Index funds and high-yield savings accounts are two very different financial instruments. Index funds are a type of investment that tracks the performance of a specific stock market index, such as the S&P 500. On the other hand, a high-yield savings account is a type of bank account that offers a higher interest rate than a traditional savings account. So, when deciding between investing in an index fund or putting your money into a high-yield savings account, it's important to consider your financial goals, risk tolerance, and time horizon.

Index funds can be a great option for those who want to invest in the stock market but don't have the time or expertise to pick individual stocks. By investing in an index fund, you can achieve diversification and lower your risk. However, it's important to remember that index funds are still subject to market risk, and there is the potential to lose money.

High-yield savings accounts, on the other hand, offer a relatively safe and stable option for your money. These accounts typically have FDIC insurance, which protects your funds up to a certain limit. While the interest rates on high-yield savings accounts can be higher than traditional savings accounts, they may not always keep up with inflation, and there is a chance that you could lose purchasing power over time.

So, when deciding between index fund investments and high-yield savings, consider your financial goals. If you're saving for a short-term goal, such as an emergency fund or a down payment on a house, a high-yield savings account could be a good option. If you're investing for the long term, such as for retirement or educational planning, index funds might be a better choice. Additionally, if you're comfortable with taking on more risk and have a higher risk tolerance, index funds may provide the potential for higher returns.

| Characteristics | Values |

|---|---|

| Risk | Index funds have a higher risk than high-yield savings accounts. |

| Returns | Index funds have higher returns than high-yield savings accounts. |

| Accessibility | High-yield savings accounts are more accessible than index funds. |

| Taxes | Both are taxed differently. |

| Fees | High-yield savings accounts have fewer fees than index funds. |

| Time horizon | High-yield savings accounts are better for short-term goals, while index funds are better for long-term goals. |

What You'll Learn

Index funds vs. savings: Risk and volatility

Index funds are a type of investment that can be purchased through a brokerage account. They are considered to be relatively low-risk compared to individual stocks, but they do carry various levels of risk depending on the underlying assets. Index funds are exposed to market volatility and can fluctuate in value. While they have the potential to generate higher returns than savings accounts, investors could also lose money.

Savings accounts, on the other hand, are considered a safe and secure way to store money. Savings accounts are FDIC-insured, which means that your money is protected up to $250,000 per depositor per bank. There is very little risk of losing your principal investment in a savings account. Savings accounts offer predictable returns, usually in the form of interest, and this interest is often guaranteed. While the returns on savings accounts are generally lower than those of index funds, there is no risk of losing money.

When deciding between index funds and savings accounts, it is important to consider your financial goals and risk tolerance. Index funds are better suited for long-term investments and can help build long-term savings. On the other hand, savings accounts are ideal for short-term financial goals and emergency funds due to their stability and liquidity. It is generally recommended to have a balanced approach and use both savings accounts and investments to achieve your financial goals.

Hedge Funds: Where Are They Placing Their Bets?

You may want to see also

Index funds vs. savings: Returns and gains

Index funds and high-yield savings accounts are two very different financial tools, each with its own advantages and disadvantages. Here, we will compare the two in terms of returns and gains to help you understand which option might be better suited to your financial goals.

Returns on Index Funds vs. High-Yield Savings

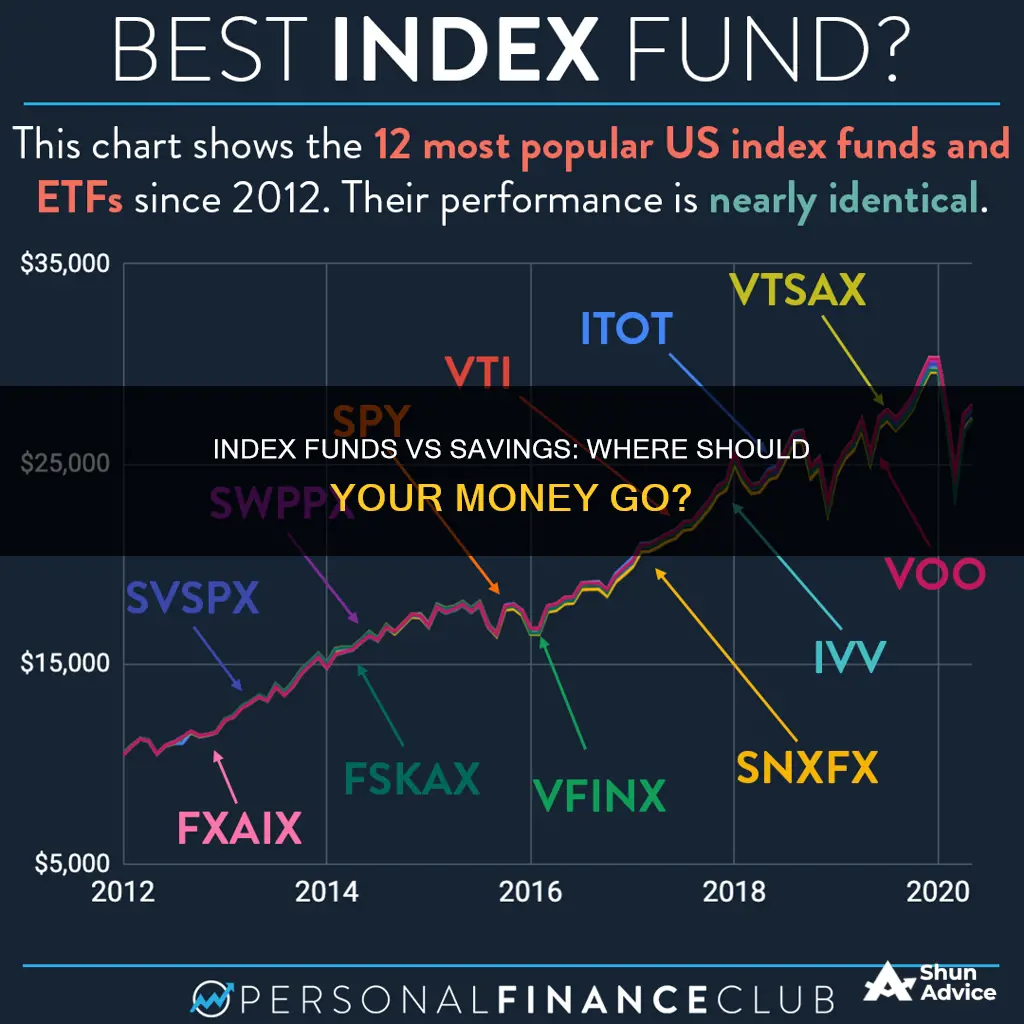

Index funds are a type of investment that hold a basket of stocks, bonds, or other securities and are designed to mirror the performance of a particular market index, such as the S&P 500. They offer investors a way to diversify their portfolio and invest in a broad range of assets without having to purchase each individual security. Over time, the S&P 500 stock index has returned about 10% annually, though returns can fluctuate from year to year.

On the other hand, high-yield savings accounts are a type of savings account that offers a higher interest rate than traditional savings accounts. While the national average savings account pays around 0.61% APY, the best high-yield savings accounts offer interest rates above 4.3%. It's important to note that these rates can change over time, and there is no guarantee that they will outperform the market.

Potential Gains from Index Funds vs. High-Yield Savings

One of the key advantages of index funds is their potential for high returns over the long term. By investing in a diverse range of securities, index funds can provide investors with gains that outperform the market and build long-term wealth. However, there is always the possibility of losing money when investing in index funds, as the value of the underlying assets can decrease.

High-yield savings accounts, on the other hand, offer a more stable option for your money. While the returns may not be as high as with index funds, your principal balance is protected. High-yield savings accounts are FDIC-insured, which means your money is protected up to $250,000 per account holder if the bank fails.

Both index funds and high-yield savings accounts have their pros and cons when it comes to returns and gains. Index funds offer the potential for higher returns but come with the risk of losing money. High-yield savings accounts, while offering lower returns, provide a safer option for your money, as your principal balance is protected. Ultimately, the best option for you will depend on your financial goals, risk tolerance, and time horizon.

How to Reinvest Dividends with Chase You Invest Mutual Funds

You may want to see also

Index funds vs. savings: Liquidity and accessibility

Liquidity and accessibility are important factors to consider when deciding between index fund investments and high-yield savings.

High-yield savings accounts are known for their liquidity, allowing you to easily access your funds. They offer the convenience of transferring money to a checking account or, in some cases, withdrawing cash through an ATM card. There may be limitations on the number of withdrawals per month due to regulations, but the funds are generally readily available. This makes high-yield savings accounts suitable for short-term financial goals, such as building an emergency fund or saving for a down payment on a home.

On the other hand, index fund investments, such as exchange-traded funds (ETFs), also offer liquidity, but with some differences. ETFs are traded on stock exchanges during market hours, and you can buy and sell shares at prevailing market prices. However, if you invest in an ETF within a retirement account, you may face penalties for early withdrawals before retirement. Additionally, selling investments can take a few days for the transactions to settle before you can withdraw money. Therefore, while ETFs provide liquidity, the accessibility of the funds may vary depending on the type of account and investment vehicle.

When comparing the accessibility of high-yield savings and index fund investments, it's important to consider the potential impact of fees and penalties. High-yield savings accounts typically do not charge monthly fees, but excessive withdrawal fees may apply if you exceed the monthly withdrawal limits set by the financial institution. With index fund investments, you may encounter trading fees, management fees, and other costs associated with managing your investment portfolio.

In summary, both high-yield savings accounts and index fund investments offer liquidity, but the level of accessibility can vary. High-yield savings accounts provide easier and more immediate access to your funds, making them suitable for short-term goals. Index fund investments, particularly those held in retirement accounts, may have restrictions on early withdrawals and take longer to liquidate, but they offer the potential for higher returns over the long term.

Understanding Federal Funds Rates, Dividends, and CODs

You may want to see also

Index funds vs. savings: Tax implications

Index funds and high-yield savings accounts are two very different financial instruments, each with its own unique features, advantages, and tax implications. Here are some key points to consider regarding the tax implications of choosing between index fund investments and high-yield savings:

Taxation of Investment Gains:

- Index Funds: When investing in index funds, you may be subject to taxes on any realized investment gains. The specific tax treatment will depend on the type of account you hold the index funds in. For example, in a taxable brokerage account, you will typically pay capital gains taxes on any profits when you sell the index funds. In tax-advantaged retirement accounts like IRAs or 401(k)s, taxes may be deferred until withdrawal.

- High-Yield Savings: The interest earned in a high-yield savings account is generally taxable as ordinary income. This interest income is typically reported to the tax authorities by the financial institution and will be included in your taxable income when you file your tax return.

Tax Efficiency:

- Index Funds: Investing in index funds can be more tax-efficient compared to actively managed funds. Index funds tend to have lower turnover, resulting in fewer taxable events. Additionally, index funds often have lower expense ratios, reducing the impact of management fees on your returns.

- High-Yield Savings: While the interest earned in a high-yield savings account is taxable, the tax consequences may be relatively straightforward. The interest income is usually reported on a 1099-INT form, and you include this amount in your taxable income. There are no complex tax calculations or special tax treatments involved.

Tax Benefits of Retirement Accounts:

- Index Funds: By holding index funds in tax-advantaged retirement accounts, such as IRAs or 401(k)s, you can take advantage of tax benefits. Contributions to traditional retirement accounts may be tax-deductible, and the investments can grow tax-free until withdrawal during retirement. With Roth accounts, withdrawals in retirement are typically tax-free.

- High-Yield Savings: While you can save for retirement with a high-yield savings account, you may not get the same tax benefits as with dedicated retirement accounts. However, you can utilize tax-advantaged retirement accounts, like IRAs, to hold high-yield savings products, such as certificates of deposit (CDs), and still enjoy tax benefits.

Early Withdrawal Penalties:

- Index Funds: Depending on the type of account, there may be penalties for withdrawing investment gains early. For example, with retirement accounts, early withdrawals may result in taxes and penalties.

- High-Yield Savings: While there are typically no taxes on withdrawing your savings, some high-yield savings accounts may impose penalties for withdrawals before a certain period, such as a minimum holding period.

Tax Treatment of Losses:

- Index Funds: If you experience investment losses with index funds, you may be able to use these losses to offset taxable capital gains, potentially reducing your tax liability.

- High-Yield Savings: In most cases, there is no tax implication for withdrawing your savings, regardless of whether your balance has grown or shrunk.

In summary, both index fund investments and high-yield savings have distinct tax implications. Index funds offer the potential for higher returns but come with the possibility of taxable events and capital gains taxes. High-yield savings accounts provide a more stable and predictable source of income, with taxable interest income. The decision between the two should consider your overall financial goals, risk tolerance, and tax strategy.

Key Factors for Investors to Consider in Mutual Funds

You may want to see also

Index funds vs. savings: When to choose each

Index funds and savings accounts are both useful tools for achieving different financial goals. Here's a detailed look at when to choose each option:

When to Choose Index Funds:

- Long-term Goals: Index funds are ideal for long-term financial goals such as retirement planning or saving for college education. These investments have the potential to generate higher returns over time, making them suitable for goals that are at least five years away.

- Wealth Accumulation: If one of your financial goals is to build and preserve wealth over the long term, index funds can help you achieve this. They offer the potential for higher returns compared to savings accounts, enabling your money to grow more aggressively.

- Beating Inflation: Savings accounts often provide returns that are lower than the rate of inflation, causing your purchasing power to decrease over time. Index funds, on the other hand, offer the potential for returns that can outpace inflation, helping you maintain or increase your purchasing power.

- Diversification: Index funds allow you to invest in a diversified portfolio of stocks, bonds, or other assets, reducing your overall investment risk. By spreading your investments across various assets, you lower the impact of any single investment loss.

When to Choose Savings:

- Emergency Fund: It is generally recommended to have an emergency fund that covers three to six months' worth of living expenses. Savings accounts are ideal for this purpose as they provide easy access to your money without any risk of losing your principal investment.

- Short-term Goals: If you are saving for a goal that you plan to achieve within the next few years, such as a down payment on a house or a car, a savings account is a better option. Savings accounts provide liquidity and stability, ensuring your money is readily available when needed.

- Accessibility: Savings accounts offer immediate access to your funds. You can easily transfer money to a checking account or withdraw cash as needed, making them suitable for short-term needs and unexpected expenses.

- Low Risk: Savings accounts are considered low-risk because they are insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA). Your deposits are protected up to $250,000 per depositor, per bank, and ownership category, providing a guarantee that your balance will not decline in value.

College Fund Investment: Strategies for Financial Security

You may want to see also

Frequently asked questions

An index fund is an investment vehicle that holds stocks, bonds, commodities, or other securities. A high-yield savings account is a basic banking product where you deposit your money, and the bank pays you interest on those deposits.

A high-yield savings account is a good option if you want easy access to your money and don't want to risk losing your principal investment. However, interest rates can fluctuate, and rates are typically not high enough to beat inflation.

An index fund offers the potential for higher returns than a savings account, and it's a relatively safe way to put your money to work. However, there is a risk of losing money, and building an effective portfolio can take time and effort.

A high-yield savings account is generally better for short-term savings because it offers liquidity and stability.

An index fund is generally better for long-term savings because it has the potential to provide higher returns, which can help you build wealth over time.