Foreign investments can be a complex aspect of tax filing, and understanding where to report them on your 1040 tax return is crucial. This paragraph will guide readers through the process of identifying the specific section on the 1040 form where foreign investments should be reported, ensuring compliance with tax regulations and providing clarity on the reporting requirements for international assets.

What You'll Learn

- Foreign Income Reporting: Report income from foreign sources on your 1040

- Tax Treaties: Understand how tax treaties affect your foreign investments

- Foreign Dividends: Claim tax credits for foreign dividends on your US tax return

- Foreign Real Estate: Report income from foreign real estate investments on Form 8938

- Foreign Trusts: Disclose ownership of foreign trusts and their assets on Schedule C

Foreign Income Reporting: Report income from foreign sources on your 1040

Reporting foreign income on your U.S. tax return, specifically Form 1040, is a crucial aspect of international tax compliance. When you have income from sources outside the United States, it's essential to understand the reporting requirements to avoid penalties and ensure accurate tax liability. Here's a detailed guide on how to report foreign income on your 1040.

Understanding the Form 1040 and Foreign Income:

Form 1040 is the U.S. Individual Income Tax Return, which is used to report various types of income, deductions, and credits. When you have income from foreign sources, it falls under the category of 'foreign income' and must be reported accordingly. This includes income from employment, investments, business activities, or any other source outside the United States.

Foreign Income Reporting on Form 1040:

- Schedule C (Profit or Loss from Business): If you have foreign business income, you'll need to complete Schedule C. Report the income from your foreign business activities, including any expenses incurred. This schedule is crucial for self-employed individuals or those with foreign business ventures.

- Form 2555 (Foreign Income and Expenses): This form is specifically designed for reporting foreign income and expenses. You'll need to provide details about the foreign income, including the type of income, the country of source, and the amount. It also allows you to claim certain foreign expenses, such as foreign housing costs or foreign tax credits.

- Foreign Tax Credit: When you report foreign income, you may be eligible to claim the foreign tax credit. This credit allows you to reduce your U.S. tax liability by the amount of foreign taxes paid. You'll need to calculate the foreign tax credit and enter it on Form 1040, line 59.

- Foreign Bank and Financial Accounts (FBAR): It's important to note that reporting foreign income is just one part of the process. You may also need to file Form 114, Foreign Bank and Financial Accounts, if you have a foreign financial account with a balance above a certain threshold.

Instructions for Filing:

- When filling out Form 1040, ensure you accurately report all foreign income sources. Provide details about each income type and the corresponding country of source.

- If you have multiple foreign income sources, you may need to attach additional schedules or forms to provide more information.

- Double-check your calculations and ensure you claim any eligible credits or deductions.

- Consider seeking professional advice if your foreign income is complex or if you have specific tax situations.

Remember, accurate reporting of foreign income is essential to comply with U.S. tax laws and to avoid any potential issues with the Internal Revenue Service (IRS). It's always recommended to stay updated with the latest tax regulations and seek professional guidance when dealing with international tax matters.

Betterment's Best ETFs: Where to Invest?

You may want to see also

Tax Treaties: Understand how tax treaties affect your foreign investments

Tax treaties play a crucial role in the world of international finance, especially when it comes to foreign investments. These agreements, signed between two or more countries, aim to prevent double taxation and provide a framework for resolving tax-related issues that may arise between nations. Understanding how tax treaties work and their impact on your foreign investments is essential for any investor looking to navigate the complex landscape of international tax laws.

When you invest in a foreign company or property, you might be subject to taxes in both your home country and the country where the investment is made. This is where tax treaties come into play. These treaties establish rules and guidelines to ensure that investors are not unfairly taxed twice. By providing a clear understanding of the tax obligations in each country, tax treaties offer a level of certainty and protection to investors. For example, if you own a piece of property in a foreign country, a tax treaty might specify that you are only taxed on the rental income generated, not on the property's value or any potential capital gains.

The impact of tax treaties is particularly significant for investors with a global portfolio. By reducing or eliminating double taxation, these treaties encourage cross-border investments and promote economic growth. They also help investors avoid the complexities and potential penalties associated with non-compliance. For instance, a tax treaty might provide for the exchange of tax information, allowing tax authorities to monitor and ensure compliance, thus reducing the risk of fraud or abuse.

Understanding the specific provisions of tax treaties relevant to your investments is crucial. These treaties often cover various aspects, including income tax, capital gains tax, corporate tax, and even estate tax. They may also include provisions for tax credits, tax exemptions, and the allocation of taxing rights between the countries involved. For foreign investors, it is essential to know that tax treaties can vary widely, and the terms and conditions can significantly impact the overall tax burden and investment returns.

In summary, tax treaties are a vital consideration for anyone investing in foreign assets. They provide a legal framework to ensure fair and efficient taxation, reducing the potential for double taxation and offering protection against excessive tax liabilities. By familiarizing yourself with these treaties and their implications, investors can make informed decisions, optimize their investment strategies, and ensure compliance with international tax laws. It is always advisable to consult with tax professionals who specialize in international tax matters to fully understand the impact of tax treaties on your specific investment portfolio.

Recording Cash Investments: A Quickbooks Guide

You may want to see also

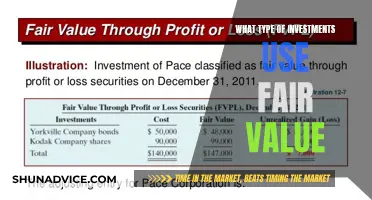

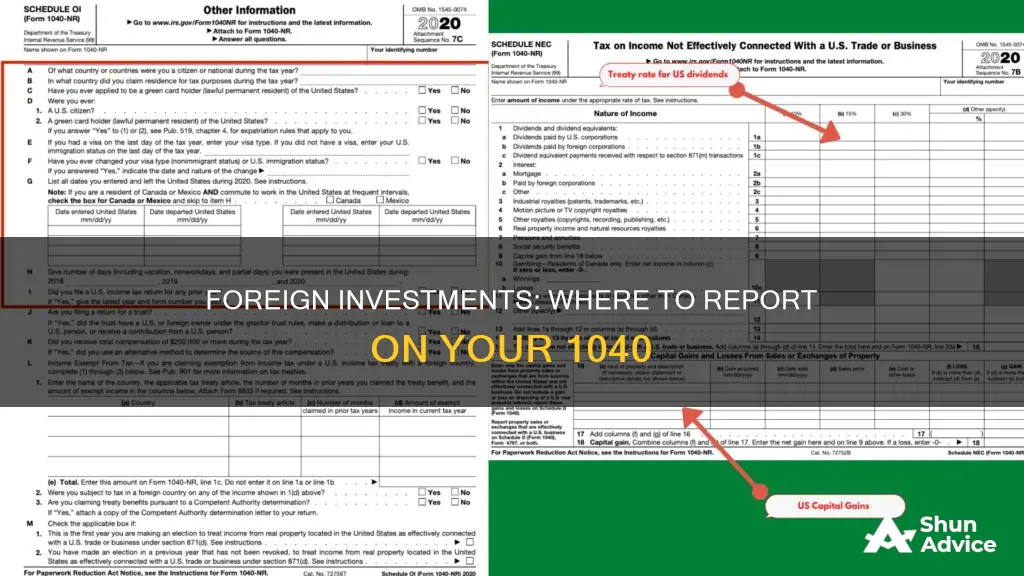

Foreign Dividends: Claim tax credits for foreign dividends on your US tax return

When it comes to filing your US tax return, it's important to understand how to properly report and claim tax credits for foreign investments, specifically foreign dividends. Many US taxpayers receive dividends from foreign corporations, and these dividends can be subject to double taxation if not handled correctly. Here's a step-by-step guide on how to claim tax credits for foreign dividends on your US tax return.

Understanding Foreign Dividends

Foreign dividends are payments received from a foreign corporation for owning shares in that company. These dividends are often paid out of the profits of the foreign entity and can be a significant source of income for US investors. However, since the US and many foreign countries have different tax laws, these dividends may be taxed twice, once in the country of origin and again in the US.

Claiming Tax Credits

The Foreign Tax Credit (FTC) is a mechanism used to prevent double taxation. When you file your US tax return, you can claim the FTC to reduce your US tax liability by the amount of tax already paid on the foreign dividends in the country of origin. Here's how you can do it:

- Gather Information: Collect all relevant documents, including Form 1118 (Foreign Currency Translation), Form 1040NR (Nonresident Alien's U.S. Income Tax Return), and any foreign tax forms that show the amount of foreign taxes paid.

- Calculate Foreign Taxes Paid: Determine the total amount of foreign taxes paid on the foreign dividends. This information is crucial for calculating the FTC.

- Fill Out Form 1118: This form is used to report the value of foreign currency and foreign-source income. You'll need to provide details about the foreign dividends received and the corresponding foreign taxes paid.

- Claim the FTC on Form 1040: On your US tax return (Form 1040), you'll find a section dedicated to foreign taxes. Here, you can claim the FTC by entering the amount of foreign taxes paid. This reduces your US tax liability, ensuring you're not double-taxed.

Important Considerations:

- It's essential to keep accurate records of all foreign dividend income and the corresponding foreign taxes paid. This documentation will be required when filing your US tax return.

- The FTC is limited to the US tax rate in effect for the year in question. If the foreign tax rate is lower than the US rate, you may not be able to claim the full amount.

- Consult a tax professional or accountant if you have complex investment portfolios or are unsure about the process. They can provide personalized advice and ensure compliance with tax regulations.

By properly claiming the Foreign Tax Credit, you can effectively manage the tax implications of foreign dividends and ensure that your US tax return is accurate and compliant. Remember, staying organized and keeping detailed records are key to successfully navigating the tax reporting process for international investments.

Understanding E-Trade Cash Availability for Investment

You may want to see also

Foreign Real Estate: Report income from foreign real estate investments on Form 8938

If you have foreign real estate investments, it's important to understand how to report the income from these investments on your U.S. tax return, specifically on Form 1040. The IRS requires individuals with significant foreign assets to disclose this information to ensure compliance with tax laws. Here's a step-by-step guide to help you navigate this process:

Understanding Form 8938

Form 8938 is a crucial document for reporting foreign assets, including foreign real estate. This form is designed to capture information about assets held outside the United States that exceed certain thresholds. It's essential to complete this form accurately to avoid potential penalties for non-compliance. When reporting foreign real estate income, you'll need to provide details about the property, rental income received, and any expenses related to the investment.

Reporting Income from Foreign Real Estate

When you own foreign real estate, you may generate rental income or experience capital gains upon sale. This income must be reported on your U.S. tax return. Here's how to approach it:

- Rental Income: If you receive rental income from your foreign property, you'll need to report it on Schedule E (Form 1040) of your tax return. This schedule allows you to detail income and expenses related to real estate activities. Include the rental income received, any expenses incurred for maintenance or repairs, and the property's fair market value.

- Capital Gains: If you sell your foreign real estate, you may have a capital gain. This gain is calculated by subtracting your basis (the original purchase price plus improvements) from the sale price. Report this gain on Form 4547-S, which is attached to Schedule D (Form 1040). Ensure you provide the necessary details, including the sale date, purchase price, and any applicable deductions.

Disclosure Requirements

It's important to note that Form 8938 has specific disclosure requirements. If the fair market value of all your foreign assets (including real estate) exceeds $100,000 at any point during the tax year, you must file Form 8938 with your tax return. This form requires you to list the assets, their values, and any income or transactions related to them. Accuracy and transparency are key to avoiding IRS scrutiny.

Seeking Professional Guidance

Given the complexity of reporting foreign investments, especially real estate, it is highly recommended to consult a tax professional or accountant experienced in international tax matters. They can provide personalized advice, ensure compliance with all relevant regulations, and help you navigate any potential tax implications.

Exchange Rates: The Unseen Force Behind Foreign Direct Investment

You may want to see also

Foreign Trusts: Disclose ownership of foreign trusts and their assets on Schedule C

When it comes to reporting foreign investments, including those held through foreign trusts, on your U.S. tax return, there are specific forms and schedules you need to complete. For individuals, this primarily involves Schedule C of Form 1040, which is used to report various types of income and other relevant information. Here's a detailed guide on how to disclose ownership of foreign trusts and their assets on Schedule C.

Understanding Foreign Trusts:

Foreign trusts are legal entities established and operated outside the United States. They can be structured in various ways, such as grantor trusts, non-grantor trusts, or charitable trusts. These trusts often hold assets like real estate, stocks, bonds, or other investments. As a U.S. taxpayer, you may have an interest in a foreign trust, either as the grantor, a beneficiary, or a trustee.

Reporting on Schedule C:

Schedule C of Form 1040 is primarily used to report income, expenses, and other items related to your business or self-employment activities. However, it also includes a section for reporting certain types of foreign investments. Here's how to disclose foreign trust information:

- Foreign Trust Information: In the "Other Income" section of Schedule C, you'll find a line labeled "Foreign Trust Income." This is where you report any income received from a foreign trust, such as trust distributions or interest. If you have multiple foreign trusts, you may need to provide details for each one.

- Trust Assets: Schedule C also requires you to disclose the value of trust assets. In the "Other Assets" section, you should list the total value of all foreign trust assets held during the tax year. This includes the fair market value of any investments, real estate, or other property owned by the trust.

- Trustee's Information: If you are a trustee of a foreign trust, you must provide your name, address, and taxpayer identification number (if applicable) for the trust. This information is crucial for identifying the trust and ensuring proper reporting.

- Grantor's Information: If you are the grantor of a foreign trust, you should also provide your details, including your name, address, and Social Security or Taxpayer Identification Number. This is important for transparency and tax compliance.

Additional Considerations:

- Form 8938: For more complex foreign trust situations, you may need to file Form 8938, which reports foreign financial assets with a value exceeding certain thresholds. This form provides more detailed information about your foreign investments, including those held in trusts.

- Foreign Bank Accounts: If your foreign trust also holds bank accounts, you should report these on Form 114 (Foreign Bank and Financial Accounts) or FinCEN Form 114 if the account is held by a trust.

- Consult a Professional: Given the complexity of foreign trust reporting, it's advisable to consult a tax professional or accountant who specializes in international tax matters. They can ensure that your reporting is accurate and compliant with all relevant tax laws.

By carefully completing Schedule C, you can accurately disclose your involvement with foreign trusts and their assets, ensuring that you meet your tax obligations as a U.S. taxpayer with global investments.

Exploring Global Investment: Types and Strategies for Foreign Investment

You may want to see also

Frequently asked questions

Foreign investments are typically reported on Schedule D (Form 1040) of your US tax return. This schedule is used to report income, expenses, gains, and losses from investments, including those held in foreign countries.

No, foreign investments are usually reported on the same Schedule D form that you use for domestic investments. You'll need to provide details about the foreign investment, such as the type of investment, the country it's located in, and any relevant financial information.

The tax treatment of foreign investments can vary depending on the type of investment and the tax laws of the country where it's held. It's important to consult the IRS publication or guidelines specific to your situation. Generally, you may need to calculate foreign tax credits or report foreign investment income on your US tax return.

Yes, when reporting foreign investments, you'll use specific codes and forms. For instance, you might use Form 6251 (Alternative Minimum Tax) or Form 8949 (Sales and Other Dispositions of Capital Assets) to report the sale or exchange of foreign investments. These forms help the IRS track the details of your foreign holdings.

Yes, the IRS requires you to disclose all foreign investments, even if they are not significant in value. This is to ensure compliance with tax laws and to provide a comprehensive view of your financial holdings. You'll typically report the details of each foreign investment on the appropriate lines of Schedule D.