Term life insurance is a smart investment for everyone as it can help individuals and their families build financial resilience and gain peace of mind. It is one of the least expensive types of life insurance available and women can benefit from this as their policies are usually less expensive than their male counterparts because women tend to live approximately seven years longer than men. Term insurance plans for women are also very often an income replacement and help your family members maintain financial stability even if something were to happen to you.

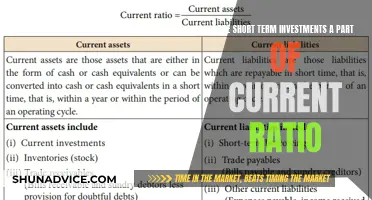

| Characteristics | Values |

|---|---|

| Income replacement | Helps family members maintain financial stability |

| Secure cash flow during retirement | Meets medical expenses and debt obligations |

| Financial security | Protects against financial uncertainty |

| Long-term savings | Builds a corpus |

| Affordable | Less expensive than male counterparts |

| Longevity | Women live approximately seven years longer than men |

| Financial resilience | Builds peace of mind |

| Women-centric | Caters to diverse needs |

| Empowerment | Makes women independent |

What You'll Learn

Financial stability for dependents

Term life insurance is a smart investment for women, as it can help them build financial resilience and gain peace of mind. It is also one of the least expensive types of life insurance available.

For women who are the sole earning member of the family, term life insurance can provide financial stability for their dependents in the event of their death. The payout from a term plan can help family members maintain financial stability and meet medical expenses and fulfil debt obligations.

Term life insurance plans are specifically designed to provide financial security to the family of the policyholder in case of death or uncertainty, such as an accident. The nominee is entitled to receive the death benefit in the event of the policyholder's sudden demise during the specified period.

Women may also invest in term life insurance to secure their golden years. Having a secure cash flow during retirement years can help them meet medical expenses and fulfil debt obligations.

Term life insurance plans have become a popular insurance option among women in India. Insurance companies now offer an online platform, where women can apply for an insurance policy anywhere, anytime. They can compare online term insurance plan features and benefits and choose one best-suited to their needs.

Is CIV a Long-Term Investment? Unlocking the Potential of a Crypto Project

You may want to see also

Long-term savings

Term life insurance is a smart investment for women, as it can help them build financial resilience and gain peace of mind. It is also one of the least expensive types of life insurance available.

One of the key benefits of term life insurance is that it can help women meet their long-term savings goals. Small investments over a period of time can help women build a sizable corpus that can be used to support their families and achieve their financial objectives.

Term life insurance can also help women secure their golden years. Having a secure cash flow during retirement years can help women meet medical expenses and fulfil debt obligations. This can help women live their life without any hassles and know that they are financially protected.

In addition to long-term savings, term life insurance can also help women support their families and provide financial security in case of a sudden demise. The payout from a term plan can help family members maintain financial stability and provide financial support in case of a policyholder's death.

Overall, term life insurance can be a valuable investment for women, as it can help them build financial resilience, secure their golden years, and provide financial security for their families.

Unlocking the Benefits: Should You Invest in Term Deposits?

You may want to see also

Peace of mind

Term life insurance is a smart investment for everyone as it can help individuals and their families build financial resilience and gain peace of mind. It is one of the least expensive types of life insurance available and is even more affordable for women because women tend to live approximately seven years longer than men.

Level term life insurance is a popular insurance option among women in India as it provides life coverage for a defined period of time. In case of a sudden demise of the policyholder during the specified period, the nominee is entitled to receive the death benefit. Such plans are specifically designed to provide financial security to the family of the policyholder in case of death or uncertainty, such as an accident.

Having a secure cash flow during retirement years helps in meeting medical expenses and fulfilling debt obligations. Women may, therefore, invest in an insurance scheme and secure their golden years. Post-retirement, they may live their life without any hassles, knowing that they are financially protected.

Insurance policies go a long way in helping women to look not only after themselves but also their dependents. Such insurance plans help women support their families especially if they are the sole earning member of the family. Women-centric insurance plans also cater to diverse needs, such as long-term savings goals, children's education and retirement planning besides many others. Such policies cover women-related diseases and maternity benefits too.

Insurance companies now offer an online platform, wherein women may apply for an insurance policy anywhere, anytime. Women may compare online term insurance plan features and benefits and choose one best-suited to their needs.

Unraveling Investment Strategies: Long-Term Benefits vs. Short-Term Gains

You may want to see also

Affordable coverage

Term life insurance is a smart investment for anyone and is one of the least expensive types of life insurance available. It is especially beneficial for women because women tend to live approximately seven years longer than men, and their policies are usually less expensive than their male counterparts.

Term life insurance plans provide life coverage for a defined period of time. In case of a sudden demise of the policyholder during the specified period, the nominee is entitled to receive the death benefit. Such plans are specifically designed to provide financial security to the family of the policyholder in case of death or uncertainty, such as an accident.

Term life insurance plans are very often used as an income replacement. It helps your family members maintain financial stability even if something were to happen to you.

Term life insurance plans have become a popular insurance option among women in India. Insurance companies now offer an online platform, where women may apply for an insurance policy anywhere, anytime. Women may compare online term insurance plan features and benefits and choose one best-suited to their needs.

Term life insurance plans also help women support their families especially if they are the sole earning member of the family. Women-centric insurance plans also cater to diverse needs, such as long-term savings goals, children's education and retirement planning besides many others. Such policies cover women-related diseases and maternity benefits too. Insurance policies have indeed empowered women and have made them independent in numerous ways.

Amazon vs. Tesla: Long-Term Investment Showdown

You may want to see also

Financial security

Term life insurance is a smart investment for women as it can help them build financial resilience and gain peace of mind. It is also one of the least expensive types of life insurance available.

A term insurance plan provides life coverage for a defined period of time. In case of a sudden demise of the policyholder during the specified period, the nominee is entitled to receive the death benefit. Such plans are specifically designed to provide financial security to the family of the policyholder in case of death or uncertainty, such as an accident.

Women-centric insurance plans also cater to diverse needs, such as long-term savings goals, children's education and retirement planning besides many others. Such policies cover women-related diseases and maternity benefits too.

Women with high personal incomes ($100,000 or more) are less likely to have life insurance than men at the same income level. However, obtaining term life insurance coverage is a smart investment for everyone—it can help individuals and their families build financial resilience and gain peace of mind and is one of the least expensive types of life insurance available.

Because women tend to live approximately seven years longer than men, their policies are usually less expensive than their male counterparts. With level term life insurance, your premium stays at a fixed rate through the duration of the specified level term of the policy and if you get this insurance at a young age, your monthly payments will remain low until the end of the level term period—often 30 years or even more for younger insureds.

Understanding Foreign Investment: A Global Perspective

You may want to see also

Frequently asked questions

Term insurance plans are popular among women as they provide life coverage for a defined period of time. In case of a sudden demise of the policyholder during the specified period, the nominee is entitled to receive the death benefit. Such plans are specifically designed to provide financial security to the family of the policyholder in case of death or uncertainty.

Insurance policies go a long way in helping women to look not only after themselves but also their dependents. Such insurance plans help women support their families especially if they are the sole earning member of the family.

A major benefit of investing in an insurance policy is long-term savings. Small investments over a period of time helps in building a sizable corpus.

Having a secure cash flow during retirement years helps in meeting medical expenses and fulfilling debt obligations. Women may, therefore, invest in an insurance scheme and secure their golden years.

Obtaining term life insurance coverage is a smart investment for everyone—it can help individuals and their families build financial resilience and gain peace of mind and is one of the least expensive types of life insurance available. But, did you know this coverage is even more affordable for women? Because women tend to live approximately seven years longer than men, their policies are usually less expensive than their male counterparts.