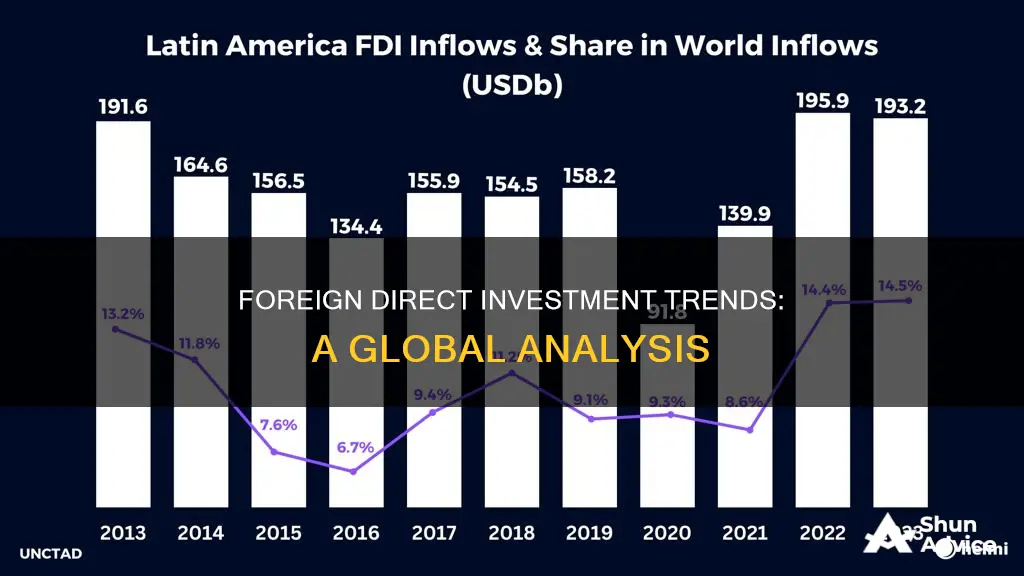

Foreign direct investment (FDI) plays a crucial role in the global economy, and understanding its trends is essential for policymakers and businesses alike. In recent years, the impact of FDI on various countries and regions has been a subject of intense interest and debate. This paragraph aims to explore the question of whether foreign direct investments have increased or decreased in a specific context, shedding light on the factors driving these changes and their implications for economic development and international trade. By examining the latest data and trends, we can gain valuable insights into the dynamics of FDI and its potential effects on different sectors and industries.

What You'll Learn

- Impact on Employment: Foreign direct investments can boost local employment, creating jobs in host countries

- Infrastructure Development: FDI often leads to improved infrastructure, enhancing transportation and communication networks

- Technology Transfer: Multinational corporations bring advanced technology, benefiting host countries' industries and innovation

- Economic Growth: Increased FDI can stimulate economic growth, raising GDP and improving living standards

- Environmental Concerns: Some FDI projects may have negative environmental impacts, requiring careful regulation and sustainability measures

Impact on Employment: Foreign direct investments can boost local employment, creating jobs in host countries

Foreign direct investment (FDI) has a significant and positive impact on employment in host countries, which is a crucial aspect to consider when evaluating its overall effects. When a foreign company invests in a local business or sets up a new operation in a country, it often leads to a surge in job creation. This is because FDI projects typically require a diverse range of skills and labor, from specialized technical roles to general labor and administrative staff. As a result, the host country's local population benefits from increased job opportunities, which can help reduce unemployment rates and improve the overall standard of living.

The employment boost from FDI is not limited to the direct employees of the foreign-owned company. Local suppliers and service providers also benefit as the foreign investor's operations expand. For instance, a foreign manufacturing company setting up a plant in a host country will require various supporting services, such as transportation, catering, and cleaning, which creates additional job openings for the local community. This multiplier effect can significantly contribute to the economic growth and development of the host nation.

Moreover, FDI often leads to skill transfer and capacity building within the host country's workforce. Foreign investors bring with them specialized knowledge and expertise, which they share with local employees during the training and development processes. This knowledge transfer can enhance the skills of the local workforce, making them more employable and adaptable to the changing demands of the job market. As a result, the host country's economy becomes more resilient and better equipped to support further investment and growth.

The positive impact of FDI on employment is particularly notable in sectors where the host country has a comparative advantage, such as agriculture, manufacturing, or tourism. In these industries, foreign investors can tap into the local expertise and resources, creating jobs that might not have existed otherwise. This can lead to a more diverse and robust economy, reducing the host country's reliance on a single industry and providing a more stable foundation for long-term economic development.

In summary, foreign direct investment has a proven track record of creating and expanding job opportunities in host countries. It stimulates economic growth, fosters skill development, and contributes to the overall prosperity of the local community. As such, policymakers and investors should recognize and encourage FDI as a powerful tool for promoting employment and sustainable development in both developed and developing nations.

Cashing Out Stash Investments: A Step-by-Step Guide

You may want to see also

Infrastructure Development: FDI often leads to improved infrastructure, enhancing transportation and communication networks

Foreign Direct Investment (FDI) plays a crucial role in the development of infrastructure, particularly in enhancing transportation and communication networks. When foreign investors enter a country, they often bring with them capital, expertise, and advanced technologies, which can significantly contribute to the improvement of these essential sectors.

In many developing nations, FDI has been instrumental in transforming the transportation landscape. For instance, multinational companies may invest in building and upgrading roads, railways, and ports, connecting previously isolated areas to major trade routes. These investments can lead to more efficient transportation systems, reducing travel times and costs, and improving the overall logistics infrastructure. This, in turn, facilitates the movement of goods and people, boosts local economies, and attracts further investment.

The impact of FDI on communication networks is equally significant. Foreign investors often bring state-of-the-art communication technologies and infrastructure, leading to improved internet connectivity, mobile networks, and digital services. This is especially beneficial for countries aiming to bridge the digital divide and provide high-speed internet access to remote areas. Enhanced communication networks enable better access to information, education, and healthcare, and also support the growth of e-commerce and digital businesses.

Moreover, FDI in infrastructure development can create a positive cycle of growth. Improved transportation and communication networks attract more FDI, as investors seek efficient logistics and reliable connectivity. This can lead to a self-reinforcing process where increased investment in infrastructure further enhances the country's attractiveness for foreign capital. As a result, the country's infrastructure becomes more resilient, efficient, and capable of supporting economic growth.

In summary, FDI has a substantial positive impact on infrastructure development, particularly in the areas of transportation and communication. It brings much-needed capital, advanced technologies, and expertise, leading to improved connectivity, efficiency, and accessibility. The benefits of FDI in this sector are far-reaching, contributing to economic growth, job creation, and the overall development of the host country.

Maximizing Your Cash Inheritance: Smart Investment Strategies

You may want to see also

Technology Transfer: Multinational corporations bring advanced technology, benefiting host countries' industries and innovation

Foreign direct investment (FDI) has been a significant driver of economic growth and development, particularly in the context of technology transfer. When multinational corporations (MNCs) invest in host countries, they bring with them advanced technology, expertise, and resources that can have a transformative impact on the local economy. This technology transfer is a crucial aspect of FDI, as it enables the transfer of knowledge, skills, and best practices from the MNCs to the host country's industries, fostering innovation and productivity.

One of the primary benefits of technology transfer through FDI is the enhancement of the host country's industrial capabilities. MNCs often introduce cutting-edge technologies and processes that are not readily available in the local market. For example, a multinational manufacturing company might set up a production facility in a developing country, bringing state-of-the-art machinery and production techniques. This transfer of technology can lead to improved product quality, increased efficiency, and the development of new industries that were previously non-existent. Over time, this can result in a more diversified and resilient economy, reducing the host country's reliance on traditional industries.

The impact of technology transfer is not limited to the immediate beneficiaries, such as the host country's industries. It can also have a ripple effect throughout the economy. As local industries adopt new technologies and improve their productivity, they may become more competitive in the global market. This increased competitiveness can lead to the expansion of export-oriented industries, generating foreign exchange and creating additional job opportunities. Moreover, the improved standards of living and economic growth can stimulate further investment, creating a positive feedback loop that attracts more FDI.

Innovation is another critical aspect of technology transfer. MNCs often bring with them a culture of innovation and research and development (R&D) that can inspire and influence local companies. Through joint ventures, technology licensing, or knowledge-sharing programs, MNCs can facilitate the transfer of innovative ideas and practices to local businesses. This can lead to the development of new products, services, and business models, fostering a more dynamic and entrepreneurial environment. As a result, the host country's innovation ecosystem may become more vibrant, attracting further investment and fostering long-term economic growth.

In summary, foreign direct investment, particularly when facilitated by technology transfer, can have a profound and positive impact on host countries. It empowers local industries with advanced technology, enhances productivity, and fosters innovation. The benefits extend beyond the immediate economic gains, contributing to a more sustainable and resilient development trajectory. As MNCs continue to play a significant role in the global economy, ensuring that technology transfer is accompanied by responsible business practices and local capacity building will be essential for maximizing the positive effects of FDI.

Graham Number: A Guide to Value Investing Strategies

You may want to see also

Economic Growth: Increased FDI can stimulate economic growth, raising GDP and improving living standards

Foreign Direct Investment (FDI) plays a crucial role in fostering economic growth and development, particularly in emerging markets and developing countries. When FDI flows into a country, it brings with it a multitude of benefits that can significantly impact the nation's economy. One of the most notable effects is the potential to stimulate economic growth and raise the country's Gross Domestic Product (GDP).

Increased FDI often leads to a boost in economic activity as it injects capital into the host country's economy. This capital can be utilized for various purposes, such as building new infrastructure, expanding existing industries, or starting new businesses. As a result, the host country's production capacity increases, leading to higher output and, consequently, a rise in GDP. This is especially beneficial for developing nations, as it can help accelerate their economic transformation and reduce income disparities.

The positive impact of FDI on economic growth is not limited to the immediate effects on GDP. It can also contribute to long-term economic development. FDI often brings advanced technologies, management practices, and expertise to the host country. This transfer of knowledge and skills can enhance the productivity of local industries, making them more competitive in the global market. Over time, this can lead to a more diversified and resilient economy, capable of sustaining growth even during global economic downturns.

Moreover, the economic benefits of FDI extend beyond the direct investments made by foreign entities. It can create a ripple effect, generating additional investment and business opportunities. Local businesses may benefit from new partnerships, joint ventures, or subcontracting arrangements with foreign investors, leading to job creation and income generation. This, in turn, can increase the overall demand for goods and services, further stimulating economic growth and improving the standard of living for the local population.

In summary, increased FDI has the potential to be a powerful catalyst for economic growth. It can raise GDP, improve the standard of living, and contribute to the long-term development of a country. By attracting foreign capital and expertise, nations can unlock new avenues for growth, enhance productivity, and create a more sustainable and prosperous economy. Understanding the positive impact of FDI is essential for policymakers and investors alike, as it highlights the importance of fostering an environment conducive to attracting and utilizing foreign direct investment effectively.

Foreign Reserves vs. Foreign Investments: Understanding the Key Differences

You may want to see also

Environmental Concerns: Some FDI projects may have negative environmental impacts, requiring careful regulation and sustainability measures

Foreign Direct Investment (FDI) has the potential to significantly influence environmental sustainability, both positively and negatively. While FDI can contribute to economic growth and development, it is essential to acknowledge and address the environmental concerns associated with certain investment projects. Some FDI initiatives may inadvertently lead to environmental degradation, highlighting the need for robust regulation and sustainable practices.

One of the primary environmental concerns is the potential for FDI projects to result in deforestation, habitat destruction, and biodiversity loss. Large-scale industrial activities, such as mining, oil exploration, or agricultural expansion, can have devastating effects on ecosystems. These projects often require extensive land acquisition, leading to the displacement of local communities and the disruption of natural habitats. For instance, the construction of dams for hydroelectric power generation can alter river ecosystems, affecting aquatic life and downstream communities that rely on these water sources.

Furthermore, the manufacturing and processing industries attracted by FDI might release pollutants into the air, water, and soil. Industrial activities can contribute to air pollution, with emissions of greenhouse gases and particulate matter, exacerbating climate change and public health issues. Similarly, improper waste management and the discharge of toxic substances into water bodies can have long-lasting environmental consequences. These environmental impacts can lead to the degradation of local ecosystems, affecting not only wildlife but also the livelihoods of nearby populations.

To mitigate these risks, governments and international organizations must implement stringent environmental regulations and impact assessments. Before approving any FDI project, thorough environmental impact assessments should be conducted to identify potential hazards and devise mitigation strategies. This includes evaluating the project's carbon footprint, water usage, waste management practices, and its overall impact on local biodiversity. By setting strict environmental standards and requiring investors to adhere to sustainable practices, governments can ensure that FDI contributes positively to the host country's economy while minimizing ecological harm.

Additionally, promoting sustainable development and green technologies can help attract environmentally conscious investors. Encouraging FDI in renewable energy, eco-friendly agriculture, and sustainable infrastructure projects can drive economic growth while preserving natural resources. Governments can offer incentives and create policies that foster environmental stewardship, ensuring that FDI becomes a catalyst for positive environmental change. In summary, while FDI can bring economic benefits, it is crucial to carefully regulate and manage its environmental implications to ensure a sustainable future for both the host country and the global community.

Pension Investments: Where Your Money Goes

You may want to see also

Frequently asked questions

Despite the economic downturn, FDI in the technology sector remained relatively stable, with some countries even experiencing an increase. For instance, the United States attracted significant FDI in technology, particularly in areas like renewable energy and healthcare, as investors sought opportunities in sectors with long-term growth potential.

Over the past decade, FDI in developing countries has generally increased, with a particular surge in the post-2015 period. This growth is attributed to various factors, including improved political stability, favorable investment policies, and the rise of emerging markets as attractive destinations for global investors. Many developing nations have also focused on diversifying their economies, making them more appealing for foreign investors.

The trade tensions and disputes between countries, such as the US-China trade war, have had a complex effect on FDI. In some cases, they led to a temporary decrease in FDI as investors became more cautious and re-evaluated their investment strategies. However, in other instances, these tensions prompted investors to seek opportunities in regions with less political risk, potentially increasing FDI in certain countries or sectors.

Yes, certain industries have consistently attracted higher levels of FDI. These include renewable energy, healthcare, and infrastructure. The renewable energy sector, in particular, has seen a significant surge in FDI due to global efforts to combat climate change and the increasing demand for sustainable energy sources. Healthcare, with its aging populations and rising healthcare costs, also attracts substantial FDI, while infrastructure development projects, especially in emerging markets, continue to draw foreign investors.