Active investing, a strategy that involves frequent buying and selling of securities with the aim of outperforming the market, has long been a subject of debate among investors and financial experts. While some argue that active management can lead to superior returns, others question its effectiveness and potential drawbacks. This paragraph will delve into the intricacies of active investing, exploring its principles, strategies, and the evidence supporting or refuting its success. By examining various studies, market trends, and expert opinions, we will attempt to answer the question: Does active investing truly work, and under what circumstances?

What You'll Learn

- Performance vs. Costs: Active management's benefits must outweigh higher fees

- Market Timing: Can active investors consistently time market turns

- Alpha Generation: Strategies for generating excess returns over benchmarks

- Risk-Adjusted Returns: Active investing's success measured by risk-adjusted gains

- Long-Term Trends: Historical evidence of active investing's impact over extended periods

Performance vs. Costs: Active management's benefits must outweigh higher fees

When considering whether active investing is a viable strategy, it's crucial to examine the relationship between performance and costs. Active management, which involves frequent buying and selling of securities to outperform the market, often comes with higher fees and expenses. These costs can significantly impact an investor's overall returns, and it's essential to evaluate whether the benefits of active management justify the additional expenses.

The primary argument for active management is the potential for superior performance. Active managers aim to identify undervalued securities and capitalize on market inefficiencies, which can lead to higher returns over time. However, this pursuit of outperformance comes at a price. Active funds typically charge higher expense ratios, including management fees and transaction costs, which can eat into the potential gains. For example, a mutual fund with a 1.5% management fee will incur higher costs compared to a passively managed fund with a lower expense ratio.

To determine if active management is worth the higher fees, investors should conduct a thorough analysis. This involves comparing the historical performance of active funds with their passive counterparts and assessing the consistency of outperformance. Investors can also consider the fund's track record, the manager's experience, and the investment strategy's transparency. By evaluating these factors, investors can make an informed decision about the potential value of active management.

Additionally, it's important to consider the market environment and the fund's investment style. In certain market conditions, active management may excel, while in others, passive strategies might be more advantageous. Investors should also be aware of the potential risks associated with active investing, such as higher volatility and the possibility of underperformance. A comprehensive understanding of these factors will enable investors to make a well-informed choice.

In summary, while active management offers the prospect of superior performance, it is essential to carefully weigh the costs against the potential benefits. Investors should conduct thorough research, compare performance metrics, and consider the fund's fees and expenses. By doing so, investors can make a strategic decision regarding active investing, ensuring that the higher fees are justified by the expected returns and the overall investment strategy aligns with their financial goals.

Next-Door Neighbors: The Pros and Cons of Buying the House Next Door as an Investment

You may want to see also

Market Timing: Can active investors consistently time market turns?

The concept of market timing is a central question in the debate over active investing versus passive investing. Active investors aim to outperform the market by making strategic decisions to buy and sell assets, often with the goal of riding out market downturns and capitalizing on upswings. The idea is that skilled investors can identify market trends and make timely adjustments to their portfolios, thus maximizing returns. However, the reality of market timing is a subject of much debate and skepticism.

Proponents of active investing argue that market timing can be a powerful tool. They suggest that successful active investors can indeed predict market turns and adjust their portfolios accordingly. This involves a deep understanding of economic indicators, company fundamentals, and market psychology. For instance, an active investor might anticipate a recession and shift investments towards defensive sectors like utilities and consumer staples, while also identifying specific stocks that are undervalued and poised to benefit from an economic recovery. This strategy requires continuous research, analysis, and a keen eye for market trends.

On the other hand, critics argue that market timing is inherently difficult and often leads to underperformance. They point out that markets are complex and influenced by numerous factors, many of which are unpredictable. Economic cycles, geopolitical events, and even investor sentiment can all impact market turns, making it challenging for any individual investor to consistently time the market. Furthermore, the costs associated with frequent buying and selling, such as transaction fees and potential taxes, can eat into any potential gains, making it harder for active investors to outperform the market over time.

Empirical evidence also suggests that active market timing is not a reliable strategy. Numerous studies have shown that active investors often underperform the market, especially when considering fees and transaction costs. The 'efficient market hypothesis' posits that markets are always in equilibrium, and any attempt to time the market will result in average returns, as all available information is already priced in. This theory implies that consistent market timing is nearly impossible, and investors would be better off with a buy-and-hold strategy.

In conclusion, while the idea of market timing is appealing, the practical challenges and risks involved make it a less reliable strategy. Active investors face the constant pressure of making accurate predictions, and the potential for underperformance due to transaction costs and market unpredictability. Ultimately, a well-diversified, long-term investment approach, combined with a thorough understanding of market dynamics, may be a more consistent path to success in the investment world.

Cash or Invest: The Great Car Buying Dilemma

You may want to see also

Alpha Generation: Strategies for generating excess returns over benchmarks

The concept of active investing is a strategy that aims to outperform the market or a specific benchmark by making proactive investment decisions. While the idea of generating excess returns, often referred to as 'alpha,' is appealing, it is essential to understand the strategies and factors that contribute to its success. Here's an exploration of the topic:

Understanding Alpha: Alpha generation is the process of achieving returns that surpass the expected performance of a benchmark index or a passive investment strategy. It is a measure of the excess return an investor can earn by actively managing their portfolio. The goal is to identify investments that can consistently beat the market, providing investors with an edge in the financial markets. This concept is particularly relevant for investors who believe that active management can lead to superior outcomes.

Strategies for Alpha Generation:

- Fundamental Analysis: This approach involves deep research and analysis of individual securities. Investors use various metrics and ratios to identify undervalued companies with strong growth potential. By carefully selecting stocks, investors can aim to beat the market's performance over time. This strategy requires a thorough understanding of financial statements, industry trends, and macroeconomic factors.

- Quantitative Models: Quantitative investing utilizes mathematical and statistical models to identify investment opportunities. These models analyze large datasets and historical market trends to make data-driven decisions. Quantitative strategies can include algorithmic trading, where computers execute trades based on predefined rules, or the use of quantitative screens to filter securities based on specific criteria. This method is often employed by institutional investors and hedge funds.

- Event-Driven Investing: This strategy focuses on capitalizing on events that can impact a company's performance, such as mergers, acquisitions, restructurings, or regulatory changes. Investors can gain an edge by anticipating and acting on these events, potentially leading to significant returns. For example, an investor might short-sell a stock before a negative event, anticipating a decline in price.

- Active Portfolio Management: Active portfolio managers make frequent adjustments to their holdings to adapt to market conditions and pursue alpha. This involves a dynamic approach, where managers actively buy and sell securities to optimize the portfolio's performance. It requires constant monitoring and a quick response to market opportunities or risks.

Challenges and Considerations:

While the potential for alpha generation is enticing, it is not without challenges. Active investing often incurs higher costs due to transaction fees and management expenses. Additionally, the pursuit of alpha can be a double-edged sword; active managers may underperform the market if their strategies are not well-executed or if they fail to adapt to changing market dynamics. Market efficiency also plays a role; in highly efficient markets, it becomes increasingly difficult to consistently generate excess returns.

In conclusion, active investing and alpha generation are complex topics that require a strategic approach and a deep understanding of financial markets. While the strategies outlined above can provide a framework, investors should also consider their risk tolerance, time horizon, and the potential costs associated with active management.

Investing on a Shoestring: Strategies for Building Wealth with Limited Capital

You may want to see also

Risk-Adjusted Returns: Active investing's success measured by risk-adjusted gains

The concept of risk-adjusted returns is a critical metric for evaluating the performance of active investing strategies. It provides a more nuanced understanding of an investment's success by considering both the potential gains and the associated risks. This approach allows investors to make more informed decisions and compare different investment options on a level playing field.

Risk-adjusted return is a measure that assesses the excess return generated by an investment relative to the risk taken. It takes into account the volatility or uncertainty associated with an investment, often represented by a statistical measure such as the standard deviation of returns. The idea is to reward strategies that deliver higher returns while also managing risk effectively. For example, an active investment strategy that consistently outperforms the market but at a high cost of risk might not be considered successful in this context.

To calculate risk-adjusted returns, investors often use the Sharpe Ratio, a widely recognized metric. The Sharpe Ratio measures the excess return per unit of risk (as measured by standard deviation) and provides a single number that represents the risk-adjusted performance. A higher Sharpe Ratio indicates better risk-adjusted returns, suggesting that the investment has generated higher returns relative to the volatility of its returns. This metric is particularly useful for investors who want to understand the trade-off between risk and reward.

Active investing, which involves frequent buying and selling of securities to capitalize on market opportunities, aims to outperform the market through skilled decision-making. However, it is essential to recognize that not all active investment strategies will be successful in terms of risk-adjusted returns. Some strategies might focus on high-risk, high-reward trades, while others may prioritize consistent, lower-risk gains. By evaluating these strategies through the lens of risk-adjusted returns, investors can identify those that truly add value while managing risk effectively.

In summary, risk-adjusted returns are a powerful tool for assessing the success of active investing strategies. It encourages investors to consider both the potential gains and the associated risks, leading to more informed decision-making. By focusing on risk-adjusted performance, investors can identify strategies that consistently deliver superior returns while effectively managing risk, ultimately contributing to long-term investment success.

The Ultimate Guide to Multiplex Investing: Unlocking the Secrets to Success

You may want to see also

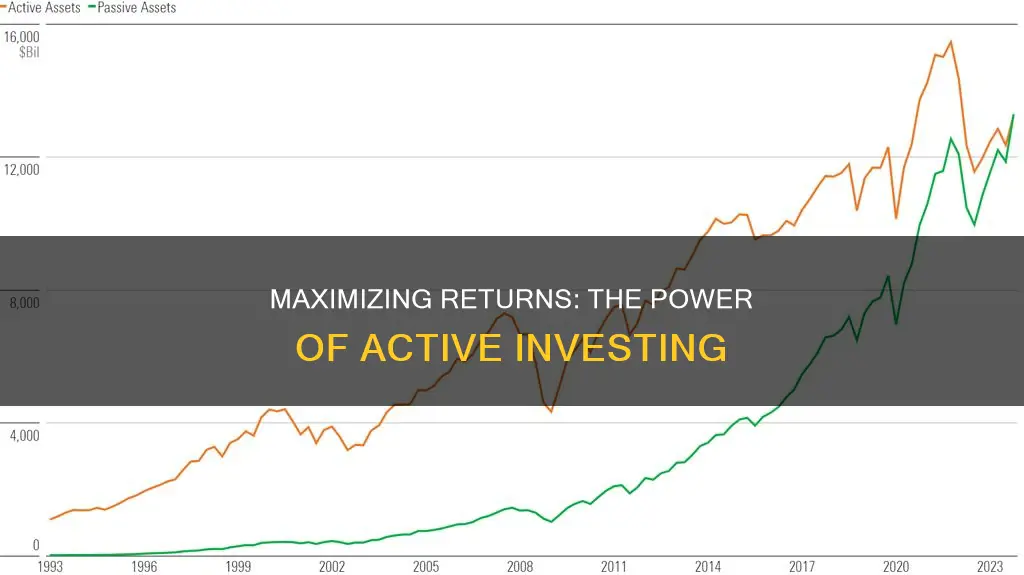

Long-Term Trends: Historical evidence of active investing's impact over extended periods

The concept of active investing, which involves frequent buying and selling of securities with the aim of outperforming the market, has been a subject of extensive debate and research. While some argue that active management can lead to superior returns, others suggest that it often falls short of market benchmarks over the long term. This analysis delves into the historical evidence to shed light on the impact of active investing over extended periods.

Historical data reveals a mixed picture when examining the performance of actively managed funds. In the short term, active investing can indeed generate impressive returns, as skilled fund managers make strategic decisions to capitalize on market opportunities. However, when considering longer time frames, the story becomes more nuanced. Over extended periods, such as a decade or more, the evidence suggests that active investing often struggles to consistently outperform the market. This phenomenon is often referred to as the "active management anomaly."

One of the key reasons behind this trend is the inherent difficulty in consistently identifying undervalued securities and timing market movements. While active managers may excel at stock selection in the short term, the market's efficiency and the presence of numerous sophisticated investors make it increasingly challenging to maintain an edge over the long haul. As a result, many actively managed funds experience underperformance relative to passive index funds, which simply track the market's performance.

Numerous studies have analyzed the performance of active and passive investing strategies over extended periods. These studies consistently show that passive investing, which aims to mirror the market's performance, often outperforms active strategies over the long term. The difference in performance is attributed to the lower costs and higher efficiency associated with passive management, as well as the market's tendency to reward passive investors for their ability to track the market accurately.

In conclusion, historical evidence suggests that active investing's impact may not be as significant over extended periods as it is in the short term. The market's efficiency and the challenges of consistently identifying undervalued securities make it difficult for active managers to maintain an edge. While active investing can still play a role in investment portfolios, investors should be aware of the potential limitations and consider a balanced approach that incorporates both active and passive strategies to achieve long-term success.

Retirement Planning: Navigating Your Investment Journey

You may want to see also

Frequently asked questions

Active investing is a strategy where investors aim to outperform the market by actively selecting and trading securities. It involves research, analysis, and decision-making to choose individual stocks, bonds, or other assets, often with the goal of generating higher returns than a passive investment approach.

Active investing is a dynamic approach that requires constant monitoring and adjustment of the investment portfolio. It involves active buying and selling of securities to capitalize on market opportunities and potential undervalued assets. In contrast, passive investing, or index investing, tracks a specific market index, aiming to mirror its performance without frequent trading.

Active investors believe that skilled professionals can identify undervalued companies, sectors, or assets that the market might overlook. This strategy can potentially lead to higher returns over time, especially if the investor has a deep understanding of the markets and can make timely decisions. It also allows for more control over the investment process.

Active investing often incurs higher costs due to frequent trading and professional fees. The potential for higher returns comes with increased risk, as active investors may face higher transaction costs, taxes, and the possibility of underperformance compared to the market. Additionally, active strategies require significant time and expertise to manage effectively.

Success in active investing is often measured by comparing the investment returns to a relevant benchmark or index. Investors can analyze their performance over time, track transaction costs, and assess the impact of market timing decisions. It is crucial to have a well-defined investment strategy, regular review processes, and a long-term perspective to evaluate the effectiveness of active investing.