Investment management fees are generally not tax deductible, at least not until 2025. The Tax Cuts and Jobs Act (TCJA) of 2017 eliminated the deductibility of most portfolio fees, including financial advisor fees. However, there are still ways to reduce taxes on investment-related spending. For example, investors who own an IRA can choose to pay financial planning or investment management fees directly out of the account being managed, as these fees are considered investment expenses and are paid on a pre-tax basis. Additionally, certain investment-related expenses may be deductible, such as investment interest expenses and qualified dividends.

| Characteristics | Values |

|---|---|

| Are investment management fees deductible in California? | No, they aren't – at least not until 2025. |

| When did the changes occur? | The Tax Cuts and Jobs Act (TCJA) enacted major changes in January 2018. |

| What other fees are not deductible? | Custodial fees for individual retirement accounts (IRAs) and other investment accounts, fees paid for legal counsel and tax advice, rental fees for a safe deposit box, investment publication subscription costs |

| What is the miscellaneous deduction threshold? | 2% of a taxpayer's adjusted gross income (AGI) |

| What are some ways to save money on investment taxes? | Capital gains losses, 401(k) and traditional IRA contributions, take advantage of lower long-term capital gains rates |

What You'll Learn

Investment management fees are deductible in California

Understanding Investment Management Fees

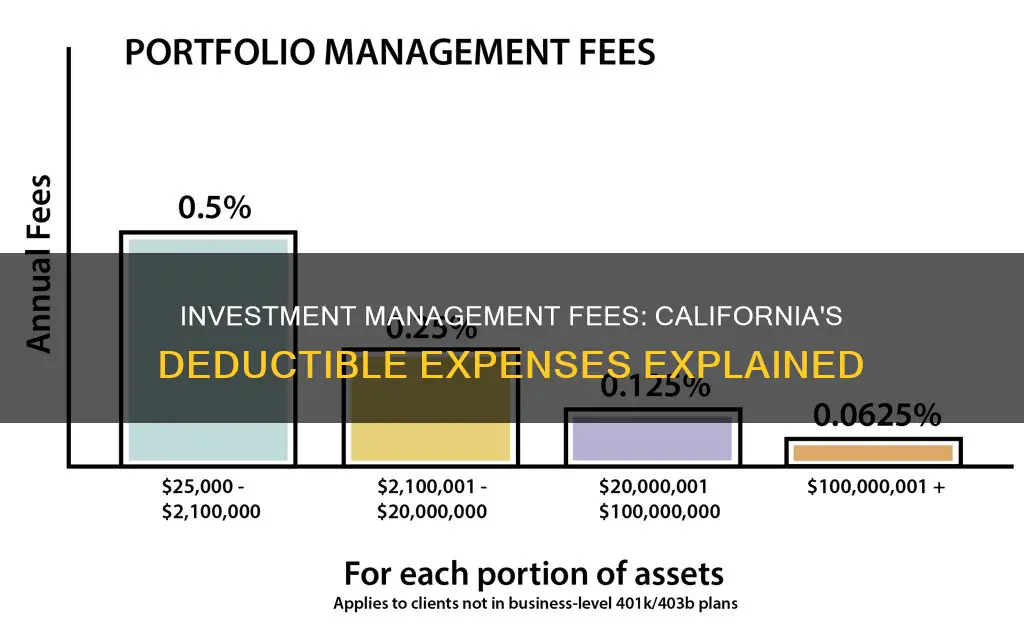

Before delving into the specifics of deductibility, let's clarify what constitutes investment management fees. These fees are typically paid to financial advisors or wealth managers for their services in managing your investments. The fees can be calculated as a percentage of the total assets under management (AUM) and may vary depending on factors such as the management style and the size of the portfolio.

Deductibility of Investment Management Fees in California

Now, let's address the main question: Are investment management fees deductible in California? The answer is yes. According to sources, investment management fees are deductible on your California state tax return. This is important to note because, while these fees were previously deductible on federal tax returns, the Tax Cuts and Jobs Act (TCJA) eliminated this deduction starting in 2018. However, it appears that California still allows the deduction of investment management fees.

How to Claim the Deduction

To claim the deduction for investment management fees on your California tax return, follow these steps:

Log into your tax return software or navigate to the appropriate section if using a physical form:

For TurboTax, log into your return and select "State" in the left navigational pane. If California is not selected, add it and choose it from the list.

- As you navigate through the questions, you will come across a section related to California-specific income handling. Look for "Investments" and then "Investment Income Expenses."

- Here, you will be able to input your investment management fees as a deductible expense.

- Ensure that you have calculated the fees accurately, especially if your portfolio includes US government bonds, as these may have different considerations.

- Additionally, keep in mind that investment management fees fall under miscellaneous deductions and must exceed 2% of your adjusted gross income (AGI) to be deductible.

Other Considerations

While investment management fees are deductible in California, it's important to note that there are other investment-related expenses that are not deductible. These include:

- Commissions paid on the trading of stocks and ETFs.

- Transaction fees to purchase and sell investments.

- Fees paid for general financial planning or counselling.

- Subscription fees for financial publications.

- Fees associated with registered accounts like Tax-Free Savings Accounts (TFSAs) or Registered Retirement Savings Plans (RRSPs).

In conclusion, investment management fees are deductible in California, and you can claim them on your state tax return. Be sure to follow the appropriate steps to accurately report these deductions and stay informed about any changes in tax laws that may impact your future returns.

The Role of an Investment Manager: Managing Your Money

You may want to see also

They were classified as miscellaneous itemized deductions

Investment management fees and financial planning fees were classified as miscellaneous itemized deductions until the 2017 Tax Cuts and Jobs Act (TCJA) eliminated them from the tax code, effective from the 2018 tax year.

Before the TCJA, you could only deduct the amount of investment management fees that exceeded 2% of your adjusted gross income (AGI). For example, if your AGI was $100,000 and you paid $3,000 in investment management fees, you could deduct $1,000 (the amount exceeding $2,000, which is 2% of your AGI).

The TCJA is set to expire in 2025, so the elimination of the deduction may only be temporary. After this period, the changes may be reversed, reinstating the tax deductibility of investment management fees.

If you could have claimed these fees but didn't, you can still amend your tax return for up to three years from the date you filed it or for two years from the date you paid any resulting tax, whichever is later.

Options Trading: A Personal Investment Portfolio Strategy?

You may want to see also

They must exceed 2% of your adjusted gross income (AGI)

Investment management fees and financial planning fees were deductible in the past, but they fell under the miscellaneous itemized deductions category, which was eliminated from the tax code by the Tax Cuts and Jobs Act (TCJA) in 2018.

Before the TCJA, investment management fees were deductible if they exceeded 2% of the taxpayer's adjusted gross income (AGI). For example, if a client had an AGI of $250,000 and spent more than $5,000 (2% of their AGI) on investment management fees, the excess amount could be deducted from their tax returns. So, if they paid $6,500 in fees during the tax year, the exceeding $1,500 would qualify them for a tax break.

Another example is if a taxpayer has an AGI of $100,000 and pays $3,000 in financial planning, accounting, and/or investment management fees. They wouldn't get a deduction for the first $2,000 of fees paid, but they would be able to deduct the last $1,000 (the amount that exceeds $2,000, which is 2% of their AGI).

The TCJA is set to expire in 2025, so the tax cuts may be temporary, and the deductibility of investment management fees may be reinstated.

Portfolio Variance: Impact of 20% Investment Strategy

You may want to see also

The Tax Cuts and Jobs Act (TCJA) eliminated the deduction

The Tax Cuts and Jobs Act (TCJA) was a major overhaul of the US tax code, signed into law by President Donald Trump in 2018. The Act eliminated the deductibility of most portfolio fees, including financial advisor fees, custodial fees for individual retirement accounts, legal counsel and tax advice fees, rental fees for safe deposit boxes, and investment publication subscription costs.

Prior to the TCJA, these investment management fees were considered as miscellaneous deductions if they exceeded 2% of a taxpayer's adjusted gross income (AGI). For example, if a taxpayer had an AGI of $250,000 and spent more than $5,000 (2% of their AGI) on investment management fees, the excess amount could be deducted from their tax returns.

The elimination of these deductions under the TCJA means that taxpayers can no longer reduce their taxable income by claiming these expenses. This change primarily affects taxpayers who previously itemized their deductions, as they can no longer offset their taxable income by claiming these investment-related fees.

The TCJA's impact on tax-paying investors is significant. Data from the Internal Revenue Service (IRS) shows a decline in the number of taxpayers itemizing their deductions after the introduction of the Act. In 2017, before the TCJA, around 46.2 million taxpayers itemized their deductions. This number dropped to 16.7 million in 2018, a 64% decline. The IRS's report also reveals that only 11.4% of those who claimed itemized deductions were individual filers.

Most taxpayers now opt for the standard deductions set by the IRS, which are regularly adjusted for inflation, instead of itemizing their deductions. This approach is more straightforward, especially if the amount they claim does not exceed the standard deduction thresholds.

It is worth noting that the TCJA's provisions regarding investment management fees are set to expire in 2025. After this period, the changes may be reversed, reinstating the tax deductibility of these fees. However, there is also a chance that the tax cuts may be renewed for another term, which could extend the elimination of these deductions.

Savings and Investment: Finding Equilibrium Balance

You may want to see also

The TCJA is set to expire in 2025

The Tax Cuts and Jobs Act (TCJA) of 2017 was a significant overhaul of the US tax code, impacting both individuals and corporations. The Act is set to expire at the end of 2025, with various provisions affecting individual taxpayers and businesses expiring between 2025 and 2028. This expiration will result in tax increases for almost all Americans, with over $4 trillion in tax hikes expected to come into effect on January 1, 2026.

The TCJA's impending expiration has become a pivotal issue in the 2024 election cycle, with control of Congress playing a significant role in determining the fate of the Act's provisions. If Congress does not intervene, the TCJA's provisions will expire, and tax rates will revert to pre-2017 levels.

Impact on Individual Taxpayers

The expiration of the TCJA will result in significant changes for individual taxpayers. The standard deduction, which was nearly doubled under the TCJA, will be reduced by almost half in 2026, adjusted for inflation. This may lead to more taxpayers itemizing their deductions. Marginal tax rates for individuals will also increase, with the top marginal tax rate rising from 37% to 39.6%.

The Child Tax Credit will be affected, reverting to $1,000 per child, compared to $2,000 under the TCJA. The income thresholds for this credit will also decrease, impacting more families. Additionally, the $10,000 cap on the deductibility of state and local taxes (SALT) will expire, primarily benefiting high-income taxpayers in high-tax states.

Impact on Businesses

The TCJA's expiration will also have consequences for businesses, particularly small business owners. The qualified business income (QBI) deduction, which allows owners of pass-through entities to claim a deduction of up to 20% of QBI, is set to expire at the end of 2025. This will result in pass-through business income being taxed at individual income tax rates without the QBI deduction.

Additionally, the business expense deductions will be phased out by 2027, with the bonus depreciation rate reduced to 50% in 2025. The estate and gift tax exclusion amount will also be cut in half at the end of 2025, impacting business succession and inheritance.

Legislative and Political Outcomes

The outcome of the 2024 elections will play a crucial role in shaping the future of the TCJA's provisions. Republicans are aiming to extend the TCJA and further expand some tax cuts, particularly for businesses. On the other hand, Democrats are focused on reforming tax breaks for lower- and middle-income households and raising taxes on higher-income individuals and corporations.

If Republicans control Congress, they may use the reconciliation process to extend the TCJA. In a divided Congress, lawmakers could pass a bipartisan agreement to address the expiring provisions, similar to what happened in 2012 with the extension of tax cuts enacted by George W. Bush. Alternatively, a short-term extension of one or two years could be decided to allow more time for negotiations.

The impending expiration of the TCJA in 2025 has significant implications for both individual taxpayers and businesses. The outcome of the 2024 elections will be pivotal in determining the fate of the Act's provisions, with potential tax increases or extensions on the horizon. Accountants and taxpayers must stay informed about possible extensions and their ramifications to make necessary adjustments.

Assessing Chase You Invest: Portfolio Performance Indicators

You may want to see also

Frequently asked questions

Yes, investment management fees are deductible in California.

To claim investment management fees on your California tax return, you need to log into your tax software account and select California as your state. As you navigate through the questions, you will arrive at a screen that says, "Here's the income that California handles differently." Go to "Investments > Investment Income Expenses" to input your investment fees.

The following investment management fees are not deductible:

- Commissions paid on the trading of stocks and ETFs

- Transaction fees to purchase and sell investments

- Fees paid for general financial counselling or planning

- Subscription fees for financial magazines and newspapers

- Fees associated with registered accounts, such as Tax-Free Savings Accounts (TFSAs) or Registered Retirement Savings Plans (RRSPs)