Dividends are a crucial aspect of long-term investment strategies, offering investors a steady stream of income and a potential source of wealth accumulation. While dividends are often associated with short-term gains, they can also be a powerful tool for long-term investors. This paragraph will explore the relationship between dividends and long-term investment, examining how dividends can contribute to wealth building and financial security over time.

What You'll Learn

- Dividend Growth: Long-term investors track consistent dividend increases over time

- Dividend Reinvestment: Compounding effect of reinvesting dividends for future growth

- Dividend Yield: High yield can attract investors, but long-term sustainability is key

- Dividend Payout Ratio: A measure of a company's ability to consistently pay dividends

- Dividend Strategy: Companies may adopt different strategies, impacting long-term dividend payments

Dividend Growth: Long-term investors track consistent dividend increases over time

Dividend growth is a key indicator for long-term investors who seek stable and consistent returns. When a company consistently increases its dividend payments over time, it signals financial health and a commitment to rewarding shareholders. This is especially important in the context of long-term investing, where the goal is to build wealth through a steady accumulation of income.

Long-term investors often focus on companies that have a history of dividend growth, as this demonstrates the company's ability to generate consistent profits and maintain a strong balance sheet. By investing in these companies, investors can benefit from the power of compounding, where the reinvestment of dividends leads to exponential growth over the years. This strategy is particularly attractive to those seeking a passive income stream, as the dividends provide a regular cash flow that can be used to fund retirement or other financial goals.

The concept of dividend growth is closely tied to the idea of a company's competitive advantage and its ability to sustain long-term profitability. Investors often analyze a company's dividend payout ratio, which compares the amount of dividends paid to its earnings. A healthy payout ratio indicates that the company is not only capable of paying dividends but also has the financial flexibility to reinvest in its business for future growth. This is a crucial aspect of long-term investing, as it ensures that the company can maintain its dividend payments even during economic downturns or industry-specific challenges.

Tracking dividend growth is a meticulous process that requires research and analysis. Investors should examine a company's dividend history, including the frequency and magnitude of increases. Consistently rising dividends over multiple years showcase a company's resilience and its commitment to shareholder value. Additionally, investors can study the company's financial statements to understand the drivers of its profitability and the sustainability of its dividend policy.

In summary, long-term investors who focus on dividend growth are seeking companies that demonstrate financial stability and a commitment to rewarding shareholders. By tracking consistent dividend increases, investors can build a robust portfolio that generates steady income and grows over time. This strategy aligns with the principles of long-term investing, emphasizing patience, discipline, and the power of compounding returns.

Understanding Long-Term Investment Strategies: Key Factors to Consider

You may want to see also

Dividend Reinvestment: Compounding effect of reinvesting dividends for future growth

Dividend reinvestment is a powerful strategy that can significantly impact long-term investment growth. When investors choose to reinvest their dividends, they are essentially putting their returns back into the same investment, allowing for a compounding effect over time. This approach is particularly beneficial for those seeking to build wealth steadily and consistently.

The concept is simple: instead of taking the cash dividends received from a stock and using it for other purposes, investors decide to purchase additional shares of the same stock. By doing so, they increase their ownership in the company without having to pay for the new shares upfront. This strategy is often associated with long-term investing as it encourages investors to hold their positions for extended periods, benefiting from the company's growth and performance.

Over time, the reinvestment of dividends can lead to substantial growth. As the investor continues to receive dividends and reinvests them, the total number of shares held increases. This accumulation of shares can result in a larger proportion of the company's ownership, potentially increasing the overall value of the investment. The beauty of this strategy lies in its ability to harness the power of compounding, where the reinvested dividends generate their own dividends, and this process repeats, leading to exponential growth.

For example, consider an investor who purchases shares of a company that pays a consistent dividend. They decide to reinvest these dividends by buying additional shares. As the company's stock price fluctuates, the investor's holdings may increase or decrease in value. However, the reinvestment strategy ensures that the investor consistently buys more shares during market downturns, potentially lowering the average cost per share. Over time, this can lead to a substantial increase in the total number of shares held, even if the individual investments are not consistently rising.

This approach is particularly attractive to long-term investors as it aligns with the idea of letting compound interest work in their favor. By reinvesting dividends, investors can benefit from the power of compounding, where their initial investment, along with the reinvested dividends, generates returns, and this process repeats over time. This strategy is often associated with successful long-term wealth-building, as it allows investors to grow their money through a combination of dividend income and capital appreciation.

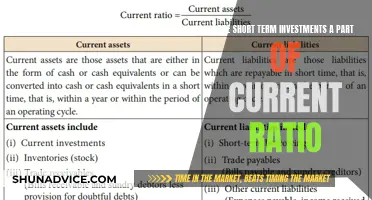

Understanding Short-Term Investments: Are They Current Assets?

You may want to see also

Dividend Yield: High yield can attract investors, but long-term sustainability is key

Dividend yield is a crucial metric for investors, especially those seeking a steady income stream from their investments. It represents the annual dividend payment per share relative to the stock's price, calculated as a percentage. A high dividend yield can be an attractive feature for investors, especially in a low-interest-rate environment where fixed-income investments may offer limited returns. When a stock pays out a substantial portion of its earnings as dividends, it can provide a consistent and reliable source of income for shareholders. This is particularly appealing to income-seeking investors who prioritize regular cash flow over capital appreciation.

However, while high dividend yields can be enticing, investors should also consider the long-term sustainability of these payments. Dividend payments are often a reflection of a company's profitability and financial health. Consistently high dividend yields may indicate that a company is distributing a significant portion of its earnings, which could impact its ability to reinvest in growth opportunities or maintain financial stability in the long run. Investors should assess the historical dividend payment trends and the company's overall financial performance to ensure that the high yield is not a one-time occurrence or a sign of potential financial distress.

Long-term sustainability is a critical factor in evaluating the quality of dividend investments. Investors should look for companies with a strong track record of consistent dividend payments, especially those that have increased their dividends over multiple years. This demonstrates a commitment to shareholder value and a robust financial position. Additionally, understanding the business model and industry dynamics is essential. Some sectors naturally have higher dividend yields due to their business nature, and this should be considered when analyzing individual stocks.

A comprehensive approach to dividend investing involves diversifying across different sectors and industries to manage risk. While high dividend yields can be attractive, they should not be the sole criterion for investment decisions. Investors should also consider the overall financial health, growth prospects, and competitive advantage of the companies they invest in. A well-rounded investment strategy may include a mix of dividend-paying stocks, bonds, and other asset classes to create a balanced portfolio that aligns with an investor's financial goals and risk tolerance.

In summary, dividend yield is a valuable metric for investors, offering a glimpse into a company's profitability and its potential to provide a steady income stream. Yet, investors must exercise caution and conduct thorough research to ensure that high yields are sustainable and aligned with the company's long-term financial health. A prudent investment approach involves a combination of dividend-focused strategies, diversification, and a comprehensive assessment of the overall investment landscape.

The Long-Term Value of Real Estate: A Smart Investment Strategy

You may want to see also

Dividend Payout Ratio: A measure of a company's ability to consistently pay dividends

The Dividend Payout Ratio is a financial metric that provides valuable insights into a company's dividend policy and its ability to maintain consistent dividend payments. This ratio is calculated by dividing a company's total dividends paid out during a specific period by its net income or earnings. The resulting value represents the proportion of earnings that a company allocates towards dividend distribution.

A high Dividend Payout Ratio indicates that a significant portion of the company's earnings is being paid out as dividends, which can be an attractive feature for income-seeking investors. However, it also suggests that the company might be less focused on reinvesting its profits into growth and expansion. On the other hand, a low payout ratio implies that the company retains a larger portion of its earnings, potentially reinvesting them to fuel future growth, which is often favored by long-term investors seeking capital appreciation.

Analyzing the Dividend Payout Ratio over multiple periods can provide a clearer picture of a company's dividend consistency and stability. Investors often prefer companies with a consistent track record of dividend payments, as it demonstrates financial health and a commitment to shareholder returns. A stable payout ratio can indicate a mature company with a strong cash flow position, capable of sustaining dividend payments even during economic downturns.

It's important to consider the industry norms and competitors' strategies when interpreting the Dividend Payout Ratio. Different industries have varying expectations regarding dividend payments. For instance, utility companies often have higher payout ratios due to their stable cash flows and regulated environments. In contrast, technology startups might prioritize reinvesting profits into research and development, resulting in lower payout ratios.

In summary, the Dividend Payout Ratio is a crucial metric for assessing a company's dividend policy and its financial health. It provides investors with insights into the company's ability to consistently pay dividends and its overall approach to profit distribution. By analyzing this ratio, investors can make informed decisions regarding their long-term investment strategies, balancing the desire for income with the potential for capital growth.

Notes Receivable: Short-Term Investment or Long-Term Liability?

You may want to see also

Dividend Strategy: Companies may adopt different strategies, impacting long-term dividend payments

Dividend strategy is a crucial aspect of a company's financial policy, especially for those seeking to maximize long-term value for shareholders. When considering whether dividends are a long-term investment, it's essential to understand the various strategies companies employ and how these impact their dividend payments over time.

One common strategy is the stable dividend policy, where companies aim to maintain a consistent dividend payout ratio. This approach provides investors with a steady income stream, making dividends an attractive long-term investment. By consistently paying out a portion of their earnings as dividends, these companies signal their financial strength and commitment to returning value to shareholders. For instance, companies like Coca-Cola and Johnson & Johnson have a long history of stable dividends, often increasing them annually, which has attracted investors seeking reliable, long-term returns.

In contrast, some companies may adopt a more aggressive dividend policy, focusing on rapid growth and expansion. These firms might reinvest a significant portion of their profits back into the business, leading to higher earnings growth but potentially lower immediate dividend payouts. This strategy is often seen in industries with high growth potential, where companies prioritize scaling operations and market share. For example, tech startups or emerging market companies might choose to retain earnings to fuel their expansion, which could result in a lower initial dividend yield but higher potential for long-term capital appreciation.

Another strategy is the cyclical dividend policy, where dividend payments fluctuate based on the company's performance and industry conditions. This approach is common in sectors that experience seasonal variations or cyclical trends. During prosperous times, these companies may increase dividends, providing a boost to shareholders. Conversely, they might reduce or suspend dividends during economic downturns or when facing financial challenges. This strategy allows companies to maintain flexibility, ensuring they can weather short-term storms while still rewarding investors in the long run.

Furthermore, some companies may opt for a combination of dividend payments and share buybacks. This hybrid strategy involves paying dividends while also repurchasing shares, which can enhance shareholder value. By returning cash to shareholders through dividends and buying back shares, companies can effectively increase the overall return on investment. This approach is particularly appealing to investors who value both income generation and capital preservation.

In summary, dividend strategy plays a pivotal role in determining the long-term viability of dividends as an investment. Companies' decisions regarding dividend policies can significantly impact the stability and growth of shareholder value. Understanding these strategies is essential for investors to make informed decisions, especially when considering the long-term prospects of dividend-paying stocks.

Understanding the Essentials of Long-Term Investment Strategies

You may want to see also

Frequently asked questions

Dividends can be a significant component of a long-term investment approach. They represent a portion of a company's profits distributed to shareholders, typically on a quarterly or annual basis. Investing in dividend-paying stocks can provide a steady income stream, which can be reinvested to grow your wealth over time. This strategy is often favored by long-term investors as it offers a more consistent return compared to capital gains, which can be more volatile.

Dividends play a crucial role in long-term wealth accumulation. When you invest in dividend-paying stocks, you receive regular payments, which can be used to reinvest in the same or other companies. Over time, these reinvested dividends can compound, leading to significant growth. Additionally, dividends provide a safety net during market downturns as they are often less affected by short-term price fluctuations, making it a more stable investment option.

Yes, dividends can be a powerful tool for long-term growth. Many successful investors, including Warren Buffett, have emphasized the importance of dividend investing. By consistently reinvesting dividends, investors can benefit from the power of compounding, where earnings generate earnings. This strategy allows investors to build a substantial portfolio over time, even with relatively small initial investments.

While dividends offer stability, there are some risks to consider. Dividend payments can be cut or reduced if a company faces financial difficulties, which may impact the long-term returns. Additionally, the performance of individual stocks can vary, and not all dividend-paying companies will provide consistent returns. Diversification is key to managing risk, so investors should consider a portfolio of various dividend-paying stocks across different sectors.

Dividend investing offers a unique advantage in the long term. Compared to growth-oriented investments, dividends provide a more predictable and consistent return. This is especially beneficial for risk-averse investors who prefer a steady income stream. However, it's important to note that dividends may not always outperform other investment strategies, and market conditions can influence their performance. A well-diversified portfolio that includes a mix of dividend-paying and non-dividend-paying stocks is often recommended for long-term financial goals.