Short-term investments are assets that can be converted into cash or sold within a short period of time, typically within 1-3 years. They offer flexibility to the investor as they do not need to wait for the security to mature in order to get cash. However, they come with high costs due to a high transaction volume and their corresponding brokerage commission fees. Taxes and inflation also reduce the returns earned via short-term investing. Short-term investments are less risky as money invested per transaction is substantially lower.

| Characteristics | Values |

|---|---|

| Flexibility | Investor does not need to wait for the security to mature in order to get cash |

| Profit | Investors can make substantial profits in a very short amount of time |

| Risk | Less risky as money invested per transaction is substantially lower |

| Expertise | Requires a certain level of expertise and time |

| High costs | High transaction volume and corresponding brokerage commission fees |

| Taxes | Taxes reduce the returns earned via short-term investing |

| Inflation | Inflation reduces the returns earned via short-term investing |

| Volatility | Higher return on long-term investments but must endure more short-term volatility |

| Safety | Money will not be at risk and will be accessible when you need to use it |

What You'll Learn

High transaction volume

Short-term investments are assets that can be converted into cash or sold within a short period of time, typically within 1-3 years. They offer flexibility to the investor as they do not need to wait for the security to mature in order to get cash. Investors can make substantial profits in a very short amount of time. It is less risky as money invested per transaction is substantially lower. However, short-term investments come with high costs due to a high transaction volume and their corresponding brokerage commission fees. Taxes and inflation also reduce the returns earned via short-term investing. It involves a certain level of expertise and time, as investors must closely monitor price movements and identify purchase and/or sale spots.

Short-term investments are liquid, like stocks listed on a major exchange that trades frequently or U.S. Treasury bonds. Marketable debt securities, aka "short-term paper", that mature within a year or less, such as U.S. Treasury bills and commercial paper, also count as short-term investments. Marketable equity securities include investments in common and preferred stock. Marketable debt securities can include corporate bonds—that is, bonds issued by another company—but they also need to have short maturity dates and should be actively traded to be considered liquid.

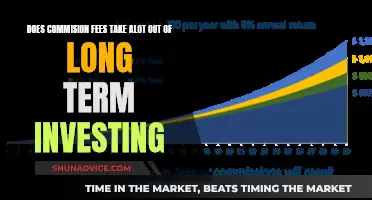

Short-term investments are accessible when you need to use it, which is one of the major reasons to have a short-term investment. In contrast, you can earn a higher return on long-term investments but must endure more short-term volatility. If you need that money, though, you might have to sell a long-term investment at a loss to access it fully. The safety of short-term investments comes at a cost. You likely won’t be able to earn as much in a short-term investment as you would in a long-term investment.

Exhausted selling is a niche strategy that is usually only employed by experienced day traders. It is usually done in the aftermath of periods of panic selling induced by recession alarms or other external threats. Investors may buy at the unusually low prices and earn a profit soon after. It is possible because the low prices created due to panic selling do not reflect the real underlying value of the asset, which may be much higher. Real-time forex trading is a form of speculation where an investor bets on the future price movements of a given currency. It uses technical indicators to gauge expected changes in the exchange ratios of currencies.

Term Life Insurance: A Smart Investment Strategy for Long-Term Wealth Building

You may want to see also

High brokerage commission fees

Short-term investments offer flexibility to the investor as they do not need to wait for the security to mature in order to get cash. On the other hand, long-term investments can be liquidated by selling in the secondary market, but the investor earns lower profits. Investors can make substantial profits in a very short amount of time. It is less risky as money invested per transaction is substantially lower. Short-term investing comes with high costs due to a high transaction volume and their corresponding brokerage commission fees. Taxes and inflation also reduce the returns earned via short-term investing. It involves a certain level of expertise and time, as investors must closely monitor price movements and identify purchase and/or sale spots.

Short-term investments are assets that can be converted into cash or can be sold within a short period of time, typically within 1-3 years. Marketable debt securities, aka "short-term paper," that mature within a year or less, such as U.S. Treasury bills and commercial paper, also count as short-term investments. Marketable equity securities include investments in common and preferred stock. Marketable debt securities can include corporate bonds—that is, bonds issued by another company—but they also need to have short maturity dates and should be actively traded to be considered liquid.

Short-term investments are liquid, like a stock listed on a major exchange that trades frequently or U.S. Treasury bonds. The management must intend to sell the security within a relatively short period, such as 12 months. Exhausted selling is a niche strategy that is usually only employed by experienced day traders. It is usually done in the aftermath of periods of panic selling induced by recession alarms or other external threats. Investors may buy at the unusually low prices and earn a profit soon after. It is possible because the low prices created due to panic selling do not reflect the real underlying value of the asset, which may be much higher. Real-time forex trading is a form of speculation where an investor bets on the future price movements of a given currency. It uses technical indicators to gauge expected changes in the exchange ratios of currencies.

Short-term investments are assets that can be converted into cash or can be sold within a short period of time, typically within 1-3 years. Common short-term investments include stocks, bonds, and mutual funds. Stocks are shares of ownership in a company that can be bought and sold on a stock exchange. Bonds are debt instruments that represent a loan made by an investor to a borrower. Mutual funds are pools of money collected from many investors to invest in a diversified portfolio of assets.

Short-term investments are assets that can be converted into cash or can be sold within a short period of time, typically within 1-3 years. Common short-term investments include stocks, bonds, and mutual funds. Stocks are shares of ownership in a company that can be bought and sold on a stock exchange. Bonds are debt instruments that represent a loan made by an investor to a borrower. Mutual funds are pools of money collected from many investors to invest in a diversified portfolio of assets.

Microsoft's Short-Term Investments: A Strategic Financial Approach

You may want to see also

Taxes and inflation

Short-term investments are assets that can be converted into cash or sold within a short period of time, typically within 1-3 years. They offer flexibility to the investor as they do not need to wait for the security to mature in order to get cash. On the other hand, long-term investments can be liquidated by selling in the secondary market, but the investor earns lower profits. Investors can make substantial profits in a very short amount of time. It is less risky as money invested per transaction is substantially lower. Short-term investing comes with high costs due to a high transaction volume and their corresponding brokerage commission fees.

Short-term investments are typically liquid assets, such as stocks listed on a major exchange that trades frequently or U.S. Treasury bonds. Marketable debt securities, aka "short-term paper", that mature within a year or less, such as U.S. Treasury bills and commercial paper, also count as short-term investments. Marketable equity securities include investments in common and preferred stock. Marketable debt securities can include corporate bonds—that is, bonds issued by another company—but they also need to have short maturity dates and should be actively traded to be considered liquid.

Short-term investments are less risky than long-term investments because money invested per transaction is substantially lower. However, short-term investments are less profitable than long-term investments. Short-term investments are liquid assets that can be converted into cash or sold within a short period of time, typically within 1-3 years. Long-term investments are investments that are held for a longer period of time, typically more than 3 years. Long-term investments are more profitable than short-term investments because the investor earns lower profits.

Unlocking Long-Term Wealth: A Guide to Making Smart Investment Choices

You may want to see also

Less risky

Short-term investments are assets that can be converted into cash or sold within a short period of time, typically within 1-3 years. They are less risky because money invested per transaction is substantially lower.

Short-term investments offer flexibility to the investor as they do not need to wait for the security to mature in order to get cash. On the other hand, long-term investments can be liquidated by selling in the secondary market, but the investor earns lower profits.

Short-term investments come with high costs due to a high transaction volume and their corresponding brokerage commission fees. Taxes and inflation also reduce the returns earned via short-term investing.

Short-term investments are less risky because they are liquid, like stocks listed on a major exchange that trades frequently or U.S. Treasury bonds. Marketable debt securities, aka "short-term paper", that mature within a year or less, such as U.S. Treasury bills and commercial paper, also count as short-term investments. Marketable equity securities include investments in common and preferred stock. Marketable debt securities can include corporate bonds—that is, bonds issued by another company—but they also need to have short maturity dates and should be actively traded to be considered liquid.

Unlocking the Future: Long-Term Benefits of Investing

You may want to see also

Easy access to cash

Short-term investments offer flexibility to the investor as they do not need to wait for the security to mature in order to get cash. On the other hand, long-term investments can be liquidated by selling in the secondary market, but the investor earns lower profits. Investors can make substantial profits in a very short amount of time. It is less risky as money invested per transaction is substantially lower. Short-term investments come with high costs due to a high transaction volume and their corresponding brokerage commission fees. Taxes and inflation also reduce the returns earned via short-term investing. It involves a certain level of expertise and time, as investors must closely monitor price movements and identify purchase and/or sale spots.

Short-term investments are assets that can be converted into cash or can be sold within a short period of time, typically within 1-3 years. Common short-term investments include stocks listed on a major exchange that trade frequently or U.S. Treasury bonds. Marketable debt securities, aka "short-term paper", that mature within a year or less, such as U.S. Treasury bills and commercial paper, also count as short-term investments. Marketable equity securities include investments in common and preferred stock. Marketable debt securities can include corporate bonds—that is, bonds issued by another company—but they also need to have short maturity dates and should be actively traded to be considered liquid.

Short-term investments are liquid, meaning they can be sold quickly and easily converted into cash. This flexibility is a key advantage of short-term investments, as it allows investors to access their cash quickly and without the need to wait for the security to mature. This is particularly useful for investors who need to access their cash for unexpected expenses or opportunities that may arise.

In contrast, long-term investments can be liquidated, but the investor earns lower profits. Long-term investments can also be more volatile, meaning they can fluctuate in value over time, which can make them less attractive for investors who need to access their cash quickly. If an investor needs to access their cash, they may have to sell a long-term investment at a loss to access it fully.

The safety of short-term investments comes at a cost. You likely won’t be able to earn as much in a short-term investment as you would in a long-term investment. However, the flexibility and liquidity of short-term investments make them a valuable option for investors who need to access their cash quickly and without the need to wait for the security to mature.

Navigating the Uncertain: Embracing Investment Risk

You may want to see also

Frequently asked questions

A short-term investment is an investment that can be easily converted to cash in less than three years without penalty or risk of loss.

Some common examples of short-term investments include CDs, money market accounts, high-yield savings accounts, government bonds, and Treasury bills.

Short-term investments are high-quality and highly liquid assets that can be converted to cash within one year. Selling a short-term investment can be a good strategy if you need to access cash quickly without incurring significant penalties.