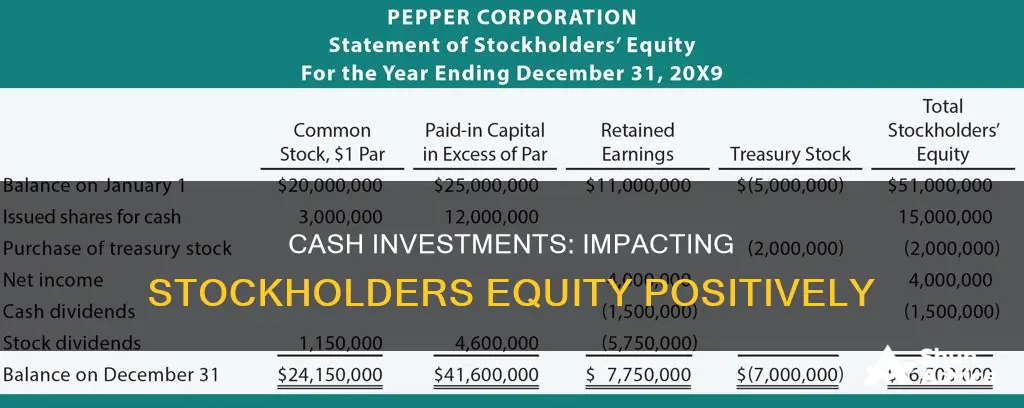

Stockholders' equity, also known as shareholders' equity, is the net worth of a company, calculated by subtracting its total liabilities from its total assets. This figure is used by analysts and investors to assess a company's financial health. When a shareholder invests cash in a corporation, the investment increases the amount of cash shown under the Cash asset on the balance sheet, thereby increasing the shareholders' equity. However, when a company pays cash dividends to its shareholders, its stockholders' equity is decreased by the total value of all dividends paid.

| Characteristics | Values |

|---|---|

| Shareholder's equity | Refers to the corporation's net worth |

| Represents the funding the corporation has received from the sale of common or preferred stock | |

| Includes retained earnings, which are the profits the company kept and did not distribute to shareholders | |

| Increases with stock sales, profit retention, and cash investments | |

| Decreases with net loss generation or dividend distribution | |

| Cash investments | Increase shareholder's equity by the amount of cash invested |

| Cash dividends | Reduce shareholder's equity |

| Stock dividends | Do not reduce shareholder's equity |

What You'll Learn

Cash dividends reduce stockholder equity

When a company issues a cash dividend to its shareholders, it reduces its stockholders' equity by the total value of the dividend payout. This is because cash dividends are typically paid out of a company's retained earnings, which directly reduces stockholder equity.

For example, if a company declares a $1.50 dividend per share and has 1 million shares of stock outstanding, it must pay out $1.5 million in dividends. This $1.5 million is deducted from the retained earnings section of the company's balance sheet and added to the dividends payable sub-account of the liabilities section. As a result, the company's stockholder equity is reduced by the dividend amount, while its total liability is temporarily increased until the dividends are paid out. Once the dividends are paid, the cash sub-account of the assets section is also reduced by the dividend amount.

It is important to note that stock dividends do not have the same effect on stockholder equity as cash dividends. While cash dividends reduce stockholder equity, stock dividends simply rearrange the allocation of equity funds. In the case of a stock dividend, the company issues additional shares to its shareholders instead of paying them cash. This does not directly reduce the company's retained earnings or stockholder equity.

The impact of dividends on stockholder equity depends on the form they take. Cash dividends reduce stockholder equity because they decrease the company's retained earnings. On the other hand, stock dividends do not have the same effect because they involve transferring funds from retained earnings to paid-in capital without a net decrease in stockholder equity.

Overall, cash dividends reduce stockholder equity by decreasing the company's retained earnings and total assets, while stock dividends do not have the same effect because they involve a transfer of funds rather than a direct reduction.

Cash App Investing: Dividends and Your Money

You may want to see also

Stock dividends don't reduce stockholder equity

When a company issues dividends to its shareholders, the type of dividend determines the effect on stockholder equity. Stockholder equity, also known as shareholder equity, represents the net worth of a corporation. It is calculated by subtracting a company's liabilities from its total assets, as shown on the company's balance sheet.

Dividends are a way for companies to reward current shareholders and attract new investors by distributing a portion of their earnings. Dividends can be paid in cash or additional stock, and the impact on stockholder equity depends on the type of dividend paid.

Cash dividends reduce stockholder equity. When a company pays cash dividends, the total value of all dividends paid is deducted from the company's retained earnings, resulting in a decrease in stockholder equity. This is because cash dividends are paid out of the company's retained earnings, directly reducing its value.

On the other hand, stock dividends do not reduce stockholder equity. Stock dividends involve distributing additional shares of stock to shareholders, rather than cash. While stock dividends affect the allocation of shares and the company's share price, they do not impact the overall stockholder equity. This is because a stock dividend results in a transfer of funds from retained earnings to paid-in capital, rearranging the allocation of equity funds without reducing the total value.

For example, consider a company that issues a 5% stock dividend on 1 million outstanding shares with a market price of $15 per share. The total value of the dividend shares is $750,000. This amount is deducted from the retained earnings and transferred to the paid-in capital account, increasing it by that amount. As a result, the net effect is a reduction in retained earnings and an increase in paid-in capital, while the total stockholder equity remains unchanged.

In summary, while cash dividends reduce stockholder equity by decreasing retained earnings, stock dividends do not have the same effect. Stock dividends redistribute funds within the equity accounts, maintaining the overall stockholder equity value.

Understanding E-Trade Cash Calls: What Investors Need to Know

You may want to see also

Shareholder equity increases with stock sales

Shareholder equity, also known as stockholders' equity, represents the amount of financing a company has received by selling stocks. It is the corporation's net worth and is documented on the company's balance sheet.

For example, if a company's shareholder equity is $500,000 and its cash balance is $50,000, and the company needs additional equity to strengthen its balance sheet and qualify for a loan, an existing shareholder might invest an additional $100,000 in cash. This would bring their total investment to $200,000, and the company's shareholder equity would increase to $600,000, with a cash balance of $150,000.

The shareholder's ownership stake, calculated by dividing their investment by the company's shareholder equity, would increase from 20% to 33%.

However, it is important to note that issuing new shares can dilute the value of existing shareholders' holdings. While shareholder equity increases, the proportion of the company owned by each shareholder decreases as the total number of shares increases.

Shareholder equity can also increase when a company retains its profits instead of paying them out as dividends. In this case, the company's cash or other assets increase in value, and the Retained Earnings line item on the balance sheet rises, contributing to overall shareholder equity.

Corporations' Cash Investment Strategies: Unlocking Business Growth

You may want to see also

Shareholder equity increases with profit retention

Shareholder equity, also known as stockholders' equity, is a company's net worth. It is the total dollar amount that would be returned to shareholders if the company were liquidated and all its debts paid off. In other words, shareholder equity is the company's total assets minus its total liabilities.

Shareholder equity can be calculated using the following formula:

Shareholder Equity = Total Assets – Total Liabilities

Shareholder equity increases with stock sales and profit retention. Profit retention refers to the percentage of net income that is retained to grow the business rather than being paid out as dividends. This is also known as the retention ratio or plowback ratio.

When a company retains profits, it can reinvest them into the business to spur growth. This can include investing in new equipment, technology, or expanding product lines. By retaining profits, a company can also avoid taking on additional debt or issuing new equity shares to finance growth.

For example, consider a company with shareholder equity of $500,000 and cash of $50,000. This company needs additional equity to strengthen its balance sheet and qualify for a bank loan. An existing shareholder agrees to invest an additional $100,000 in cash, bringing the total investment to $200,000. As a result, the company's shareholder equity increases to $600,000, and the cash increases to $150,000.

Shareholder equity can also increase when owners invest in additional stock. This is reflected in the company's balance sheet, with the Common Stock account being credited and increasing.

It is important to note that shareholder equity can also decrease with net loss generation or dividend distribution. Cash dividends reduce shareholder equity, while stock dividends do not have the same effect.

Cashing Out Investments: Using the Cash App to Withdraw Funds

You may want to see also

Shareholder equity decreases with dividend distribution

When a company issues dividends to its shareholders, it is usually a way of rewarding current shareholders and encouraging new investors to purchase stock. Dividends are often issued when a company is doing well and wants to reward its shareholders for their investment. Dividends can be paid out in cash or additional shares of stock, or a combination of both.

When dividends are paid in cash, shareholder equitysection is reduced by the total value of the dividends paid out. This is because cash dividends are paid out of retained earnings, which directly reduces shareholder equity.

For example, assume company ABC has had a profitable year and decides to issue a $1.50 dividend to its shareholders for each share owned. If ABC has 1 million shares of stock, it must pay out $1.5 million in dividends. ABC's balance sheet shows retained earnings of $4 million. When the cash dividend is declared, $1.5 million is deducted from the retained earnings and added to the dividends payable sub-account of the liabilities section. The company's shareholder equity is reduced by the dividend amount, and its total liability is temporarily increased until the dividend has been paid out. Once the dividends are paid, the $1.5 million is deducted from the dividends payable sub-account to reduce the company's liabilities, and the cash sub-account of the assets section is also reduced by $1.5 million.

On the other hand, stock dividends do not reduce shareholder equity. This is because, when a company issues stock dividends, the value of the dividend is deducted from retained earnings and transferred to the paid-in capital sub-account. The total shareholder equity remains unchanged.

In summary, cash dividends reduce shareholder equity, while stock dividends do not.

Cash vs Investing: Is Holding Cash Ever Better?

You may want to see also

Frequently asked questions

Stockholders' equity is the remaining assets available to shareholders after all liabilities are paid. It is calculated by subtracting total liabilities from total assets.

A cash investment increases stockholders' equity. This is because the investment increases the ownership interest in the company, which is reflected in the stockholders' equity section of the balance sheet.

Stockholders' equity can also be calculated by taking the sum of share capital and retained earnings and then subtracting treasury shares.

Stockholders' equity includes common stock, paid-in capital, retained earnings, and treasury stock.

A cash dividend decreases stockholders' equity. This is because the dividend reduces the amount of cash that the company has, without any offsetting increase in value elsewhere.