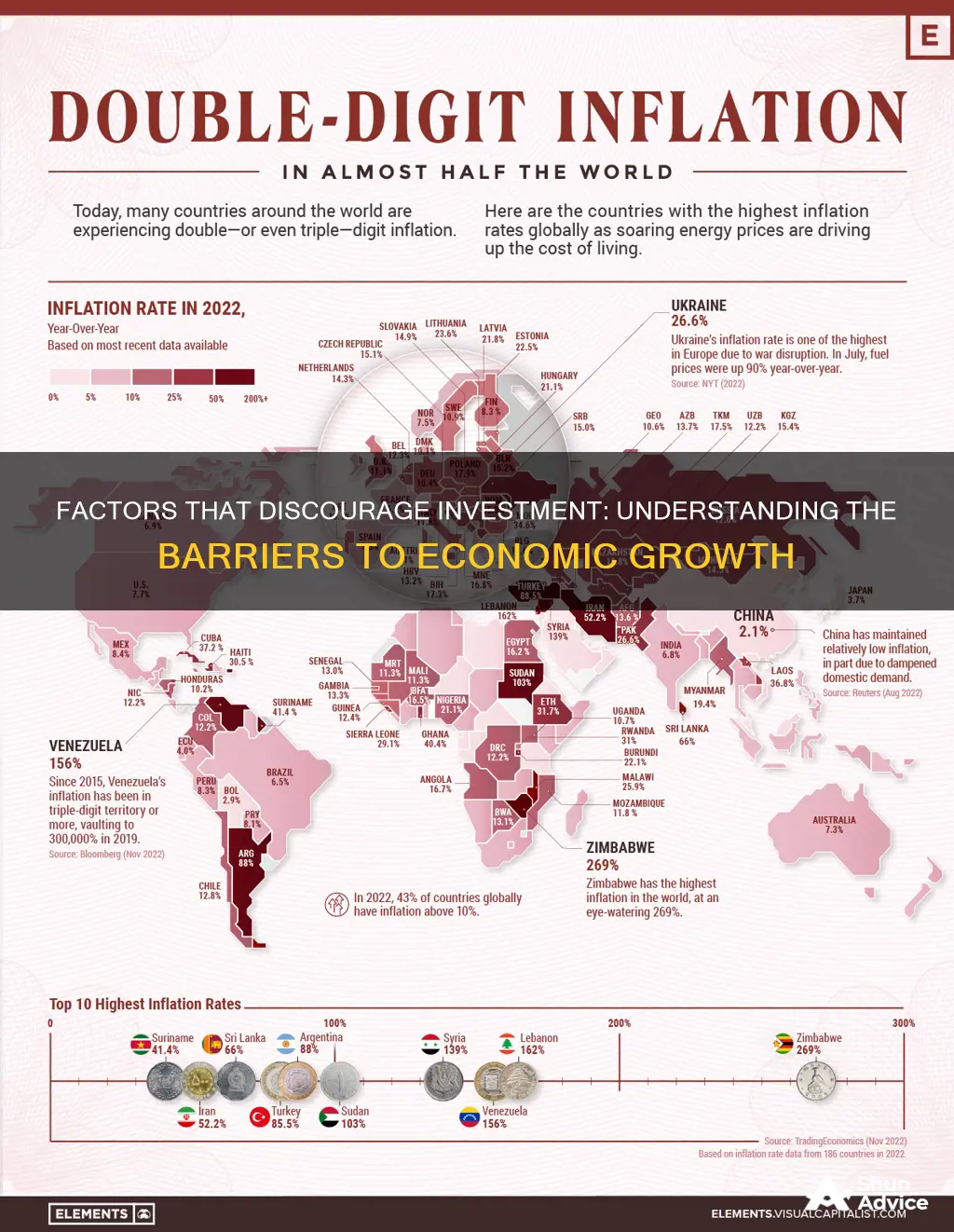

Many factors can discourage investment, including monetary instability, high and variable rates of inflation, high marginal tax rates, and political instability. For instance, high personal income tax rates can reduce incentives, investment, and production. Similarly, high corporate tax rates can hinder economic growth by reducing the funds available for investment and shielding existing businesses from competition. Political instability and insecure property rights can also retard economic growth by reducing the incentive to invest and create wealth.

| Characteristics | Values |

|---|---|

| High and variable rates of inflation | Discourages investment |

| Low and steady rate of inflation | Discourages investment |

| Monetary instability | Discourages investment |

| High marginal tax rates | Discourages investment |

| Political instability | Discourages investment |

| Insecure property rights | Discourages investment |

What You'll Learn

High and variable rates of inflation

- Uncertainty and Risk: High and variable inflation rates create uncertainty about future price levels and economic conditions. This uncertainty may discourage firms from investing in research and development (R&D) and other long-term projects. Uncertainty about future inflation can also make it difficult for businesses to plan and make long-term investments.

- Increased Costs: Inflation can lead to higher costs for businesses, including production costs, labour costs, and borrowing costs. This may discourage investment by making it more expensive to undertake new projects or expand operations.

- Reduced Profitability: High inflation can result in lower profitability for businesses, especially if their revenue and sales do not keep up with the rate of inflation. This may discourage investment by reducing the expected returns on investments.

- Distortion of Relative Prices: Inflation can distort relative prices and wages, making it difficult for businesses to accurately assess the costs and benefits of potential investments. This distortion can lead to inefficient allocation of resources and discourage firms from investing in productive areas.

- Opportunity Cost: High inflation increases the opportunity cost of holding cash and can encourage firms to invest in tangible assets or other inflation-hedged investments. This may reduce the amount of capital available for other types of investments.

- Interest Rates: High inflation often leads to higher interest rates as central banks try to control inflation. Higher interest rates can make borrowing more expensive for businesses, potentially discouraging investment in new projects or expansion.

- Impact on Financial Markets: High inflation can negatively impact financial markets and stock prices. It can also affect the performance of different sectors, with growth stocks typically underperforming during periods of high inflation.

- Impact on Wages and Employment: High inflation can lead to wage-price spirals, where workers demand higher wages to keep up with rising prices. This can create labour market distortions and make it difficult for businesses to hire new employees or invest in training and development.

- Impact on Savings and Fixed Income: High inflation can erode the value of savings and fixed-income investments, such as bonds and certificates of deposit (CDs). This may discourage individuals from investing in these types of assets and reduce the amount of capital available for investment.

- Impact on International Trade: High inflation can affect a country's competitiveness in international trade. It can make exports more expensive and reduce the demand for imports, impacting businesses that rely on international markets.

Investing: Inspired by Future Security

You may want to see also

Monetary instability

For example, during periods of financial distress, information flows may be disrupted, and price discovery may be impaired. This can lead to high-risk spreads and reluctance to purchase assets, as investors struggle to understand the potential losses and complexity of certain financial products.

Additionally, monetary instability can lead to adverse selection and moral hazard issues. Adverse selection occurs when investments with undesirable outcomes are most likely to be financed, such as high-risk projects. Moral hazard arises when borrowers have incentives to invest in risky projects, where the lender bears most of the loss if the project fails.

Furthermore, monetary instability can disrupt the flow of credit, becoming a threat to economic performance. It can also lead to a decline in investment and aggregate activity as lenders become less willing to lend.

Overall, monetary instability discourages investment by creating an uncertain environment, disrupting information flows, and increasing the potential for adverse selection, moral hazard, and various financial risks.

Two Harbors Investment Corp: Dividend Payment Date and Expectations

You may want to see also

Political instability

A shift in government due to political instability can also lead to changes in economic policies, making it challenging for companies and investors to make long-term plans. Inconsistent economic policies can further discourage investment and make it difficult for a country to achieve sustainable economic growth.

Additionally, political instability can lead to a reduction in international trade due to a lack of trust in the country's political environment. International trade is crucial for economic growth as it provides access to new markets, technology and capital.

To encourage investment, a country must maintain political stability and provide a favourable investment climate. This includes implementing policies that promote investment, such as tax incentives and investment guarantees, as well as ensuring a stable and predictable environment for businesses to operate in.

The IT Investment Equation: Unraveling the ROI Riddle

You may want to see also

High marginal tax rates

Secondly, high marginal tax rates can encourage a country's most productive citizens to emigrate to nations with lower tax rates, resulting in a brain drain and a loss of talent that could have contributed to economic growth. It also discourages foreigners from investing in the country, as they may seek more favourable tax conditions elsewhere.

Additionally, high marginal tax rates can lead to tax avoidance, where individuals and businesses engage in legal or illegal strategies to minimise their tax liability. This can include taking payment in non-taxed benefits, claiming deductions, or even moving their business activities to countries with more favourable tax regimes.

Finally, high marginal tax rates can disproportionately affect certain groups, such as single parents or low-income households, creating barriers to upward mobility and discouraging them from pursuing career advancements or higher wages.

Retiree Investments: Unveiling the Unknown Numbers

You may want to see also

Trade restrictions

One of the main reasons countries impose trade restrictions is to protect established domestic industries from foreign competition. By restricting the flow of foreign goods and services into the domestic market, governments can reduce competition and give domestic producers an advantage. This can be particularly important for infant industries that are not yet mature or internationally competitive. Governments may also impose trade restrictions to protect industries deemed strategically important, such as those related to national security.

Another reason for trade restrictions is to secure domestic employment and income. Imports can increase production and create jobs in the exporting country, while reducing opportunities for domestic producers and workers. By restricting imports, governments can help maintain employment and income levels within their own country.

In addition, trade restrictions may be imposed as a retaliatory measure against trading partners who are perceived to be engaging in unfair trade practices. This could include dumping, which is the sale of goods at prices lower than those normally charged in the exporter's domestic market.

There are several types of trade restrictions, including import tariffs, quotas, embargoes, and license requirements. Import tariffs are taxes on imported goods, which increase their price in the domestic market. Quotas limit the quantity of goods that can enter the domestic market, reducing supply and potentially leading to shortages. Embargoes are political decisions to stop transactions with specific countries, often for political reasons such as human rights violations. License requirements make it more difficult for importers to bring foreign goods into the domestic market, limiting competition.

While trade restrictions can provide benefits to domestic producers and workers, they also have negative consequences. They can lead to higher prices, reduced supply, and decreased competitiveness for domestic industries. Consumers may have fewer choices and face higher costs due to the reduced availability of imported goods. Additionally, domestic firms may have less incentive to invest in technological advances or research and development, potentially impacting the quality of products over time.

Infosys: Invest Now or Miss Out?

You may want to see also

Frequently asked questions

Monetary instability.

Monetary and price instability generate uncertainty, causing investors and businesses to move their activities to countries with a more stable monetary environment.

A high corporate income tax reduces the incentive for investment and also reduces the funds available for investment.