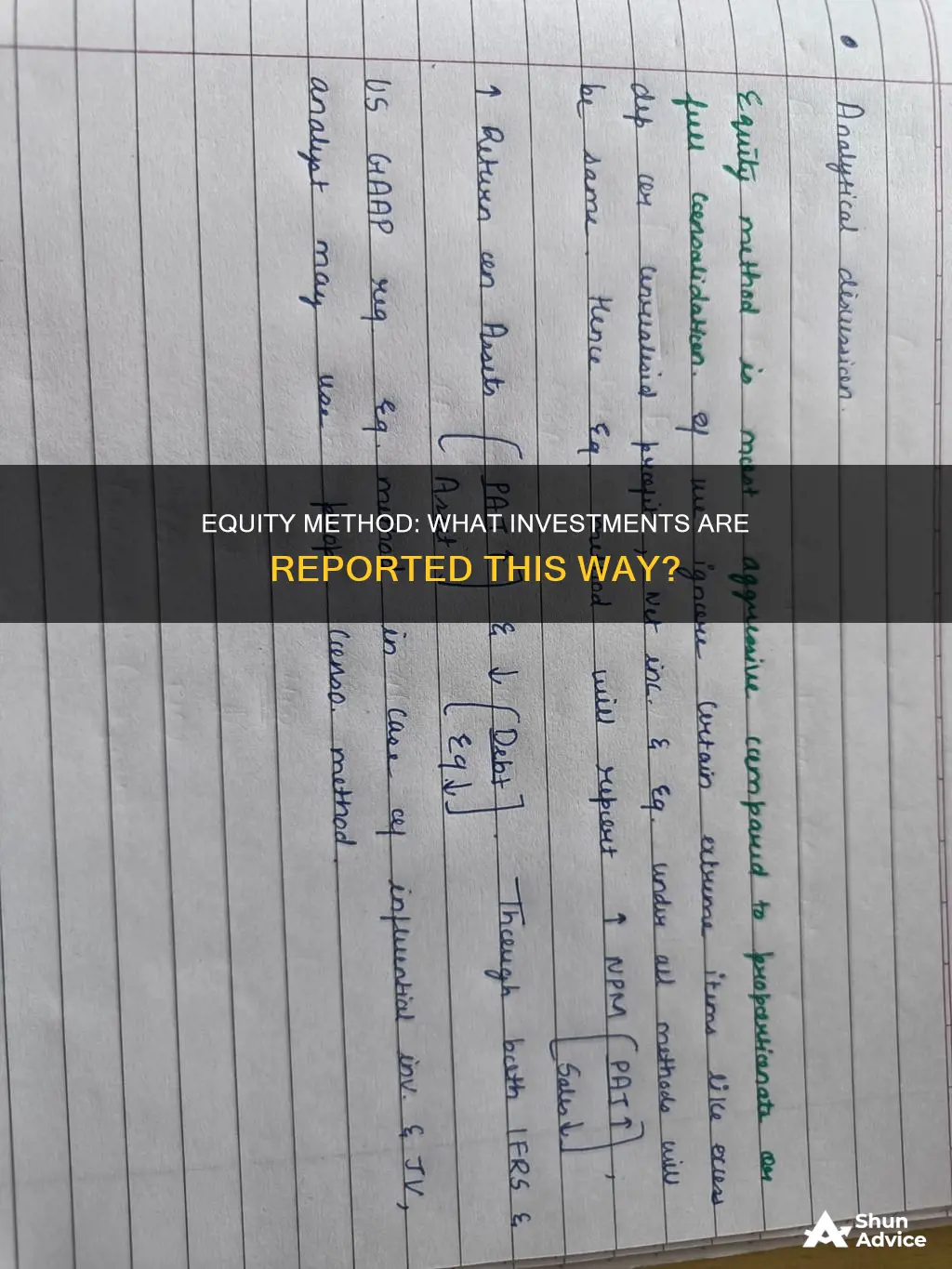

The equity method is an accounting technique used to record the profits earned by a company through its investment in another company. This method is used when the investor holds significant influence over the company they are investing in, usually defined as owning 20-50% of the company's stock or voting rights. The equity method is not used when the investor has full control over the company they are investing in, in which case the consolidation method is used, nor is it used when the investor has no influence, in which case the cost method is used. Under the equity method, the investor reports the revenue earned by the company they are investing in on their income statement, in proportion to the percentage of their equity investment. The equity method also requires periodic adjustments to the value of the asset on the investor's balance sheet.

What You'll Learn

- The equity method is used when an investor has significant influence over the investee

- The investor must report the revenue earned by the investee

- The initial investment is recorded at historical cost

- Net income of the investee increases the investor's asset value

- Dividends paid out by the investee are deducted from the account

The equity method is used when an investor has significant influence over the investee

The equity method is an accounting technique used for intercorporate investments. It is used when an investor holds significant influence over the investee but does not exercise full control over it. This is often the case when a company holds 20% or more of another company's stock, allowing them to impact the value of the investee company.

The equity method is used to record the profits earned by a company through its investment in another. The investor company reports the revenue earned by the investee company on its income statement, proportional to its equity investment. The initial investment is recorded at historical cost, and adjustments are made based on the investor's percentage ownership in net income, loss, and dividend payouts. Net income increases the investor's asset value, while loss or dividend payouts decrease it.

The equity method acknowledges the substantive economic relationship between the two entities. The investor records their share of the investee's earnings as revenue from investment on their income statement. For example, if a firm owns 25% of a company with a $1 million net income, they report earnings of $250,000 under the equity method.

The equity method is a standard technique used when an investor has significant influence over the investee. This influence is defined as the ability to exert power over the company, including representation on the board of directors, involvement in policy development, and the interchange of managerial personnel.

It is important to note that owning 20% or more of the shares does not automatically indicate significant influence. Other factors, such as operating agreements, ongoing litigation, or the presence of other majority shareholders, should also be considered.

Demand-Supply Equilibrium: Savings, Investments Balance

You may want to see also

The investor must report the revenue earned by the investee

The equity method is an accounting technique used to record the profits earned by a company through its investment in another company. It is generally used when the investor company holds significant influence over the company it is investing in, usually owning 20-50% of the stock in the investee company.

The equity method acknowledges the substantive economic relationship between the two entities. The investor records their share of the investee's earnings as revenue from investment on their income statement. This amount is proportional to the percentage of their equity investment in the other company. For example, if a firm owns 25% of a company with a $1 million net income, the firm reports earnings from its investment of $250,000 under the equity method.

The investor company must report the revenue earned by the investee on its income statement. The initial investment is recorded at historical cost, and adjustments are made to the value based on the investor's percentage ownership in net income, loss, and dividend payouts. Net income of the investee company increases the investor's asset value on their balance sheet, while the investee's loss or dividend payout decreases it.

The equity method is applied when the investor has the ability to exert significant influence over the operating and financing decisions of the investee. This can include representation on the board of directors, involvement in policy development, and the interchanging of managerial personnel.

When applying the equity method, the investor does not wait until dividends are received to recognize profit from its investment. Instead, the investor reports income as it is earned by the investee. For example, if a company reports net income of $100,000, an investor holding a 40% ownership immediately records an increase in its own income of $40,000. In recording this income, the investor also increases its investment account to reflect the growth in the size of the investee company.

The equity method ensures proper reporting on the business situations for both the investor and the investee, given the substantive economic relationship between the two entities.

Knowledge Management: A Smart Investment for Future Success

You may want to see also

The initial investment is recorded at historical cost

The equity method of accounting is a technique used to record the profits earned by a company through its investment in another company. This method is used when the investor company has significant influence over the company it is investing in, which is usually the case when the investor owns 20% or more of the company's stock.

The initial investment made by the investor company is recorded at its historical cost, which is the price paid for the asset at the time of purchase. This is done regardless of whether the investment is in a subsidiary or another company. The historical cost method is a fundamental accounting principle that is used for fixed assets and is based on the idea that the value of an asset should be recorded at its original cost to the company.

Historical cost accounting has several advantages. It provides a consistent and reliable basis for accounting, making it easier to report financial performance to stakeholders and providing a clear audit trail for transactions. It also improves the accuracy of financial statements, allowing for easier comparisons across different periods and companies, which can enhance decision-making. Additionally, it prevents the overstating of an asset's value, which can be important in cases of market volatility.

However, there are also limitations to historical cost accounting. It does not reflect the current value of an asset, nor does it account for inflation or deflation. It can also undervalue a company's assets, which may not provide an accurate indicator of the company's ability to continue performing at a specific level.

Building an Investment Portfolio: Where to Begin?

You may want to see also

Net income of the investee increases the investor's asset value

The equity method of accounting is a technique used to record the profits earned by a company through its investment in another company. It is generally used when the investor company holds significant influence over the company it is investing in, usually owning 20% or more of the company's stock.

When the net income of the investee company, or the company that is being invested in, increases, it also increases the investor company's asset value on its balance sheet. This is because the equity method acknowledges the substantive economic relationship between the two entities. The investor records their share of the investee's earnings as revenue from investment on their income statement.

For example, if an investor company owns 25% of a company that reports a net income of $1 million, the investor company will report earnings from its investment of $250,000 under the equity method. This amount is proportional to the percentage of its equity investment in the other company.

The equity method is used to record the profits earned by the investor company through its investment in the investee company. The investment is initially recorded at historical cost, and adjustments are made to the value based on the investor's percentage ownership in net income, loss, and dividend payouts.

The equity method provides a more complete and accurate picture of the economic interest that one company has in another. It allows for more consistent financial reporting over time and gives a clearer picture of how the investee's finances can impact the investor.

Building an Ally Investment Portfolio: A Guide

You may want to see also

Dividends paid out by the investee are deducted from the account

The equity method is an accounting technique used to record the profits earned by a company through its investment in another company. It is generally used when the investor company holds significant influence over the company it is investing in, usually owning 20% or more of the company's stock.

When dividends are paid out by the investee company, the investor company receiving the dividend will record an increase in its cash balance. However, this is offset by a decrease in the carrying value of its investment. This is because the dividend payout is considered a return on investment, reducing the value of the investor's shares.

For example, let's consider Lion Inc., which purchases 30% of Zombie Corp for $500,000. At the end of the year, Zombie Corp reports a net income of $100,000 and a dividend of $50,000 to its shareholders. Lion Inc. initially records its investment under "Investments in Associates/Affiliates", a long-term asset account, at the cost of $500,000.

Lion Inc. then receives $15,000 in dividends, which is 30% of the total dividend payout. This results in a reduction in their investment account, as they have received an outflow of cash from Zombie Corp. The reduction in the investment account is also equal to $15,000, reflecting the proportion of their ownership in Zombie Corp.

Overall, the dividend payout by Zombie Corp leads to a decrease in the carrying value of Lion Inc.'s investment, as the dividend is treated as a return on investment, reducing the value of Lion Inc.'s shares in Zombie Corp.

Who's the Shark Tank India's Top Investor Shark?

You may want to see also

Frequently asked questions

The equity method of accounting is a technique used to record the profits earned by a company through its investment in another company. This method is typically used when the investor company holds significant influence over the company it is investing in, usually owning 20-50% of the company's stock.

Under the equity method, the investor company reports the revenue earned by the investee company on its income statement, proportional to its percentage of equity investment. The initial investment is recorded at historical cost, and adjustments are made based on the investor's percentage ownership in net income, losses, and dividend payouts.

The equity method is used when an investor company has a significant, but not controlling, influence over the investee company. This typically means owning 20-50% of the investee company's stock. If the investor company has a controlling interest of 51% or more, the investment is reported as a consolidated subsidiary.

The cost method is used when the investor has no influence over the investee company. The investment is recorded at historical cost, and the investor recognises dividend income when received, rather than a share of the investee company's profits.

One criticism of the equity method is that it does not provide usable insights for investors. The investing company does not control how the investee company uses its assets, and it may not receive any financial profit unless the investee company pays a dividend.