Buying an investment home will not directly boost your credit score. Your personal assets are not factored into credit score calculations. However, if you take out a mortgage to buy the property, that can impact your credit score. Shopping for the best rate will trigger a hard inquiry into your credit history, causing your score to drop in the short term. On the other hand, taking out a mortgage can benefit the credit mix portion of your credit score, as it adds another type of account to your credit profile.

| Characteristics | Values |

|---|---|

| Will buying an investment home boost my credit score? | No, buying an investment home will not boost your credit score. However, taking out a mortgage to buy a home can impact your credit score. |

| How does taking out a mortgage impact my credit score? | Shopping around for the best mortgage rate will trigger a hard inquiry into your credit history, causing your score to drop in the short term. Taking out a mortgage can benefit the credit mix portion of your credit score, as it adds another type of account to your credit profile. Consistently making mortgage payments on time will increase your credit score. |

| What is a credit score? | A credit score is a numerical summary of your credit report, outlining how well you've paid off past debts. |

| What is a good credit score? | A credit score can range from 300 to 850. 850 is a perfect credit score. Generally, lenders will look for a credit score of 660 or higher to grant a mortgage. |

| What are the main variables that make up a credit score? | Credit payment history (35%); Debt-to-credit utilization (30%); Length of credit history (15%); Credit mix (10%); New credit accounts (10%). |

What You'll Learn

Taking out a mortgage can impact your credit score

If you consistently make your mortgage payments on time, your credit score will increase over time. This increase, however, is not due to owning a home but rather due to your payment history, which is a factor considered in credit score calculations. Credit scores take into account five main types of credit information: payment history, amounts owed, length of credit history, new credit, and types of credit.

While taking out a mortgage can impact your credit score, owning a home outright does not directly influence your credit score. Credit scores are based on the likelihood of an individual repaying their debts, and personal assets are not factored into these calculations. Therefore, while taking out a mortgage can have both positive and negative effects on your credit score in the short term, consistently making timely payments will have a positive impact over time.

The Future of ESG: What's Next for Sustainable Investing?

You may want to see also

Consistently making mortgage payments on time will increase your credit score

While buying an investment home will not directly boost your credit score, taking out a mortgage to buy the home can impact it. Shopping for the best rate will trigger a hard inquiry into your credit history, causing your score to drop in the short term. However, taking out a mortgage can benefit the credit mix portion of your credit score calculation by adding another type of account to your credit profile.

Making consistent and timely mortgage payments will have a positive impact on your credit score. Payment history is a significant factor in credit score calculations, accounting for 35% of your score. Late or missed payments can negatively affect your score, while consistently making payments on time will increase your score. This is because your payment history demonstrates your ability to manage debt and repay credit.

In addition to payment history, other factors that influence your credit score include credit utilization (30%), length of credit history (15%), credit mix (10%), and new credit (10%). Credit utilization refers to the amount of debt you've accumulated on your credit accounts relative to the credit limit. The longer your credit history, the more favourable it is for your score. Credit mix considers the different types of credit accounts you have, such as credit cards, store credit cards, and loans. New credit accounts can impact your score, as opening a new line of credit decreases the average length of your credit history.

While buying an investment home may not directly boost your credit score, consistently making mortgage payments on time will have a positive impact. This, combined with other factors such as credit utilization and credit history, will contribute to an increase in your credit score over time.

The Future of Finance: Unlocking the Transformative Power of Investment

You may want to see also

Credit scores consider five main types of credit information

Payment history is the most influential factor in your credit score. It is a record of how you've managed your debt payments over time. Making on-time payments builds a positive credit history, while late or missed payments, accounts sent to collections, foreclosure, and bankruptcy all negatively impact your payment history.

The second most important factor is the amounts owed, which looks at how much money you owe overall. This includes your outstanding balances and the total amount of debt listed on your credit report, as well as your credit utilisation rate (the percentage of your available credit that you're using). It is recommended to keep your credit utilisation rate under 30%.

The length of your credit history is also important. This factor measures how long you've been using credit and takes into account the average age of all your credit accounts, the age of your oldest account, and how long it's been since you last opened an account. Keeping old accounts open and only applying for new credit when necessary can help improve this factor.

New credit refers to recent hard inquiries on your credit report and how many new accounts you've opened. Too much new credit in a short period can make you appear risky to lenders, so it's best to avoid applying for credit you don't need.

Lastly, the types of credit you have are considered. An ideal credit mix includes both revolving credit (e.g. credit cards) and installment credit (e.g. loans). Having experience with different types of credit can help your credit score, although it won't be a major factor.

While buying an investment home will not directly boost your credit score, taking out a mortgage can benefit the "new credit" and "types of credit" portions of your credit score. However, shopping around for the best rate will trigger a hard inquiry into your credit history, causing your score to drop in the short term. If you consistently make your mortgage payments on time, your credit score will increase due to your positive payment history.

Fear of Losing Money: Why People Don't Invest

You may want to see also

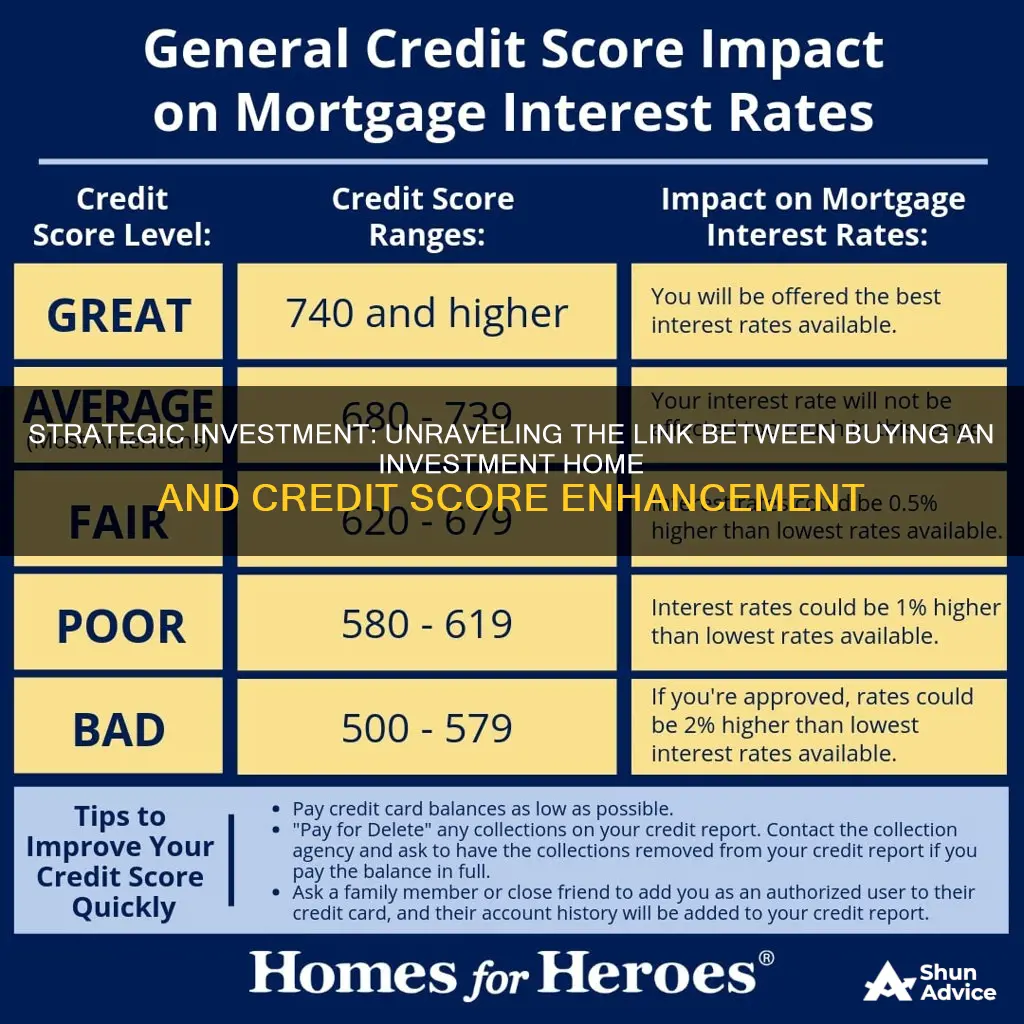

A good credit score is key to the home-buying process

The minimum credit score required to qualify for a mortgage depends on the type of loan and the lender. For example, a conventional loan typically requires a credit score of 620 or higher, while a Federal Housing Administration (FHA) loan may only need a credit score of 500 with a 10% down payment, or a score of 580 with a 3.5% down payment.

Your credit score is not the only factor lenders consider when evaluating your mortgage application. They will also look at your debt-to-income ratio (DTI), loan-to-value ratio (LTV), income, and employment history.

If you're looking to improve your credit score before buying a home, there are several steps you can take, such as paying off outstanding debt, paying your bills on time, and avoiding opening new lines of credit. Checking your credit report for errors and disputing any inaccuracies can also help boost your score.

In summary, a good credit score is crucial when applying for a mortgage, as it can impact the interest rates and terms you qualify for. Taking steps to improve your credit score and understanding the different loan options available can increase your chances of securing a favourable mortgage deal.

Smart Ways to Invest $25,000

You may want to see also

Credit score ranges: from 300 to 850

Credit scores are a tool used by lenders to make lending decisions. They are a three-digit number, usually ranging from 300 to 850, that estimates how likely you are to repay borrowed money and pay bills. The two most prominent credit scores are from FICO and VantageScore, and while they both use the same data, they weight it differently, producing slightly different scores.

The credit score ranges are as follows:

- Poor credit: 300 to 579

- Fair credit: 580 to 669

- Good credit: 670 to 739

- Very good credit: 740 to 799

- Excellent credit: 800 to 850

The two main factors that impact your credit score are:

- Payment history: Paying on time is crucial, as a late payment that's 30 days or more past the due date stays on your credit history for years.

- Credit utilization: It is good to use less than 30% of your credit limit; the lower, the better.

Other factors that influence your credit score include:

- Credit history: The longer you've had credit, and the higher the average age of your accounts, the better for your score.

- Credit mix: Having a mix of revolving and installment credit accounts with balances can positively impact your score.

- Recent credit applications: Applying for new credit accounts can lead to hard inquiries, which may result in a temporary dip in your score.

It's important to remember that your credit score is not static and can fluctuate frequently. Checking your credit score is free and easy, and by focusing on improving the underlying information in your credit report, you can take steps to enhance your overall creditworthiness.

Rich People: Where's the Money?

You may want to see also

Frequently asked questions

Buying an investment home will not directly boost your credit score. Your personal assets are not factored into credit score calculations. However, if you take out a mortgage to buy the home, that can impact your credit score. Shopping around for the best rate will trigger a hard inquiry into your credit history, causing your score to drop in the short term. On the other hand, taking out a mortgage can benefit the credit mix portion of your credit score by adding another type of account to your credit profile.

The main factors that determine your credit score are:

- Payment history (35%)

- Debt-to-credit utilization (30%)

- Length of credit history (15%)

- Credit mix (10%)

- New credit accounts (10%)

Here are some ways to improve your credit score:

- Check for and dispute any credit score errors

- Pay down your credit debts

- Get your credit bills current by making payments by their due dates

- Open a new credit card account to increase your total outstanding credit line and improve your credit mix

- Become an authorized user on the account of someone with good credit history