William J. Bernstein is an American financial theorist, neurologist, and co-founder of Efficient Frontier Advisors, an investment management firm. He has written several books on finance and economic history, including The Four Pillars of Investing: Lessons for Building a Winning Portfolio, which provides investors with the tools they need to construct top-returning portfolios without the help of a financial advisor. Bernstein's book offers a blend of market history, investing theory, and behavioural finance, helping investors become more self-sufficient and make better-informed investment decisions.

| Characteristics | Values |

|---|---|

| Author | William J. Bernstein |

| Profession | Financial theorist, neurologist, co-founder of Efficient Frontier Advisors |

| Book Genres | Finance, Economic History |

| Book Tone | Relaxed, non-threatening |

| Target Audience | Individual investors, less comfortable with statistical thought |

| Main Topics | Market history, investing theory, behavioural finance |

| Key Principles | Wide diversification, passive index funds, buy-and-hold strategy |

| Number of Books | 11+ |

What You'll Learn

The importance of history in investing

William J. Bernstein is an American financial theorist, neurologist, and co-founder of Efficient Frontier Advisors, an investment management firm. He has written several books on finance and economic history. Bernstein's work often focuses on the history of markets and investing, and how this knowledge can be used to inform portfolio design.

Bernstein's book "The Four Pillars of Investing: Lessons for Building a Winning Portfolio" is a prime example of his emphasis on historical context. In this book, Bernstein outlines four essential lessons for investors, with the second pillar being dedicated to investment history. He argues that the more history you know, the better prepared you will be for the market's ups and downs. This includes understanding the historical occurrence of bubbles and the basic rule of technology investing, where users profit the most, not the makers.

Another one of Bernstein's works, "Deep Risk: How History Informs Portfolio Design", further underscores the importance he places on historical knowledge in investing. By studying the past, investors can identify patterns, trends, and potential risks that may impact their investment strategies.

Bernstein's historical perspective also extends beyond the realm of finance. His book "A Splendid Exchange: How Trade Shaped the World from Prehistory to Today" offers a comprehensive history of world trade, demonstrating how economic growth and trade are interconnected.

In addition to his focus on history, Bernstein is a proponent of modern portfolio theory. He believes that asset allocation within a portfolio is the primary driver of returns, rather than individual stock selection or market timing. This approach is reflected in his introduction of "Coward's Portfolio", a form of a lazy portfolio that involves splitting equity exposure across various types of stocks.

In conclusion, William J. Bernstein's body of work emphasizes the importance of historical context in investing. By understanding market history, investment psychology, and the business of investing, individuals can make more informed decisions and build winning portfolios.

UPRO: Why Investors Are Not Buying

You may want to see also

The psychology of investing

William J. Bernstein is an American financial theorist, neurologist, and co-founder of Efficient Frontier Advisors, an investment management firm. He has written several books on finance and economic history, with a focus on helping individual investors manage their own equity portfolios.

One of his most popular books, "The Four Pillars of Investing: Lessons for Building a Winning Portfolio", covers the psychology of investing as one of its four pillars. Here is a more detailed look at this aspect of the book:

Bernstein recognises that most investors follow the conventional wisdom of the time, investing in specific stocks or asset classes that are currently the most successful. This often leads to buying at high prices and can deplete a portfolio quickly. To counter this, Bernstein offers two strategies. Firstly, he suggests identifying the conventional wisdom and doing the opposite. Secondly, he advises that assets with the highest future returns tend to be the ones that are currently most unpopular. By going against the flow and focusing on unpopular asset classes, investors can make better decisions and improve their long-term success.

The relationship between risk and return is a key concept in Bernstein's psychological pillar. He emphasises that high returns require high risk. This means that the best time to invest is when things are going poorly, and the worst time to invest is when things are going well. For example, investing during a bear market is riskier and therefore can lead to higher returns, whereas investing during a bubble is safer but will likely result in lower returns.

Another aspect of the psychology of investing that Bernstein highlights is the impact of expenses and the media's influence. He recommends ignoring financial media and focusing on long-term data. Investors should pay attention to management fees and expenses, as these can be costly in the long run. Instead of relying on financial media, Bernstein suggests that the collective wisdom of the market is the best advisor.

Overall, Bernstein's psychological pillar aims to help investors make more informed and disciplined investment decisions by understanding the relationship between risk and return, going against the flow, and ignoring financial media and their expenses. By focusing on these strategies, investors can improve their chances of long-term success.

Funding Strategies for Your Investment Property Empire

You may want to see also

The business of investing

The fourth pillar of investing, as outlined by William J. Bernstein in his book "The Four Pillars of Investing", is the business of investing. This pillar focuses on the role of brokers, analysts, and the media in the investment industry and how they can influence and impact individual investors.

Bernstein takes a critical view of the investment industry, arguing that brokers, mutual fund managers, and financial writers are often more interested in profiting from investors' ignorance and peddling biased information rather than providing genuine value. He advises investors to be cautious of the financial media and to focus on getting their asset allocation right, rather than following the collective wisdom of the market.

One key aspect of the business of investing is the fees and expenses associated with investment services. Bernstein emphasizes the importance of minimizing costs by paying attention to management fees and expenses, which can eat into investment returns over time. He suggests that investors can often get better value by investing in low-expense index funds through companies like Vanguard, instead of relying on expensive financial advisors or brokerage firms.

Additionally, Bernstein highlights the importance of understanding the different types of financial intermediaries, such as brokers, fund houses, and investment banks, and how they profit from investors. He also discusses the role of the financial press and how it primarily serves to market financial products rather than provide unbiased information.

By understanding the business of investing, investors can make more informed decisions and avoid common pitfalls. This includes recognizing and avoiding biased or misleading information, minimizing fees and expenses, and focusing on building a well-diversified portfolio that aligns with their investment goals and risk tolerance.

Overall, the business of investing pillar in Bernstein's book provides valuable insights and guidance for investors looking to navigate the complex world of investing and make more informed and successful investment decisions.

Fees and the Erosion Effect: Understanding the True Cost of Investing

You may want to see also

The theory of investing

William J. Bernstein is an American financial theorist, author, and neurologist. His research is in the field of modern portfolio theory, and he has published several books for individual investors who wish to manage their own equity portfolios.

Bernstein's book, 'The Four Pillars of Investing: Lessons for Building a Winning Portfolio', outlines four essential lessons for investors to build a solid foundation for investing. The four pillars are:

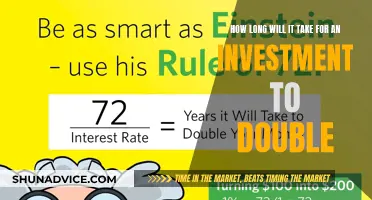

- Investment Theory: Bernstein emphasizes the relationship between risk and reward. He argues that high returns require high risk and that investors cannot time the market or pick winning stocks. Therefore, asset allocation becomes the critical factor that investors can control. He suggests indexing the whole market and starting with a percentage of bonds equal to the investor's age.

- Investment History: According to Bernstein, understanding the history of the markets helps investors navigate market ups and downs. He highlights that bubbles have occurred throughout history and will continue to do so. He also notes the basic rule of technology investing: users, not makers, profit the most.

- Investment Psychology: In this pillar, Bernstein focuses on long-term data and behavioural finance. He suggests that investors should focus on large and small value stocks, which tend to outperform large growth stocks over time. He also advises against pattern recognition and encourages investors to ignore their instincts and conventional wisdom.

- Investment Business: Bernstein critiques the investment industry, including brokers, analysts, and the media, for providing biased or misleading information. He recommends ignoring financial media and focusing on getting the asset allocation right. Additionally, he emphasizes the importance of paying attention to fees and expenses, as these can impact returns over time.

Overall, Bernstein's theory of investing revolves around understanding market history, behavioural finance, and the business of investing, all while emphasizing the importance of wide diversification, passive index funds, and a long-term buy-and-hold strategy.

Young People: Invest Now, Gain Later

You may want to see also

The history of trade

Trade has a long and complex history that has shaped the world as we know it today. From the earliest days of human civilisation, trade has been a fundamental aspect of society, facilitating the exchange of goods, services, and ideas. Over centuries, trade routes emerged and evolved, connecting different regions and cultures, and giving rise to powerful trading empires.

One of the earliest known trade networks was established by the Sumerians in Mesopotamia, who traded with neighbouring regions for resources such as timber, stone, and metals. This network expanded over time, with the Phoenicians, a maritime trading culture, playing a significant role in connecting the Mediterranean and the Middle East. The Phoenicians' extensive trade network facilitated the exchange of goods, technologies, and cultural practices, shaping the development of ancient societies.

Another notable trade route was the Silk Road, which connected East Asia, South Asia, Central Asia, and the Mediterranean region. Established during the Han dynasty in China, this network facilitated the exchange of luxurious goods, including silk, spices, and precious stones, as well as the spread of religions and cultural influences. The Silk Road played a pivotal role in connecting diverse civilisations and fostering economic and cultural exchange.

During the Middle Ages, trade networks expanded further, with European merchants establishing trading posts and colonies in Asia, Africa, and the Americas. This period, known as the Age of Discovery, witnessed the rise of powerful trading empires, such as the Portuguese and Spanish empires, which sought to monopolise trade routes and gain access to valuable resources. The establishment of these colonies had a profound impact on global trade and led to the exchange of commodities, crops, and cultural artefacts between continents.

In the 18th and 19th centuries, the Industrial Revolution transformed global trade. Technological advancements in transportation and communication revolutionised trade networks, making them faster and more efficient. The development of steam-powered ships and railways enabled the transportation of goods over long distances, while the emergence of telegraph systems improved communication between traders. This period also saw the growth of international trade agreements and the establishment of global trade organisations, such as the World Trade Organization (WTO).

In conclusion, the history of trade is a dynamic and intricate narrative that has shaped civilisations, economies, and cultural exchanges throughout human history. From ancient trade networks to the globalised trade of today, the evolution of trade has played a pivotal role in connecting societies and shaping the world economy.

Retirement Planning: Why Investing is a Must, Not a Maybe

You may want to see also

Frequently asked questions

William J. Bernstein is an American financial theorist, neurologist, and co-founder of Efficient Frontier Advisors, an investment management firm.

Bernstein is a proponent of modern portfolio theory, which states that most returns are determined by the asset allocation of the portfolio rather than by asset selection. He argues that investors should focus on allocating between asset classes rather than selecting individual stocks and bonds.

Some of Bernstein's notable books on investing include "The Four Pillars of Investing," "The Intelligent Asset Allocator," "The Investor's Manifesto," and "Rational Expectations: Asset Allocation for Investing Adults."

Bernstein's investing books are targeted towards individual investors who wish to manage their own equity portfolios. His books provide a blend of market history, investing theory, and behavioral finance, empowering investors to make better-informed decisions without relying heavily on financial advisors.