Genesis Investing is a relatively new concept in the financial world, offering an alternative approach to traditional investment strategies. This innovative method has gained attention for its unique take on wealth generation and portfolio management. The question of whether Genesis Investing works is a complex one, as it involves understanding the underlying principles and strategies employed by this investment approach. This paragraph aims to provide an overview, exploring the key aspects that contribute to its effectiveness and potential benefits for investors.

What You'll Learn

- Long-Term Perspective: Focus on long-term gains, not short-term market fluctuations

- Diversification: Spread investments across various assets to reduce risk

- Fundamental Analysis: Study company fundamentals for informed investment decisions

- Risk Management: Implement strategies to minimize potential losses

- Compounding Returns: Reinvest profits to accelerate wealth growth over time

Long-Term Perspective: Focus on long-term gains, not short-term market fluctuations

In the world of investing, it's easy to get caught up in the excitement of short-term market gains and the fear of missing out. However, a long-term perspective is crucial for building wealth and achieving financial success. While short-term market fluctuations can be tempting, they often lead to impulsive decisions that can have negative consequences. Instead, investors should focus on the long-term gains that can be achieved through a well-thought-out investment strategy.

One of the key benefits of a long-term perspective is the ability to ride out market volatility. Short-term market fluctuations can be unpredictable and often driven by emotional responses or external factors. By focusing on the long-term, investors can avoid the temptation to make impulsive decisions based on fear or greed. Instead, they can stick to their investment plan and benefit from the power of compounding returns over time.

A long-term perspective also allows investors to take advantage of the power of diversification. By spreading investments across different asset classes, sectors, and geographic regions, investors can reduce their risk exposure and smooth out the impact of market downturns. Diversification helps to ensure that the portfolio is not overly exposed to any one investment or market segment, providing a more stable and consistent return over the long term.

Additionally, a long-term perspective encourages investors to adopt a disciplined approach to investing. This means setting clear investment goals, regularly reviewing and rebalancing the portfolio, and making informed decisions based on research and analysis. By taking a disciplined approach, investors can avoid emotional decision-making and focus on making rational choices that align with their long-term financial objectives.

Finally, a long-term perspective allows investors to benefit from the power of compounding returns. Over time, even modest investment returns can accumulate to significant gains. By reinvesting dividends and capital gains, investors can build a substantial nest egg that grows exponentially over the years. This is especially true for long-term investments in companies with strong growth potential, as their value can increase significantly over time.

In conclusion, a long-term perspective is essential for successful investing. By focusing on long-term gains, investors can avoid the pitfalls of short-term market fluctuations, take advantage of diversification, adopt a disciplined approach, and benefit from the power of compounding returns. While it may require patience and discipline, a long-term investment strategy can lead to substantial wealth accumulation and financial security.

Blockchain Bets: Exploring Investment Opportunities Beyond Cryptocurrencies

You may want to see also

Diversification: Spread investments across various assets to reduce risk

Diversification is a fundamental strategy in investing that aims to minimize risk and maximize returns by spreading your investments across a variety of assets. This approach is based on the idea that not all investments will perform well at the same time, and by diversifying, you can protect your portfolio from significant losses in any one area. Here's a detailed breakdown of how diversification works and why it's a crucial component of a successful investment strategy:

Understanding Risk and Return: In investing, risk and return are closely intertwined. Generally, higher potential returns are associated with higher-risk investments. For instance, stocks often offer the potential for significant gains but also carry a higher risk of loss compared to more stable assets like bonds or cash equivalents. Diversification allows you to balance these risks by allocating your investments in a way that no single asset or asset class dominates your portfolio.

Asset Allocation: This is the process of dividing your investment capital among different asset classes such as stocks, bonds, cash, real estate, and commodities. The goal is to create a balanced portfolio that aligns with your investment goals, risk tolerance, and time horizon. For example, a young investor with a long-term investment horizon might allocate a larger portion of their portfolio to stocks, while an older investor approaching retirement might favor more conservative investments like bonds and cash.

Benefits of Diversification: By diversifying, you can achieve several key benefits. Firstly, it reduces the impact of market volatility. When certain assets in your portfolio perform poorly, others may perform well, thus offsetting potential losses. Secondly, it can help you achieve your investment goals more consistently. Diversification ensures that your portfolio's performance is not overly dependent on the performance of any single investment. Lastly, it can provide a more stable and consistent return over time, which is particularly important for long-term investors.

Implementing Diversification: There are several ways to diversify your investments. One common approach is to invest in a mix of asset classes. For instance, you could own stocks from various sectors, bonds from different countries, and alternative investments like real estate investment trusts (REITs) or commodities. Another strategy is to use mutual funds or exchange-traded funds (ETFs), which are baskets of securities that allow you to invest in a diverse range of assets with a single purchase.

Regular Review and Adjustment: Diversification is not a one-time task but an ongoing process. It's essential to regularly review and adjust your portfolio to ensure it remains aligned with your investment objectives and risk tolerance. Market conditions change, and so should your asset allocation. For example, if you've allocated a significant portion of your portfolio to technology stocks and the sector experiences a downturn, you might consider rebalancing by selling some of these stocks and buying into other sectors or asset classes.

Hydrogen's Future: Invest Now

You may want to see also

Fundamental Analysis: Study company fundamentals for informed investment decisions

Fundamental analysis is a critical approach to evaluating the intrinsic value of a company, which is a cornerstone of informed investment decisions. This method involves a deep dive into the financial, operational, and market aspects of a business to assess its current and future performance. By studying these fundamentals, investors can make more accurate predictions about a company's potential, which is essential for strategic investing.

The process begins with a thorough examination of the company's financial statements, including the balance sheet, income statement, and cash flow statement. These documents provide a snapshot of the company's financial health, revenue, expenses, assets, liabilities, and cash position. Investors should look for trends, such as consistent revenue growth, stable cash flow, and a healthy balance sheet, which are indicators of a robust and sustainable business. For instance, a company with a strong balance sheet might have a low debt-to-equity ratio, indicating that it relies less on debt financing and is more financially stable.

Beyond the financial data, fundamental analysis also involves assessing the company's management team, business model, and competitive advantages. A strong management team with a proven track record of successful decision-making and strategic implementation is a significant positive. Investors should also evaluate the company's business model, understanding its revenue streams, cost structure, and the barriers to entry in its industry. For example, a company with a unique and proprietary technology or a strong market position in a niche industry might have a competitive edge that is difficult for rivals to replicate.

Market analysis is another crucial component of fundamental analysis. This includes studying industry trends, market share, and the company's position within its industry. Investors should identify the company's competitors and assess their strengths and weaknesses to understand the company's market dynamics. For instance, a company that has successfully navigated industry disruptions or has a strong market share in a growing sector might be a more attractive investment.

By combining these various aspects of fundamental analysis, investors can make well-informed decisions. This approach allows for a comprehensive understanding of the company's value, risks, and potential for growth, enabling investors to make strategic choices that align with their investment goals and risk tolerance. In summary, fundamental analysis is a powerful tool for investors to evaluate companies and make informed decisions, ensuring that their investments are based on a solid understanding of the business and its prospects.

Strategic Retirement: Investing $700,000 for a Secure Future

You may want to see also

Risk Management: Implement strategies to minimize potential losses

Risk management is a critical component of any investment strategy, especially when it comes to generative investing. This approach, which involves using artificial intelligence and machine learning to automate investment decisions, can be highly effective but also carries inherent risks. To ensure the success of your generative investing endeavors, it's essential to implement robust risk management strategies. Here's a detailed guide on how to minimize potential losses:

- Diversification: One of the fundamental principles of risk management is diversification. In the context of generative investing, this means spreading your investments across various assets, sectors, and geographic regions. By diversifying, you reduce the impact of any single investment's performance on your overall portfolio. For example, if you're using generative models to trade stocks, consider allocating your capital to a mix of large-cap, mid-cap, and small-cap companies across different industries. This approach helps to mitigate the risk associated with market volatility and specific industry downturns.

- Risk Assessment and Monitoring: Regularly assess and monitor the risks associated with your generative investing strategy. This involves identifying potential sources of risk, such as market fluctuations, technological failures, or data inaccuracies. Develop a comprehensive risk assessment framework that includes historical data analysis, stress testing, and scenario analysis. By monitoring these risks, you can quickly identify any deviations from expected performance and take appropriate actions to mitigate them. For instance, set up automated alerts for significant price movements or unusual trading patterns, allowing you to intervene promptly.

- Position Sizing and Stop-Loss Orders: Determine appropriate position sizes for each investment to manage risk effectively. A common strategy is to use a fixed percentage of your portfolio for each trade, ensuring that no single investment dominates your holdings. Additionally, implement stop-loss orders to automatically sell assets if they reach a certain price threshold. This strategy limits potential losses by automatically locking in a loss when the market moves against your position. For example, you could set a stop-loss order at a 2% loss from the purchase price, ensuring that you sell if the asset price drops by that amount.

- Risk-Adjusted Performance Metrics: Evaluate the performance of your generative investing strategy using risk-adjusted metrics such as the Sharpe ratio or Sortino ratio. These metrics provide a more comprehensive view of risk-adjusted returns, helping you understand the strategy's effectiveness in generating returns relative to the risk taken. By regularly analyzing these metrics, you can identify areas for improvement and make informed decisions to enhance your risk management approach.

- Continuous Learning and Adaptation: Generative investing is an evolving field, and your risk management strategies should adapt accordingly. Stay updated with the latest research, market trends, and technological advancements in the field. Continuously refine your risk management techniques by learning from past experiences and market events. This iterative process ensures that your risk management approach remains effective and relevant in a dynamic investment landscape.

By implementing these risk management strategies, you can significantly enhance the resilience of your generative investing portfolio. Remember, effective risk management is an ongoing process that requires vigilance, adaptability, and a deep understanding of your investment strategy.

Investing: Nice People, Psychopaths?

You may want to see also

Compounding Returns: Reinvest profits to accelerate wealth growth over time

Compounding returns is a powerful strategy that can significantly accelerate wealth growth over time. It involves reinvesting the profits generated from your investments back into the same or similar investments, allowing your wealth to grow exponentially. This concept is often associated with the famous quote by Albert Einstein, who referred to compounding as the "eighth wonder of the world."

The beauty of compounding returns lies in its ability to create a snowball effect. When you reinvest your earnings, you earn interest or dividends on the initial investment, and then on the accumulated interest or dividends. This process repeats, leading to a rapid increase in the overall value of your portfolio. For example, if you invest $1,000 and it generates a 10% return, you will have $1,100 at the end of the year. Reinvesting this $1,100 will result in a higher return in the subsequent year, and so on. Over time, this can lead to substantial wealth accumulation.

To maximize compounding returns, it is essential to start early and be consistent. The power of compounding is most effective when applied over an extended period. By investing regularly, even small amounts, and allowing the reinvestment of profits, you can build a substantial nest egg. For instance, consider the story of Warren Buffett, who, through his disciplined approach to reinvesting profits and a long-term investment horizon, became one of the wealthiest individuals in the world.

Diversification is another key aspect of achieving compounding returns. By spreading your investments across different asset classes, sectors, and industries, you reduce risk and increase the potential for long-term growth. This strategy ensures that even if some investments underperform, others may compensate, providing a steady stream of reinvestment opportunities. For instance, investing in a mix of stocks, bonds, and real estate can offer a balanced approach to wealth accumulation.

In summary, compounding returns is a strategy that can transform your financial journey. By reinvesting profits, you can harness the power of exponential growth, turning your investments into a powerful tool for wealth creation. It requires discipline, consistency, and a long-term perspective, but the potential rewards are significant. Understanding and implementing this strategy can be a game-changer for anyone looking to build a robust financial future.

Retirement Planning: Navigating Your Investment Journey

You may want to see also

Frequently asked questions

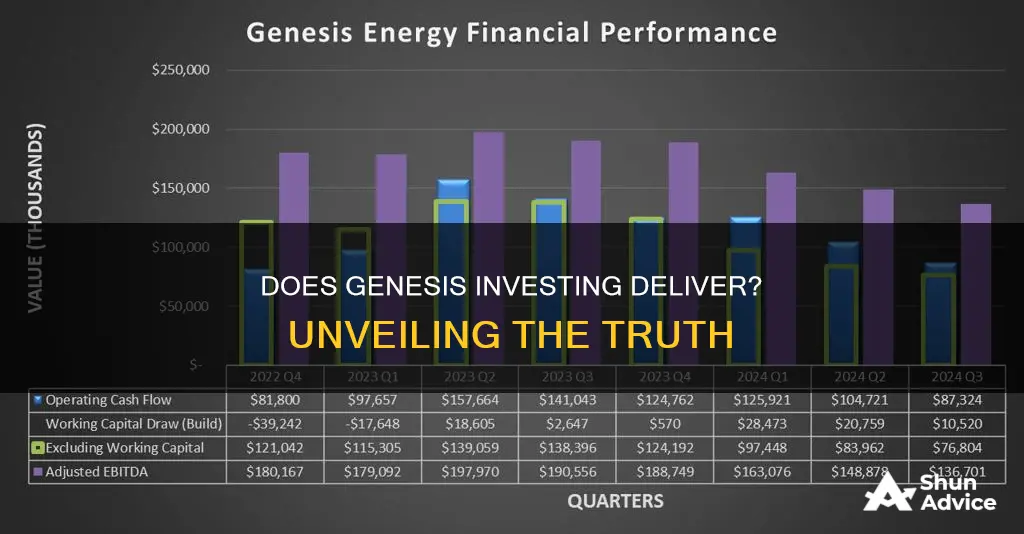

Genesis Investing is a platform that connects investors with startups and small businesses seeking funding. It operates on a peer-to-peer lending model, allowing investors to lend money to these companies in exchange for interest and potential returns. The process involves a thorough evaluation of the business's financial health, growth potential, and the amount of funding required. Investors can choose to lend in various ways, such as providing a one-time loan or participating in a crowdfunding campaign.

This platform offers several advantages for both investors and borrowers. For investors, it provides an opportunity to diversify their portfolios by investing in various industries and business models. The potential for higher returns compared to traditional savings accounts is a significant draw. Investors can also benefit from the platform's security measures, which include thorough borrower screening and the use of smart contracts to ensure transparency and protect investments. For borrowers, Genesis Investing offers an alternative to traditional bank loans, often with more flexible terms and faster access to capital.

While Genesis Investing provides a secure environment for peer-to-peer lending, like any investment, there are risks involved. The platform does its best to mitigate these risks by conducting thorough due diligence on borrowers and offering tools for investors to manage their portfolios. However, investors should be aware that there is always a possibility of default, especially with small businesses. It is recommended to diversify investments and carefully assess the creditworthiness of borrowers before lending. The platform also provides resources and educational materials to help investors make informed decisions.