Quicken is a money management application that allows users to manage multiple bank accounts, credit cards, loans, and investment accounts. While the application has been widely used for decades, some users have reported issues with reconciling their investment accounts. The Reconcile function in Quicken only reconciles the cash balance of an investment account and does not take into account the number of shares. This has caused confusion for some users, especially those who have both cash and money market funds in their investment accounts. In such cases, Quicken may only reflect the cash balance, while the brokerage platform aggregates the cash and money market funds, resulting in a discrepancy. Additionally, some users have reported issues with the automatic transaction download feature, which may result in incorrect cash balances if transactions are not reviewed and corrected manually. To ensure accurate reconciliation, users should manually verify the number of shares and cash balance against their brokerage statements and make any necessary adjustments in Quicken before performing a reconciliation.

| Characteristics | Values |

|---|---|

| Reconcile function for investment accounts | Only reconciles cash balance, not share balance |

| Reconcile function for investment accounts | Reconcile shares option not available for offline accounts |

| Reconcile function for investment accounts | Reconcile shares option not available for all brokerages |

| Reconcile function for investment accounts | Reconcile shares option not available for all versions of Quicken |

| Reconcile function for investment accounts | Reconcile shares option not available for all types of investment accounts |

| Reconcile function for investment accounts | Reconcile shares option not available if using pop-up registers |

| Reconcile function for investment accounts | Reconcile shares option may not be compatible with all financial institutions |

| Reconcile function for investment accounts | Reconcile shares option may not be accurate if financial institution reports cash and money market funds separately |

| Reconcile function for investment accounts | Reconcile shares option may not be accurate if financial institution does not sweep cash into money market fund |

| Reconcile function for investment accounts | Reconcile shares option may not be accurate if financial institution reports cash and money market funds as separate line items |

| Reconcile function for investment accounts | Reconcile shares option may not be accurate if financial institution does not provide accurate transaction data |

| Reconcile function for investment accounts | Reconcile shares option may not be accurate if user does not review and correct downloaded transactions |

What You'll Learn

Dividends and cash balances

When it comes to dividends and cash balances in Quicken, there are a few things to keep in mind. Firstly, let's differentiate between cash dividends and stock dividends. A cash dividend is a payment made by a company to its shareholders, typically in the form of cash or cash equivalents. On the other hand, a stock dividend is when a company pays dividends in the form of additional shares of stock instead of cash.

In Quicken, the treatment of cash dividends and stock dividends can vary. For cash dividends, the amount is typically added to the cash balance of the investment account. This means that if you receive a cash dividend, your cash balance in Quicken should increase by the amount of the dividend. However, there may be times when the cash dividend is not automatically added to the cash balance, and you may need to manually enter the transaction. This can be done through the "Enter Transactions" dialog or directly into the investment account transaction register. The transaction type for a cash dividend is typically "Div" or "DivX", depending on the version of Quicken you are using.

For stock dividends, the treatment can vary depending on the settings in your account. If your account is set up to track the running cash balance, you may need to manually adjust the cash balance to reflect the stock dividend. This is because stock dividends do not directly affect the cash balance but instead increase the number of shares you own.

It's important to note that in some cases, dividends may not appear in the cash balance of your investment account, even if they are correctly recorded in the dividend box. This can be due to the presence of "Placeholders" in your account. Placeholders are used to compensate for missing or incorrect investing transactions and can affect the calculation of cost basis and performance for the affected securities. To manage placeholders, go to "Edit > Preferences > Investing" and ensure that the "Show hidden transactions" box is checked. Placeholders will appear with a gray background in the account's transaction list and will have "Entry" in the Action column. To allow transactions to affect the cash balance, you may need to delete any placeholders with later dates than the transaction you are entering.

Additionally, the way dividends are treated can vary depending on the type of investment account you have. For example, in a retirement account, a dividend is typically recorded as "Div" and stays in the account unless it is reinvested or used in another way. In contrast, in a taxable account with a linked cash account, a dividend is automatically recorded as "DivX" and transferred to the linked cash account.

Finally, when purchasing stocks using the cash balance from dividends, it's important to record the transaction correctly. If you buy a security using the cash balance, the transaction type should be "Bought" or "Buy", as this increases your Amount Invested. On the other hand, if the dividend is automatically reinvested to purchase more shares, the transaction type would be "Reinvest - Income Reinvested" or "ReinvDiv", as this does not affect your cash balance.

Strategizing Initial Investment: Deciding Your First Cash Flow

You may want to see also

Reconcile function changes

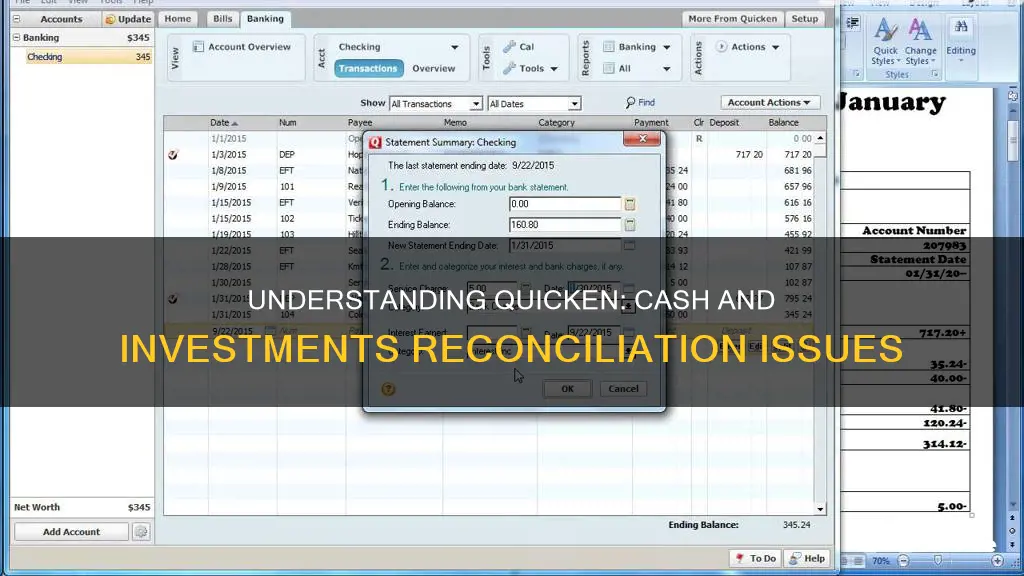

The Reconcile function in Quicken has always just reconciled the cash. To reconcile your share balances, click on the gear at the top right of the accounts and select "Reconcile shares". This reconciles your current share balances in Quicken to the most recent balances downloaded from your brokerage. For some brokerages, this was broken for several months last year.

The Reconcile function in investing accounts has always just reconciled the cash. Even though the cash reconcile windows show “investment transactions” like Buy, Sold, Div, it is only looking at the cash balance. You always have to ensure that the number of shares in your register are correct before doing the cash reconcile.

In Quicken Mac, at this time, Reconcile only works for cash. But the developers have recently stated that they are going to implement the ability to reconcile share balances as well.

In the meantime, you can mark individual transactions for securities as reconciled (green checkmark in the Clr column) manually, if you wish. When you click on the Clr column, it toggles between no status and “cleared” (blue checkmark) — if you hold down the Option key, it will toggle between no status, cleared, and reconciled (green checkmark).

You can also mark all the share transactions as reconciled via the Reconcile window. You're technically just reconciling the cash balance, but in the process, you can set all the share transactions to a status of reconciled via this window. Alternatively, you can go to the Portfolio window, set the "As of" date to match a brokerage statement, and check the share balance and market value of each security on the statement versus the Quicken portfolio window. Once you have verified they agree, you can then go to the Transaction screen, click Reconcile, and mark all the transactions for cash as well as shares as reconciled.

You can also check your share balances for each account and each security in Quicken versus your brokerage statements when you get them monthly or quarterly, so you know your transactions in Quicken are reconciled; you just don't bother adding the green checkmarks in Quicken.

Investing Wisely: Understanding Cash Flow & Depreciation

You may want to see also

Online vs statement cash balance

When it comes to online vs statement cash balance, there are a few things to consider. Firstly, it's important to understand the difference between these two types of balances. The online balance is the amount of money that is currently available in your account, according to your financial institution. This balance is usually updated in real-time and can be accessed through online banking or mobile banking apps. On the other hand, the statement balance refers to the amount of money in your account as of the last statement date. This balance is typically updated once a month and can be found on your monthly account statement.

Now, let's discuss some scenarios where these balances might not match and explore ways to resolve discrepancies. One common issue is that the online balance may include pending transactions that have not yet been processed, while the statement balance only includes cleared transactions. In this case, it's important to review your recent transactions and identify any pending items that could be causing the discrepancy. Another possibility is that there may be errors or discrepancies in the transaction data. In this case, it's crucial to carefully review and reconcile your transactions, ensuring that all deposits, withdrawals, and other activities are accurately reflected in your records.

Additionally, it's worth noting that some financial institutions might use different methods to calculate these balances, which can lead to discrepancies. For instance, they might include or exclude certain types of transactions, such as pending transactions or interest accruals. Therefore, it's always a good idea to familiarise yourself with your financial institution's policies and procedures regarding balance calculations.

In the context of Quicken, a popular financial management application, users have reported challenges in reconciling their investment accounts. Specifically, some users have observed that the reconcile function only considers the cash balance within the account, disregarding the total value of the account, including holdings. This limitation has caused confusion and frustration among users, particularly those with complex investment portfolios. However, it's worth noting that Quicken developers have acknowledged this issue and plan to implement the ability to reconcile share balances in the future.

To address the immediate concerns of Quicken users, there are a few workarounds available. One suggestion is to utilise the Portfolio screen to verify the share balance and market value of each security against the brokerage statement. Once the share balances are confirmed, users can manually mark the transactions as reconciled in the Transaction screen. Alternatively, users can opt to compare their holdings to the statement and refrain from using the reconcile function altogether. While these solutions may not be ideal, they offer temporary solutions until the anticipated update is released.

Cash Investments: When to Take the Plunge

You may want to see also

Portfolio reconciliation

To reconcile share balances, users can go to the gear icon in the transaction list and select "Reconcile Shares". This will compare the share balances in Quicken to the downloaded numbers from the brokerage. Alternatively, users can manually mark individual transactions for securities as reconciled by clicking on the "Clr" column in the transaction list.

To reconcile cash balances, users can go to the transaction list, click on the gear icon, and select "Reconcile". They will then be prompted to enter the ending balance and date, and then check off the transactions that are included. If there is a discrepancy, users can create a new transaction and enter a Type=Payment/Deposit and Category=Adjustment to adjust the cash balance.

It is important to note that the portfolio reconciliation process may vary depending on the brokerage and the user's specific account settings in Quicken. Additionally, there may be instances where the cash balance in Quicken does not match the cash balance in the brokerage statement. This could be due to differences in how the brokerage reports cash, such as including accrued settlement fund dividends or not. In such cases, users may need to manually adjust the cash balance in Quicken to match the brokerage statement.

Cash Value Life Insurance: Is It a Smart Investment?

You may want to see also

Cash vs share balance

When reconciling investment accounts in Quicken, the software only uses transactions that affect the cash balance. This means that the share balance is not taken into account when reconciling. This has been a source of confusion for some users, who have pointed out that the reconcile function can be rendered useless if the brokerage lists cash and money market funds separately but aggregates them for download.

In response to this issue, Quicken developers have stated that they plan to implement the ability to reconcile share balances as well as cash balances. However, this feature has not yet been released.

In the meantime, users can manually check their share balances and mark transactions as reconciled. This can be done by first setting the "As of" date in the Portfolio window to match a brokerage statement, then checking the share balance and market value of each security on the statement against the Quicken portfolio window. Once the user has verified that these amounts match, they can go to the Transaction screen, click Reconcile, and mark all the transactions for cash and shares as reconciled.

Alternatively, users can mark individual transactions for securities as reconciled manually. To do this, click on the Clr column in the Transaction screen; this will toggle between no status and “cleared” (blue checkmark). If you hold down the Option key and click on the Clr column, it will also toggle between reconciled (green checkmark).

It is important to note that marking investment transactions as reconciled does not serve any functional purpose other than allowing the user to keep track of which transactions they have verified. Some users may find this helpful, while others may prefer to simply verify their share balances and market values against their brokerage statements without marking transactions as reconciled in Quicken.

Understanding Cash Investing Activities: A Beginner's Guide

You may want to see also