In today's economic landscape, understanding where millionaires choose to invest their substantial cash reserves is a fascinating subject. While traditional savings accounts and low-risk investments may not offer the growth potential sought by high-net-worth individuals, they often seek safer alternatives to preserve their wealth. This paragraph will explore the various strategies and asset classes that millionaires employ to safeguard their financial assets, including real estate, precious metals, private equity, and diversified portfolios, each offering unique advantages in terms of liquidity, stability, and long-term growth potential.

What You'll Learn

- Real Estate: Millionaires often invest in luxury properties or commercial real estate for long-term wealth preservation

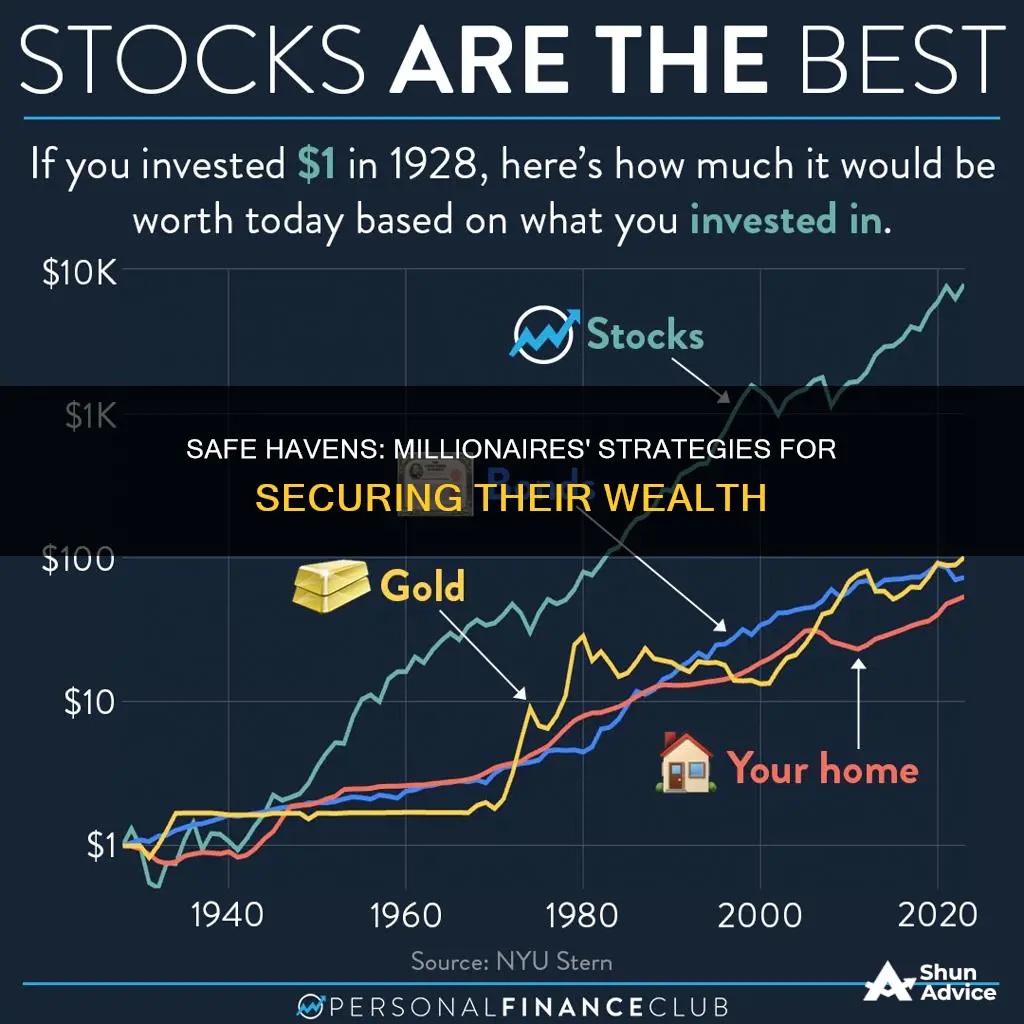

- Stocks and Bonds: Diversifying into the stock market and corporate bonds can provide steady returns and capital appreciation

- Precious Metals: Gold, silver, and other precious metals are a hedge against inflation and economic uncertainty

- Private Equity: Investing in private companies offers high returns but requires significant capital and expertise

- Cryptocurrency: Digital currencies like Bitcoin and Ethereum are seen as a modern, high-risk, high-reward investment option

Real Estate: Millionaires often invest in luxury properties or commercial real estate for long-term wealth preservation

Real estate has long been a cornerstone of wealth management for millionaires, offering a tangible and often highly profitable investment strategy. The allure of real estate lies in its ability to provide a secure and stable asset class, offering both a hedge against inflation and a means to build generational wealth. Millionaires often view real estate as a long-term investment, a strategy that has proven its worth over centuries.

When it comes to real estate investments, millionaires typically focus on two main areas: luxury properties and commercial real estate. Luxury properties, such as high-end residential homes, offer a unique appeal to wealthy individuals. These homes are often situated in exclusive neighborhoods, providing a sense of prestige and privacy. Millionaires may invest in these properties either directly, purchasing and renovating existing homes, or through the development of new luxury residential complexes. The key here is to identify areas with strong market demand and limited supply, ensuring that the property retains or increases in value over time.

Commercial real estate is another attractive option for millionaire investors. This category includes office spaces, retail stores, warehouses, and industrial properties. Millionaires often view commercial real estate as a more stable investment compared to residential properties, as it is less susceptible to market fluctuations and can provide a steady income stream through rent. For instance, investing in a prime office space in a bustling financial district can offer consistent rental income and the potential for significant capital appreciation as the area continues to develop.

The strategy of investing in real estate is not without its challenges. Millionaires must carefully consider factors such as location, market trends, and the potential for future development. They may also need to navigate complex legal and financial structures, especially when dealing with large-scale projects. However, with the right expertise and research, real estate can be a powerful tool for wealth creation and preservation.

In summary, millionaires often turn to real estate as a safe haven for their cash, particularly in the form of luxury properties and commercial real estate. This investment strategy offers a tangible asset, a hedge against inflation, and the potential for long-term wealth accumulation. By carefully selecting properties in desirable locations, millionaires can build a robust portfolio that withstands market challenges and provides a solid foundation for their financial future.

Understanding Managed Investment Schemes: Corporations Act Explained

You may want to see also

Stocks and Bonds: Diversifying into the stock market and corporate bonds can provide steady returns and capital appreciation

The stock market and corporate bonds are essential tools in the investment arsenal of millionaires seeking to safeguard and grow their wealth. These assets offer a strategic approach to diversification, providing a balance between risk and reward. Here's an in-depth look at why these investments are favored by the wealthy:

Stocks: Unlocking Capital Appreciation

Investing in stocks is a powerful strategy for millionaires to build substantial wealth over time. The stock market offers a vast array of investment opportunities, allowing individuals to diversify their portfolios across various sectors and industries. By purchasing shares of companies, investors gain ownership stakes, which can lead to significant capital appreciation. Millionaires often focus on long-term investments, allowing their portfolios to benefit from the compounding effect of reinvesting dividends and the potential for substantial price increases. This approach enables them to build a robust financial foundation, ensuring their assets grow in value over extended periods.

Corporate Bonds: A Steady Income Stream

Corporate bonds are another critical component of a millionaire's investment strategy. These bonds are issued by companies to raise capital, and they offer a more conservative investment option compared to stocks. Millionaires often utilize corporate bonds to generate a steady income stream through regular interest payments. This income can be particularly attractive for those seeking a more predictable and consistent return on their investments. Additionally, corporate bonds provide an opportunity to diversify across different companies and industries, reducing risk through a well-rounded approach.

Diversification is a key principle in wealth management, and millionaires understand the importance of spreading their investments across various asset classes. By allocating a portion of their portfolio to stocks and corporate bonds, they can achieve a balance between growth potential and risk mitigation. This diversification strategy ensures that their investments are not overly exposed to any single market or sector, providing a more stable and secure financial position.

In the pursuit of safeguarding and growing their cash, millionaires often turn to stocks and corporate bonds as fundamental building blocks of their investment portfolios. These assets offer a unique combination of growth potential and income generation, allowing investors to navigate the financial markets with a strategic and diversified approach. By embracing these investment avenues, millionaires can secure their financial future and potentially build even greater wealth over time.

Building a Robust Investment Portfolio at 50

You may want to see also

Precious Metals: Gold, silver, and other precious metals are a hedge against inflation and economic uncertainty

Precious metals, such as gold and silver, have long been considered a safe haven for investors, especially during times of economic and political uncertainty. This is because they possess intrinsic value and have historically maintained their worth even when other asset classes, such as stocks and bonds, experience significant declines. Millionaires and high-net-worth individuals often turn to these tangible assets as a means of safeguarding their wealth and protecting against the erosion of purchasing power caused by inflation.

The appeal of precious metals lies in their ability to act as a hedge against inflation. When inflation rises, the value of paper money decreases, and the purchasing power of cash diminishes. Gold, in particular, has a unique property of being a limited resource, and its supply is finite. As a result, it tends to retain its value or even appreciate in price during inflationary periods. For instance, during the 1970s, when inflation was high, gold prices soared, making it an attractive investment for those seeking to preserve their wealth.

Silver, another precious metal, also serves as a valuable hedge against inflation. It is more abundant than gold but still holds significant intrinsic value. Silver's industrial applications and its use in various products make it a versatile asset. While gold is often seen as a more traditional safe-haven investment, silver can provide diversification and potentially offer higher returns in certain market conditions.

Investing in precious metals can be done through various means. One common approach is to purchase physical gold or silver coins and bars, which can be stored securely. This method provides direct ownership and control over the assets. Alternatively, investors can gain exposure to precious metals through exchange-traded funds (ETFs) or mutual funds that specialize in these investments. These funds allow for a more liquid and diversified approach, as they hold a basket of gold and silver-related securities.

Additionally, millionaires may consider investing in mining companies that extract and produce precious metals. This strategy provides an indirect way to benefit from the price movements of gold and silver. By supporting the mining industry, investors can potentially gain from the increasing demand for these metals while also contributing to the global supply chain. However, it is essential to conduct thorough research and due diligence when investing in mining companies to ensure the quality and reliability of the investment.

Equities vs. Fixed Investments: What's the Best Choice for You?

You may want to see also

Private Equity: Investing in private companies offers high returns but requires significant capital and expertise

Private equity is a strategy that millionaires and high-net-worth individuals often consider when seeking to grow and protect their wealth. This investment approach involves investing in private companies, typically at an early stage, before they go public. The allure of private equity lies in its potential for high returns, as these companies can offer significant growth opportunities. However, it is a complex and specialized field that demands substantial capital and a certain level of expertise.

Investing in private equity requires a substantial amount of capital, often in the millions or even billions of dollars. Millionaires and their financial advisors must carefully consider their investment capacity and ensure that the funds allocated to private equity are part of a well-diversified portfolio. The idea is to balance the potential risks and rewards, as private equity investments can be highly volatile and illiquid.

The process of investing in private companies is intricate and often requires a deep understanding of the market and specific industries. Millionaires typically engage the services of experienced private equity firms or venture capital funds that have the necessary expertise to identify and evaluate investment opportunities. These firms employ teams of professionals who conduct thorough due diligence, assess the company's potential, and negotiate terms that align with the investor's goals.

One of the key advantages of private equity is the potential for substantial returns. Successful investments can lead to significant capital appreciation and attractive dividends. However, this comes with a higher level of risk. Private companies may face challenges in their growth and operations, and the investment process can be lengthy and uncertain. Millionaires must be prepared for the possibility of holding these investments for extended periods, sometimes even years, until the company goes public or is acquired.

In summary, private equity is a sophisticated investment strategy that can offer millionaires the opportunity to diversify their portfolios and potentially achieve high returns. However, it requires a substantial financial commitment and a deep understanding of the market. Engaging the services of experienced private equity firms can provide the necessary expertise to navigate this complex investment landscape, ensuring that millionaires can make informed decisions to safeguard and grow their wealth.

Fidelity Investment Strategies: A Beginner's Guide to Success

You may want to see also

Cryptocurrency: Digital currencies like Bitcoin and Ethereum are seen as a modern, high-risk, high-reward investment option

Cryptocurrency has emerged as a fascinating and relatively new asset class that has captured the attention of investors, including millionaires, seeking alternative ways to safeguard and grow their wealth. This digital form of currency, operating independently of central banks, offers a unique investment opportunity with both potential rewards and significant risks. Bitcoin, the pioneer of this digital revolution, and its subsequent offspring, Ethereum, have become household names in the financial world.

The appeal of cryptocurrency lies in its decentralized nature, which means it operates on a technology called blockchain, a distributed ledger system that ensures transparency, security, and immutability. This technology underpins the entire cryptocurrency market, providing a secure and efficient way to conduct transactions without the need for intermediaries like banks. Millionaires are drawn to this system because it offers a level of privacy and control that traditional financial institutions might not provide.

However, the very nature of cryptocurrency also presents a high level of risk. The market is highly volatile, with prices fluctuating dramatically over short periods. This volatility can be both a blessing and a curse. On one hand, it provides the potential for substantial gains, which is why some millionaires are willing to take the leap and invest in this emerging asset class. On the other hand, the lack of intrinsic value and the speculative nature of the market mean that investors could potentially lose a significant portion of their capital.

For those who are willing to take on this risk, investing in cryptocurrency can be a strategic move. Millionaires often diversify their portfolios, and adding a small allocation to cryptocurrency can provide an opportunity to benefit from the long-term growth potential of this technology. The key is to understand the market dynamics, stay informed about regulatory changes, and be prepared for rapid price movements.

In summary, cryptocurrency, with its associated risks and rewards, is a modern investment option that millionaires are increasingly considering. It offers a unique blend of security, privacy, and potential for wealth creation, but it also demands a careful and informed approach due to its volatile nature. As with any investment, thorough research and a long-term perspective are essential to navigating this digital asset class successfully.

Maximizing Returns: Strategies to Earn 10% on Investments

You may want to see also

Frequently asked questions

Millionaires often prioritize liquidity and security when investing their cash. They may choose to keep a portion of their wealth in high-quality, short-term investments like money market funds, which offer a safe haven for their cash while providing a modest return. These funds are highly liquid, allowing millionaires to access their money quickly if needed.

Yes, another popular choice is to hold a portion of their assets in government bonds, particularly short-term ones. These bonds offer a low-risk investment with a stable return, often considered a safe haven during economic uncertainties. Millionaires may also explore options like certificates of deposit (CDs) from reputable banks, providing a fixed return over a specified period.

Millionaires often adopt a diversified approach to manage risk. They may allocate a significant portion of their cash to low-risk investments while also exploring opportunities in the stock market or real estate. For instance, they might invest in index funds or exchange-traded funds (ETFs) that track the performance of a specific market sector, offering a balance between safety and potential growth.

Alternative investments can be attractive to millionaires seeking unique opportunities. These may include private equity investments, which offer access to exclusive deals and potential high returns. Additionally, millionaires might explore real estate investment trusts (REITs), allowing them to invest in property without the need for direct ownership, thus diversifying their portfolio and potentially benefiting from rental income or property appreciation.