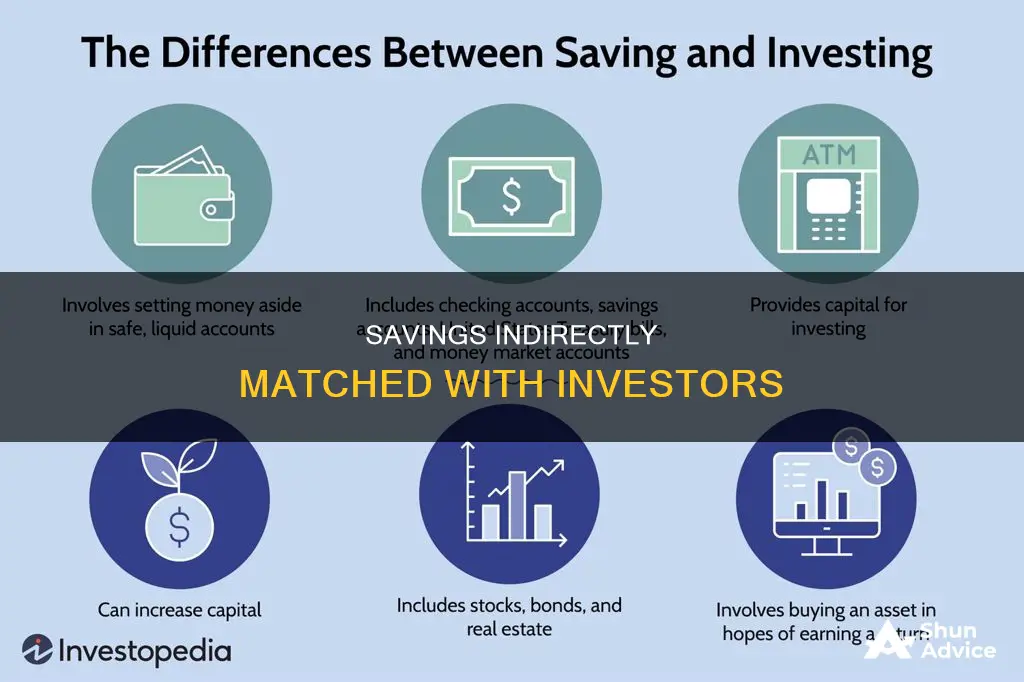

Saving and investing are two different financial strategies. Saving means putting money aside, typically into a bank account, for a particular goal, like paying for a car or a down payment on a house. On the other hand, investing involves using money to buy assets that might increase in value, such as stocks, property or shares in a mutual fund.

Savings accounts are very safe but tend to offer low rates of return. In contrast, investing can provide higher returns but always involves risk.

| Characteristics | Values |

|---|---|

| Purpose | People's savings are matched with those investing to allow savers to earn interest on their savings and investors to access funds for their ventures. |

| Risk | Savings are generally considered safe and insured against loss, whereas investments carry the risk of losing some or all funds. |

| Returns | Savings accounts typically offer lower returns than investments, which have the potential to earn higher returns over time. |

| Liquidity | Savings are highly liquid and readily accessible, while investments must be sold to be converted to cash. |

| Time horizon | Savings are suitable for short-term goals, while investments are typically chosen for longer-term financial objectives. |

| Emergency funds | Savings are recommended for emergency funds, whereas investments are suggested for goals like retirement or a down payment on a house. |

| Financial institutions | Banks and credit unions typically offer savings accounts, while investments can be made through brokerages or investment firms. |

What You'll Learn

High-yield savings accounts

SoFi Checking and Savings

SoFi members with Direct Deposit or $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 4.60% annual percentage yield (APY) on savings balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits will earn 1.20% APY on savings balances. Interest rates are variable and subject to change at any time. There is no minimum balance requirement.

UFB Direct

UFB Direct is an online bank and a division of Axos Bank. It offers a high-yield savings account with a 5.25% APY. There is no minimum deposit requirement and zero monthly fees. UFB Direct also has a massive ATM network of over 91,000 locations and highly-rated mobile apps.

Credit Karma Money Save

Credit Karma Money Save does not have a minimum deposit requirement to open the account or pay monthly maintenance fees. It offers a 5.10% APY, and the minimum balance needed to earn the APY is only a penny. Deposits are held by MVB Bank and its partner banks and are FDIC-insured for up to $5 million.

My Banking Direct

My Banking Direct is an online-only bank and a division of Flagstar, one of the largest regional banks in the Midwest and California. It offers a 5.55% APY, with no monthly fee and only $1 needed to earn the APY. It also has a mobile app that uses fingerprint and face ID for extra security.

BrioDirect High Yield Savings Account

BrioDirect High Yield Savings Account offers a highly competitive rate on any balance over $25, making it well-suited for emergency funds and cash reserves for large purchases. There is no monthly maintenance fee, and interest compounds daily. However, there is a high minimum opening deposit of $5,000.

Varo Savings Account

The Varo Savings Account has no service fees and offers the potential for a high APY. It also has tools to automate transfers and round up your debit card transactions to the nearest dollar, helping you save your spare change automatically. To earn 5.00% APY, customers must receive total direct deposits of $1,000 or more within each qualifying period and have a positive balance in both savings and bank accounts at the end of the calendar month. All balances above $5,000 earn an APY of 3.00%.

Crypto Investments: Legal or Not?

You may want to see also

Long-term certificates of deposit

With a long-term CD, you agree to leave your money in the account for a specified period, usually several years. In exchange, the bank pays you a higher interest rate than you would earn on a savings account. Once the CD matures, you get back your original principal plus any accrued interest.

Long-term CDs are a good choice for risk-averse investors, especially those who don't need immediate income and can commit to keeping their money in the account for an extended period. They are also suitable for retirees who don't rely on immediate income and can lock up their money for a while.

It's important to note that long-term CDs carry reinvestment risk. This means that if interest rates fall, you may earn less when you reinvest your principal and interest in new CDs with lower rates. On the other hand, if interest rates rise, you won't be able to take advantage of the higher rates because your money is already locked into a CD.

When considering a long-term CD, it's crucial to shop around for the best rates and compare the minimum deposit requirements, terms, and early withdrawal penalties offered by different banks. Some banks may also offer specialty CDs, such as bump-up or no-penalty CDs, which can provide more flexibility.

Overall, long-term CDs can be an excellent option for savers looking for a safe and reliable investment with a higher return than traditional savings accounts.

Trump Investors: Winners or Losers?

You may want to see also

Money market accounts

A money market account (MMA) is a type of savings account offered by banks and credit unions. They tend to pay higher interest rates than other types of savings accounts, but there are usually restrictions on the number of transactions that can be made by check, debit card, or electronic transfer. For example, you may only be able to make six transactions per statement cycle. With an MMA, you usually can make unlimited withdrawals and payments using an ATM, by mail, or in person.

MMAs often include check-writing and debit card privileges, which can make them more flexible than a regular checking account. However, they may require a minimum amount to be deposited, and there may be a monthly fee if your balance falls below a certain threshold.

The main reason to open an MMA is to earn a higher interest rate compared to a traditional savings or checking account, while also having the ability to write a few checks. Some high-yield savings accounts may beat MMA rates and have lower fees, so it's important to weigh your options before deciding which type of account is best for you.

Retirement Planning: Overcoming Investment Inertia

You may want to see also

Dividend stock funds

- Cash flow: Dividend funds provide a stable and consistent income.

- Yield: Dividend funds often generate higher dividend yields than broad-market indexes, which can appeal to income-oriented investors.

- Resilience: According to Morningstar analyst Todd Trubey, "Dividend funds tend, as a group, to hold up better in downturns than other equity funds."

Dividend funds can be a good choice for investors seeking regular income, capital growth, or a combination of the two. It's important to assess your investment goals, risk tolerance, and financial situation before deciding to invest in dividend funds.

AI-Assisted Investing: The Future of Finance

You may want to see also

Value stock funds

When investing in value stock funds, it is important to consider the company's fundamentals, such as financial performance, revenue, earnings, cash flow, and competitive advantage. Analyzing financial statements, such as the balance sheet, income statement, and statement of cash flows, can provide valuable insights into the company's financial health and help investors make informed decisions.

Overall, value stock funds offer a balanced approach to investing, providing the potential for capital appreciation while also offering steady income through dividends. They are a good option for investors seeking a combination of growth and safety in their investment portfolio.

Investing in People: Debt as an Asset

You may want to see also

Frequently asked questions

Saving means putting money aside, typically into a bank account, for a particular goal. Investing, on the other hand, involves using money to buy assets that might increase in value, such as stocks, property, or shares in a mutual fund.

Savings are a good strategy if you need your money in the short term. You may earn some interest on your balance, and your funds are insured against loss by organisations like the Federal Deposit Insurance Corporation (FDIC).

Investing is a good strategy for achieving longer-term financial goals. You can give your financial goals a head start by earning returns that are higher than what you could get from a savings account.

Examples of savings goals include a down payment for a home, home improvement projects, or an emergency fund.

Examples of investment goals include a down payment for a house in the distant future or leaving a financial legacy for your family.