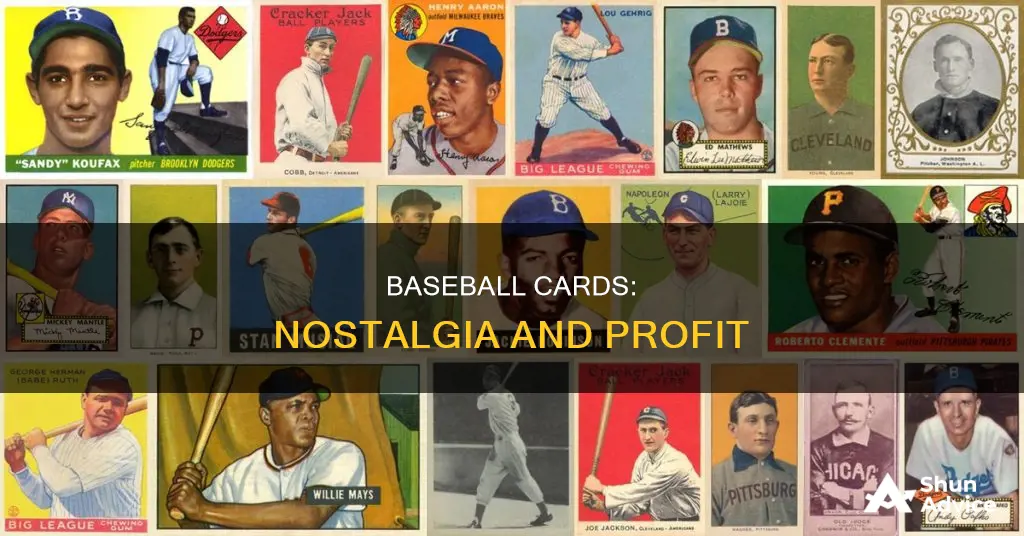

Baseball cards have become a popular investment option for sports fans, with the global sports card trading market valued at more than $13 billion in 2021 and projected to reach $49 billion by 2032. This surge in popularity can be attributed to several factors, including nostalgia, the thrill of collecting, and the potential for financial gains.

For many, buying and trading baseball cards was a beloved childhood pastime. As these collectors grew up and gained financial means, their hobby evolved into a serious investment strategy. The value of certain cards has skyrocketed, with a 1952 Mickey Mantle rookie card selling for a record-breaking $12.6 million. This shift has transformed the baseball card market, attracting investors seeking lucrative returns.

However, it's important to approach baseball card investing with caution. While some cards have delivered impressive returns, the market is volatile, and card values can fluctuate. Additionally, the high fees associated with buying and selling cards, as well as the time and effort required, can impact overall profitability.

Despite the risks, baseball card investing offers a unique opportunity for sports enthusiasts to combine their passion with potential financial gains. Diversifying one's investment portfolio with a small portion of assets in baseball cards can be a fun and rewarding strategy for those with a keen eye for card selection.

| Characteristics | Values |

|---|---|

| Nostalgia | Reminds people of their childhood |

| Diversification | Can be added to a portfolio of stocks, bonds, and real estate |

| Profit | Can be sold for a profit |

| Hobby | Collecting cards is a fun hobby |

| Passion | People are passionate about sports and their favourite players |

| Connection | People want to invest in things they have a personal connection with |

| Scarcity | Cards are limited in number and so are autographs by players |

| Serial Numbers | Serial numbers indicate the number of cards produced in a series |

| Grading | Grading cards helps investors be assured of their value |

| Liquidity | Cards can be easily sold on platforms like eBay |

| Data | Data helps investors make informed decisions |

What You'll Learn

Nostalgia and emotional connection

The nostalgia factor is particularly strong for cards from the 1980s and 1990s, which were a golden age for the hobby. During this period, baseball card collecting was a popular pastime for many Americans, and the cards hold fond memories for those who grew up during that time. However, it is important to note that the massive overproduction of cards during this era has led to a saturation of the market, and most cards from this period are now considered "worthless".

Despite the overall decline in value, certain cards from the 1980s and 1990s can still command high prices, especially those in pristine condition. The 1989 Upper Deck Ken Griffey Jr. rookie card, for example, remains a highly sought-after item. Additionally, autographed cards or cards with printing errors can also be valuable.

For investors, the key to success in the baseball card market is diversification. While it is tempting to focus on one's favourite players or teams, a diverse collection that spans different sports, players, series, and card types is more likely to provide a solid investment.

Young Investors: Emulate Warren Buffett's Strategy

You may want to see also

Potential for high returns

Baseball cards, like other sports cards, have the potential to deliver high returns. The global sports card trading market was valued at more than $13 billion in 2021 and is projected to reach over $49 billion by 2032, representing an impressive compound annual growth rate (CAGR) of 13% over 11 years.

The potential for high returns in baseball card investing is exemplified by notable sales of individual cards. For instance, a 1952 Mickey Mantle rookie card sold for $5.2 million in 2021, while a game-worn jersey patch card of Michael Jordan from 1997-98 fetched $2.7 million at auction in the same year.

The Honus Wagner T206 tobacco card, considered the rarest sports card, exemplifies the potential for high returns in the long term. Baseball historians trace its origins to Wagner's 20-year career, which began in 1897. Over time, the value of this card has skyrocketed. It could have been purchased for around $1500 in 1975, and today, it is worth approximately $5 million, representing a staggering 333,000% return on investment.

Another example of substantial returns is the 1952 Topps Mickey Mantle card, which sold for $282,000 in 2006 and then for $2.88 million in 2018, reflecting a nearly 1,000% return. Similarly, the 1963 Topps Pete Rose card appreciated significantly, with an investor purchasing it for $157,000 in 2012 and selling it for $717,000 in 2016, marking a 100% annual value increase.

The potential for high returns in baseball card investing is further illustrated by comparing it to the stock market. If an investor had put $10,000 into an index for trading cards in 2007, it would have grown to $165,000, significantly outperforming the S&P 500, which would have yielded $71,000 over the same period.

The limited supply and high demand for sports cards, particularly baseball cards, contribute to their potential for high returns. Card manufacturers have introduced measures to enhance scarcity, such as serial numbers, autographed cards, and grading systems, which assure investors of their cards' value. Additionally, the emotional connection that investors have with sports and specific players also drives the demand for these cards.

Fidelity's Investor Numbers

You may want to see also

Diversification of portfolios

Sports cards can be a fun and profitable way to diversify one's portfolio. They are considered alternative investments, similar to investing in fine wine, rare coins, or art. By including sports cards in their portfolios, investors can gain exposure to a different asset class, which can help reduce overall risk.

For example, a 2021 eBay report found that U.S. trading card transactions on its platform surged 142% in 2020 compared to the previous year. This surge in popularity is expected to continue, making sports cards a viable option for investors looking to diversify.

Additionally, the sports card market has evolved to include serial numbers, autographed cards, and grading systems, which enhance their value and provide assurance to investors. The introduction of these measures has helped maintain the value of sports cards, making them a more attractive investment option.

However, it is important to note that the sports card market can be volatile, and card values can fluctuate. As such, investors should approach this market with caution and ensure that sports cards are only a small part of their overall investment strategy.

Overall, investing in baseball cards can be a strategic way to diversify one's portfolio, providing exposure to a unique asset class with the potential for impressive returns.

Wealthy Investing: Should They Continue?

You may want to see also

Cards as alternative assets

Baseball cards, along with other sports cards, are increasingly being seen as alternative assets for investors to put their money into. While the majority of an investor's portfolio should be in traditional assets like stocks, bonds, and real estate, a small portion can be allocated to alternative assets such as sports cards, which can fluctuate with supply and demand.

Sports card investing is becoming an increasingly popular way for sports fans to profit from their favourite pastime. The sports card market is growing, with a global value of over $13 billion in 2021, and it is projected to reach more than $49 billion by 2032, representing a compound annual growth rate (CAGR) of 13% over 11 years. This growth is driven by investors who are nostalgic for their childhood hobby and want to invest in something they have a personal connection with.

The sports card market also offers impressive returns. For example, a Mike Trout rookie card sold for $3.9 million in 2020, and a Honus Wagner card sold for $6.6 million in 2021. A 1952 Mickey Mantle rookie card set the record for the most expensive sports card sale at $12.6 million. These returns are significantly higher than what could be achieved in the stock market.

One of the main reasons for the growth in the sports card market is the introduction of measures to ensure scarcity and maintain value. Card manufacturers have introduced serial numbers, autographed cards, and grading systems, which provide investors with assurance about the value of their cards. The industry has also become more liquid, with online platforms like eBay making it easier for investors to buy and sell cards.

Sports card investing can be a credible alternative asset class, especially with the availability of data to help investors make more informed decisions. However, it is important to note that card values can fluctuate, and there may be challenges in selling high-end cards due to the time and effort required for negotiating and verification. Additionally, it is crucial to diversify one's collection to manage risks effectively.

Stash Investing: Millions of Users

You may want to see also

Cards as a hobby

Baseball card collecting has been a favourite hobby for many Americans for decades. In recent times, interest has grown massively, and sports cards are fast becoming more than just a hobby. A 1952 Topps Mickey Mantle rookie card recently sold for $12.6 million, solidifying the idea that sports cards are here to stay.

Sports card collecting was once a childhood rite of passage, and adult investors may still enjoy buying sports cards for the love of collecting, their favourite sport, or a particular player. Today, the four major U.S. sports leagues—the NFL, NHL, NBA, and MLB—all have exclusive deals with a single card manufacturer that produces that league's cards.

The sports card industry has seen several positive changes in recent years. Card manufacturers have introduced measures of scarcity, such as serial numbers, autographed cards, and grading, which help cards maintain their value. The introduction of serial numbers and autographed cards assures investors of the value of their cards due to the obvious scarcity these measures provide. Additionally, the industry has become more liquid, with platforms like eBay and Check Out My Cards, making it easier for investors to sell their cards and get paid.

Sports card collecting has also become a way for sports fans to profit from their hobby. Investors can buy cards of highly-rated young players, betting on their careers' trajectory. Cards can gain or lose value depending on how well the players perform during a season. This has made sports card investing a credible alternative asset class.

While some people may view sports card collecting as a horrible investment choice, others argue that it can be a good investment strategy if one has a knack for selecting the right cards. For instance, a Mike Trout rookie card worth $500 in 2017 was worth over $4,000 four years later. Similarly, a 1952 Mickey Mantle card sold for $282,000 in 2006 and then for $2.88 million in 2018, almost a 1,000% return.

However, it is essential to approach sports card investing with caution. Card values can fluctuate, and the lack of tangible value makes card investing risky. It is recommended to diversify one's collection by investing in various sports, players, series, generations, and card types. Additionally, card flipping, buying and holding cards for the long term, and purchasing cards for enjoyment or potential future value are some investment strategies to consider.

HSA Investors: Who and How Many?

You may want to see also

Frequently asked questions

Baseball cards can be a good investment, but only if you do your research. The value of cards can fluctuate, and there is a lack of tangible value, making card investing risky. However, if you diversify your collection and devise a specialised investment strategy, you can make profitable decisions.

The value of baseball cards is influenced by the player's performance and their career trajectory. Cards can gain or lose value depending on how well the players do during a season. Other factors include the card's rarity, condition, and demand from collectors.

Baseball card investing may be suitable for beginners who are sports fans and have a personal connection with the cards. However, it is crucial to treat it as a hobby first and not expect quick profits. Start with a small portion of your income and gain experience before allocating a more significant part of your portfolio to baseball cards.

When considering a baseball card as an investment, look for cards with a limited print run, autographed cards, and those in good condition. Grading services like PSA, SGC, and Beckett's BGS provide impartial assessments of a card's condition, which can help you make more informed decisions.

The primary risk of investing in baseball cards is the potential for financial loss due to market fluctuations or changes in demand. Additionally, the lack of liquidity in the market can make it challenging to sell cards quickly, and the fees associated with auctions or online platforms can eat into your profits. It's essential to approach baseball card investing with a long-term perspective and diversify your investments.