Special Purpose Vehicles (SPVs) are separate legal entities created by a parent company to isolate financial risk. SPVs are often used by venture capitalists to consolidate a pool of capital to invest in a startup. SPVs are formed as LLCs or limited partnerships and function as pass-through vehicles, meaning they pass through income or losses to members in proportion to each member's ownership.

When investing in an SPV, it's important to understand the potential outcomes, as every startup and SPV outcome will differ. SPV investors are not direct stakeholders in the business and therefore won't have a say in day-to-day operations. It's crucial to align with SPV managers who will represent investors' interests and keep them informed.

This paragraph introduces the topic of whether to use the consolidation method when investing in an SPV by providing an overview of what SPVs are, how they function, and what investors should consider when investing in them.

| Characteristics | Values |

|---|---|

| Legal Status | A Special Purpose Vehicle (SPV) is a separate legal entity from its parent company |

| Purpose | SPVs are used to isolate financial risk, securitize assets, and perform separate financial transactions |

| Structure | SPVs can be formed as limited partnerships, trusts, corporations, or limited liability companies (LLCs) |

| Investment | SPVs pool money from investors to deploy capital into a single company |

| Investor Type | SPVs are commonly used by venture capitalists and angel investors |

| Investor Benefits | SPVs offer lower investment minimums, flexibility in investment selection, and exposure to the startup economy |

| Investor Considerations | SPV investors are bound by the terms of the SPV and may have limited rights compared to direct investors |

| Investor Rights | SPV investors typically receive membership interest and have voting rights as outlined in the governing documents |

| Taxation | Returns from SPV investments are typically taxed as long-term capital gains |

| Dilution | SPV investments may be diluted as startups raise additional funding rounds |

| Exit Scenarios | SPV investments can exit through IPOs, acquisitions, secondary market sales, or business failure |

What You'll Learn

SPVs are formed as LLCs or limited partnerships

Special Purpose Vehicles (SPVs) are separate legal entities formed by a parent company to isolate financial risk. They are also called Special Purpose Entities (SPEs). SPVs are created as separate companies with their own balance sheets, keeping their obligations secure even in the event of the parent company's bankruptcy.

SPVs are often formed as Limited Liability Companies (LLCs) or as Limited Partnerships. When formed as LLCs, investors become members of the LLC, which is a legal entity formed with the sole purpose of investing in a private company. The LLC then appoints a manager. LLC SPVs are the traditional way for VC firms to set up an SPV in the United States. However, they may have trouble accepting capital from international investors.

On the other hand, Limited Partnerships offer the same benefits and protections as LLCs, along with additional advantages across international jurisdictions. LP SPVs are a good choice when planning to raise capital from international investors because this entity type is recognised worldwide.

Understanding Quicken: Cash and Investments Reconciliation Issues

You may want to see also

SPVs function as pass-through vehicles

Special Purpose Vehicles (SPVs) are often established as limited liability companies (LLCs) or limited partnerships. They function as "pass-through vehicles", owned by members. Income or losses generated by the SPV are distributed to members based on ownership stakes.

"Members" of an SPV are its investors. These members receive what’s known as a "membership interest", typically expressed as a percentage. For example, an investor that invests $5,000 in an SPV that raises $100,000 has a 5% membership interest in the SPV.

SPVs are commonly used by venture capitalists to consolidate a pool of capital to invest in a startup. They allow multiple investors to come together and invest in a particular company without each one being individually listed on the company's cap table. Instead, the SPV appears as a single entry, simplifying the administrative process for the startup.

SPVs can be powerful tools for financial management and risk mitigation, but they must be used responsibly. If misused or manipulated, they can become vehicles for hiding company debt, leading to disastrous consequences.

Unlocking Investment Strategies: Determining Cash Availability

You may want to see also

SPV investors are its members

Special Purpose Vehicles (SPVs) are legal entities that are created for a specific purpose. They are often used by investors to pool their money together to invest in a single company. When an LP invests in an SPV, they become a "member" of the SPV and receive "membership interest" in return for their capital. This membership interest is usually expressed as a percentage.

SPVs are typically formed as limited liability companies (LLCs) or limited partnerships. In either case, they are "pass-through vehicles" that are owned by their members. Any income (or losses) is passed through to those members in proportion to each member's ownership. SPVs are subject to the same laws and regulations as other private funds.

SPVs have multiple use cases. They can be used to isolate certain holdings from a parent company's balance sheet or to establish a track record before raising a traditional venture capital fund. They can also be used to invest in companies that don't fit a fund's investment strategy or that fall outside of a fund's terms.

There are several advantages to using an SPV. They can be used to isolate financial risk, so if the investment performs poorly, it doesn't impact the VC firm's flagship funds. SPVs also expand LP access and are less expensive to set up than a VC fund.

However, there are some potential drawbacks. For example, it might be challenging to align LPs and the portfolio company on exit terms if setting up an SPV as a continuation fund. Additionally, because SPVs typically only invest in one company, they aren't as diversified as a typical VC fund.

Obama's Investment Strategies: Blind Trust or Personal Control?

You may want to see also

SPV members receive membership interest

When an LP invests in an SPV, they become a "member" of the SPV and receive "membership interest" in the SPV. This interest is usually expressed as a percentage. For example, an LP who invests $10,000 into an SPV that raises a total of $100,000 will receive 10% membership interest in the SPV. The income or losses are shared with members in proportion to each member's ownership.

SPV members are investors in the SPV, and the SPV is an investor in the company. The SPV's income 'passes through' to the SPV members. For instance, if the SPV invests in a company and later that company is acquired, and the SPV gains £20 million, a member with 5% membership interest gets 5% of the income, minus any carry fee.

SPVs are often formed as limited liability companies (LLCs) or limited partnerships. Both protect investors from personal liability in the event that the invested entity is sued. SPVs are also referred to as "pass-through vehicles" as they are owned by their members and pass through income (or losses) to those members in proportion to each member's ownership.

SPV members should be aware of the risks associated with SPV investing. SPVs invest in a single company, so if that company fails, investors in the SPV may not see any return on their capital. SPV members inside the SPV do not have voting or information rights that direct shareholders sometimes have. They need to trust the SPV manager to represent their interests.

Corporations' Cash Investment Strategies: Unlocking Business Growth

You may want to see also

SPVs are commonly used by funds to invest in follow-on rounds

Special Purpose Vehicles (SPVs) are separate legal entities created for a specific purpose. They are often used to consolidate a pool of capital from multiple investors to invest in a startup. SPVs are typically formed as limited liability companies (LLCs) or limited partnerships.

SPVs are formed as LLCs or limited partnerships and function as “pass-through vehicles”. This means they pass through income or losses to members in proportion to each member’s ownership. Members of an SPV are its investors and they receive “membership interest”, typically expressed as a percentage.

SPVs are useful for funds that want to invest in follow-on rounds but don't have enough capital left to deploy. They are also used when an investment falls outside of a fund’s usual investment philosophy, allowing investors to self-select if they want to participate. SPVs can also be used to fill pro rata allocations.

Investment vs. Owner Cash: Understanding the Difference

You may want to see also

Frequently asked questions

SPV stands for Special Purpose Vehicle, a legal entity or company created to fulfil a special purpose or objective.

SPVs are a great way to gain exposure to the startup economy, learn the nuances of startup investing, and build an investment track record. They typically require lower investment minimums than funds and offer more flexibility for investors to select specific startup investments.

SPVs are formed as LLCs or limited partnerships and function as "pass-through vehicles", meaning they pass through income or losses to members in proportion to each member's ownership. Members of an SPV are its investors and they receive "membership interest", usually expressed as a percentage.

The SPV comes in as a single line on the startup's cap table. This means that the SPV's investors are not investing directly in the startup. Instead, they hold an ownership stake in the SPV, which in turn invests in the startup.

If the startup exits successfully, the SPV will receive proceeds from the exit in proportion to its equity stake and will pass those returns along to its members. If the startup is unsuccessful, the SPV's investors may not receive any of their principal back, depending on the circumstances.

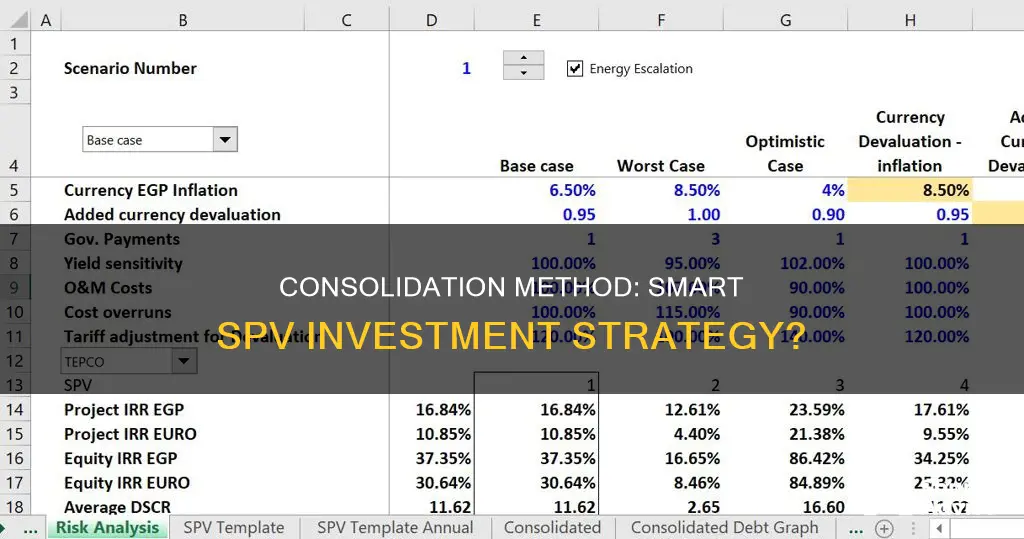

It is important to assess the need for consolidation of an SPV based on control rather than legal ownership. If the parent company or creator controls the SPV, then it must be consolidated even if the parent owns zero percent share. This is to avoid accounting scandals and to provide transparency to investors.