Net Present Value (NPV) is a crucial metric for investors to evaluate the potential profitability of an investment, project, or business venture. It is calculated by comparing the present value of expected cash inflows to the present value of cash outflows over a specific period. This analysis is essential for investment planning and capital budgeting, helping investors make informed decisions about how and where to allocate their capital. By using NPV, investors can determine if an investment is likely to be profitable in the long run, considering both the timing and amount of cash flows. A positive NPV indicates that the projected earnings exceed anticipated costs, suggesting a profitable opportunity. Conversely, a negative NPV implies a potential loss.

| Characteristics | Values |

|---|---|

| Purpose | To determine how much an investment, project, or series of cash flows is worth |

| Use Cases | Investment banking, accounting, budgeting, business valuation, investment planning, capital budgeting, financial modelling |

| Formula | NPV = Today’s value of the expected cash flows − Today’s value of invested cash |

| Components | Cash inflows, cash outflows, discount rate, number of time periods |

| Outcome Interpretation | Positive NPV: Profitable and worth pursuing |

| Negative NPV: Unlikely to be profitable and should not be pursued | |

| Zero NPV: Neither profitable nor costly, but may still be considered if there are significant intangible benefits | |

| Benefits | Considers the time value of money and provides a single, clear number for comparison with the initial investment |

| Limitations | Requires a long list of assumptions, sensitive to small changes in assumptions, may not capture second- and third-order impacts |

What You'll Learn

NPV accounts for the time value of money

Net present value (NPV) is a capital budgeting technique used to estimate the current value of the future cash flows that a proposed project or investment may generate. It is a useful tool for investors to determine how much an investment, project, or any series of cash flows is worth.

The time value of money is represented in the NPV formula by the discount rate, which is central to the formula. The discount rate, or required rate of return, is the baseline rate of return that a project must exceed to be worthwhile. It is the rate of return that could be earned in alternative investments of comparable risk.

To calculate NPV, each future cash flow must be discounted to get the present value of each cash flow, and then these present values are summed. The discount rate is used to discount each cash flow by the number of time periods that the cash flow is away from the present date. This is because each cash flow is assumed to be at the end of each period.

For example, an investor could receive $100 today or a year from now. Most investors would not be willing to postpone receiving $100 today. However, what if an investor could choose to receive $100 today or $105 in one year? The 5% rate of return might be worthwhile if comparable investments of equal risk offered less over the same period. On the other hand, if an investor could earn 8% with no risk over the next year, then the offer of $105 in a year would not be sufficient. In this case, 8% would be the discount rate.

SPVs: Smart Startup Investment Vehicles for Diversification

You may want to see also

NPV can be used to compare the rates of return of different projects

Net Present Value (NPV) is a capital budgeting technique used to estimate the current value of the future cash flows that a proposed project or investment may generate. It is the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

The time value of money is represented in the NPV formula by the discount rate, which might be a hurdle rate for a project based on a company's cost of capital, such as the weighted average cost of capital (WACC). No matter how the discount rate is determined, a negative NPV shows that the expected rate of return will fall short of it, meaning that the project will not create value.

The discount rate is central to the formula. It accounts for the fact that, as long as interest rates are positive, a dollar today is worth more than a dollar in the future. Inflation erodes the value of money over time.

For example, an investor could receive $100 today or a year from now. Most investors would not be willing to postpone receiving $100 today. However, what if the investor could choose to receive $100 today or $105 in a year? The 5% rate of return might be worthwhile if comparable investments of equal risk offered less over the same period.

On the other hand, if the investor could earn 8% with no risk over the next year, then the offer of $105 in a year would not be enough. In this case, 8% would be the discount rate.

When comparing the rates of return of different projects, investors can use NPV to determine which project is more likely to be profitable and create value.

Bernoulli Model Selection for Smart Investments

You may want to see also

NPV is used to determine the profitability of an investment

Net Present Value (NPV) is a capital budgeting technique used to estimate the profitability of an investment. It calculates the difference between the present value of cash inflows and the present value of cash outflows over a given period. This allows investors to determine whether an investment will be profitable or not.

NPV is calculated using the following formula:

NPV = Today's value of expected cash flows - Today's value of invested cash

The formula takes into account the timing and amount of future cash flows and the discount rate, which is equal to the minimum acceptable rate of return. The discount rate reflects the cost of capital or the returns available on alternative investments of comparable risk.

A positive NPV indicates that the projected earnings generated by an investment exceed the anticipated costs, suggesting that the investment will be profitable. On the other hand, a negative NPV indicates that the expected costs outweigh the expected earnings, signalling potential financial losses.

NPV is a valuable tool for investors as it provides a single, clear number that can be compared with the initial investment to assess the success of a project or investment. It also considers the time value of money, which is the concept that money received in the future is worth less than money received today due to factors such as inflation and interest rates.

Overall, NPV is a widely used metric that helps investors determine the profitability of an investment by taking into account various factors such as cash flows, discount rates, and the timing of cash flows.

Understanding Invested Assets: Does Cash Count?

You may want to see also

NPV is used to compare a projected rate of return with the hurdle rate

Net present value (NPV) is a capital budgeting technique used to estimate the current value of the future cash flows that a proposed project or investment may generate. It is used to determine how much an investment, project, or series of cash flows is worth.

The hurdle rate is important when companies or investors make important decisions, such as pursuing a specific project. It gives companies clarity on whether they should pursue a project. If the expected rate of return is above the hurdle rate, the investment is considered sound. If the rate of return falls below the hurdle rate, the company may choose not to proceed.

The hurdle rate is calculated using the formula:

> Hurdle rate = weighted average cost of capital (WACC) + risk premium

The WACC is the average rate a company is expected to pay to finance its assets, taking into account its equity and debt. The risk premium reflects the level of risk associated with the investment, with higher-risk projects typically demanding higher risk premiums.

The NPV formula for a project with multiple cash flows and a longer duration is:

> NPV = sum of the present value of expected cash flows - initial investment

The NPV calculation takes into account the timing of each cash flow, which can significantly impact the present value of an investment. It also considers the discount rate, which may be a hurdle rate based on a company's cost of capital, such as the weighted average cost of capital (WACC).

By comparing the NPV with the hurdle rate, investors can determine if a projected rate of return is sufficient to justify the risk and cost of an investment.

Understanding IRS Forms for Your Investment Profits

You may want to see also

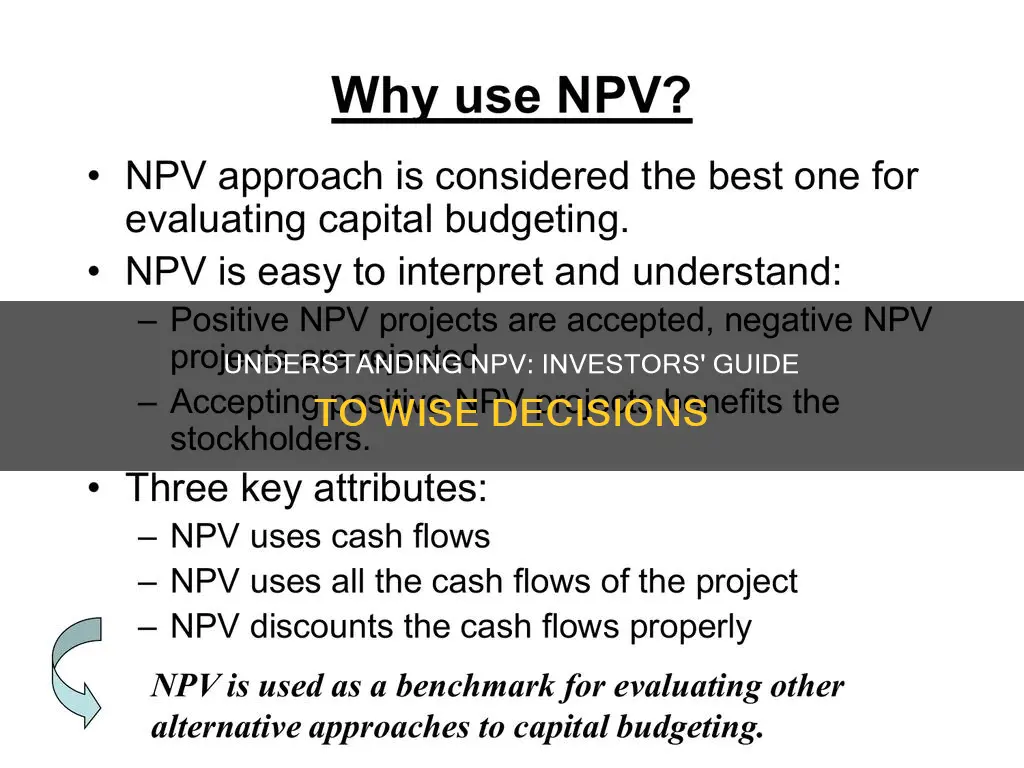

NPV is used in capital budgeting and investment planning

Net Present Value (NPV) is a capital budgeting technique used to estimate the current value of the future cash flows that a proposed project or investment may generate. It is used in investment planning and capital budgeting to measure the profitability of projects or investments.

NPV is the result of calculations that find the current value of a future stream of payments using the proper discount rate. It accounts for the time value of money and can be used to compare the rates of return of different projects or to compare a projected rate of return with the hurdle rate required to approve an investment.

NPV is useful for capital budget planners because it provides results in dollar values and can be a fair indicator of an investment's profitability. It allows users to employ present values to determine the potential future earnings of a project. NPV also takes into account the timing of each cash flow, which can significantly impact the present value of an investment.

To calculate NPV, one must estimate the timing and amount of future cash flows and select a discount rate equal to the minimum acceptable rate of return. The discount rate may reflect the cost of capital or the returns available on alternative investments of comparable risk.

A positive NPV indicates that the projected earnings generated by an investment exceed the anticipated costs, suggesting profitability. Conversely, a negative NPV implies that the expected costs outweigh the earnings, signalling potential financial losses.

Understanding Investment Revenue in the Cash Flow Statement

You may want to see also

Frequently asked questions

Net Present Value (NPV) is a calculation that determines the difference between the present value of cash inflows and the present value of cash outflows over a given period. It is used in investment planning and capital budgeting to measure the profitability of projects or investments.

Investors use NPV to determine whether an investment, project, or business will be profitable in the long run. It allows investors to compare the value of future cash flows to the initial cost of an investment, helping them make informed decisions about how and where to allocate their capital.

To calculate NPV, you need to estimate the timing and amount of future cash flows and choose a discount rate that reflects the minimum acceptable rate of return. The formula for NPV is:

NPV = Today's value of expected cash flows - Today's value of invested cash