Long-term investments and current liabilities are two distinct financial concepts that play crucial roles in a company's financial health. While long-term investments are assets held for an extended period, typically with a maturity date beyond one year, current liabilities are obligations that a company expects to pay within the next year. This paragraph aims to explore the relationship between these two financial elements, examining how long-term investments can impact a company's current financial obligations and the strategies employed to manage them effectively.

What You'll Learn

- Understanding Current Liabilities: What are current liabilities and how do they differ from long-term investments

- Liquidity and Cash Flow: How do current liabilities impact a company's liquidity and cash flow

- Debt Management: Strategies for managing and reducing current liabilities through long-term investment

- Risk Assessment: Evaluating the risks associated with current liabilities and their impact on long-term investments

- Financial Planning: Integrating current liabilities into long-term financial planning and investment strategies

Understanding Current Liabilities: What are current liabilities and how do they differ from long-term investments?

Current liabilities and long-term investments are two distinct financial concepts that play crucial roles in a company's financial health and planning. Understanding the difference between these terms is essential for investors, analysts, and business owners alike.

Current liabilities refer to the financial obligations or debts that a company expects to pay or settle within one year or one operating cycle, whichever is longer. These are short-term financial commitments that a business must meet in the near future. Examples of current liabilities include accounts payable, short-term loans, wages payable, and accrued expenses. For instance, if a company owes suppliers for raw materials used in the production of goods that will be sold in the next month, these accounts payable are considered current liabilities. Similarly, wages that the company needs to pay to its employees for the current month fall under this category.

On the other hand, long-term investments are financial assets or securities that a company purchases with the intention of holding for an extended period, typically beyond one year. These investments are not expected to be converted into cash or sold in the near future. Examples of long-term investments include bonds, stocks, and other marketable securities. For instance, if a company invests in a 10-year government bond, this investment is considered long-term and is not classified as a current liability.

The key difference lies in the time horizon and liquidity of these financial items. Current liabilities are short-term obligations that require immediate or near-term payment, while long-term investments are long-term assets that provide returns over an extended period. Current liabilities are essential for maintaining day-to-day operations and ensuring the company's short-term financial stability, while long-term investments contribute to the company's growth and capital appreciation over time.

In financial statements, current liabilities are typically listed separately from long-term investments to provide a clear picture of a company's short-term financial obligations and its long-term financial strategy. Understanding this distinction is vital for assessing a company's financial health, as it provides insights into its ability to meet short-term debts and its approach to long-term financial goals.

Unlocking the Secrets: How Long is Long-Term Investing?

You may want to see also

Liquidity and Cash Flow: How do current liabilities impact a company's liquidity and cash flow?

When examining a company's financial health, understanding the relationship between current liabilities and liquidity is crucial. Current liabilities are short-term obligations that a company is expected to pay within one year or one operating cycle, whichever is longer. These obligations can include accounts payable, short-term loans, accrued expenses, and dividends payable. The impact of current liabilities on a company's liquidity and cash flow is significant and can influence its ability to meet its short-term financial commitments.

Liquidity refers to a company's ability to quickly convert its assets into cash to meet its short-term obligations. Current liabilities play a critical role in assessing liquidity because they represent the company's immediate financial responsibilities. A company with a high level of current liabilities may struggle to generate sufficient cash to cover these obligations, especially if its assets are illiquid or difficult to convert into cash quickly. For instance, if a company has a large inventory that takes time to sell or accounts receivable that are slow to be collected, it may face challenges in meeting its short-term liabilities.

The management of current liabilities is essential for maintaining a healthy cash flow. Effective management involves ensuring that the company has sufficient cash or easily convertible assets to cover its short-term obligations. One way to improve liquidity is by negotiating extended payment terms with suppliers, which can reduce the immediate cash outflow for inventory purchases. Additionally, companies can optimize their accounts receivable processes to speed up the collection of payments from customers, thereby improving cash flow.

In the context of long-term investments, it is important to note that these are typically not considered current liabilities. Long-term investments are financial assets held for a period extending beyond one year, such as stocks, bonds, or property. These investments are not expected to be converted into cash in the near term and, therefore, do not directly impact a company's short-term liquidity or cash flow. However, they can still influence a company's overall financial health and investment strategy.

In summary, current liabilities have a direct and significant impact on a company's liquidity and cash flow. Effective management of these liabilities is crucial for ensuring the company can meet its short-term financial obligations. By understanding and monitoring current liabilities, companies can make informed decisions to improve their financial stability and overall cash flow management.

Unraveling the True Nature of Short-Term vs. Long-Term Investments

You may want to see also

Debt Management: Strategies for managing and reducing current liabilities through long-term investment

The concept of "long-term investment" in the context of current liabilities is an intriguing strategy for businesses aiming to optimize their financial health. While current liabilities are typically short-term obligations that a company must meet within one year, the idea of investing in long-term assets can be a powerful tool for debt management and financial stability. This approach involves a shift in perspective, viewing long-term investments as a means to reduce the burden of short-term debts.

One key strategy is to utilize long-term investments to generate a steady cash flow that can be directed towards debt repayment. For instance, a company might invest in long-term projects or assets that provide a consistent revenue stream over several years. This revenue can then be allocated to pay off current liabilities, reducing the overall debt burden. By doing so, the business can avoid the pressure of immediate repayment, allowing for better cash flow management and financial planning.

Another approach is to consider the tax implications of long-term investments. In many jurisdictions, long-term capital gains are taxed at a lower rate compared to short-term gains. This can be advantageous for businesses as it provides an incentive to hold investments for the long term. By strategically managing investments to realize long-term gains, companies can potentially reduce their tax liabilities, which in turn can be used to service current debts more efficiently.

Additionally, long-term investments can provide a hedge against market volatility and economic downturns. By diversifying their investment portfolio, businesses can ensure a more stable cash flow, even during challenging economic periods. This stability can be crucial in managing current liabilities, as it provides a buffer against potential short-term financial crises. For example, investing in a mix of assets like real estate, infrastructure, or even alternative investments can offer a more resilient financial position.

Implementing these strategies requires careful planning and a long-term financial vision. It involves assessing the company's financial health, understanding its current liabilities, and developing a robust investment strategy. By doing so, businesses can effectively manage their debts, reduce financial risks, and ensure a more sustainable and prosperous future. This approach to debt management is particularly relevant for companies aiming to maintain a healthy balance sheet and foster long-term growth.

Long-Term Investments: Separating Fact from Fiction

You may want to see also

Risk Assessment: Evaluating the risks associated with current liabilities and their impact on long-term investments

When assessing the risks associated with current liabilities, it's crucial to understand their potential impact on long-term investments. Current liabilities, such as short-term debts and accounts payable, can significantly influence a company's financial health and stability, especially when considering long-term investment strategies. Here's a detailed breakdown of the risk assessment process:

Understanding Current Liabilities:

Current liabilities are obligations that a company expects to settle within one year or its operating cycle, whichever is longer. These include accounts payable, short-term loans, accrued expenses, and dividends payable. While these liabilities are essential for day-to-day operations, they can pose risks if not managed effectively. The key is to ensure that current liabilities are not excessive compared to the company's ability to generate short-term cash flow.

Risk Assessment Process:

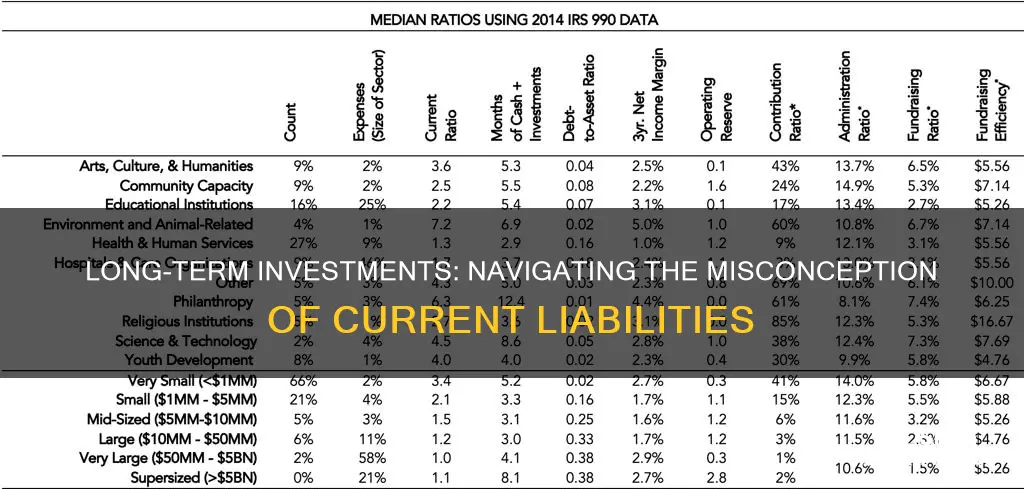

- Liquidity Analysis: Begin by evaluating the company's liquidity position. Calculate the current ratio (current assets/current liabilities) and quick ratio (current assets minus inventory/current liabilities). These ratios provide insights into the company's ability to meet its short-term obligations. A declining current ratio or a quick ratio below 1 may indicate potential liquidity issues.

- Cash Flow Projections: Assess the company's cash flow projections for the next 12 months. Analyze the sources and uses of cash, including expected payments to suppliers, loan repayments, and dividend distributions. Ensure that the cash flow projections are realistic and consider potential scenarios, such as economic downturns or changes in market conditions.

- Debt Management: Examine the company's debt structure. Evaluate the interest coverage ratio, which measures the company's ability to pay interest on its debts. High-interest expenses relative to earnings can strain the company's financial resources. Additionally, consider the maturity profile of short-term debts to ensure that the company has sufficient funds to meet upcoming obligations.

- Impact on Long-Term Investments: Here's where the focus shifts to the potential risks for long-term investments:

- Liquidity Risk: Excessive current liabilities may lead to liquidity risk, where the company struggles to meet its short-term obligations, potentially affecting its ability to invest in long-term projects or assets.

- Financial Stability: High levels of current liabilities can impact the company's financial stability, making it challenging to secure favorable terms for long-term financing or investments.

- Strategic Planning: Effective management of current liabilities is crucial for strategic planning. Companies must balance short-term obligations with long-term investment goals to ensure sustainable growth.

Mitigation Strategies:

- Regularly review and optimize the company's cash flow management to ensure a healthy balance between current liabilities and short-term cash requirements.

- Diversify funding sources to reduce reliance on short-term debts and improve financial stability.

- Implement robust financial forecasting and scenario planning to anticipate and manage potential risks associated with current liabilities.

By conducting a comprehensive risk assessment, companies can make informed decisions regarding their current liabilities and their impact on long-term investments, ensuring financial stability and sustainable growth. This process empowers businesses to navigate the complexities of short-term financial obligations while pursuing their long-term strategic objectives.

Understanding NAV: The Key to Investment Clarity

You may want to see also

Financial Planning: Integrating current liabilities into long-term financial planning and investment strategies

When considering financial planning and investment strategies, it's crucial to understand the role of current liabilities and how they fit into the broader context of long-term financial health. Current liabilities are obligations that a company must meet within one year or one operating cycle, whichever is longer. These obligations can include accounts payable, short-term loans, and accrued expenses. While they are essential for day-to-day operations, they can also impact a company's ability to invest in long-term growth and development.

Integrating current liabilities into long-term financial planning involves a strategic approach to managing these obligations while also considering future investment opportunities. Here are some key steps and considerations:

- Assess Current Liability Position: Begin by thoroughly understanding your company's current liability position. Identify the types of current liabilities, their amounts, and the terms of repayment. This assessment will help you gauge the potential impact on your cash flow and overall financial stability. For example, if a significant portion of current liabilities consists of short-term loans, it may indicate a need to explore alternative financing options or improve cash flow management.

- Create a Cash Flow Forecast: Develop a detailed cash flow forecast that extends beyond the current year. This forecast should consider both expected income and expenses, including current liabilities. By analyzing historical data and trends, you can identify patterns and make more accurate predictions. This forecast will enable you to anticipate potential cash flow gaps and plan accordingly. For instance, if a cash flow gap is identified, you might consider negotiating extended payment terms with suppliers or exploring short-term financing options.

- Prioritize Liability Management: Effective management of current liabilities is crucial for long-term financial success. Prioritize strategies such as negotiating favorable payment terms with suppliers, optimizing inventory management to reduce holding costs, and implementing robust accounts payable processes. By actively managing these liabilities, you can improve cash flow, reduce financial strain, and create a more stable foundation for long-term investments.

- Align Current Liabilities with Investment Goals: When planning for long-term investments, consider how current liabilities can be strategically aligned with your financial goals. For instance, if a company has a substantial amount of accounts payable, it might consider investing in assets that can generate a return to help offset the cost of these liabilities. Alternatively, if short-term loans are a significant burden, exploring refinancing options or negotiating better terms could free up capital for long-term investments.

- Regular Review and Adjustment: Financial planning is an ongoing process, and current liabilities should be regularly reviewed and adjusted as necessary. Market conditions, business performance, and external factors can all influence the management of current liabilities. By staying proactive and making informed decisions, you can ensure that your long-term investment strategies remain robust and adaptable.

Incorporating current liabilities into long-term financial planning requires a thoughtful and strategic approach. By assessing and managing these obligations effectively, businesses can optimize their financial health, improve cash flow, and make informed decisions regarding long-term investments. This integration is vital for sustainable growth and success in an ever-changing business landscape.

Unlocking Wealth: Discover the Ultimate Long-Term Investment Strategy

You may want to see also

Frequently asked questions

Long-term investment current liabilities refer to the portion of a company's long-term investments that are due within one year. These are considered short-term obligations and are typically part of a company's current assets on the balance sheet. They can include investments in marketable securities, such as bonds or stocks, that are expected to be sold or converted into cash within the next year.

While long-term investment current liabilities are not as critical as other current liabilities like accounts payable or short-term debt, they still provide insight into a company's liquidity and investment strategy. A company with a significant amount of these liabilities may have a more conservative investment approach, aiming to preserve capital and ensure quick access to funds if needed.

Yes, if a company decides to hold onto its long-term investments for an extended period, they can become long-term assets. However, if the investments are expected to be sold or converted into cash within a year, they remain classified as current assets and liabilities. It's important to note that the classification can change if the investment strategy shifts or market conditions impact the expected timeline for conversion.

Yes, the accounting standards provide guidelines for recognizing and measuring long-term investment current liabilities. These standards ensure consistency and transparency in financial reporting. Companies must disclose the fair value of these investments and any related valuation adjustments. Additionally, any changes in the investment's value should be reflected in the income statement, impacting the company's net income.