Short-term investments are often considered less risky than long-term ones, but they still carry certain maturity risks that investors should be aware of. These risks can impact the value of an investment and the potential returns an investor can expect. Understanding these risks is crucial for investors who are considering short-term investments as part of their portfolio strategy. This paragraph will explore the maturity risks associated with short-term investments and discuss how these risks can affect investors.

What You'll Learn

- Market Volatility: Fluctuations in asset prices can impact short-term investments, increasing maturity risk

- Liquidity Concerns: Short-term investments may have limited liquidity, making it harder to sell quickly

- Interest Rate Sensitivity: Changes in interest rates can affect the value of short-term investments

- Credit Risk: Default risk is higher for short-term investments, especially those with lower credit ratings

- Economic Cycles: Short-term investments are more vulnerable to economic downturns and recessions

Market Volatility: Fluctuations in asset prices can impact short-term investments, increasing maturity risk

Market volatility refers to the rapid and significant changes in asset prices, which can have a substantial impact on short-term investments. This phenomenon is particularly relevant when considering maturity risk, which is the potential for an investment to lose value due to adverse market movements before the expected maturity date. Short-term investments, by their very nature, are more susceptible to these fluctuations, and understanding this relationship is crucial for investors.

In the context of short-term investments, market volatility can lead to several risks. Firstly, the value of these investments can fluctuate significantly over a short period. For instance, a short-term bond fund might experience a rapid decline in price if interest rates rise unexpectedly, causing a shift in the market's perception of risk. This volatility can result in investors selling their holdings prematurely, potentially at a loss, especially if the market downturn is sudden and severe. Secondly, short-term investments often aim to provide liquidity and capital preservation, but market volatility can challenge this objective. During periods of high volatility, investors may seek safer assets, causing a rush to exit short-term investments, further exacerbating price drops.

The impact of market volatility on maturity risk is twofold. Firstly, it increases the likelihood of price movements that can lead to early redemption or forced selling. This is particularly concerning for short-term investments, as they are typically designed for quick access to funds. If an investor needs to sell prematurely due to market volatility, they may incur losses, especially if the investment has not yet reached its maturity date. Secondly, market volatility can create a feedback loop, where negative price movements trigger further selling, potentially causing a downward spiral in asset prices. This dynamic can be particularly challenging for short-term investments, as it may result in a reduced net asset value, impacting the overall performance of the investment vehicle.

To mitigate these risks, investors should consider the following strategies. Diversification is key; spreading investments across various asset classes and sectors can reduce the impact of market volatility on any single holding. Additionally, investors should carefully assess their risk tolerance and investment goals. Short-term investments might be suitable for those seeking quick access to funds, but during volatile periods, they may require more cautious management. Regular review and rebalancing of portfolios can help investors stay aligned with their objectives and adjust their strategies as market conditions change.

In summary, market volatility significantly influences short-term investments, posing maturity risks that investors should be aware of. Understanding the relationship between price fluctuations and early redemption potential is essential for making informed investment decisions. By implementing strategies such as diversification and regular portfolio reviews, investors can navigate market volatility more effectively and potentially minimize the impact of maturity risk on their short-term holdings.

Understanding Short-Term Investments: Are They Current Assets?

You may want to see also

Liquidity Concerns: Short-term investments may have limited liquidity, making it harder to sell quickly

When considering short-term investments, one of the key concerns that investors should be aware of is the issue of liquidity. Liquidity refers to how easily an investment can be converted into cash without a significant impact on its price. Short-term investments, by their very nature, are designed to be held for a relatively short period, often less than a year. However, this short-term focus can sometimes come at the cost of reduced liquidity.

In the context of short-term investments, liquidity is crucial because it determines how quickly an investor can access their funds if needed. For instance, if an investor requires immediate cash for an unexpected expense or an emergency, they might face challenges in selling their short-term investments promptly. This is especially true for certain types of short-term investments, such as money market funds or treasury bills, which are known for their high liquidity and low risk. Despite their liquidity, these investments may still have limited trading volumes, meaning there might be fewer buyers and sellers in the market, which can result in potential delays or reduced selling prices.

The limited liquidity of short-term investments can be attributed to several factors. Firstly, the market for these investments may not always be as active as that for longer-term securities. With a smaller number of participants, there could be fewer opportunities to find a buyer quickly, especially during periods of market volatility or when there is a sudden increase in demand for cash. Secondly, some short-term investments might have specific restrictions on daily or frequent selling, which further limits the investor's ability to access their funds without penalty.

To mitigate the impact of limited liquidity, investors should carefully consider their investment strategies and time horizons. Diversifying short-term investments across different asset classes and markets can help reduce the risk of being unable to sell an investment when needed. Additionally, investors should be prepared to hold their short-term investments for the full term, especially if they are invested in less liquid instruments. This approach ensures that the investment remains intact until maturity, providing the full return without the need for early liquidation.

In summary, while short-term investments offer advantages such as lower risk and higher liquidity compared to longer-term investments, they may still present liquidity concerns. Investors should be mindful of the potential challenges in selling these investments quickly and take appropriate measures to manage their cash flow and access to funds. Understanding the liquidity characteristics of different short-term investment options is essential for making informed financial decisions.

Unlocking Long-Term Wealth: Are Trading Securities a Wise Investment Strategy?

You may want to see also

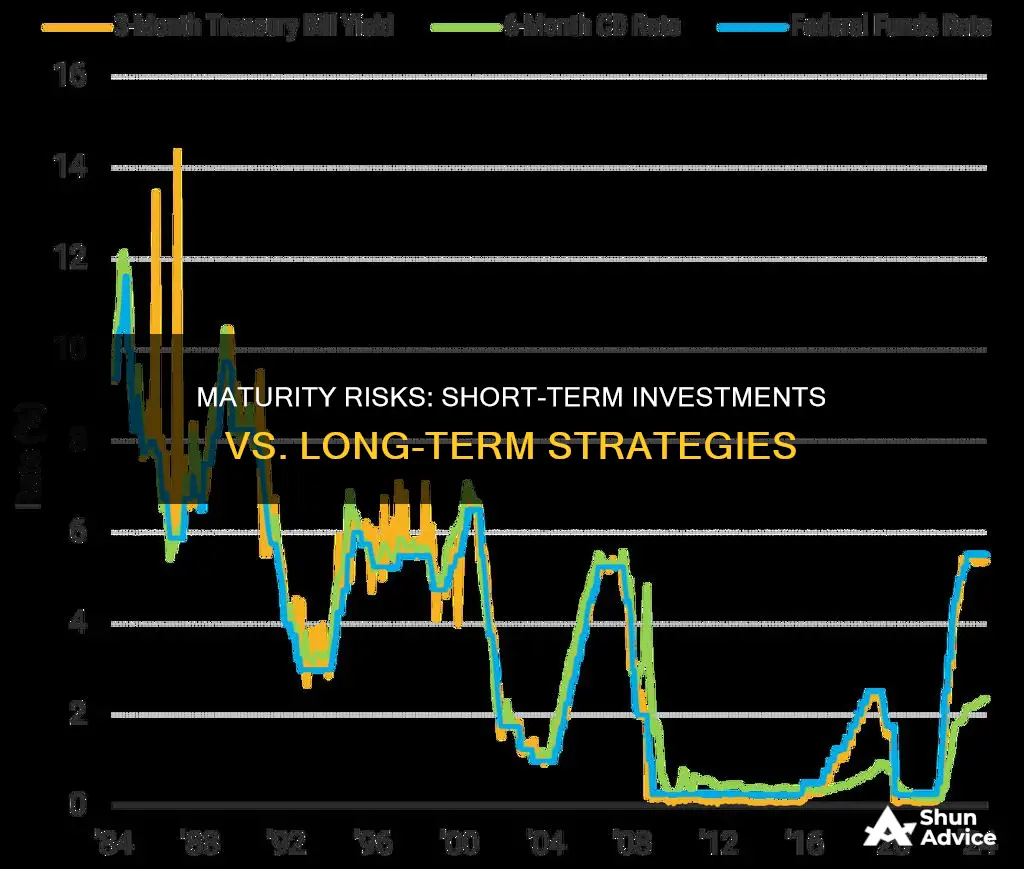

Interest Rate Sensitivity: Changes in interest rates can affect the value of short-term investments

Interest rate sensitivity is a critical aspect of short-term investments, as it highlights the potential impact of changes in interest rates on the value of these investments. Short-term investments, by their very nature, are typically those with a maturity period of less than one year. While they offer liquidity and relatively low risk compared to longer-term investments, they are not immune to the effects of interest rate fluctuations.

When interest rates rise, the value of short-term investments can be significantly affected. This is because short-term investments often have a fixed maturity date and a fixed interest rate. As interest rates increase, new investments will offer higher yields, making existing short-term investments less attractive. Consequently, investors may sell their short-term holdings to purchase newer, higher-yielding securities, causing the value of the original investments to decrease. This phenomenon is often referred to as 'duration risk' or 'interest rate risk'.

Conversely, when interest rates fall, short-term investments become more appealing. Lower interest rates mean that new investments will offer lower yields, and investors may be inclined to hold onto their existing short-term investments, especially if they have a fixed maturity date. In this scenario, the value of short-term investments can increase as investors seek to capitalize on the higher returns that these investments offer during a period of low interest rates.

The sensitivity of short-term investments to interest rate changes is an important consideration for investors. It is particularly relevant for those who rely on the stability and predictability of short-term investments, such as individuals seeking a safe haven for their savings or institutional investors with short-term financial goals. Understanding this sensitivity can help investors make more informed decisions, especially when managing a portfolio that includes a mix of short-term and longer-term investments.

In summary, short-term investments are not immune to the effects of interest rate changes. Rising interest rates can lead to a decrease in the value of these investments, while falling interest rates can have the opposite effect. This interest rate sensitivity is a key factor that investors should consider when evaluating the risks and potential returns of short-term investment options.

Debt Investments: Short-Term Impact on Balance Sheet

You may want to see also

Credit Risk: Default risk is higher for short-term investments, especially those with lower credit ratings

When considering the maturity risks associated with short-term investments, it is important to understand the concept of credit risk and its relationship with default risk. Credit risk refers to the possibility that a borrower or issuer will fail to meet their financial obligations, leading to potential losses for investors. In the context of short-term investments, this risk is particularly relevant as these investments often have a shorter time horizon and may be more susceptible to default.

One key factor that influences credit risk is the credit rating of the investment. Credit ratings are assigned by credit rating agencies to assess the creditworthiness of an entity or security. These ratings provide an indication of the likelihood of default. Short-term investments, especially those with lower credit ratings, are generally considered riskier. This is because lower-rated investments often have a higher probability of default, meaning there is a greater chance that the issuer will fail to repay the principal or interest as promised.

The default risk associated with short-term investments can be attributed to several factors. Firstly, short-term investments typically have a shorter duration, which means that any negative events or financial distress experienced by the issuer can have a more immediate impact. If an issuer defaults on a short-term obligation, investors may face a rapid loss of capital. Additionally, short-term investments often require more frequent payments, increasing the potential for liquidity issues if the issuer's financial situation deteriorates.

Furthermore, the credit quality of the investment plays a crucial role. Investments with lower credit ratings are often considered more speculative and may have weaker financial fundamentals. These factors can contribute to a higher default risk. Investors should carefully evaluate the creditworthiness of the issuer and consider the potential impact of credit rating downgrades or defaults on their investment portfolios.

In summary, short-term investments, particularly those with lower credit ratings, carry a higher default risk. This is due to the shorter time horizon, more frequent payments, and potential for immediate financial distress. Investors should be aware of these maturity risks and carefully assess the creditworthiness of short-term investments to make informed decisions and manage their portfolios effectively. Understanding credit risk and its relationship with maturity is essential for navigating the investment landscape and mitigating potential losses.

Unlocking the Long-Term Potential: Savings vs. Investments

You may want to see also

Economic Cycles: Short-term investments are more vulnerable to economic downturns and recessions

The relationship between economic cycles and short-term investments is a critical aspect of financial risk management. During economic downturns and recessions, the performance of short-term investments can be significantly impacted, making them more vulnerable to maturity risks. This is primarily due to the nature of short-term investments, which are typically defined as assets with a maturity period of less than one year.

In economic downturns, the overall market sentiment often becomes highly pessimistic, leading to a decrease in investor confidence. This shift in sentiment can cause a rapid outflow of capital from various investment vehicles, including short-term investments. As a result, these investments may experience a higher degree of price volatility and potential losses. For instance, during the 2008 financial crisis, many short-term money market funds faced significant redemptions, leading to a temporary drying up of liquidity and potential losses for investors.

The vulnerability of short-term investments during economic recessions is also tied to the underlying assets they hold. Short-term investments often include a mix of high-quality, short-term debt instruments, such as commercial paper, treasury bills, and money market funds. When the economy slows down, the creditworthiness of these underlying assets may be called into question, especially if the issuing entities are facing financial difficulties. This can lead to a higher risk of default or a decrease in the value of these assets, directly impacting the performance of short-term investments.

Furthermore, the short-term nature of these investments means that they are often more sensitive to changes in interest rates and market liquidity. During economic downturns, central banks may lower interest rates to stimulate the economy, which can negatively affect the value of short-term investments. As interest rates fall, the returns on these investments may also decline, reducing their attractiveness to investors. Additionally, reduced market liquidity during recessions can make it more challenging to buy or sell short-term investments quickly, potentially leading to losses if investors need to liquidate their positions.

In summary, short-term investments are indeed more susceptible to maturity risks during economic downturns and recessions. The combination of decreased investor confidence, potential losses due to underlying asset defaults, and sensitivity to interest rate changes and market liquidity can significantly impact the performance of these investments. Understanding these risks is crucial for investors to make informed decisions and manage their portfolios effectively during challenging economic periods.

Unveiling the Potential: Is Short-Term Investment an Asset?

You may want to see also

Frequently asked questions

Maturity risk refers to the possibility of losses due to changes in interest rates or market conditions before an investment reaches its maturity date. It is a concern for both short-term and long-term investments, but the impact can vary.

Short-term investments typically have lower maturity risks because they mature within a short period, often a few days to a few months. These investments are less sensitive to interest rate fluctuations and market volatility, making them relatively safer.

While short-term investments have lower maturity risks, they are not entirely immune to losses. Market conditions can still affect short-term investments, especially if there are sudden shifts in interest rates or economic events. However, the impact is usually less severe compared to long-term investments.

Common short-term investments include money market funds, certificates of deposit (CDs) with short-term durations, and treasury bills. These assets are designed to provide liquidity and relatively stable returns over a short period.

Yes, short-term investments can be an excellent choice for risk-averse investors as they offer a balance between safety and potential returns. Due to their shorter duration, they provide a more stable investment experience, making them less risky compared to long-term investments.