects. The industry values strong leadership skills, strategic thinking, and the ability to manage high-pressure situations. Investment bankers who demonstrate exceptional performance and leadership qualities can progress into senior management roles, influencing the overall direction and success of the firm. This progression allows individuals to shape their careers and contribute to the organization's long-term goals.

Better Investing Magazine: Where to Secure Your Copy

You may want to see also

Frequently asked questions

Investment banking is known for its demanding and high-pressure environment, often requiring long hours and intense dedication. However, many banks are increasingly recognizing the importance of work-life balance and are implementing initiatives to support their employees' well-being. These may include flexible work arrangements, wellness programs, and initiatives to promote a healthier lifestyle. While the job can be challenging, many investment bankers prioritize self-care and set boundaries to maintain a healthy balance.

The nature of investment banking often leads to a blurred line between work and personal life. Long working hours, especially during busy seasons or when dealing with critical deals, can make it challenging for bankers to find time for personal commitments, hobbies, or relaxation. Additionally, the competitive and fast-paced industry may create a culture of overworking, where employees feel pressured to constantly be available and responsive. Managing client expectations and maintaining a healthy lifestyle can be a delicate balance for investment bankers.

Achieving a better work-life balance is essential for long-term career satisfaction and well-being. Investment bankers can take proactive steps such as setting clear boundaries, prioritizing self-care, and managing their time effectively. This may involve learning to say no to non-essential tasks, delegating when possible, and utilizing time management techniques. Additionally, seeking support from colleagues, mentors, or HR departments can help create a sustainable work environment. Regularly reviewing and adjusting work schedules, taking breaks, and engaging in activities outside of work can contribute to a healthier and more fulfilling professional life.