John Maynard Keynes' economic theories, developed in the 1930s, were a response to the Great Depression. Keynesian economics is a macroeconomic theory of total spending in the economy and its effects on output, employment, and inflation. Keynes' central belief was that government intervention can stabilise the economy.

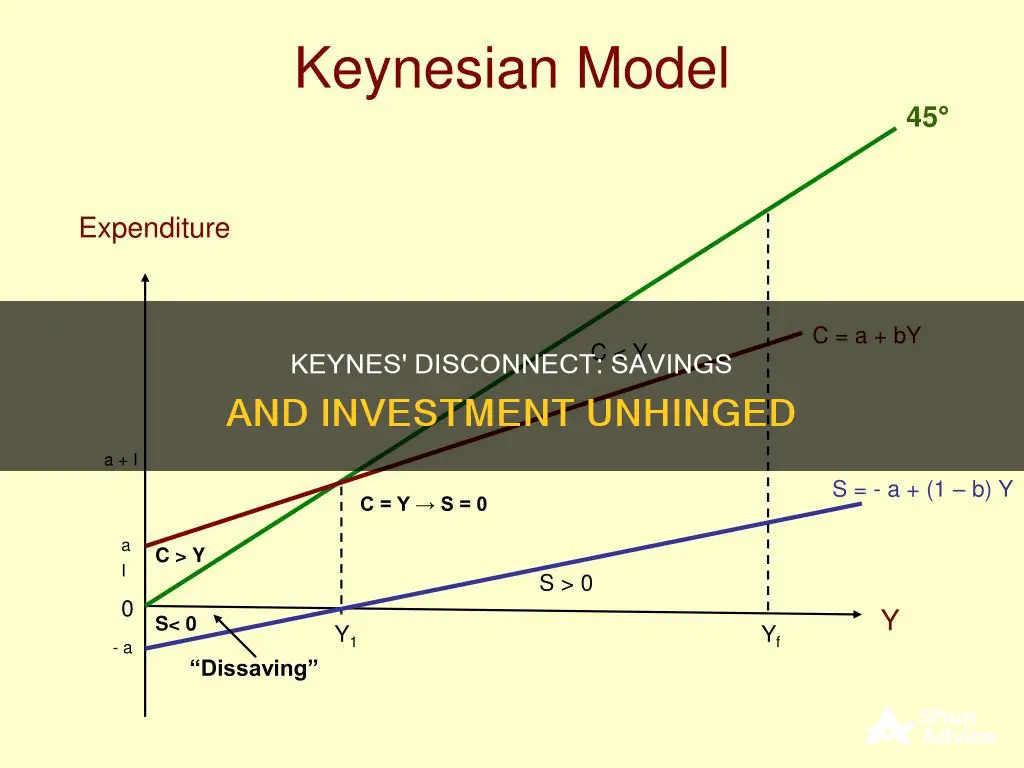

Keynesian economics is based on the view that there is a disconnect between savings and investment. In his book, 'The General Theory of Employment, Interest and Money', Keynes defined savings and investment in such a way that they are always equal. This is called accounting equality. However, this equality only holds true in a closed economy without a government sector.

Keynes also introduced the concept of 'functional equality', which states that savings and investment are equal only in equilibrium. This means that savings and investment can be equal at less than full employment, which is referred to as an 'underemployment equilibrium'.

Keynes' theory of savings and investment was a stark contrast to the classical economics that preceded his work, which focused on aggregate supply. Classical economists believed that savings and investment equality is brought about by the rate of interest, which would fall or rise to discourage savings or encourage investment, respectively.

Keynes disagreed with this view, arguing that the equality between savings and investment is brought about by changes in income. He proposed that when investment exceeds savings, the increased investment must increase the aggregate income of the community to a level where the increased savings out of the increased income is equal to the investment.

| Characteristics | Values |

|---|---|

| Keynes' view on savings and investment | Keynes defined savings and investment in such a way that they are always equal. This is called accounting equality. |

| Keynes also believed that savings and investment are equal only in equilibrium. This is called functional equality. | |

| Classical view on savings and investment | Classical economists also believed in savings and investment equality. They thought this equality was brought about by the rate of interest. |

| Classicals also believed that this equality was always brought about at full employment income. | |

| Keynes' disagreement with the classical view | Keynes questioned both propositions of the classical view. He held the opinion that the equality between saving and investment is brought about not by the rate of interest, but by changes in income. |

| Keynes also believed that savings and investment can be equal at less than full employment. |

What You'll Learn

- Keynesian economics is a macroeconomic theory of total spending in the economy and its effects on output, employment, and inflation

- Keynes' theory was the first to sharply separate the study of economic behaviour and individual incentives from the study of broad aggregate variables and constructs

- Keynes advocated for increased government expenditures and lower taxes to stimulate demand and pull the global economy out of the Depression

- Keynesian economics was used to refer to the concept that optimal economic performance could be achieved by influencing aggregate demand through economic intervention by the government

- Keynesian economists believe that government intervention can result in full employment and price stability

Keynesian economics is a macroeconomic theory of total spending in the economy and its effects on output, employment, and inflation

The central belief of Keynesian economics is that government intervention can stabilize the economy. Keynes advocated for increased government expenditures and lower taxes to stimulate demand and pull the global economy out of the Depression. This type of economic thinking was a stark contrast to the classical economics that preceded it, which assumed that free markets would automatically provide full employment.

Keynesian economics revolves around the concept of aggregate demand, which is the sum of spending by households, businesses, and the government. Keynes argued that inadequate overall demand could lead to prolonged periods of high unemployment. He identified four components of an economy's output of goods and services: consumption, investment, government purchases, and net exports. Any increase in demand must come from one of these components.

Keynesian economics identifies three principal tenets of how the economy works:

- Aggregate demand is influenced by many economic decisions, both public and private. Private sector decisions can sometimes lead to adverse macroeconomic outcomes, such as reduced consumer spending during a recession. These market failures may call for active policies by the government, such as a fiscal stimulus package. Therefore, Keynesian economics supports a mixed economy guided mainly by the private sector but with room for government intervention.

- Prices, especially wages, respond slowly to changes in supply and demand, resulting in periodic surpluses and shortages, particularly of labour.

- Changes in aggregate demand, whether anticipated or unanticipated, have their most significant short-run effect on real output and employment, rather than prices. Keynesians believe that because prices are somewhat rigid, fluctuations in any component of spending (consumption, investment, or government expenditures) cause output to change.

Keynesian economics also includes the concept of a multiplier effect, where output changes by a multiple of the increase or decrease in spending. For example, a one-dollar increase in government spending may result in an increase in output greater than one dollar.

Keynesian economics emphasizes the active role of the government in managing the economy, particularly during recessions and depressions. It advocates for countercyclical fiscal policies, such as deficit spending on labour-intensive infrastructure projects during economic downturns, and raising taxes to cool the economy and prevent inflation during times of abundant demand-side growth.

Keynesian economics was widely accepted during Keynes' lifetime and influenced economic policies worldwide. However, it faced scrutiny and contestation from various schools of economic thought, including the Austrian School of Economics and monetarists. Keynesian economics dominated economic theory and policy after World War II but lost some influence following the oil shock and stagflation of the 1970s. It later saw a resurgence, especially after the 2007-2008 financial crisis, with governments around the world adopting Keynesian policies to stimulate their economies.

Savings and Investment: Interplay in a Closed Economy

You may want to see also

Keynes' theory was the first to sharply separate the study of economic behaviour and individual incentives from the study of broad aggregate variables and constructs

John Maynard Keynes' theory of economics, now known as Keynesian economics, was developed during the Great Depression of the 1930s. Keynes' theory was a response to the failure of classical economic theory to explain the causes of the economic collapse and provide a solution to stimulate production and employment. Keynesian economics is a macroeconomic theory of total spending in the economy and its effects on output, employment, and inflation.

Keynesian economics also holds that free markets do not have self-balancing mechanisms that lead to full employment. This is because, according to Keynes, inadequate overall demand can lead to prolonged periods of high unemployment. Keynes argued that the economy does not necessarily revert to a state of general equilibrium, and that there is no guarantee that goods produced will be met with adequate effective demand. Therefore, Keynesian economics supports a mixed economy guided mainly by the private sector but with an active role for government intervention during recessions and depressions.

Keynes' theory also asserts that changes in aggregate demand have their greatest short-run effect on real output and employment, rather than on prices. This is because prices and wages respond slowly to changes in supply and demand, resulting in periodic shortages and surpluses, especially of labour. Keynesian economics, therefore, advocates for government intervention to moderate the booms and busts of economic activity, otherwise known as the business cycle.

Keynesian economics gets its name from British economist John Maynard Keynes, who is regarded as the founder of modern macroeconomics. His most famous work, 'The General Theory of Employment, Interest and Money', was published in 1936. However, his earlier work, 'A Treatise on Money' (1930), is often regarded as more important to economic thought as it marked a large step towards his later views.

Investment Opportunities in Pakistan: Where to Invest Your Savings

You may want to see also

Keynes advocated for increased government expenditures and lower taxes to stimulate demand and pull the global economy out of the Depression

John Maynard Keynes was a British economist who developed the macroeconomic theory of Keynesian economics during the 1930s. This was in response to the Great Depression, which Keynes believed could not be explained by classical economic theory. Keynesian economics holds that government intervention can stabilize the economy and prevent economic slumps.

Keynes advocated for increased government spending and lower taxes to stimulate demand and pull the global economy out of the Great Depression. He believed that government intervention was necessary to moderate the booms and busts of economic activity, otherwise known as the business cycle. This is known as countercyclical fiscal policy.

Keynesian economics supports a mixed economy guided mainly by the private sector but partly operated by the government. During economic downturns, Keynesian economists may advocate deficit spending on labour-intensive infrastructure projects to stimulate employment and stabilize wages. They may also recommend lowering interest rates to encourage investment.

Keynesian economics was the dominant economic theory after World War II until the 1970s, when it lost popularity due to its inability to address stagflation. However, it experienced a resurgence following the 2007-2008 financial crisis.

Investment Trust Savings Schemes: How Do They Work?

You may want to see also

Keynesian economics was used to refer to the concept that optimal economic performance could be achieved by influencing aggregate demand through economic intervention by the government

Keynesian economics, developed by British economist John Maynard Keynes, is a macroeconomic theory that asserts that optimal economic performance can be achieved by influencing aggregate demand through economic intervention by the government. Keynesian economics revolves around the idea that government intervention can stabilize the economy and prevent economic slumps. Keynes advocated for increased government spending and lower taxes to stimulate demand and pull the economy out of a depression.

The central tenets of Keynesian economics include the belief that aggregate demand, influenced by many economic decisions, is the most important driving force in an economy. Keynesian economics supports a mixed economy guided by the private sector but partly operated by the government. It also asserts that prices and wages respond slowly to changes in supply and demand, resulting in periodic shortages and surpluses, especially of labour. Additionally, Keynesians believe that changes in aggregate demand have their greatest short-run effect on real output and employment, rather than prices.

Keynesian economics emphasizes the use of activist fiscal and monetary policies to manage the economy and combat unemployment. During economic downturns, Keynesian economists may advocate for deficit spending on labour-intensive infrastructure projects to stimulate employment and stabilize wages. They may also recommend lowering interest rates to encourage investment and consumption spending. The theory suggests that such interventions can lead to full employment and price stability.

The Keynesian perspective focuses on aggregate demand, arguing that real GDP is determined by aggregate demand rather than aggregate supply. Keynesian economics recognizes that government intervention can influence aggregate demand by stimulating or reducing consumption, investment, government spending, and net exports.

Certificate of Deposit: Investment or Savings?

You may want to see also

Keynesian economists believe that government intervention can result in full employment and price stability

The central tenet of Keynesian economics is that government intervention can stabilize the economy. Keynesian economists believe that such intervention can result in full employment and price stability.

During the Great Depression of the 1930s, existing economic theory was unable to explain the causes of the severe worldwide economic collapse or to provide an adequate public policy solution to jump-start production and employment. British economist John Maynard Keynes spearheaded a revolution in economic thinking that overturned the then-prevailing idea that free markets would automatically provide full employment. Keynes's theory was the first to sharply separate the study of economic behaviour and individual incentives from the study of broad aggregate variables and constructs.

Keynesian economics advocates using active government policy to manage aggregate demand to address or prevent economic recessions. Keynes argued that inadequate overall demand could lead to prolonged periods of high unemployment. An economy's output of goods and services is the sum of four components: consumption, investment, government purchases, and net exports. Any increase in demand has to come from one of these four components. But during a recession, strong forces often dampen demand as spending goes down. For example, during economic downturns, uncertainty often erodes consumer confidence, causing them to reduce their spending, especially on discretionary purchases like a house or a car. This reduction in spending by consumers can result in less investment spending by businesses, as firms respond to weakened demand for their products. This puts the task of increasing output on the shoulders of the government.

Keynesian economists generally argue that aggregate demand is volatile and unstable and that, consequently, a market economy often experiences inefficient macroeconomic outcomes, including recessions when demand is too low and inflation when demand is too high. Further, they argue that these economic fluctuations can be mitigated by economic policy responses coordinated between the government and central bank. In particular, fiscal policy actions taken by the government and monetary policy actions taken by the central bank can help stabilize economic output, inflation, and unemployment over the business cycle.

Keynesian economics developed during and after the Great Depression from the ideas presented by Keynes in his 1936 book, The General Theory of Employment, Interest and Money. Keynes's approach was a stark contrast to the aggregate supply-focused classical economics that preceded his book. Interpreting Keynes's work is a contentious topic, and several schools of economic thought claim his legacy. Keynes's ideas became widely accepted after World War II, and until the early 1970s, Keynesian economics provided the main inspiration for economic policymakers in Western industrialized countries.

Keynesian economics recognizes the role of government in sparking aggregate demand. For instance, federal spending and tax cuts leave more money in people's pockets, which can stimulate demand and investment. Unlike free-market economists, Keynesian economics welcomes limited government intervention and stimulus during times of recession.

Workplace Savings and Investment Plans: What You Need to Know

You may want to see also

Frequently asked questions

Keynesian economics, as developed by British economist John Maynard Keynes, argues that savings and investment are necessarily equal in a closed economy without a government sector. This is derived from the general equality of aggregate demand and aggregate supply, where equilibrium is reached when total demand is equal to total supply. However, this equality does not necessarily imply a state of equilibrium in the economy, as it depends on the dynamic relationship between savings and investment.

Classical economics holds that savings and investment equality is achieved through the rate of interest. When savings exceed investments, the interest rate falls to discourage savings and encourage investment. Keynes, on the other hand, argued that this equality is brought about by changes in income. He believed that when investment exceeds savings, increased investment must increase the aggregate income of the community through the multiplier effect, such that the increased savings out of the increased income is equal to the investment.

The paradox of thrift states that if all individuals in a community try to save more, the total savings will not rise. This is because one person's saving is another person's reduced income, leading to a decline in effective demand, income, and employment. This results in a situation where savings and investment are equal but not in a state of equilibrium, which Keynes referred to as an "underemployment equilibrium".

Keynes believed that government intervention was necessary to address situations where savings exceeded investment, which he saw as a key cause of economic crises. He advocated for countercyclical fiscal policies, such as deficit spending on labour-intensive infrastructure projects during economic downturns, to stimulate employment and stabilize wages.