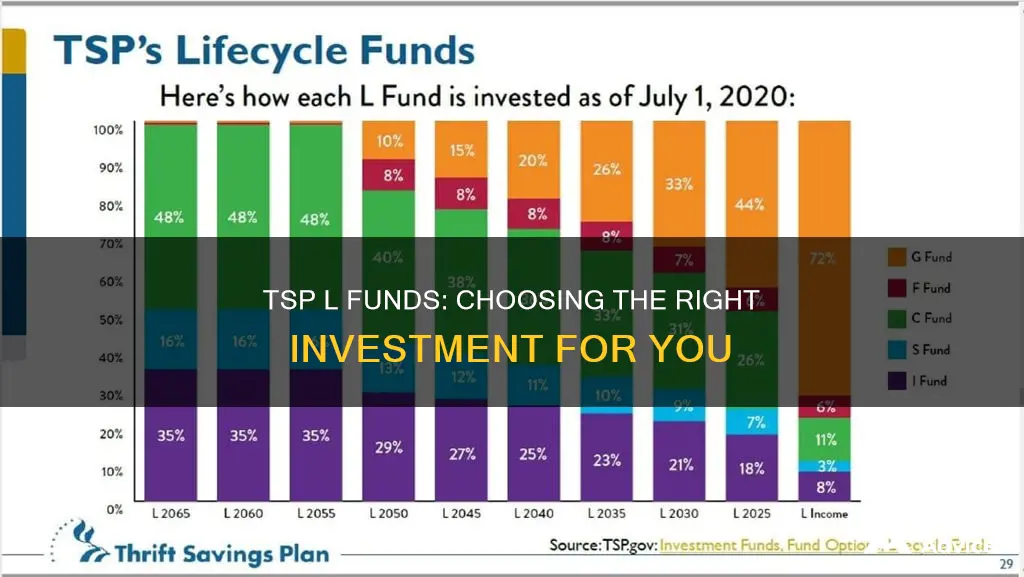

The Thrift Savings Plan (TSP) offers five core mutual funds for US government employees to invest in as part of their retirement plan. These are the Government Securities Investment Fund (G Fund), Fixed-Income Investment Index Fund (F Fund), Common Stock Index Investment Fund (C Fund), Small-Capitalization Stock Index Fund (S Fund), and International Stock Index Investment Fund (I Fund). Each fund specialises in a different asset class or market segment, such as US equities, international equities, and corporate bonds. The Lifecycle (L) Funds are composite funds that invest in a combination of the five core funds. They are designed to reduce investors' risk as they age and are based on a target retirement date. As this date approaches, the investment mix becomes more heavily weighted towards fixed-income or stable value investments, including bonds or bond funds, and Treasury securities. The L Income Fund is the most conservative of the L Funds and is designed for those already retired or planning to retire soon.

| Characteristics | Values |

|---|---|

| Investment type | Lifecycle funds |

| Investment objective | Highest possible rate of return for the amount of risk taken |

| Investment strategy | Gradual shift to more conservative investments as the target retirement date approaches |

| Number of funds | 10 active L funds |

| Investment mixes | Based on target retirement date, current age, and years until retirement |

| Investment risk | All L funds get very conservative over time |

| Investment returns | Average annual return of 4.26% for the L Income Fund since 2006 |

| Investment expenses | Net administrative expense ratio of 0.048% as of 12/31/2023 |

| Investment manager | Blackrock Capital Advisers and State Street Global Advisors |

| Investment transfers | Specify a percentage of payroll contribution or make an interfund transfer |

What You'll Learn

L Funds are designed to manage investors' risk as they age

The Thrift Savings Plan (TSP) is a retirement investment program offered to US government employees. It is one of the simplest and most efficient retirement plans available today. The Lifecycle (L) Funds are composite funds that invest in a combination of the five core TSP funds. They are designed to manage investors' risk as they age.

The L Funds are a good option for those who want to put their retirement savings on "autopilot". They are simple to use and allow federal employees to have all their money in a single fund that changes automatically as they approach retirement. The L Funds are also a good default option for those who are unsure about their investment choices.

The L Funds are based on a target retirement date, such as 2020, 2030, etc. If that date is a long time from now, the L Fund will be more heavily weighted towards stocks or stock mutual funds. As the date approaches, the investment mix will become more heavily weighted towards fixed-income or stable value investments, including bonds or bond funds and treasury securities. This gradual shift to more conservative investments is designed to reduce your risk as you get older.

The L Funds are not a one-size-fits-all solution, however. They may be too conservative for some investors, especially those who are already retired and need their investments to combat inflation and ensure their money does not run out. The L Income Fund, which is the most conservative of the L Funds, has been criticised for being too conservative, with slow growth over time.

There are a few ways to address the problem of the L Funds becoming too conservative. One way is to invest in an L Fund that is further out from your retirement date, so your money stays aggressive for longer. Another option is to leave the L Funds and invest directly in the core TSP funds.

Fund Setter: Minimum Investment Requirements and More

You may want to see also

L Income Fund is the most conservative of the L Funds

The L Income Fund is the most conservative of the L Funds. It is designed for employees who are already retired or are nearing retirement and are looking to preserve their assets. The fund has a low-level growth objective and focuses on money preservation, with 75% of the fund invested in bonds and 25% in stocks.

The L Income Fund is made up of the G Fund (71.92%), F Fund (5.83%), C Fund (11.60%), S Fund (2.86%), and I Fund (7.79%). The G and F Funds are considered very conservative, making the L Income Fund relatively safe, albeit with slow growth over time. Since 2006, the fund has grown by 4.26% on average per year, slightly above the average inflation rate of 1.5%-3%.

The L Income Fund is a good choice for those seeking a simple, low-maintenance investment strategy. It is the default fund for federal employees who are closest to their retirement date. However, some financial advisors argue that the fund may be too conservative, potentially resulting in subpar returns over time.

While the L Income Fund provides stability, it is important to consider your unique financial goals and circumstances when deciding on an investment strategy.

Actively Managed Funds: Where to Invest Your Money?

You may want to see also

L Funds are designed to simplify TSP investing

The Thrift Savings Plan (TSP) is a retirement investment program offered to US government employees. It is one of the simplest and most efficient retirement plans available today. TSP offers five core mutual funds to invest in, four of which are diversified index funds. Each index fund specializes in a different asset class or market segment, such as US equities, international equities, and corporate bonds.

The Lifecycle (L) Funds are designed to simplify TSP investing and reduce the risk of investors as they age. They are composite funds that invest in a combination of the five core funds and act like target-date funds. L Funds are the default fund for new plan participants who don't specify a contribution allocation when they make their contribution. The L fund closest to an employee's expected retirement date is the default fund for new hires. This means that even if new employees don’t change their allocation, their TSP will have a much higher chance of growing during the early parts of their career.

L Funds are designed to become more conservative over time. As the target retirement date approaches, the investment mix will become weighted more heavily toward fixed-income or stable value investments, including bonds or bond funds and Treasury securities. This gradual shift to more conservative investments is designed to reduce your risk as you approach retirement.

The L Income Fund is the most conservative of the L Funds and is designed for those who are already retired and need a conservative stream of income. It focuses on money preservation while providing small exposure to the riskier funds to reduce inflation's effect on purchasing power.

L Funds are not a one-size-fits-all solution and may not be tailored to your specific situation. They can become too conservative, which may be dangerous if you don’t want to run out of money in retirement. It is important to understand what the L Funds are designed to do and if that aligns with your circumstances and goals.

International Company Funds: Where to Invest Your Money

You may want to see also

L Funds are a better default option than G Funds

L Funds, or "Lifecycle" funds, are a type of investment fund offered by the Thrift Savings Plan (TSP) that are designed to meet the needs of investors at different stages of their lives. The main advantage of L Funds is that they simplify the investment process by automatically adjusting their asset allocation to become more conservative as an investor's retirement age approaches. This makes them a good option for those who want a simple, low-maintenance investment strategy.

Secondly, L Funds provide a simple, low-maintenance investment strategy. Investors can choose the L Fund closest to their retirement date and their portfolio will automatically adjust over time without any additional action required. This can be particularly beneficial for those who have limited investment knowledge or who don't want to actively manage their portfolios.

Additionally, L Funds offer a diversified approach to investing. By investing in a mix of G, F, C, S, and I Funds, L Funds provide exposure to different types of assets, reducing the overall risk of the portfolio. This diversification can help to minimise the impact of market fluctuations and improve long-term returns.

Furthermore, L Funds can help investors avoid the potential pitfall of investing too conservatively. G Funds, which were previously the default option, may have caused some investors to miss out on growth opportunities by being too conservative. L Funds, on the other hand, offer a balance between growth and preservation of assets, helping investors strike an optimal balance between risk and return.

Finally, L Funds can be beneficial for those who want a "set-it-and-forget-it" investment strategy. By automatically adjusting their asset allocation, L Funds remove the need for investors to constantly monitor and rebalance their portfolios. This can be especially advantageous for those who want a hands-off approach to investing.

TSP F Fund: Best Times to Invest and Why

You may want to see also

L Funds are not tailored to your situation

Additionally, the L Funds are designed to become more conservative over time, and eventually, all merge with the L Income Fund. This means that if you are planning to retire in the distant future, your money will be heavily invested in conservative funds, which may not be the best strategy if you want your money to continue growing.

Furthermore, L Funds are not tailored to your specific retirement needs and circumstances. For example, someone retiring in New York City will have different needs from someone retiring in rural Oklahoma. The L Funds are a one-size-fits-all solution and may not align with your personal financial goals.

It is important to note that the L Funds are not inherently bad, but they may not be suitable for everyone. They are designed to simplify investing and provide a default option for those who are unsure about their investment choices. However, if you want more control over your investments and want to ensure they align with your specific goals, you may need to consider alternative investment options or seek advice from a financial planner.

Mutual Fund Investment: Best Day to Invest and Grow Wealth

You may want to see also

Frequently asked questions

The Thrift Savings Plan is a retirement investment program offered to US government employees. It is similar to the 401(k) plans offered by private-sector employers.

The L funds, or lifecycle funds, are composite funds that invest in a combination of the five core TSP funds. They are designed to manage investors' risk as they age.

You should choose the L fund that is closest to your retirement date. The fund will then get more conservative for you as you approach retirement.

The L Income fund is the most conservative of the L funds. It focuses on money preservation while providing small exposure to riskier funds to reduce inflation's effect on your purchasing power.

The L funds can get too conservative, which may not suit everyone's investment goals. They are designed as a one-size-fits-all solution, so they are not tailored to individual circumstances.