Ethical investing, also known as sustainable or responsible investing, is a growing trend in the financial world, where investors aim to align their portfolios with their values and contribute to positive social and environmental outcomes. This approach involves selecting investments based on factors beyond just financial returns, such as a company's impact on society, the environment, and governance. The question of whether ethical investing works is a complex and multifaceted one, as it involves balancing financial performance with the pursuit of ethical goals. This paragraph will explore the effectiveness of ethical investing, examining the potential benefits and challenges it presents to investors and the broader financial market.

What You'll Learn

- Performance: Ethical investing funds often outperform traditional ones

- Impact: It can drive positive change in companies and industries

- Transparency: Ethical investors demand clear reporting on sustainability efforts

- Risk Management: Ethical investing may reduce financial and reputational risks

- Consumer Demand: Ethical investments align with growing consumer preferences

Performance: Ethical investing funds often outperform traditional ones

The performance of ethical investing funds has been a subject of growing interest and debate in the financial world. While some argue that ethical considerations may limit investment opportunities, recent studies and market trends suggest that these funds often outperform their traditional counterparts. This phenomenon can be attributed to several key factors.

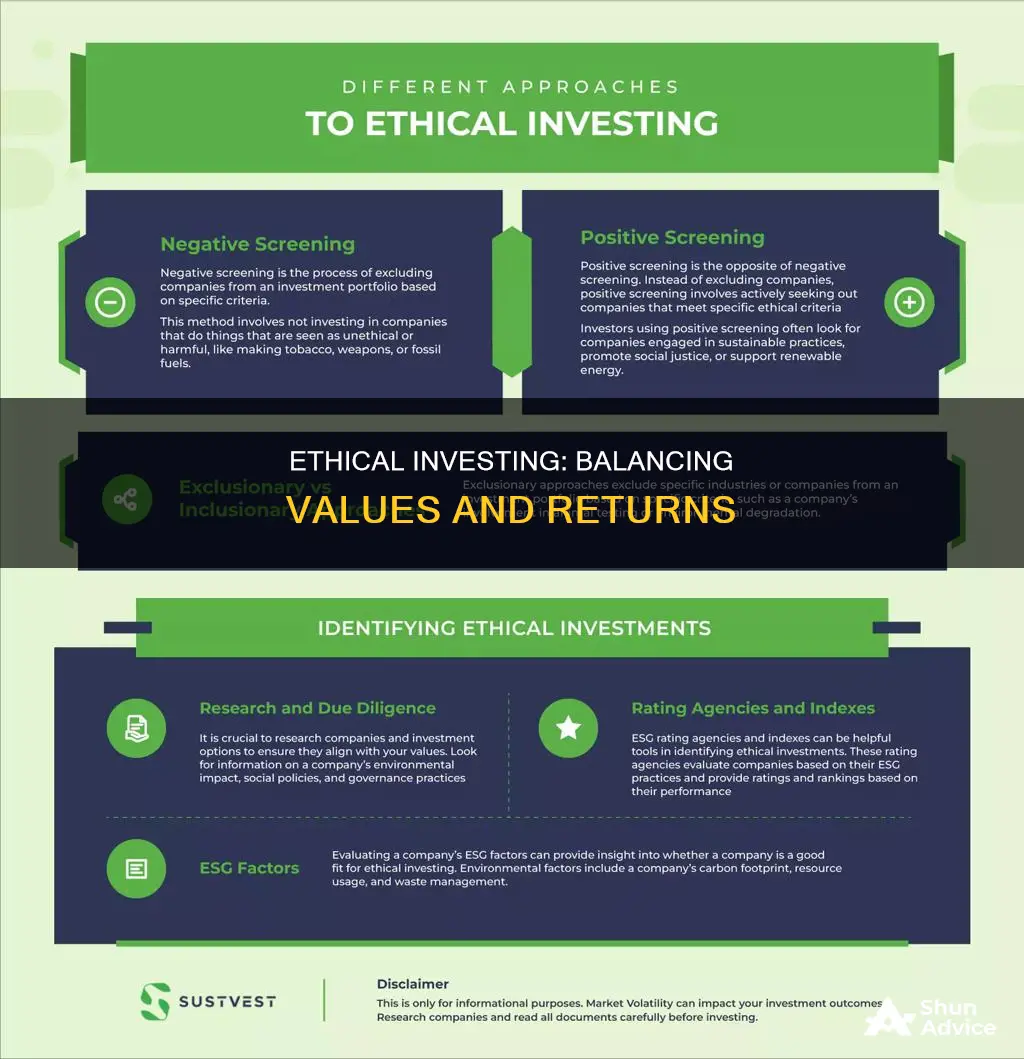

Firstly, ethical investing funds tend to have a more rigorous and selective investment process. These funds focus on companies that demonstrate strong environmental, social, and governance (ESG) practices. By incorporating ESG criteria, investors can identify businesses with sustainable competitive advantages, robust risk management, and a commitment to long-term value creation. As a result, these companies often exhibit better financial performance, as evidenced by their consistent revenue growth, higher profit margins, and reduced operational risks.

Secondly, the integration of ethical considerations into investment strategies can lead to a more diversified portfolio. Ethical investors often avoid industries and companies associated with controversial practices, such as tobacco, weapons, or fossil fuels. This approach encourages investors to explore a broader range of sectors and companies, which can enhance portfolio resilience. Diversification is a powerful risk management tool, as it helps to smooth out volatility and provides a more stable investment return over time.

Furthermore, the positive performance of ethical investing funds can be linked to the increasing awareness and demand for sustainable and responsible investing among investors. As more individuals and institutions become environmentally and socially conscious, they are increasingly directing their investments towards funds that align with their values. This shift in investor behavior creates a positive feedback loop, where the success of ethical funds attracts more investors, further driving up performance.

In summary, the performance of ethical investing funds often surpasses that of traditional funds due to their rigorous investment process, focus on sustainable companies, and the growing demand for responsible investing. As the financial industry continues to evolve, embracing ethical considerations can lead to better investment outcomes while also contributing to a more sustainable and responsible global economy.

Retirement Investing: Building a Secure Future

You may want to see also

Impact: It can drive positive change in companies and industries

Ethical investing, also known as sustainable or responsible investing, is a powerful approach that goes beyond traditional financial considerations. It focuses on the impact of investment decisions on both financial returns and societal well-being. When investors choose to align their portfolios with ethical principles, they can significantly influence the behavior of companies and industries, driving positive change. This impact-driven strategy has the potential to create a ripple effect, transforming the way businesses operate and contributing to a more sustainable and equitable future.

One of the key impacts of ethical investing is the encouragement of corporate responsibility. Investors who prioritize ethical considerations often seek companies that demonstrate a commitment to environmental sustainability, social justice, and good governance. By directing capital towards these companies, investors send a clear message that such practices are not only desirable but also financially rewarding. As a result, businesses are incentivized to adopt more sustainable and ethical business models, reducing their environmental footprint, promoting fair labor practices, and ensuring transparency in their operations. This shift in corporate behavior can lead to long-term success and resilience, as companies become more adaptable to changing societal expectations and regulatory landscapes.

The influence of ethical investing extends to industry-wide transformations. As more investors embrace this approach, industries may undergo significant changes. For instance, the financial sector can become more environmentally conscious, with banks and investment firms integrating sustainability into their core strategies. This could lead to the development of green financing options, impact investment funds, and the exclusion of high-risk industries, such as fossil fuels, from investment portfolios. Similarly, other sectors like technology, consumer goods, and healthcare can experience a shift towards more ethical practices, with companies prioritizing data privacy, ethical data collection, and the development of products that benefit society.

Furthermore, ethical investing can foster innovation and long-term growth. By supporting companies that prioritize sustainability and social impact, investors contribute to the development of new technologies, business models, and solutions. For example, investing in renewable energy companies can drive innovation in clean energy sources, while backing ethical fashion brands can promote sustainable supply chains and fair trade practices. This, in turn, creates opportunities for businesses to differentiate themselves, attract socially conscious consumers, and gain a competitive edge in the market. As these companies grow, they can become catalysts for positive change, inspiring others to follow suit.

In summary, ethical investing has a profound impact on driving positive change in companies and industries. It encourages corporate responsibility, influences industry-wide transformations, and fosters innovation. By aligning investment decisions with ethical principles, investors can shape the behavior of businesses, leading to more sustainable practices and long-term success. This approach not only benefits the companies involved but also contributes to a broader societal impact, creating a more responsible and equitable investment landscape. As the concept of ethical investing gains traction, its potential to create a positive and lasting impact on the world becomes increasingly evident.

Retirement and Investment Expenses: Unraveling the Standard Deduction Mystery

You may want to see also

Transparency: Ethical investors demand clear reporting on sustainability efforts

In the realm of ethical investing, transparency is a cornerstone, and it's no wonder that ethical investors are demanding clear and detailed reporting on sustainability efforts. This demand for transparency is a powerful force driving positive change in the financial industry. Ethical investors, who prioritize environmental, social, and governance (ESG) factors alongside financial returns, are increasingly influential in shaping corporate behavior and promoting sustainable practices.

The concept of transparency in this context goes beyond mere disclosure of information. It entails a comprehensive and accessible approach to reporting, ensuring that investors can make informed decisions and hold companies accountable for their sustainability claims. Ethical investors seek detailed insights into a company's environmental impact, social responsibility, and governance practices. This includes data on carbon emissions, waste management, labor conditions, diversity and inclusion, board composition, and ethical business conduct. By demanding such transparency, investors can assess the authenticity of a company's sustainability efforts and make choices that align with their ethical values.

Clear reporting on sustainability efforts is essential for several reasons. Firstly, it enables investors to evaluate the effectiveness of a company's sustainability initiatives. Well-structured reports provide quantitative and qualitative data, allowing investors to measure progress, identify areas of improvement, and understand the impact of sustainability strategies. This transparency fosters a culture of accountability, encouraging companies to maintain and enhance their sustainability efforts to meet investor expectations.

Secondly, transparency in sustainability reporting attracts and retains ethical investors. As more investors embrace ESG criteria, they seek companies that demonstrate a genuine commitment to sustainability. Transparent reporting not only showcases a company's dedication to ethical practices but also provides a competitive advantage in attracting like-minded investors. This, in turn, can lead to increased capital inflows and improved long-term financial performance.

Moreover, the demand for transparency in sustainability reporting encourages companies to adopt more sustainable practices. When investors can scrutinize a company's performance, it creates a powerful incentive for businesses to integrate sustainability into their core operations. This may involve implementing more efficient energy systems, improving labor standards, or adopting circular economy principles. As a result, transparency becomes a catalyst for positive change, driving companies to go beyond compliance and strive for excellence in sustainability.

In summary, ethical investors' demand for transparency in sustainability reporting is a critical aspect of the ethical investing landscape. It empowers investors to make informed decisions, holds companies accountable, and promotes the adoption of sustainable practices. By embracing clear and detailed reporting, companies can not only meet the expectations of ethical investors but also contribute to a more sustainable and responsible business environment. This transparency is a vital tool in the pursuit of a more ethical and environmentally conscious investment world.

Home Sweet Home Investment: Exploring the Wise Choice of Buying a House

You may want to see also

Risk Management: Ethical investing may reduce financial and reputational risks

The concept of ethical investing, which focuses on investing in companies and funds that align with social, environmental, and governance (ESG) criteria, has gained significant traction in recent years. While the primary motivation for this approach is often driven by ethical and sustainability concerns, it also offers a compelling strategy for risk management, particularly in terms of financial and reputational risks. Here's how ethical investing can contribute to effective risk management:

Financial Risk Mitigation: Ethical investing can help investors navigate financial risks by carefully selecting companies that demonstrate strong ESG performance. These companies often exhibit better risk management practices, such as efficient resource utilization, robust internal controls, and a commitment to long-term sustainability. For instance, companies with high environmental standards are less likely to face regulatory fines or lawsuits related to environmental violations, which can significantly impact their financial health. By integrating ESG factors into investment decisions, investors can identify and avoid companies with higher financial risks, thus diversifying their portfolios and potentially improving overall risk-adjusted returns.

Reputational Risk and Stakeholder Confidence: Ethical investing also plays a crucial role in managing reputational risks. Investors increasingly consider the social and environmental impact of their investments, and companies that fail to meet these expectations may face public backlash, negative media coverage, and a decline in investor confidence. By investing in companies with strong ethical standards, investors can contribute to the preservation of the company's reputation and brand value. This is especially important for long-term investors who aim to build sustainable portfolios. Moreover, companies that actively embrace ethical practices are more likely to attract and retain customers, employees, and investors who value sustainability, thereby reducing the risk of reputational damage.

Long-Term Sustainability and Risk Resilience: Ethical investing encourages a long-term perspective, which is essential for effective risk management. Companies that prioritize sustainability and ethical practices often have a more resilient business model, capable of withstanding market fluctuations and external shocks. For example, companies with diverse and inclusive workplaces are more likely to foster innovation and adaptability, reducing the risk of talent shortages and ensuring a more stable business environment. Additionally, ethical investing can help investors identify potential risks early on, allowing for proactive risk mitigation strategies.

In summary, ethical investing provides a comprehensive approach to risk management by addressing both financial and reputational risks. It enables investors to make informed decisions, considering factors beyond traditional financial metrics. By integrating ESG criteria, investors can build portfolios that not only align with their values but also offer a more stable and sustainable investment journey, ultimately contributing to the long-term success and resilience of their financial endeavors.

Investing: Why the Fear?

You may want to see also

Consumer Demand: Ethical investments align with growing consumer preferences

In today's world, where consumers are increasingly conscious of the impact of their choices, ethical investing has emerged as a powerful trend. This shift in consumer demand is reshaping the financial landscape, with investors seeking opportunities that go beyond traditional financial returns. The idea that ethical investments can be both financially rewarding and socially responsible is gaining traction, and it's transforming the way people approach their portfolios.

The rise of ethical investing is closely tied to the growing awareness of environmental, social, and governance (ESG) factors. Consumers are now more informed and actively seek products and services that align with their values. When it comes to investments, this translates to a preference for funds and assets that demonstrate a commitment to sustainability, ethical practices, and positive societal impact. This trend is particularly prominent among younger generations, who are often referred to as 'millennials' and 'Gen Z,' who are even more conscious of the environmental and social consequences of their financial decisions.

As a result, investment firms and financial institutions are responding to this consumer demand by incorporating ESG criteria into their investment strategies. This includes integrating factors such as carbon emissions reduction, corporate governance, and community engagement into the decision-making process. By doing so, these companies are not only attracting a larger, more conscious investor base but also positioning themselves as leaders in the ethical investing space. This shift in the market has led to the creation of numerous ESG-focused funds, ETFs, and investment vehicles, providing consumers with a wide range of options to align their financial goals with their ethical beliefs.

The power of consumer demand in this context is evident. As more people choose to invest in companies that demonstrate a strong commitment to ethical practices, these businesses are more likely to thrive and succeed. This, in turn, encourages further investment and reinforces the positive feedback loop. Ethical investing is not just a trend but a long-term shift in consumer behavior, and it has the potential to drive significant change in various industries.

In conclusion, the alignment of consumer preferences with ethical investments is a powerful force that is reshaping the investment landscape. As consumers become more conscious and demanding, the financial industry is responding by offering products that cater to these values. This trend not only benefits investors but also contributes to a more sustainable and responsible business environment, proving that ethical investing is not just a concept but a practical and effective approach to financial decision-making.

GameStop Investors: Who's In?

You may want to see also

Frequently asked questions

Ethical investing, also known as sustainable or responsible investing, is an investment approach that considers environmental, social, and governance (ESG) factors alongside financial returns. It involves investing in companies and funds that meet certain ethical, social, and environmental criteria. This approach differs from traditional investing as it focuses on aligning investments with personal values and promoting positive change, rather than solely maximizing financial gains.

Yes, ethical investing can have a tangible impact on various real-world outcomes. By investing in companies with strong ESG practices, investors can support businesses that contribute to sustainable development, social justice, and environmental conservation. This can lead to improved corporate governance, reduced environmental impact, and the creation of more sustainable products and services. Ethical investing also encourages companies to adopt better practices, as they become more accountable to investors and stakeholders who prioritize ethical considerations.

Absolutely! Ethical investing is not about sacrificing financial performance. In fact, many studies and analyses suggest that companies with strong ESG ratings often outperform their peers in the long term. Ethical investing focuses on identifying companies that are well-managed, financially stable, and committed to sustainable practices. These companies tend to have a competitive advantage, attract and retain talent, and foster innovation, all of which contribute to better financial performance. Additionally, ethical investing can provide diversification benefits, as it allows investors to access a wide range of investment opportunities across various sectors and industries.