The quick ratio, also known as the acid-test ratio, is a liquidity metric that measures a company's ability to meet its short-term obligations. It focuses on the most liquid assets, excluding inventory, to determine a company's financial health. When considering whether short-term investments are included in the quick ratio, it is important to understand the definition and purpose of this financial ratio. Short-term investments are typically considered in the broader category of current assets, but their inclusion in the quick ratio is limited to those assets that can be quickly converted into cash without significant loss of value. This paragraph will explore the criteria for including short-term investments in the quick ratio and the implications for assessing a company's liquidity.

What You'll Learn

- Definition of Quick Ratio: Measures liquidity by excluding illiquid assets

- Short-Term Investments: Includes marketable securities, like stocks and bonds

- Liquidity Analysis: Quick ratio assesses a company's ability to meet short-term obligations

- Asset Classification: Short-term investments are distinct from current assets

- Impact on Ratio: Inclusion affects the quick ratio's accuracy and interpretation

Definition of Quick Ratio: Measures liquidity by excluding illiquid assets

The quick ratio, also known as the acid-test ratio, is a liquidity metric that provides a more conservative view of a company's ability to meet its short-term financial obligations. It is a more stringent measure compared to the current ratio, as it focuses on the most liquid assets that can be quickly converted into cash. This ratio is particularly useful for assessing a company's financial health and its capacity to cover its immediate liabilities.

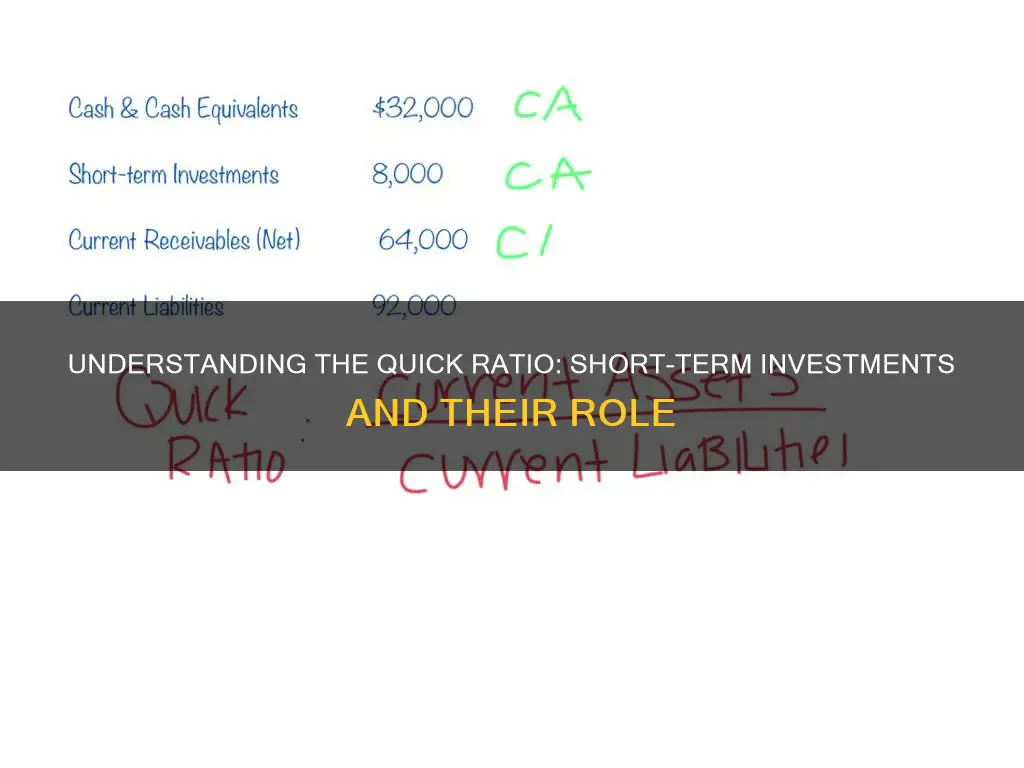

In the context of liquidity analysis, the quick ratio is calculated by dividing the sum of a company's cash, accounts receivable, and short-term investments by its current liabilities. The key aspect here is the exclusion of illiquid assets, such as inventory and long-term investments, which may not be easily convertible into cash in the short term. By doing so, the quick ratio provides a clearer picture of a company's ability to pay off its debts with the most liquid assets it possesses.

Short-term investments, which are often included in the current assets section of a company's balance sheet, can be considered for the quick ratio calculation. However, their inclusion or exclusion depends on the nature and liquidity of these investments. If short-term investments are highly liquid and can be readily converted into cash within a short period, they may be included in the quick ratio. For instance, marketable securities or highly liquid derivatives can be part of the quick assets.

On the other hand, if short-term investments are illiquid or have restrictions on their conversion to cash, they are typically excluded from the quick ratio. This is because the quick ratio aims to assess the company's ability to meet immediate financial obligations, and illiquid investments may not provide the necessary liquidity. For example, long-term bonds or equity investments with restrictions on sale may not be considered quick assets.

In summary, the quick ratio is a critical financial metric that evaluates a company's liquidity by focusing on the most liquid assets. Short-term investments can be included in the quick ratio if they are highly liquid, but their inclusion or exclusion depends on the specific characteristics of the investments. This ratio offers a more accurate representation of a company's short-term financial health by excluding illiquid assets, providing valuable insights for investors, creditors, and financial analysts.

Long-Term Investments vs. Long-Term Debt: Understanding the Difference

You may want to see also

Short-Term Investments: Includes marketable securities, like stocks and bonds

The quick ratio, also known as the acid-test ratio, is a liquidity metric that measures a company's ability to meet its short-term financial obligations. It is a more conservative measure compared to the current ratio, as it excludes inventory from the assets in the numerator. This ratio is particularly useful for assessing a company's ability to quickly convert its assets into cash to pay off its debts.

Short-term investments, such as marketable securities, play a crucial role in a company's financial health and are an essential component of the quick ratio calculation. These investments are highly liquid assets that can be quickly converted into cash with minimal impact on their market value. Marketable securities typically include stocks, bonds, and other financial instruments that can be bought and sold in the open market.

When calculating the quick ratio, short-term investments are included in the numerator, along with cash and cash equivalents, accounts receivable, and other highly liquid assets. This is because these investments can be readily sold or exchanged for cash without significant loss of value. For example, if a company holds a portfolio of stocks and bonds, these can be quickly sold to generate cash, making them valuable assets in the quick ratio calculation.

The inclusion of short-term investments in the quick ratio provides a more accurate representation of a company's liquidity and ability to meet its short-term obligations. It highlights the company's capacity to quickly access and utilize its liquid assets to cover debts. Investors and creditors often analyze this ratio to assess the financial stability and efficiency of a company's asset management.

In summary, short-term investments, particularly marketable securities, are an integral part of the quick ratio. They contribute to a company's liquidity by providing easily convertible assets that can be quickly transformed into cash. Understanding the role of these investments in the quick ratio is essential for evaluating a company's financial health and its ability to manage short-term financial commitments.

Understanding the Essentials of Long-Term Investment Strategies

You may want to see also

Liquidity Analysis: Quick ratio assesses a company's ability to meet short-term obligations

The quick ratio, also known as the acid-test ratio, is a liquidity ratio that provides a more conservative measure of a company's ability to meet its short-term financial obligations compared to the current ratio. This ratio is particularly useful for assessing a company's liquidity in the event of a sudden need to pay off its short-term liabilities. It is calculated by dividing a company's quick assets by its total current liabilities. Quick assets are those that can be quickly converted into cash, typically including cash and cash equivalents, accounts receivable, and short-term investments.

This financial metric is an important tool for investors and creditors as it provides insight into a company's financial health and its capacity to handle immediate financial demands. A higher quick ratio indicates that a company has more liquid assets readily available to cover its short-term debts, suggesting a stronger financial position. On the other hand, a low quick ratio may signal potential liquidity issues, as the company might struggle to meet its short-term obligations.

The inclusion of short-term investments in the quick ratio calculation is a critical aspect of this liquidity analysis. Short-term investments are assets that can be easily liquidated within a year or less. These investments are considered highly liquid and are often used to quickly generate cash if needed. By including these investments in the quick ratio, the assessment becomes more accurate, as it reflects the company's ability to access its most liquid resources to meet short-term liabilities.

However, it is essential to consider the nature of these short-term investments. If they are highly illiquid or have restrictions on their sale, they might not be as useful in a quick ratio calculation. For instance, if a company has significant investments in real estate or long-term bonds, these may not be considered quick assets and could distort the quick ratio. Therefore, a comprehensive understanding of a company's investment portfolio is necessary to interpret the quick ratio accurately.

In summary, the quick ratio is a valuable liquidity metric that helps assess a company's short-term financial health. By including short-term investments in the calculation, the ratio provides a more realistic view of a company's ability to meet its immediate obligations. Investors and analysts should carefully evaluate a company's investment strategy and the liquidity of its assets to make informed decisions regarding its financial stability.

Navigating Short-Term Acquisitions: Strategies for Success

You may want to see also

Asset Classification: Short-term investments are distinct from current assets

When discussing asset classification in financial reporting, it's essential to understand the distinction between short-term investments and current assets. Short-term investments are a specific category of assets that companies hold with the intention of selling or converting them into cash within a relatively short period, typically one year or less. These investments are a crucial component of a company's financial health and are often a key indicator of its liquidity and ability to meet short-term obligations.

In contrast, current assets encompass a broader range of assets that a company expects to convert into cash or use up within one year. This category includes not only short-term investments but also accounts receivable, inventory, and other liquid assets. Current assets are vital for assessing a company's day-to-day operations and its ability to cover short-term financial commitments.

The distinction between these two categories is significant for several reasons. Firstly, it provides a more accurate representation of a company's liquidity position. By separating short-term investments from current assets, financial analysts can better understand the company's ability to meet its immediate financial needs. Short-term investments, being highly liquid, can quickly be converted into cash, whereas other current assets may take longer to liquidate.

Secondly, this classification aids in financial decision-making. Investors and creditors often analyze the composition of a company's assets to gauge its financial stability and risk. By clearly identifying short-term investments, stakeholders can make informed decisions regarding the company's short-term financial strategies and risk exposure.

Furthermore, this distinction is crucial for compliance with accounting standards and regulations. Financial reporting standards, such as those set by the International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP), require companies to provide detailed information about their assets to ensure transparency and accuracy in financial statements. Proper classification of short-term investments ensures that financial statements reflect the company's financial position accurately.

In summary, understanding the difference between short-term investments and current assets is essential for effective asset classification and financial reporting. It allows for a more nuanced analysis of a company's liquidity, aids in financial decision-making, and ensures compliance with accounting standards. By recognizing the unique nature of short-term investments, financial professionals can provide valuable insights into a company's short-term financial health and strategies.

Rights as Long-Term Assets: A Wise Investment Strategy

You may want to see also

Impact on Ratio: Inclusion affects the quick ratio's accuracy and interpretation

The quick ratio, also known as the acid-test ratio, is a liquidity metric that measures a company's ability to meet its short-term financial obligations. It is calculated by dividing a company's current assets (excluding inventory) by its current liabilities. The inclusion of short-term investments in the quick ratio calculation can significantly impact its accuracy and interpretation.

When short-term investments are included in the quick ratio, it can potentially overstate a company's liquidity. These investments are typically considered highly liquid assets, meaning they can be quickly converted into cash without significant loss of value. By including them in the numerator, the quick ratio may appear higher than it would be without these investments. This could lead to an overly optimistic view of the company's financial health, especially if the investments are not easily convertible or are subject to market volatility.

On the other hand, excluding short-term investments from the quick ratio calculation can provide a more conservative and realistic assessment of a company's liquidity. This approach focuses on the most liquid assets that can be readily used to cover short-term debts. By doing so, the ratio becomes a more accurate representation of a company's ability to meet its immediate financial obligations.

The impact of including or excluding short-term investments becomes even more critical when comparing the quick ratios of different companies. If one company includes short-term investments in its quick ratio calculation, while another does not, the comparison may not be meaningful. It could lead to misinterpretation and potentially misleading conclusions about the financial positions of these companies.

In summary, the inclusion of short-term investments in the quick ratio can affect its accuracy and interpretation. It may provide an overly optimistic view of liquidity, especially if the investments are not highly liquid. Excluding these investments offers a more conservative perspective, focusing on the most liquid assets. Understanding the implications of these inclusions is essential for investors and analysts to make informed decisions and interpretations when assessing a company's financial health and liquidity.

Understanding the Role of Short-Term Investments in the Current Ratio

You may want to see also

Frequently asked questions

The quick ratio, also known as the acid-test ratio, is a liquidity metric that measures a company's ability to meet its short-term financial obligations. It is calculated by dividing a company's current assets (excluding inventory) by its current liabilities. The quick ratio provides a more conservative view of a company's liquidity compared to the current ratio, as it excludes inventory, which may not be easily convertible to cash in the short term.

No, short-term investments are not included in the quick ratio. The quick ratio focuses on the most liquid assets that can be quickly converted to cash to cover short-term debts. Short-term investments, such as marketable securities, are considered more illiquid and may not be readily available for immediate use, hence they are excluded from this ratio.

The quick ratio is a more stringent measure of liquidity compared to the current ratio. The current ratio includes inventory in the calculation, which may not be as liquid as other current assets. By excluding inventory, the quick ratio provides a clearer picture of a company's ability to pay off its short-term debts with the most liquid assets. This ratio is important as it helps assess a company's financial health and its capacity to manage short-term financial obligations without relying on less liquid assets.