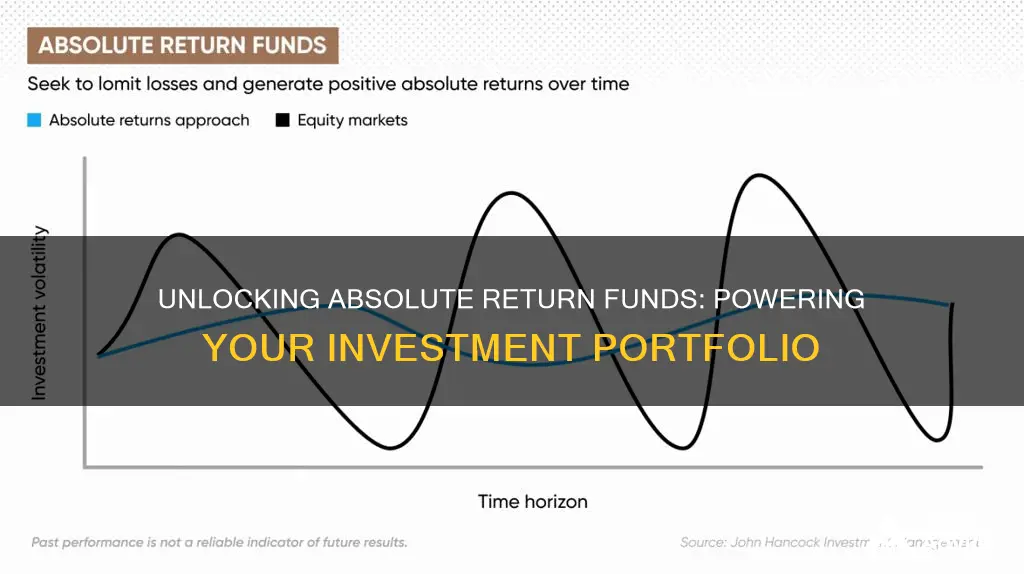

Absolute return funds are a type of investment vehicle that aims to generate steady, positive returns regardless of market conditions. They are designed to provide slow and steady annual growth over long periods, making them appealing to risk-averse investors. These funds employ a range of investment strategies, such as derivatives, arbitrage, short selling, and leverage, to navigate market fluctuations and deliver growth with limited correlation to traditional market returns. While absolute return funds do not guarantee positive performance, they can be a good option for those seeking stable returns with reduced exposure to volatility.

| Characteristics | Values |

|---|---|

| Definition | Funds that aim to turn a profit for investors, regardless of market conditions |

| Comparison to Relative Return Funds | Does not aim to outperform the market, unlike relative return funds |

| Investment Strategies | Utilise a wide range of strategies, including derivatives, arbitrage, short selling, leverage, and investing in unconventional assets |

| Risk Mitigation | Less likely to be affected by a poorly-performing market and may hold up better in a falling market |

| Investor Profile | Suits investors seeking slow and steady annual growth with reduced exposure to volatility and lower risk |

| Diversification | Offers diversification to an investor's portfolio due to low correlation with traditional funds |

| Historical Performance | The Vanguard 500 Index ETF (VOO) delivered an absolute return of 150.15% over a 10-year period ending Dec. 31, 2017 |

| Example Funds | John Hancock Global Absolute Return Strategies (JHAIX), GMO Benchmark-Free Allocation (GBMFX) |

| Pros | Potential for stable returns with less volatility |

| Cons | May underperform in a strong market, no guarantee of positive returns |

| Industry Trend | One of the fastest-growing investment strategies worldwide |

| Fees | Typically higher fees due to the specialised nature of the funds |

What You'll Learn

- Absolute return funds are an alternative to traditional investment strategies

- They aim to provide a positive return in all market conditions

- Absolute return funds are good for those wanting to avoid high-risk investments

- They are a good way to diversify your portfolio

- Absolute return funds are one of the fastest-growing investment strategies worldwide

Absolute return funds are an alternative to traditional investment strategies

Absolute return funds use a range of investment strategies, such as derivatives, arbitrage, short selling, leverage, and investing in unconventional assets. These funds are often seen as a good way to mitigate risk and diversify portfolios. They are also less likely to be affected by a poorly performing market and can hold up better than other investments in a falling market.

However, it is important to note that positive performance is not guaranteed with absolute return funds. In a well-performing market, these funds may underperform and not deliver as high a return as other funds.

Absolute return funds have been around for decades, with the first fund of this type being established in 1949. In recent years, the absolute return approach has become one of the fastest-growing investment strategies worldwide, particularly appealing to those who are more comfortable with lower levels of risk.

Venture Capital's XAI Investment: Who's Leading the Pack?

You may want to see also

They aim to provide a positive return in all market conditions

Absolute return funds aim to provide positive returns in all market conditions. They are designed to make investors a profit, regardless of how the markets behave. This means that they can be appealing to those who are more comfortable with lower levels of risk.

These funds are not concerned with comparing their performance to that of other funds or the market as a whole. Instead, they focus on generating steady, positive returns over the long term with limited volatility. This is achieved through a wide range of investment strategies, such as derivatives, arbitrage, short selling, leverage, and more. By employing these strategies, absolute return funds can navigate market fluctuations and generate growth with little to no correlation to traditional market returns.

Absolute return funds are often seen as a good option for those seeking slow and steady annual growth with reduced exposure to volatility. They are also suitable for investors who are afraid of losing money during market downturns or those with a known spending need in the future, such as a property purchase.

It is important to note that positive performance is not guaranteed with absolute return funds. While they aim to provide positive returns in all market conditions, there is no assurance that they will always be successful. As with any investment, there is a risk of losing money, and it is crucial for investors to conduct their own research and carefully consider their risk tolerance before investing.

Index Funds: Utopia or Dystopia for Investors?

You may want to see also

Absolute return funds are good for those wanting to avoid high-risk investments

Absolute return funds use a variety of investment strategies, such as derivatives, arbitrage, short selling, and leverage, to navigate the market and achieve growth with little correlation to traditional market returns. This means that even if the market is performing poorly, absolute return funds can still provide positive returns, reducing the risk of loss for investors.

The goal of absolute return investing is to deliver consistent, positive returns over time, with limited volatility. This makes it an attractive option for those who are cautious about losing money during market downturns. Absolute return funds are often seen as a way to achieve slow, steady growth without the high volatility associated with other investments.

Additionally, absolute return funds can help diversify an investment portfolio. They operate independently of market direction and can provide a hedge against the risk of other portfolio investments. This diversification benefit is particularly appealing to investors seeking to reduce their overall risk exposure.

However, it is important to note that positive performance in absolute return funds is not guaranteed. While they aim to generate steady returns, there is no assurance that they will always outperform the market. Investors should conduct their own research and be aware that markets can move against their position.

Bond Fund Investment: Where to Begin?

You may want to see also

They are a good way to diversify your portfolio

Absolute return funds are a good way to diversify your portfolio. They are an alternative to traditional investment strategies, such as stocks and bonds, as they use a variety of instruments across different asset classes. Absolute return funds can invest in unconventional assets, such as commodities, loan notes, or real estate, which can provide investors with potentially useful diversification.

These funds are also a good way to diversify your portfolio because they are less dependent on the direction of the underlying assets. They can operate independently of market direction and are good in times of market downturns, which can help to reduce the risk of other portfolio investments. Absolute return funds aim to provide slow and steady annual growth over long periods, making them a good option for those looking to diversify their portfolio with reduced exposure to volatility.

Additionally, absolute return funds can be a good way to gain exposure to more diversified assets than a typical managed fund. For example, the BlackRock Strategic Funds Dynamic Diversified Growth Fund invests in a diversified portfolio of global equities, government and non-government bonds, alternative assets, financial derivatives, and cash. This allows investors to access the performance of a wide range of asset classes without incurring large administrative costs.

The variety of investment strategies employed by absolute return funds, such as derivatives, arbitrage, short selling, and leverage, further enhances their ability to diversify an investor's portfolio. By encompassing a wide range of strategies, these funds can navigate the market and generate growth with little to no correlation to traditional market returns. Overall, absolute return funds offer a good opportunity to diversify one's portfolio and manage risk.

Municipal Bond Funds: When to Invest for Maximum Returns

You may want to see also

Absolute return funds are one of the fastest-growing investment strategies worldwide

So, what exactly are absolute return funds? Simply put, they are funds that aim to turn a profit for investors, regardless of market conditions. This sets them apart from relative return funds, which focus on outperforming the market, even if it means making a smaller loss than average. Absolute return funds provide an attractive alternative to traditional bond and stock funds by investing in a diverse range of instruments and asset classes.

The goal of absolute return investing is to provide slow and steady annual growth over long periods, with reduced exposure to volatility. To achieve this, fund managers employ a wide range of investment strategies, including derivatives, arbitrage, short selling, leverage, and unconventional assets. This diversification helps to mitigate risk and protect investors during market downturns.

Absolute return funds are particularly appealing to investors who seek lower-risk investment opportunities. They are often chosen by those who are afraid of losing money during market downturns or those with specific future spending needs, such as a property purchase. While these funds offer stable returns, it's important to remember that positive performance is not guaranteed, and they may underperform in a booming market.

In summary, absolute return funds have become a popular choice for investors worldwide due to their ability to provide stable returns, mitigate risk, and diversify investment portfolios. With their focus on slow and steady growth, these funds are well-suited for investors seeking lower-risk opportunities, especially during market downturns. However, it's crucial to remember that returns are not guaranteed, and professional advice should always be sought before making any investment decisions.

How to Choose the Right Managed Funds

You may want to see also