Taking care of your investment portfolio is essential for optimising your financial health and security. A well-maintained investment portfolio can help you achieve your financial goals, whether you are investing for growth, income, or stability. Here are some key reasons why you should take care of your investment portfolio:

1. Regular Review: Market conditions can fluctuate, and your portfolio may need adjustments. For example, during an economic downturn, you might want to increase defensive investments, while in an expansionary period, you may prefer more cyclical stocks.

2. Risk Management: Understanding your risk tolerance is vital. Your portfolio should align with your ability to accept losses and your mental comfort when the market fluctuates. A well-diversified portfolio can help manage risk by spreading it across various investments.

3. Asset Allocation: Different assets, such as stocks, bonds, funds, and real estate, offer varying levels of risk and potential returns. Determining the appropriate mix of these assets based on your goals and risk tolerance is crucial for effective portfolio management.

4. Rebalancing: Over time, the allocation of your assets may deviate from your desired strategy. Periodically rebalancing your portfolio involves buying or selling certain assets to restore it to its original composition.

5. Long-Term Growth: A well-diversified portfolio is your best bet for consistent long-term growth. It ensures your investments grow steadily while managing risk.

In summary, taking care of your investment portfolio is about making informed decisions, regularly reviewing your strategy, managing risk, and optimising your asset allocation for long-term growth. It is a dynamic process that requires attention and adjustments to navigate changing market conditions effectively.

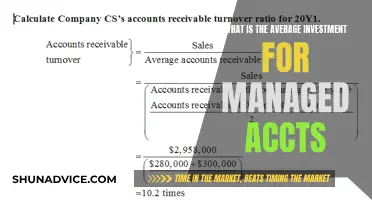

| Characteristics | Values |

|---|---|

| Purpose | Gain value, generate interest or dividend income |

| Risk | Higher-risk investments can generate high rewards but can also result in large losses |

| Time horizon | The younger you are, the more time you have to recover from losses |

| Tax | Diversifying the investments in your portfolio can help with tax exposure |

| Asset allocation | Stocks, bonds, mutual funds, exchange-traded funds (ETFs), cash equivalents, real estate investments |

| Diversification | Spread your investments across different asset types and markets |

| Rebalancing | Restore your portfolio to its original makeup when your chosen asset allocation gets out of balance |

What You'll Learn

Understand your risk tolerance

Understanding your risk tolerance is a crucial aspect of investing. Risk tolerance refers to the degree of risk an investor is willing to accept, given the potential for gains or losses in the value of their investments. It is influenced by various factors, and it's important to assess your risk tolerance regularly as it can change over time. Here are some key considerations to help you understand your risk tolerance:

Factors Affecting Risk Tolerance

- Age and Life Stage: Your age and life stage play a significant role in determining your risk tolerance. Younger investors tend to have a longer investment horizon, allowing them to recover from potential losses over time. As a result, they may be more comfortable with higher-risk investments. On the other hand, older investors, especially those nearing retirement, typically have a lower risk tolerance and seek more stable investments.

- Investment Goals: Your investment goals are closely tied to your risk tolerance. If you are investing for the long term, such as saving for retirement or a child's education, you may be willing to take on more risk to achieve potentially higher returns. Conversely, if your goal is short-term, such as saving for a down payment on a house, you may prefer more conservative investments to protect your capital.

- Income and Financial Stability: Your income and overall financial stability impact your risk tolerance. If you have a stable job, a diverse range of assets, and additional sources of income, you may be more comfortable taking on higher-risk investments. In contrast, those with less financial stability may prefer lower-risk options to protect their capital.

- Psychological Factors: Risk tolerance also has a psychological component. Some individuals are naturally more comfortable with risk and volatility, while others prefer a more conservative approach. It's important to be honest with yourself about your anxiety levels regarding market fluctuations and how you would handle potential losses.

- Market Conditions: The state of the market can influence your risk tolerance. During periods of economic expansion, you may be more inclined to take on risk, while a contracting economy may prompt a more defensive investment strategy.

Assessing Your Risk Tolerance

- Risk Tolerance Assessments: Online risk tolerance assessments and questionnaires can provide valuable insights into your risk tolerance. These tools help you evaluate your comfort with risk and how it aligns with your investment goals.

- Historical Returns: Reviewing historical returns for different asset classes can help you understand the volatility associated with various investments. This knowledge will enable you to make more informed decisions about the level of risk you are willing to accept.

- Time Horizon: Consider your investment time horizon. If you have a long-term investment goal, you may be able to withstand higher-risk investments, as you have more time to recover from potential downturns. Conversely, short-term goals typically require a more conservative approach.

- Financial Situation: Assess your overall financial situation, including your income, expenses, and emergency funds. A strong financial foundation can provide the stability needed to tolerate higher-risk investments.

- Risk Capacity: While risk tolerance focuses on your willingness to take risk, risk capacity assesses your financial ability to take risk. Consider your future earning potential, the stability of your income, and the presence of other assets, as these factors influence your overall risk capacity.

Understanding your risk tolerance is essential for making informed investment decisions. It helps you construct a portfolio that aligns with your goals and comfort level, ensuring you don't take on more risk than you are willing or able to handle. Remember, risk tolerance is unique to each individual, and it's crucial to assess it regularly as your circumstances and the market conditions evolve.

College Savings vs Investments: Where Should Your Money Go?

You may want to see also

Diversify your investments

Diversifying your investments is a crucial aspect of managing your investment portfolio. Here are some detailed tips to help you diversify effectively:

Understand the Importance of Diversification

Diversification is a risk management strategy that involves spreading your investments across various asset classes, sectors, and industries. By not putting all your eggs in one basket, you reduce the potential loss if a particular investment or sector underperforms. Diversification also allows you to take advantage of growth opportunities in different areas of the market.

Allocate Your Assets Wisely

Broadly speaking, the two main types of investments are stocks and bonds. Stocks are considered high-risk, high-return investments, while bonds are usually more stable with lower returns. A common strategy is to allocate your funds based on your age. For example, a younger investor might opt for a portfolio that is 70% stocks and 30% bonds, while an older investor might prefer a more conservative mix of 40% stocks and 60% bonds.

Go Beyond Stocks and Bonds

While stocks and bonds are the traditional foundation of investment portfolios, there are other options to consider. These include commodities, exchange-traded funds (ETFs), real estate investment trusts (REITs), and global markets. By investing in different types of assets, you further reduce your risk and increase your potential for returns.

Consider Index Funds and Mutual Funds

Index funds and mutual funds are an easy and cost-effective way to diversify your portfolio. These funds allow you to invest in a variety of companies and sectors without having to build a portfolio from scratch. Index funds, in particular, tend to have low fees and can be a great way to track broad market indexes like the S&P 500.

Don't Forget About Cash

Cash is often overlooked in investment portfolios, but it can provide a buffer during market downturns and give you the flexibility to take advantage of future investment opportunities. While cash may lose value over time due to inflation, it is still an important part of a well-diversified portfolio.

Periodic Rebalancing

Over time, the performance of your investments will cause shifts in your portfolio's allocation. It's important to periodically rebalance your portfolio to maintain your desired level of diversification. This might involve selling some stocks or investing in other asset classes to return your portfolio to its original makeup.

Remember, diversification is a key part of successful investment portfolio management. By following these tips, you can effectively spread your investments and reduce your risk while maximizing your potential returns.

Savings, Investments, and the Economy: National Symbiosis

You may want to see also

Regularly review your portfolio

Regularly reviewing your portfolio is essential to ensure it aligns with your financial goals and risk tolerance. Market conditions can fluctuate, and your portfolio may need adjustments to stay on course. For instance, if an economic contraction is expected, you might want to increase "defensive" investments that are less susceptible to economic cycles. Conversely, during economic expansions, favouring more cyclical stocks could be advantageous, as they tend to perform better in upturns.

To effectively review your portfolio, you can use indicators that track market and economic performance. These include stock market indices like the Straits Times Index (STI) and the Dow Jones Industrial Average, as well as economic indicators such as leading, lagging, and coincident indicators. Leading indicators, like the Consumer Confidence Index (CCI), forecast future economic shifts, while lagging indicators, such as unemployment rates and corporate profits, reflect past economic changes. Coincident indicators, including payroll data, provide insights into the current state of the economy.

When reviewing your portfolio, it's important to evaluate these indicators over a period rather than at a single point in time. The assessment period can vary depending on your investment horizon and goals. For short-term trading, evaluating over one or two quarters may be sufficient, while for long-term investments, a longer period, such as 10 years, might be more appropriate.

In addition to indicators, it's crucial to monitor the diversification of your portfolio and make adjustments as needed. This involves checking how weightings have changed and deciding which underweighted securities to buy and overweighted securities to sell. Remember to consider the tax implications of selling assets and the outlook for your holdings.

By regularly reviewing your portfolio, you can ensure it remains aligned with your financial goals and risk tolerance, even as market conditions evolve.

Maximizing Your Savings Account: A Guide to Smart Investing

You may want to see also

Choose the right investment accounts

Choosing the right investment account is a crucial step in achieving your financial goals. Here are some factors to consider when selecting the right investment account:

Standard Brokerage Account:

Standard brokerage accounts offer access to a wide range of investments, including stocks, mutual funds, bonds, and exchange-traded funds. They provide more flexibility but do not offer any tax benefits. You can choose between a cash account, which allows you to buy investments with deposited funds, and a margin account, which lets you borrow money from the broker to invest.

Retirement Accounts:

Retirement accounts, such as Individual Retirement Accounts (IRAs), are similar to standard brokerage accounts in terms of investment options. However, they offer tax advantages for contributions, investment gains, and withdrawals. Traditional IRAs offer upfront tax breaks, while Roth IRAs provide tax-free withdrawals in retirement.

Investment Accounts for Kids:

If you want to start investing for your children, you can consider custodial brokerage accounts, such as Uniform Gift to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA) accounts. These accounts are set up for minors, with an adult custodian controlling the assets until the child reaches the age of majority. UGMA and UTMA accounts differ in the types of assets they can hold, with UTMAs allowing investments in real estate.

Education Accounts:

Education accounts, like 529 savings plans and Coverdell Education Savings Accounts (ESAs), are designed to save for education expenses. Contributions to these accounts are typically not tax-deductible, but qualified distributions are tax-free. Additionally, ABLE accounts are similar to 529 accounts but are specifically created for individuals with disabilities, offering tax-advantaged savings for disability-related expenses.

Risk Tolerance and Time Horizon:

When choosing an investment account, consider your risk tolerance and time horizon. If you have a low-risk tolerance and a shorter time horizon, safer investments like savings accounts, certificates of deposit (CDs), or government-backed securities may be more suitable. On the other hand, if you are comfortable with higher risk and have a longer time horizon, investing in stocks, stock funds, or small-cap funds may provide attractive returns.

Financial Goals and Advice:

Finally, consider your financial goals and whether you want hands-on or hands-off management of your investments. If you want a more hands-off approach, robo-advisors can build and manage your investment portfolio based on your goals and risk tolerance. Alternatively, financial advisors can provide comprehensive financial planning services, including portfolio management.

Computing Investment Gains: Maximizing Your Portfolio Returns

You may want to see also

Monitor the performance of stocks

Monitoring the performance of stocks is an essential aspect of investment portfolio management. Here are some strategies to help you monitor the performance of your stocks effectively:

- Review your account statements: Regularly review your account records and statements to track your investments' performance. Keep track of the costs associated with your investments and compare their performance against your financial goals and guidelines outlined in your investment policy statement.

- Check stock tables: Stock tables, typically found in the business section of newspapers and online, provide valuable information about changes in stock values and trading activity.

- Compare against benchmarks: Utilize market or sector indices, such as the S&P/TSX indices, to compare the performance of your stocks against the broader market or specific sectors. This helps identify stocks that may be underperforming relative to their peers.

- Stay informed about your invested companies: Read recent disclosure documents, news releases, and other timely information from the companies you have invested in. Additionally, seek information from third-party sources like newspapers, trading sites, and analyst reports to make informed decisions.

- Consult your financial advisor: If you have a financial advisor, don't hesitate to seek their expertise. Ask them to explain sudden price fluctuations and their potential impact on your stock portfolio.

- Follow stock market news: Stay updated with stock market trends and developments. Understand whether the market is in a bull (strong market with rising stock prices) or bear (weak market with falling stock prices) phase. The Toronto Stock Exchange is a valuable source for market insights.

- Keep up with general economic news: Read business sections of major newspapers and stay informed about economic indicators such as interest rates, inflation rates, and currency exchange rates. These factors can influence stock prices, so it's essential to consider their potential impact.

- Utilize financial indicators to assess stocks: Several financial indicators can help you evaluate stocks, including Earnings per Share (EPS), Price to Earnings (P/E) ratio, Price to Earnings ratio to Growth ratio (PEG), Price to Book Value ratio (P/B), Dividend Payout ratio (DPR), and Dividend Yield. These indicators provide insights into a company's profitability, valuation, and dividend policies.

- Monitor your stocks' progress: Review your account statements, stay updated on company news, and follow market and economic news to make informed decisions about buying, holding, or selling stocks.

- Use portfolio management apps: Take advantage of mobile investment apps and portfolio management apps to track your investments in real time. Examples include Empower, SigFig Wealth Management, Sharesight, and Yahoo Finance. These apps offer features such as performance tracking, asset allocation analysis, and retirement planning.

Create a Portfolio on Investing.com: A Step-by-Step Guide

You may want to see also

Frequently asked questions

It is important to regularly review the state and financial health of your portfolio. Market conditions can change drastically over time, and when they do, your portfolio may need readjusting.

You should consider your current financial situation, future needs, and risk tolerance. If these things change, you may need to adjust your portfolio accordingly. For example, if your risk tolerance has dropped, you may need to reduce the number of equities held.

Diversification is a management strategy that blends different investments in a single portfolio. The idea behind diversification is that a variety of investments will yield a higher return. It also suggests that investors will face lower risk by investing in different vehicles.