Debt investments, particularly those with short-term maturities, present a nuanced question for financial reporting. While short-term debt investments are generally not considered long-term assets and may not be included on a company's balance sheet, they can still have significant implications for a company's financial health and risk management. Understanding the classification and treatment of these investments is crucial for investors and financial analysts to assess a company's liquidity, financial stability, and overall investment strategy. This paragraph will explore the considerations and potential impacts of short-term debt investments on a company's financial statements.

What You'll Learn

- Debt Investment Duration: Short-term debt investments are typically classified as current assets, not long-term

- Balance Sheet Impact: Short-term debt investments do not significantly affect the balance sheet's long-term financial health

- Liquidity and Risk: Short-term investments offer liquidity but may carry higher risk due to market volatility

- Accounting Treatment: Short-term debt investments are reported at fair value, with changes reflected in the income statement

- Strategic Allocation: Short-term investments can be used for tactical asset allocation and risk management

Debt Investment Duration: Short-term debt investments are typically classified as current assets, not long-term

When it comes to accounting for debt investments, the duration of the investment plays a crucial role in determining its classification on a company's balance sheet. Short-term debt investments, by their very nature, are those that are expected to be converted into cash or liquidated within a relatively short period, typically one year or less. This short-term horizon is a key factor in how these investments are categorized and reported.

In financial accounting, short-term debt investments are generally classified as current assets. This classification is based on the principle of matching the timing of cash flows. Current assets are those that are expected to be converted into cash or used up within the next accounting period. Short-term debt investments fall into this category because they are highly liquid and can be readily converted into cash without significant risk or loss. For example, if a company purchases a short-term bond with a maturity of three months, it will be classified as a current asset until the bond reaches maturity and the principal is returned.

The classification of short-term debt investments as current assets is important for several reasons. Firstly, it provides a clear picture of a company's liquidity and ability to meet its short-term financial obligations. Investors and creditors often analyze the current ratio, which is the ratio of current assets to current liabilities, to assess a company's financial health. A higher proportion of short-term debt investments as current assets can indicate a more liquid balance sheet and a better capacity to cover short-term debts.

Secondly, the classification affects the presentation of financial statements. Current assets are reported on the balance sheet, providing a snapshot of the company's assets that are readily available for use or conversion to cash. This classification also influences the company's cash flow statement, as the investment's purchase and sale will be reflected in the operating activities section, showing the cash inflows and outflows related to these short-term investments.

In contrast, long-term debt investments, which are expected to mature or be sold after one year, are typically classified as non-current assets or investments. This distinction highlights the different time horizons and risk profiles associated with short-term and long-term investments. Understanding this classification is essential for investors and analysts to interpret financial statements accurately and make informed decisions regarding a company's financial health and investment strategies.

Unlocking Long-Term Wealth: ETFs as a Strategic Investment Strategy

You may want to see also

Balance Sheet Impact: Short-term debt investments do not significantly affect the balance sheet's long-term financial health

Short-term debt investments are a common financial strategy for many businesses and individuals, offering a way to manage cash flow and potentially generate returns. However, when it comes to their impact on a company's balance sheet, it's important to understand the nuances. Unlike long-term debt, short-term debt investments are typically classified as current assets on a balance sheet. This classification is crucial because it indicates that these investments are expected to be converted into cash or used up within one year or the operating cycle, whichever is longer.

The primary reason short-term debt investments don't significantly affect a company's long-term financial health is their liquidity. These investments are designed to be short-term, providing quick access to funds without long-term commitments. As a result, they are not considered long-term liabilities and do not impact the company's ability to meet its long-term financial obligations. This is in contrast to long-term debt, which is a long-term liability and can affect a company's financial stability over an extended period.

In terms of balance sheet management, short-term debt investments offer several advantages. They provide a means to diversify a portfolio, potentially generating higher returns compared to traditional savings accounts. Additionally, they can be used to take advantage of market opportunities or to bridge the gap between cash inflows and outflows. For individuals and businesses, these investments can be a strategic tool to optimize cash flow and potentially improve overall financial performance.

However, it's essential to approach short-term debt investments with caution. While they may not directly impact long-term financial health, they can still carry risks. Market volatility, credit risk, and liquidity risk are some of the potential challenges associated with these investments. Investors and businesses should carefully consider their risk tolerance and ensure that short-term investments align with their overall financial goals and strategies.

In summary, short-term debt investments are a flexible financial tool that can be used to manage cash flow and potentially generate returns. Their classification as current assets on the balance sheet highlights their short-term nature and limited impact on long-term financial health. By understanding the characteristics and risks associated with these investments, individuals and businesses can make informed decisions to optimize their financial positions.

Navigating Short-Term Acquisitions: Strategies for Success

You may want to see also

Liquidity and Risk: Short-term investments offer liquidity but may carry higher risk due to market volatility

Short-term investments, often referred to as liquid assets, are a crucial component of a company's financial strategy, offering both flexibility and potential risks. These investments typically include marketable securities such as treasury bills, certificates of deposit, and short-term bonds. The primary advantage of short-term investments is their liquidity, allowing companies to quickly convert these assets into cash with minimal impact on their market value. This liquidity is particularly valuable for businesses that require immediate access to funds to meet short-term obligations or take advantage of unexpected opportunities. For instance, a company might use short-term investments to bridge the gap between paying invoices and receiving payments from customers, ensuring smooth cash flow management.

However, the very nature of short-term investments also exposes them to higher risks, primarily due to market volatility. These investments are sensitive to changes in interest rates, credit ratings, and overall market conditions. For example, if a company invests in short-term bonds, a sudden increase in interest rates could lead to a decrease in the market value of these bonds, resulting in a loss for the investor. Similarly, a decline in the credit rating of a short-term debt instrument can significantly impact its value, potentially causing financial losses. Market volatility can also affect the timing of cash flows, as short-term investments may mature or be sold at a time when market conditions are unfavorable, leading to potential losses.

To manage these risks, investors and financial managers must employ various strategies. Diversification is a key approach, where short-term investments are spread across different asset classes, sectors, and geographic regions to reduce the impact of any single investment's performance. Regular monitoring and evaluation of the investment portfolio are essential to identify potential risks and adjust the strategy accordingly. Additionally, companies can use hedging techniques, such as forward contracts or options, to protect against adverse market movements. These tools allow investors to lock in favorable exchange rates or interest rates, mitigating the risk of loss due to market volatility.

Despite the risks, short-term investments play a vital role in a company's financial management. They provide a balance between liquidity and risk, allowing businesses to maintain a strong financial position while also taking advantage of potential market opportunities. By carefully selecting investments, employing risk management strategies, and staying informed about market trends, companies can optimize their short-term investment portfolios, ensuring they meet their financial goals without exposing themselves to unnecessary risks.

In summary, short-term investments offer a unique combination of liquidity and risk. While they provide the flexibility to manage cash flow and take advantage of market opportunities, they also expose investors to potential losses due to market volatility. A well-informed and strategic approach to short-term investments is essential for businesses to navigate this delicate balance and achieve their financial objectives.

Understanding Inventory's Financial Impact: Short-Term Investment or Long-Term Asset?

You may want to see also

Accounting Treatment: Short-term debt investments are reported at fair value, with changes reflected in the income statement

Short-term debt investments are a type of financial asset that companies often hold in their portfolios, and their accounting treatment is an important consideration for financial reporting. When a company invests in short-term debt, it typically involves purchasing securities with a maturity of less than one year, such as treasury bills, certificates of deposit, or short-term corporate bonds. These investments are considered highly liquid and are intended to be sold or converted into cash within a short period.

According to accounting standards, short-term debt investments are reported at fair value in the company's financial statements. Fair value is the price that would be received to sell the investment in an orderly transaction between market participants at the measurement date. This means that the investment is valued based on its current market value, which may fluctuate over time. The fair value measurement is crucial as it provides a realistic representation of the investment's value and helps in assessing the company's financial health.

The accounting treatment for these investments involves several key steps. Firstly, the company must identify the investment as a short-term debt instrument and classify it accordingly. This classification is essential for proper categorization and reporting. Secondly, the fair value of the investment is determined, which can be obtained from market quotes, independent price sources, or valuation techniques. The fair value measurement is then recorded in the company's balance sheet, typically under the current assets section.

Furthermore, any changes in the fair value of short-term debt investments are reflected in the income statement. This is in contrast to long-term investments, where changes in value are generally reported as other comprehensive income. The income statement treatment ensures that the company's financial performance is accurately represented, showing the gains or losses associated with these short-term investments. This approach provides transparency and helps stakeholders understand the impact of these investments on the company's profitability.

In summary, short-term debt investments are accounted for at fair value, with any fluctuations in value impacting the income statement. This treatment ensures that the company's financial statements provide a clear picture of its financial position and performance, allowing investors and other stakeholders to make informed decisions. Proper accounting for these investments is essential for maintaining financial reporting standards and providing accurate financial information.

Local Government Investment Pools: Long-Term Strategy or Short-Term Gain?

You may want to see also

Strategic Allocation: Short-term investments can be used for tactical asset allocation and risk management

Short-term debt investments play a crucial role in strategic asset allocation and risk management for investors and financial institutions. These investments are typically classified as highly liquid assets, meaning they can be quickly converted into cash without significant loss of value. This characteristic makes them an essential tool for financial institutions and investors to manage their portfolios and mitigate risks.

In the context of tactical asset allocation, short-term debt investments offer a flexible approach to portfolio management. Investors can utilize these investments to fine-tune their asset allocation strategies, especially during periods of market volatility or when specific market opportunities arise. For instance, during economic downturns or market corrections, short-term debt investments can provide a safe haven for investors, allowing them to maintain a portion of their portfolio in a liquid asset while waiting for market conditions to improve. This tactical allocation enables investors to take advantage of potential market rallies without committing to long-term investments that may be less favorable in the short term.

Risk management is another critical aspect where short-term debt investments excel. These investments are generally considered low-risk, providing a stable and secure option for investors. By allocating a portion of their portfolio to short-term debt, investors can diversify their risk exposure. This strategy is particularly useful for institutions that need to maintain a certain level of liquidity while also seeking a stable return on investment. Short-term debt investments can act as a buffer, ensuring that the institution can meet its short-term financial obligations while also generating a steady income stream.

Furthermore, short-term debt investments can be strategically used to adjust the overall risk profile of a portfolio. Investors can increase or decrease their exposure to risk by adjusting the allocation of short-term debt investments. For example, during periods of high market volatility, investors might reduce their allocation to short-term debt and shift towards more aggressive investments to take advantage of potential upside. Conversely, when market conditions are stable, investors may increase their short-term debt allocation to preserve capital and maintain liquidity.

In summary, short-term debt investments are a valuable asset for strategic allocation and risk management. Their liquidity, low risk, and flexibility make them an essential tool for investors and financial institutions to navigate market conditions and achieve their financial objectives. By incorporating short-term debt investments into their portfolios, investors can effectively manage their risk exposure, take advantage of market opportunities, and ensure a well-balanced and dynamic investment strategy.

Prepaid Expenses: Are They a Short-Term Investment?

You may want to see also

Frequently asked questions

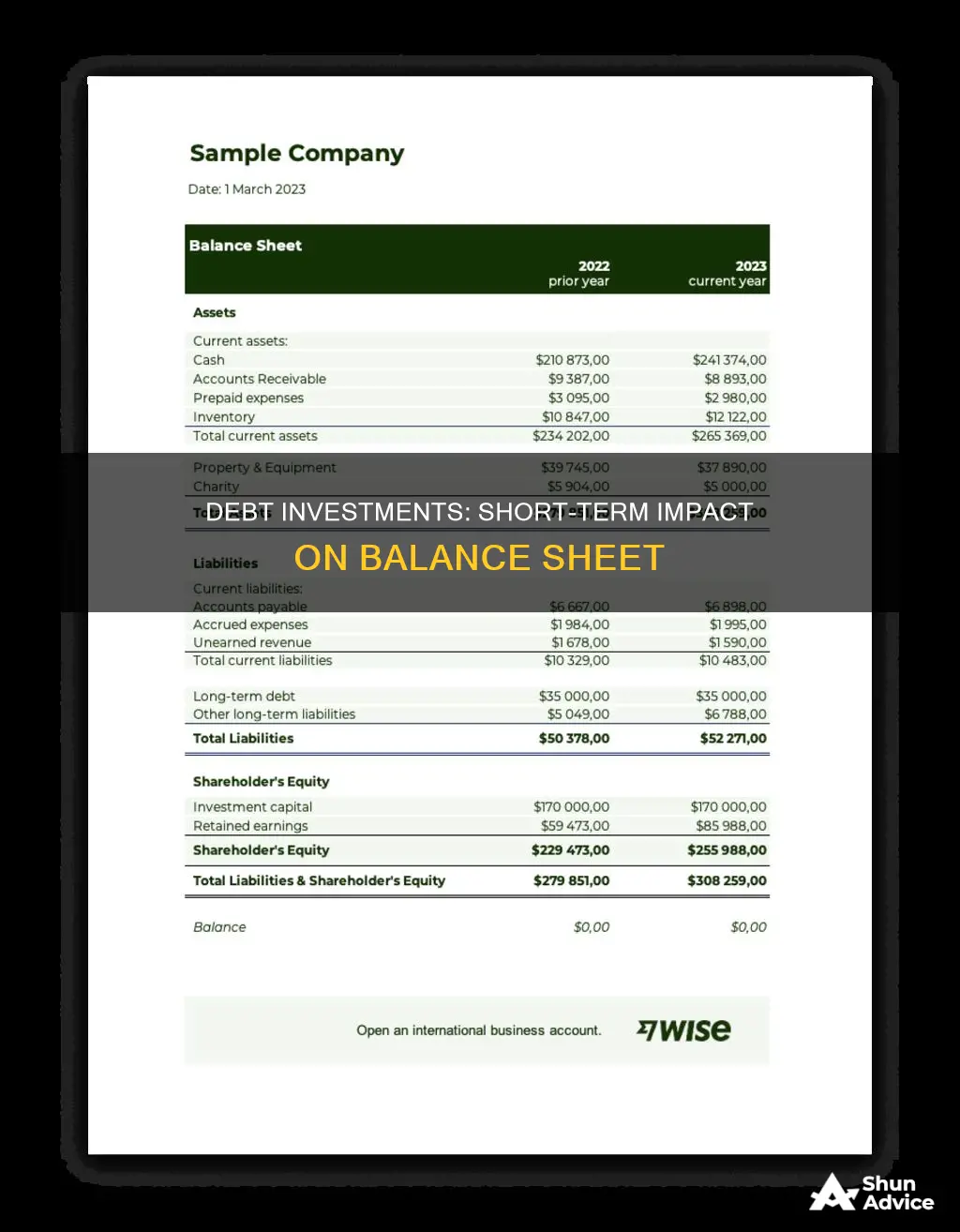

Short-term debt investments, also known as marketable securities, are financial assets that a company plans to convert into cash or sell within one year. These investments are typically recorded at fair value on the balance sheet. They are considered highly liquid assets, meaning they can be quickly converted into cash without a significant loss in value. When a company purchases these short-term investments, it increases its assets and, in turn, its shareholders' equity. However, it also increases the company's short-term liabilities, as these investments are often used to meet upcoming financial obligations.

These investments can impact a company's financial ratios, particularly liquidity ratios. For instance, the current ratio, which measures a company's ability to pay short-term debts, may be affected. A higher proportion of short-term debt investments can lead to an increase in the current ratio, making the company appear more financially stable. However, it's important to note that the quality and liquidity of these investments are crucial. If the investments are not easily convertible into cash, it may not accurately represent the company's liquidity position.

Short-term debt investments are primarily used for liquidity management and to meet short-term financial goals. They are not typically part of a company's long-term investment strategy. These investments are often used to generate a modest return while keeping capital accessible for immediate needs. Companies may use them to take advantage of market opportunities, manage cash flow, or provide a safe haven for excess funds. However, they are not considered long-term assets and are not usually included in long-term financial planning.

Accounting standards, such as Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), provide guidelines for reporting short-term debt investments. According to these standards, short-term investments are classified as current assets and are valued at fair value, with any unrealized gains or losses recognized in the income statement. This treatment ensures that the financial statements provide a clear picture of a company's financial position, including its short-term liquidity and investment activities.