When it comes to investing your 401(k), finding a safe and reliable place to park your retirement savings is crucial. With a 401(k), you're looking for an investment strategy that balances risk and reward while ensuring the long-term growth of your money. A safe place to invest your 401(k) might include low-risk assets like bonds, treasury bills, or index funds, which offer stability and a steady return over time. Alternatively, you could consider a diversified portfolio that includes a mix of stocks, bonds, and other assets to balance risk and reward. It's essential to consult with a financial advisor to determine the best investment strategy for your specific financial goals and risk tolerance.

What You'll Learn

- Traditional Stocks: Diversify across sectors for long-term growth

- Bonds: Offer stability and income, ideal for risk-averse investors

- Real Estate: Invest in REITs for property exposure without direct ownership

- Mutual Funds/ETFs: Managed funds provide instant diversification and professional management

- Alternative Investments: Explore options like gold, crypto, or private equity

Traditional Stocks: Diversify across sectors for long-term growth

When considering where to invest your 401(k), traditional stocks can be a viable option, especially when approached with a strategic focus on diversification. Diversification is a key principle in investing, and it involves spreading your investments across various sectors and asset classes to mitigate risk. By diversifying your 401(k) into traditional stocks, you can aim for long-term growth while also managing potential risks.

The stock market has historically demonstrated the potential for substantial returns over extended periods. Traditional stocks, which are shares of publicly traded companies, offer investors ownership in these businesses. Over time, these companies can grow, and their stock prices can rise, providing investors with capital appreciation. However, it's important to note that stock prices can also fluctuate, and there is inherent risk involved. This is where diversification comes into play.

Diversifying your 401(k) across different sectors is a prudent strategy. Sectors such as technology, healthcare, finance, energy, and consumer goods each have unique characteristics and growth potentials. By investing in a range of sectors, you reduce the impact of any single sector's performance on your overall portfolio. For instance, if the technology sector experiences a downturn, your investments in healthcare or consumer goods might provide a stabilizing effect, ensuring that your 401(k) doesn't take a significant hit.

To implement this strategy, consider the following: Research and select companies within each sector that you believe have strong growth prospects. Look for businesses with a competitive edge, innovative products or services, and a solid management team. Diversify your portfolio by choosing a mix of large-cap, mid-cap, and small-cap companies across various sectors. This approach ensures that you benefit from the growth potential of multiple industries while also managing risk.

Additionally, consider the time horizon of your investment. Traditional stocks are often recommended for long-term investors, as they provide an opportunity to ride out short-term market volatility and benefit from the compounding effect of reinvesting dividends. By maintaining a diversified portfolio over an extended period, you increase the likelihood of achieving your financial goals, such as retirement savings or financial independence.

In summary, investing your 401(k) in traditional stocks with a focus on diversification across sectors can be a safe and effective strategy for long-term growth. It allows you to participate in the potential upside of the stock market while managing risk through a well-rounded investment approach. Remember, diversification is a powerful tool to help smooth out the ride in the stock market and potentially enhance your overall investment returns.

Raisins: A Sweet Investment Strategy or a Sour Deal?

You may want to see also

Bonds: Offer stability and income, ideal for risk-averse investors

Bonds are a type of investment that can provide a sense of security and stability, making them an attractive option for those seeking a safe haven for their 401(k) contributions. These financial instruments represent a loan made by an investor to a borrower, typically a government, municipality, or corporation. When you invest in bonds, you essentially lend your money, and in return, you receive regular interest payments, known as coupon payments. This makes bonds a reliable source of income, especially for risk-averse investors who prioritize capital preservation and consistent returns.

One of the key advantages of bonds is their ability to offer a steady stream of income. Unlike stocks, which can be volatile and subject to market fluctuations, bonds provide a predictable cash flow. This predictability is particularly appealing to investors who want to ensure a regular return on their investments, especially during retirement when income stability is crucial. For instance, Treasury bonds, issued by the U.S. government, are renowned for their safety and reliability, offering a fixed interest rate over a specified period.

In the context of a 401(k) plan, bonds can be a valuable addition to your investment portfolio. They provide a diversification benefit, reducing the overall risk of your retirement savings. By allocating a portion of your 401(k) to bonds, you can balance the potential volatility of stocks with the stability of fixed-income securities. This strategy is often recommended by financial advisors to ensure that your retirement savings remain intact even during market downturns.

When considering bond investments, it's essential to understand the different types available. Government bonds, such as those issued by the federal, state, or local governments, are generally considered low-risk. These bonds are backed by the full faith and credit of the issuing entity, making them a safe bet for investors. Corporate bonds, on the other hand, carry more risk but can offer higher returns, especially for those seeking to maximize their 401(k) contributions.

For risk-averse investors, bonds provide a sense of security and a reliable income stream. They are a crucial component of a well-diversified retirement portfolio, offering a safety net during market volatility. By carefully selecting the right bonds and considering the various types available, investors can make informed decisions to ensure their 401(k) savings grow steadily and securely over time. This approach allows individuals to maintain control over their financial future, providing peace of mind and a stable foundation for retirement.

Goldman Sachs Investment Strategies: A Comprehensive Guide

You may want to see also

Real Estate: Invest in REITs for property exposure without direct ownership

Investing in real estate can be a powerful way to grow your 401(k) and diversify your portfolio, but it doesn't necessarily mean you need to own physical properties. One of the safest and most accessible ways to gain exposure to the real estate market is through Real Estate Investment Trusts (REITs). These companies offer an opportunity to invest in a portfolio of income-generating properties without the hassle and risk of direct property ownership.

REITs are companies that own and operate income-producing real estate or mortgage loans. They are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends, making them an attractive investment for those seeking regular income. When you invest in a REIT, you become a shareholder and benefit from the profits and growth of the underlying real estate assets. This investment vehicle provides a way to access the real estate market with the potential for steady returns.

One of the key advantages of REITs is the diversity they offer. These companies typically own a wide range of properties, including office buildings, shopping malls, apartments, and hotels. By investing in a REIT, you gain exposure to multiple properties and locations, reducing the risk associated with a single asset. This diversification is crucial for long-term wealth building and can provide a more stable investment compared to direct property ownership.

Additionally, REITs offer liquidity, which is an essential factor when considering investments for your 401(k). Unlike direct real estate investments, REITs can be bought and sold on major stock exchanges, providing easy access to your funds when needed. This liquidity also allows you to take advantage of market opportunities or rebalance your portfolio without the complexities of selling physical properties.

In summary, investing in REITs is a strategic way to gain exposure to the real estate market and grow your 401(k). It offers the benefits of property ownership without the associated risks and maintenance. With the potential for steady income and portfolio diversification, REITs are a safe and attractive option for those looking to invest in real estate without direct ownership. Researching and selecting reputable REITs can be a wise step towards building a robust retirement portfolio.

Where Equity Investments Hide in Financial Statements

You may want to see also

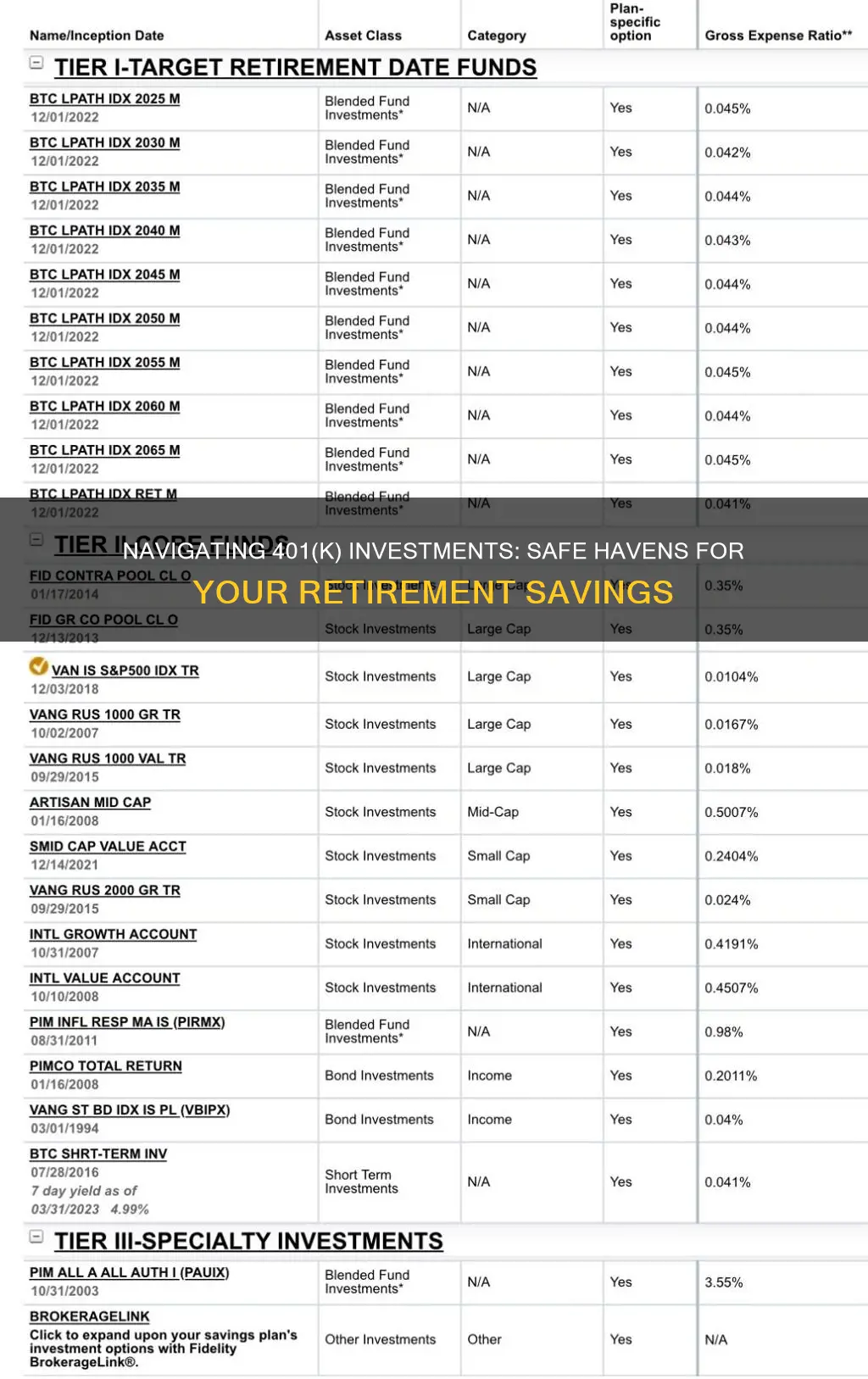

Mutual Funds/ETFs: Managed funds provide instant diversification and professional management

Mutual funds and Exchange-Traded Funds (ETFs) are popular investment options for those looking to diversify their 401(k) portfolios. These managed funds offer a convenient way to gain instant diversification and professional management, which can be beneficial for long-term investors. Here's a detailed look at why these investment vehicles might be a safe and strategic choice for your retirement savings.

Mutual funds are a type of investment fund that pools money from many investors to purchase a diverse range of securities, such as stocks, bonds, or other assets. When you invest in a mutual fund, you essentially buy a small fraction of the entire portfolio. This diversification is a key advantage, as it reduces the risk associated with individual stock or bond performance. For instance, if one stock in the fund underperforms, the overall impact on your investment is minimized due to the presence of other strong holdings. This strategy is particularly appealing for retirement savings, as it aligns with the goal of building a robust, long-term investment strategy.

ETFs, on the other hand, are similar to mutual funds but trade on stock exchanges like individual stocks. They also offer diversification and can be an excellent addition to your 401(k) portfolio. ETFs typically track an index, such as the S&P 500, and provide exposure to a broad range of companies or asset classes. This means you can invest in a diverse set of companies without having to pick individual stocks, which can be a challenging task for many investors. The trading nature of ETFs also allows for more flexibility, as they can be bought and sold throughout the trading day, providing investors with the ability to react quickly to market changes.

The professional management aspect of these funds is another significant benefit. Mutual funds and ETFs are managed by experienced fund managers who make investment decisions on behalf of the investors. These professionals have the resources and expertise to research, analyze, and select securities, ensuring that your 401(k) is invested in a well-diversified and carefully curated portfolio. This management can be particularly valuable for those who prefer a more hands-off approach to investing or lack the time and knowledge to make frequent investment decisions.

Additionally, mutual funds and ETFs often have lower expense ratios compared to actively managed individual stocks or bonds. This means that a smaller portion of your investment goes towards management and operational costs, leaving more of your money working for you. Lower fees can contribute to higher long-term returns, making these investment vehicles even more attractive for retirement savings.

In summary, mutual funds and ETFs provide a safe and strategic approach to investing in your 401(k). They offer instant diversification, reducing the risk associated with individual securities, and professional management, ensuring your investments are carefully selected and managed. By considering these investment options, you can build a well-rounded retirement portfolio that aligns with your financial goals and provides a sense of security for your future.

Investing Wisely: Earning $50,000 Annually with Smart Strategies

You may want to see also

Alternative Investments: Explore options like gold, crypto, or private equity

When it comes to investing your 401(k), it's important to consider alternative options beyond traditional stocks and bonds. While these conventional assets have their merits, exploring alternative investments can potentially offer diversification and unique benefits. Here's a breakdown of some alternative investment avenues to consider:

Gold and Precious Metals:

Investing in physical gold or precious metals like silver and platinum can be a hedge against market volatility and inflation. Gold, in particular, has a long history of retaining value during economic downturns. You can invest in gold through physical purchases, gold exchange-traded funds (ETFs), or gold-focused mutual funds. This strategy provides a tangible asset that can serve as a safety net for your retirement savings.

Cryptocurrency:

The rise of cryptocurrency has opened up a new frontier for investors. Bitcoin, Ethereum, and other digital currencies offer an alternative to traditional fiat currencies. Cryptocurrency investments can be made through specialized exchanges or cryptocurrency-focused mutual funds. While it's a relatively new and volatile asset class, some investors see it as a long-term store of value and a way to diversify their portfolios. However, due to its speculative nature, it's essential to carefully research and understand the risks involved before investing a significant portion of your 401(k).

Private Equity:

Private equity investments involve supporting private companies or funds that invest in private companies. This asset class can provide access to exclusive opportunities and potentially higher returns. Private equity firms invest in various sectors, including technology, healthcare, and consumer goods. Investing in private equity can be done through private equity funds or via your 401(k) if your plan offers such options. This strategy allows you to support innovative businesses while potentially earning competitive returns.

Real Estate Investment Trusts (REITs):

REITs offer an alternative way to invest in the real estate market without directly purchasing properties. These companies own and manage income-generating real estate, such as office buildings, shopping centers, or apartments. REITs provide investors with a share of the real estate market's performance through a publicly traded company. This investment vehicle can offer diversification and a steady income stream, making it an attractive alternative for those seeking a non-traditional investment.

Exploring these alternative investments can be a strategic move to enhance your 401(k) portfolio. However, it's crucial to remember that these investments often come with higher risks and may not be suitable for everyone. Conduct thorough research, consider your risk tolerance, and consult with a financial advisor to ensure these alternative options align with your long-term financial goals.

Exploring Private Savings and Investment Spending Dynamics

You may want to see also

Frequently asked questions

A safe and reliable investment option for your 401(k) is to consider index funds or exchange-traded funds (ETFs) that track a broad market index like the S&P 500. These funds offer diversification across multiple companies and industries, reducing risk. They have historically provided steady long-term returns and are a popular choice for retirement savings.

Absolutely! A common strategy is to use a target-date fund, which adjusts its asset allocation based on your expected retirement date. For example, a 2050 target-date fund will initially have a higher stock allocation and gradually shift to more bonds as the target date approaches. This strategy helps manage risk by automatically rebalancing your portfolio.

Diversifying internationally can be a smart move, but it's essential to research and understand the risks. Consider investing in international ETFs or mutual funds that track global markets. This approach provides exposure to foreign companies and currencies, potentially offering higher returns and reducing reliance on the US market. However, be aware of the additional risks associated with international investing, such as political instability and currency fluctuations.