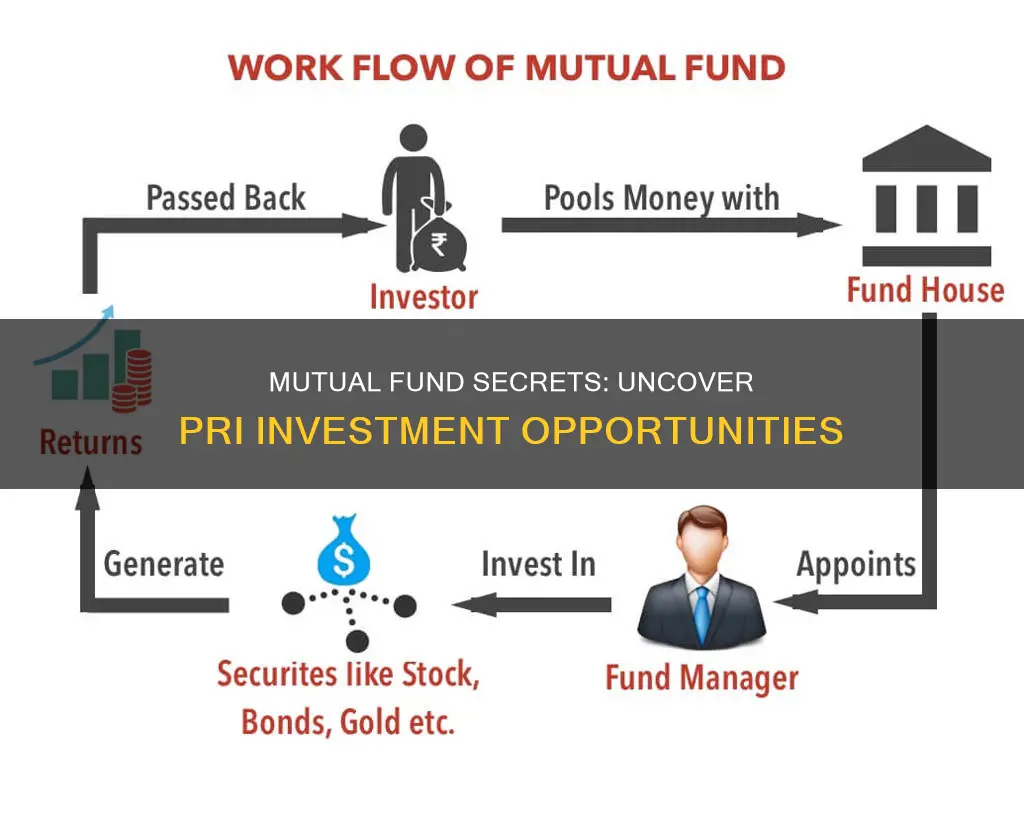

Mutual funds are a popular investment choice as they offer professional management, diversification, affordability, and liquidity. They are investment vehicles that pool money from several investors to purchase a range of securities, such as stocks, bonds, or other assets, to meet specified objectives. The funds are managed by financial experts called fund managers, who are skilled in analysing and making investment decisions.

Mutual funds are known for their diversification benefits, as they typically invest in a range of companies and industries, reducing the risk of losing money if one company fails. They are also affordable, with relatively low initial investment requirements, and investors can easily redeem their shares at any time.

The underlying investments of a mutual fund are an essential aspect of understanding its performance. The fund managers use the pooled money to buy assets according to the fund's investment objectives and strategy. For example, a stock fund might invest in a range of companies, while a bond fund might focus on government or corporate bonds. The performance of these underlying investments, minus any fund fees, determines the fund's investment return.

Mutual funds provide investors with access to a diversified and professionally managed portfolio, making them an attractive option for those seeking a balanced approach to investing.

| Characteristics | Values |

|---|---|

| Definition | A mutual fund is an investment vehicle that pools money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities |

| Management | Managed by professional fund managers |

| Investment strategy | The fund manager uses the pooled money to buy a variety of assets according to the fund's investment objectives and strategy |

| Net Asset Value (NAV) | The value of one share or unit of the mutual fund, calculated by dividing the total value of the fund's assets minus any liabilities by the number of outstanding shares or units |

| Returns to investors | Capital gains and income distributions |

| Buying and selling | Investors can buy or sell their mutual fund shares at the NAV price at the end of each trading day |

| Fees | Management fees, administrative costs, and sometimes exit load |

| Tax implications | Subject to capital gains tax (short-term and long-term) |

What You'll Learn

- Mutual funds are a type of investment company, known as an open-end fund

- They pool money from many investors and invest it based on specific investment goals

- The fund's performance depends on how its collective assets are doing

- Mutual funds are managed by financial experts called fund managers

- They are a popular choice among investors because they offer professional management and diversification

Mutual funds are a type of investment company, known as an open-end fund

Mutual funds pool money from many investors to purchase a range of securities, such as stocks, bonds, or short-term debt, to meet specified objectives. These objectives may include growth, income, or a combination of both. The fund's professional managers decide how to divide the money across sectors, industries, and companies based on the fund's strategy.

Each mutual fund has a different investment objective. Some funds invest in specific products, such as stocks or bonds, while others focus on particular industries or regions. Some funds also seek to replicate a market index.

Mutual funds offer built-in diversification, allowing investors to spread their risk across multiple investments. They are also more cost-effective than purchasing individual stocks and bonds. However, it is important to note that investing in a mutual fund involves certain risks, including the possibility of losing money.

Mutual funds are registered with the Securities Exchange Commission (SEC) and are subject to SEC regulation. They are priced and traded only once daily, at the end of the trading day, based on the net asset value (NAV) of their shares.

Mutual funds charge various fees, including annual fees, expense ratios, and commissions, which can lower overall returns. These fees cover operating expenses such as management fees, administrative costs, and marketing expenses.

Overall, mutual funds provide investors with access to diversified, professionally managed portfolios tailored to different objectives and risk tolerances.

Best IRA Companies for Mutual Fund Investors

You may want to see also

They pool money from many investors and invest it based on specific investment goals

Mutual funds are a type of investment company that pools money from many investors to purchase securities such as stocks, bonds, and short-term debt. The fund's portfolio is made up of these combined holdings. Each share in a mutual fund represents an investor's part ownership in the fund and the income it generates.

Mutual funds are a popular investment choice because they offer professional management, diversification, affordability, and liquidity. They are also versatile and accessible for those looking to diversify their portfolios.

Here's how it works:

Pooling Money from Many Investors

Mutual funds raise money by selling their own shares to investors. The money collected is then used to purchase a range of securities, such as stocks, bonds, or other assets, based on the fund's specific investment goals and strategy. Each investor owns a portion of the fund's underlying assets and has a proportional right to the income and capital gains generated by the fund.

Investing Based on Specific Investment Goals

The investment goals of a mutual fund are outlined in its prospectus, which details the fund's investment strategy, risk profile, performance history, management, and fees. The fund's professional manager(s) oversee the portfolio and make investment decisions to align with these goals. Some funds may focus on growth, income, or a combination of both. Others may invest in specific industries, regions, or types of securities, such as stocks or bonds.

By pooling money from many investors, mutual funds offer individual investors access to a diversified portfolio of securities that may otherwise be out of reach. This diversification helps to reduce risk by spreading investments across various assets, industries, and sectors.

Benefits of Pooling Money and Investing Based on Specific Goals

There are several advantages to the way mutual funds pool money and invest based on specific goals:

- Diversification: Mutual funds provide a diversified portfolio of securities, reducing the risk associated with investing in a single stock or bond.

- Professional Management: The fund's professional managers conduct research, select securities, and monitor performance, providing expertise and saving time for individual investors.

- Affordability: Mutual funds typically have low minimum investment requirements, making them accessible to a wide range of investors.

- Liquidity: Mutual fund investors can easily redeem their shares at any time, providing flexibility and access to funds.

- Economies of Scale: Pooling money from many investors allows mutual funds to benefit from economies of scale, reducing transaction costs per dollar invested.

Best Mutual Funds for One-Time Investments: Where to Invest?

You may want to see also

The fund's performance depends on how its collective assets are doing

A mutual fund is a pool of money that invests in assets like stocks, bonds, and short-term debt. The fund's performance depends on how its collective assets are doing. When the underlying assets increase in value, so does the value of the fund's shares. Conversely, when the assets decrease in value, the value of the shares also decreases.

The fund manager oversees the portfolio, deciding how to divide money across sectors, industries, and companies, based on the fund's strategy. The fund manager's goal is to beat the market by choosing investments that will perform better than a benchmark. However, the fund's performance needs to compensate for its operating costs, including the cost of hiring a professional fund manager and the cost of buying and selling investments.

Mutual funds are typically priced and traded only once daily, at the end of the day. The value of one share, known as the net asset value (NAV), is calculated by adding up the total value of the fund's investment holdings, subtracting the fund's fees and expenses, and then dividing that amount by the number of shares currently held by investors.

Mutual funds offer three ways to earn money:

- Dividend Payments: The fund distributes dividends on stocks or interest on bonds to shareholders, minus expenses.

- Capital Gains Distributions: When the fund sells a security that has increased in price, it passes on the profits, minus expenses, to shareholders.

- Increased NAV: If the market value of the fund's portfolio increases, the value of the fund and its shares also increases.

When researching the returns of a mutual fund, you will typically find a figure for the "total return," which includes any interest, dividends, or capital gains generated by the fund, as well as the change in its market value over a specific period.

It's important to consider the fees and expenses charged by a mutual fund, as these costs can significantly impact your investment returns. Mutual funds charge various fees, including management fees, 12b-1 fees, and other expenses. Sales charges or "loads" may also be applied when buying or selling shares.

When evaluating a mutual fund, it's recommended to look beyond its past performance and consider factors such as fees, taxes, age and size of the fund, risks, volatility, and recent changes in operations.

Mutual Funds vs Real Estate: Where Should You Invest?

You may want to see also

Mutual funds are managed by financial experts called fund managers

Mutual funds are managed by financial experts known as fund managers. These professionals are responsible for overseeing the fund's portfolio, making decisions about how to allocate money across different sectors, industries, and companies. They are also in charge of selecting the underlying investments that align with the fund's stated strategy.

Fund managers play a crucial role in the success of mutual funds. They bring expertise and experience to the table, conducting thorough research and monitoring the performance of the fund's investments. Their primary goal is to seek investment opportunities that help the fund outperform its benchmark, such as a widely followed index like the Standard & Poor's 500.

Fund managers have the challenging task of making investment decisions that benefit the fund and its investors. They employ various strategies, including individual security evaluation, sector allocation, and analysis of technical factors, to identify securities to buy and sell. Their performance can be evaluated by comparing the fund's returns relative to its benchmark. However, it is important to consider longer-term performance rather than focusing solely on short-term gains.

The role of fund managers is crucial in actively managed mutual funds, where they actively select and monitor investments. In contrast, passively managed funds, also known as index funds, aim to replicate the performance of a specific market index. These funds have lower operating costs as they do not require active professional managers.

Fund managers are legally obligated to act in the best interests of the mutual fund shareholders. They are held accountable by regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, to ensure that they comply with regulations and work towards the fund's stated objectives.

Overall, mutual fund managers play a vital role in the investment process, providing professional expertise and making strategic decisions to help the fund achieve its investment goals.

Smart Mutual Fund Investing in Today's Volatile Market

You may want to see also

They are a popular choice among investors because they offer professional management and diversification

Mutual funds are a popular investment choice because they offer professional management and diversification.

Professional Management

Mutual funds are overseen by professional fund managers who have the necessary experience to judge the profitability of different investments. Fund managers are less likely to make emotionally-driven investment decisions and are highly motivated to ensure their funds are as profitable as possible. They are legally obligated to follow the fund's stated mandate and to work in the best interest of shareholders. This allows investors to leverage the expertise of fund managers who make investment decisions based on their research and analysis.

Diversification

Mutual funds offer instant diversification, allowing investors to spread their risk over a number of investments. Diversification is a golden rule of investing, as it helps to reduce the risk to your overall portfolio. For example, investing in both retail and industrial stocks can protect your portfolio from a poor quarter in one of those sectors. Mutual funds are also less volatile than individual stocks, making them a safer investment option.

Other Benefits

In addition to professional management and diversification, mutual funds offer several other benefits that contribute to their popularity:

- Affordability: Most mutual funds have a relatively low dollar amount for initial investment and subsequent purchases.

- Liquidity: Mutual fund investors can easily buy and sell shares, and mutual funds are just as liquid as traditional stock investments.

- Variety: There is a wide range of mutual funds available that can cater to different interests and investment needs, regardless of the investor.

- Low Minimum Investment: Many mutual funds have low minimum investment requirements, with a typical minimum of $1,000 to start.

- Customizability: Mutual funds can be tailored to meet different investment objectives and risk tolerances, from high-risk, high-reward stock funds to minimal-risk funds offering slower, steadier growth.

- Accessibility: Mutual funds are easily accessible to new investors or those with limited funds, as they can be purchased directly through investment firms, financial advisors, or retirement accounts.

Mutual Fund Strategies: Deposits and Investments Timeline

You may want to see also

Frequently asked questions

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers and offer investors a reliable, time-tested method of growing their investments.

Mutual funds offer professional investment management and potential diversification. They also provide three ways to earn money: dividend payments, capital gains distributions, and increased NAV. Additionally, mutual funds are a cost-effective way to invest, with relatively low initial investment requirements.

All funds carry some level of risk, and there is always the possibility of losing money. The securities held by a mutual fund can decrease in value, and dividends or interest payments may change as market conditions fluctuate. Mutual funds also charge various fees and expenses that can impact overall returns.