When evaluating short-term investments, it's important to understand the liquidity of assets. Short-term investments typically refer to assets that can be easily converted into cash within a year or less. In contrast, prepaid expenses are amounts paid in advance for goods or services that will be received and used in the future. While both are considered liquid assets, short-term investments generally offer more immediate liquidity due to their ability to be quickly sold or redeemed without significant loss of value. Prepaid expenses, on the other hand, are not considered liquid as they are not readily convertible into cash and may have restrictions on their use or transfer. Understanding the differences between these two types of assets is crucial for effective financial management and decision-making.

| Characteristics | Values |

|---|---|

| Definition | Short-term investments are assets that can be quickly converted into cash within one year or less. Prepaid expenses are amounts paid in advance for goods or services that will be received in the future. |

| Nature | Liquid assets that can be easily converted into cash. Prepaid expenses are not liquid as they represent future rights to receive goods or services. |

| Accessibility | Highly accessible and can be sold or redeemed quickly. Prepaid expenses are not immediately accessible and require time to be converted into cash. |

| Risk | Generally less risky as they can be sold or redeemed without significant loss of value. Prepaid expenses may be subject to market fluctuations or changes in the value of the goods/services. |

| Examples | Stocks, bonds, money market funds, certificates of deposit (CDs), treasury bills, etc. |

| Usage | Often used for short-term goals, emergency funds, or as a means of speculation. Prepaid expenses are used to manage cash flow and ensure future payments. |

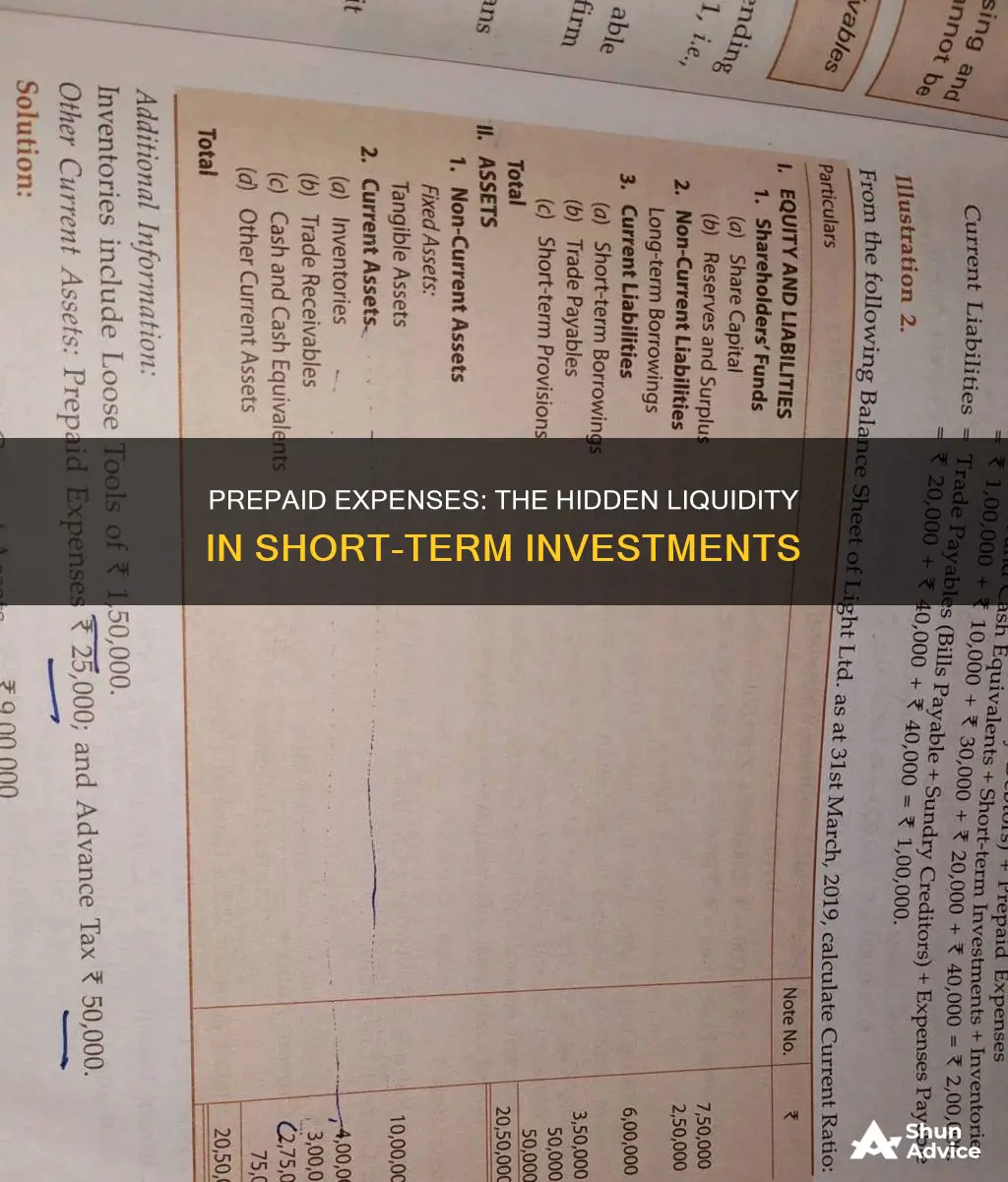

| Accounting Treatment | Short-term investments are classified as current assets. Prepaid expenses are initially recorded as an asset and then expensed over the period they cover. |

| Turnover | Typically have higher turnover rates as they are frequently bought and sold. Prepaid expenses may have lower turnover as they represent long-term commitments. |

| Market Influence | Can be influenced by market conditions and investor sentiment. Prepaid expenses are less influenced by market dynamics. |

What You'll Learn

- Liquidity: Short-term investments like stocks and bonds are more liquid than prepaid expenses, which are non-cash items

- Accessibility: Prepaid expenses are less accessible and more restricted in use compared to short-term investments

- Conversion Time: Short-term investments can be quickly converted to cash, while prepaid expenses require time to be utilized

- Market Value: Short-term investments have a readily available market value, unlike prepaid expenses, which have no immediate market value

- Risk: Prepaid expenses carry less financial risk compared to short-term investments, which can fluctuate in value

Liquidity: Short-term investments like stocks and bonds are more liquid than prepaid expenses, which are non-cash items

Liquidity is a crucial concept in finance, referring to the ease and speed with which an asset can be converted into cash without impacting its market value. When discussing short-term investments, it's essential to understand the liquidity of different financial instruments. Among these, short-term investments like stocks and bonds are generally considered more liquid than prepaid expenses, which are non-cash items.

Short-term investments, such as stocks and bonds, are highly liquid assets. Stocks represent ownership in a company and can be easily bought or sold on stock exchanges. Bonds, on the other hand, are debt instruments issued by governments or corporations, and they can be traded in the bond market. These markets provide a vast network of buyers and sellers, ensuring that investors can quickly convert these assets into cash with minimal impact on their value. For example, if an investor decides to sell stocks or bonds, they can typically do so within a few days, and the sale will not significantly affect the asset's price.

Prepaid expenses, in contrast, are non-cash items that represent advance payments made by a company for goods or services that will be received in the future. These expenses are not liquid assets because they are not readily convertible into cash. Prepaid expenses are typically recorded on a company's balance sheet as an asset until the goods or services are received, at which point they are expensed. For instance, if a company pre-pays for office rent, it is considered an asset until the actual rent period begins, and then it is expensed as incurred.

The key difference in liquidity lies in the nature of these assets. Short-term investments are actively traded and have a large market of potential buyers and sellers, allowing for quick transactions. Prepaid expenses, however, are not traded in the same way and are often unique to each company's operations. They represent future commitments and are not easily convertible into cash without impacting the company's operations or incurring additional costs.

In summary, short-term investments like stocks and bonds are more liquid than prepaid expenses due to their active trading markets and ease of conversion to cash. Prepaid expenses, being non-cash items, are less liquid and represent future commitments rather than readily available assets. Understanding the liquidity of these financial instruments is essential for investors and companies to make informed decisions regarding their short-term financial strategies.

The Pitfalls of a Bad Business Investment: A Comprehensive Guide

You may want to see also

Accessibility: Prepaid expenses are less accessible and more restricted in use compared to short-term investments

Prepaid expenses, while an essential component of a company's financial management, are inherently less accessible and more restricted in use compared to short-term investments. This is primarily due to the nature of prepaid expenses, which are essentially advance payments made by a company to suppliers or service providers for goods or services that will be received or utilized in the future. These payments are recorded as assets on the balance sheet until the goods or services are received, at which point they are expensed.

The restricted nature of prepaid expenses becomes evident when considering their intended use. Unlike short-term investments, which can be readily converted into cash or used for operational purposes, prepaid expenses are typically tied to specific transactions or services. For example, a company might prepay for office rent, which is a recurring expense, or for advertising services that will be delivered over a period. Once the service is received, the prepaid amount is no longer an asset but an expense, and it is recognized in the income statement. This process of expensing prepaid items is a standard accounting practice and ensures that the financial statements reflect the economic reality of the company's financial position and performance.

In contrast, short-term investments are more flexible and accessible. These investments are typically made in highly liquid assets, such as stocks, bonds, or money market funds, which can be quickly converted into cash with minimal impact on their value. Companies can easily buy or sell these investments to meet short-term financial objectives, such as maintaining a certain cash balance or taking advantage of market opportunities. The liquidity of short-term investments allows companies to quickly adjust their financial strategies without incurring significant costs or delays.

The accessibility of short-term investments is further emphasized by their ability to provide a buffer for unexpected financial needs. Companies can use these investments to cover short-term liabilities, manage cash flow, or respond to market changes without disrupting their core operations. For instance, if a company needs to pay off a short-term debt, it can sell a portion of its short-term investments to generate the required cash, ensuring that its financial obligations are met without compromising its long-term investment strategy.

In summary, prepaid expenses are less accessible and more restricted in use compared to short-term investments. Prepaid expenses are tied to specific transactions and are expensed over time, while short-term investments offer flexibility, liquidity, and the ability to meet short-term financial needs. Understanding these differences is crucial for companies to effectively manage their financial assets and liabilities, ensuring that their financial statements accurately reflect their financial health and operational capabilities.

Understanding Short-Term Investments: A Brainly Guide

You may want to see also

Conversion Time: Short-term investments can be quickly converted to cash, while prepaid expenses require time to be utilized

The concept of liquidity is crucial when assessing the value of short-term assets in a company's financial health. In this context, we're comparing two key categories: short-term investments and prepaid expenses. Understanding the conversion time for each can provide valuable insights into their liquidity.

Short-term investments, such as marketable securities, treasury bills, and short-term bonds, are highly liquid assets. These investments can be readily converted into cash within a short period, often a year or less. For instance, if a company purchases a 90-day Treasury bill, it can be sold and the cash received within that timeframe, providing immediate liquidity. This quick conversion to cash makes short-term investments an attractive option for businesses seeking to manage their short-term financial obligations or take advantage of immediate investment opportunities.

On the other hand, prepaid expenses represent a different aspect of liquidity. These are payments made by a company for goods or services that will be received in the future. Prepaid expenses are not immediately convertible to cash. For example, if a company pays for office rent in advance, it will take time for the landlord to provide the service, and the cash paid cannot be quickly recouped. This time lag between payment and utilization is a critical factor in assessing the liquidity of prepaid expenses.

The key difference in liquidity lies in the time required to convert these assets into cash. Short-term investments offer immediate liquidity, allowing companies to access funds quickly when needed. In contrast, prepaid expenses tie up cash for a period until the goods or services are received, making them less liquid in the short term. This distinction is essential for financial management, as it influences a company's ability to meet its short-term financial commitments and manage its cash flow effectively.

In summary, when considering short-term investments versus prepaid expenses, the former provides more immediate liquidity due to its quick conversion to cash. Prepaid expenses, while essential for various business operations, require time to be utilized and thus have a different liquidity profile. Understanding these conversion times is vital for financial decision-making and ensuring a company's financial health.

Campground Investment: A Wise Long-Term Strategy?

You may want to see also

Market Value: Short-term investments have a readily available market value, unlike prepaid expenses, which have no immediate market value

When considering the liquidity of short-term investments and prepaid expenses, it's important to understand the concept of market value and how it applies to each. Liquidity refers to how quickly an asset can be converted into cash without significant loss of value. In the context of short-term investments, these are typically financial instruments that can be easily bought or sold in the market, and their market value is readily available. For instance, stocks, bonds, and mutual funds are considered highly liquid short-term investments because they can be quickly sold to investors willing to buy them at the current market price. This market value is determined by supply and demand, and it reflects the current price at which these assets can be exchanged in the market.

On the other hand, prepaid expenses represent future economic benefits that a company has already paid for but has not yet used. These expenses are not typically traded in the open market, and thus, they do not have a readily available market value. Prepaid expenses are more like an internal accounting entry, indicating that a company has made a payment for a service or product that will be received in the future. For example, if a company pays for office rent in advance, this prepaid rent is recorded on its balance sheet until the actual use of the office space occurs. At that point, the prepaid rent is expensed, and the asset is fully utilized.

The key difference in liquidity lies in the fact that short-term investments are actively traded in financial markets, providing a clear and immediate market value. This market value is determined by the forces of supply and demand and can fluctuate based on various economic factors. In contrast, prepaid expenses are not traded in the market and do not have a direct market value that can be easily determined. They are more of a record of past transactions and future obligations, which are managed and accounted for within the company's financial systems.

In summary, short-term investments are more liquid because they have a readily available market value that can be quickly determined and exchanged. Prepaid expenses, however, are less liquid as they lack a direct market value and are more of an internal accounting representation of future benefits. Understanding this distinction is crucial for financial reporting, investment analysis, and managing a company's short-term financial obligations.

Decoding CSA: Unlocking Investment Advisory Secrets

You may want to see also

Risk: Prepaid expenses carry less financial risk compared to short-term investments, which can fluctuate in value

Prepaid expenses and short-term investments are both important components of a company's financial management, but they serve different purposes and carry distinct levels of risk. When comparing the two, it becomes evident that prepaid expenses carry less financial risk compared to short-term investments.

Prepaid expenses refer to advance payments made by a company for goods or services that will be received and utilized in the future. These expenses are typically recorded on the balance sheet as an asset until the goods or services are consumed or delivered. For example, a company might prepay for office rent, insurance, or subscription services. Since these expenses are already paid for and the goods or services are expected to be received, they represent a committed but not yet consumed resource. This nature of prepaid expenses means that they are relatively stable and less susceptible to market fluctuations.

On the other hand, short-term investments are financial assets that a company acquires with the intention of selling them within a year or less. These investments can include marketable securities, such as stocks, bonds, or mutual funds. Short-term investments are more liquid and carry a higher level of financial risk. The value of these investments can fluctuate based on market conditions, interest rates, and economic factors. For instance, if a company invests in stocks, its returns are directly tied to the performance of the stock market, which can be volatile and unpredictable.

The key difference in risk lies in the timing and certainty of the financial outcome. Prepaid expenses are a committed cost, and their value is known and stable until the goods or services are utilized. In contrast, short-term investments are more speculative, as their values can change rapidly, and the company may need to sell them at a loss if market conditions turn unfavorable. This volatility in short-term investments can impact a company's financial stability and cash flow, especially if the investments are a significant portion of its assets.

In summary, prepaid expenses carry less financial risk because they represent advance payments for future goods or services, providing a stable and committed cost. Short-term investments, however, are more risky due to their potential for value fluctuation and the speculative nature of their returns. Understanding this risk difference is crucial for companies to manage their financial resources effectively and make informed decisions regarding their short-term investments and prepaid expenses.

ACST for Long-Term Investing: A Strategic Approach

You may want to see also

Frequently asked questions

Short-term investments are financial assets that are expected to be converted into cash or sold within one year. These can include marketable securities, treasury bills, and short-term bonds. Prepaid expenses, on the other hand, are payments made in advance for goods or services that will be received and used up within one year. Examples include prepaid rent, prepaid insurance, and advance payments for services.

Short-term investments are classified as current assets on a company's balance sheet, as they are highly liquid and can be easily converted into cash. Prepaid expenses are also considered current assets because they represent cash that has been paid out but not yet used or consumed. Both of these categories are important for assessing a company's liquidity and financial health in the short term.

Not necessarily. While prepaid expenses are current assets, they represent future economic benefits that are not yet available to the company. Short-term investments, being highly liquid, can be quickly converted into cash without significant loss of value. Therefore, short-term investments are generally considered more liquid than prepaid expenses, as they provide immediate access to cash.