The Rule of 72 is a formula used by investors to estimate how long it will take to double their investment. It's a quick and easy method that assumes a fixed annual rate of return. The rule is most accurate for rates of return of 5% to 10% and can be adjusted for rates outside this range. For example, if you want to double your money in 3 years, you will need a 24% rate of return on your investment.

| Characteristics | Values |

|---|---|

| Formula | The Rule of 72 |

| How it works | Divide 72 by the number of years you want to double your money in to get the rate of return you need |

| Example | If you want to double your money in 3 years, you need a 24% rate of return |

| Accuracy | The Rule of 72 is most accurate for rates of return of 5% to 10% |

What You'll Learn

The Rule of 72

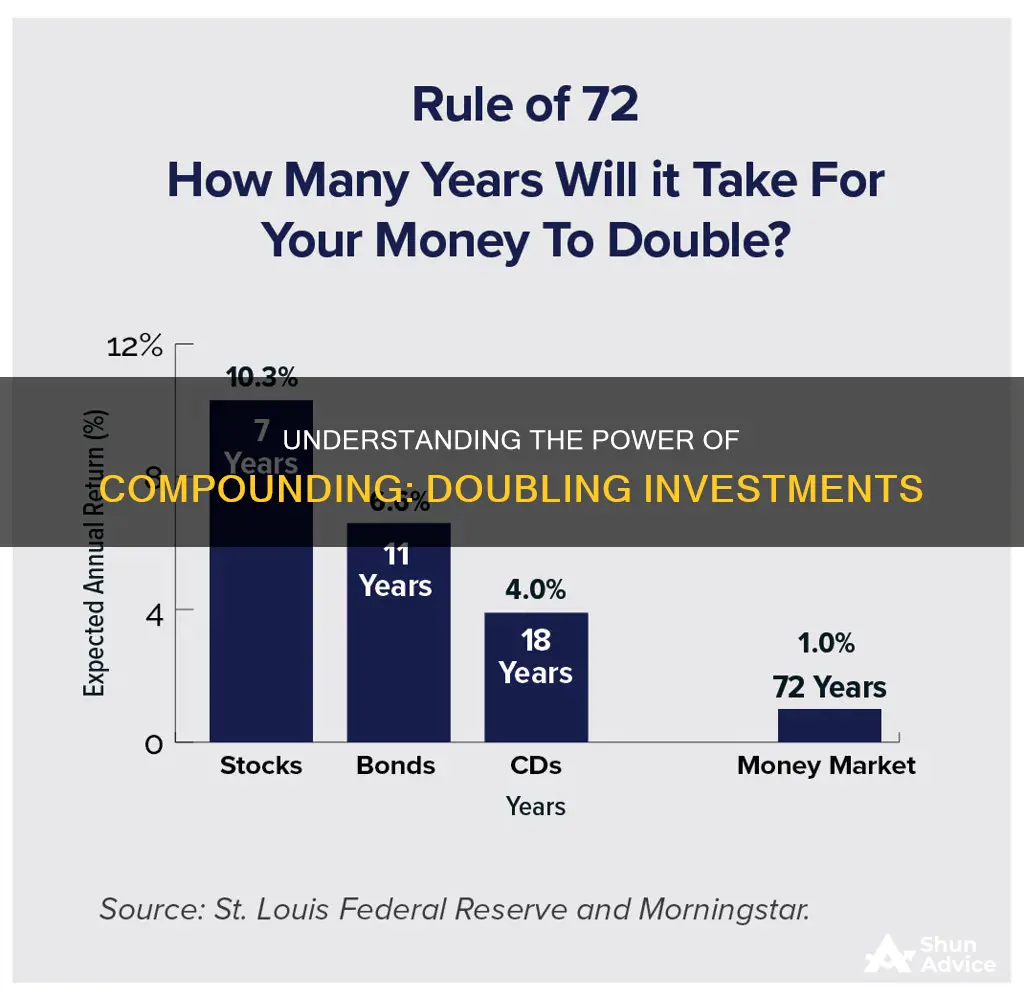

To use the Rule of 72, you divide 72 by the annual rate of return you expect to receive on your investment. For example, if you expect to earn an 8% annual return on your investment, it will take approximately (72 / 8) = 9 years to double your money.

Budget Surplus Impact: Interest Rates and Investments

You may want to see also

How to calculate the interest rate

The Rule of 72 is a formula used by investors to estimate the amount of time it will take to double their investment. It is most accurate for rates of return of 5% to 10%.

To calculate the interest rate, you can reverse the equation. For example, if you want to double your money in three years, divide 72 by three to get 24. This means you will need a 24% rate of return on your investment.

If you want to calculate the exact doubling time for an investment earning a compounded interest rate of r% per period, you can use the following formula:

> To find out exactly how long it would take to double an investment that returns 8% annually, you would use the following equation: ... As you can be seen, this result is very close to the approximate value obtained by (72 / 8) = 9 years.

The Rule of 72 can be adjusted by adding or subtracting one from 72 for every three points the interest rate diverges from the 8% threshold. For example, if the interest rate is 11%, you would subtract one from 72 to get 71. This means it would take approximately 71/11 = 6.45 years to double the investment.

Understanding Investment Interest: How to Make Your Money Work

You may want to see also

How long it takes to quadruple your money

The Rule of 72 is a formula used by investors to estimate the amount of time it will take to double their investment. The rule is most accurate for rates of return of 5% to 10%.

The Rule of 72 can be used to calculate how long it will take to quadruple your money. If you can double your money in seven years, you can quadruple it in 14 years by allowing the interest to compound.

For example, if you want to double your money in three years, you will need a 24% rate of return on your investment. If you decide to leave your money invested for another six to seven years, it will double two more times.

The Rule of 72 provides only an estimate, but the estimate can be adjusted by adding or subtracting one from 72 for every three points the interest rate diverges from the 8% threshold.

Keynesian Theory: Interest Rates and Investment Insights

You may want to see also

How compound interest works with debt

The Rule of 72 is a formula used by investors to estimate the amount of time it will take to double their investment. The rule is most accurate for rates of return of 5% to 10%. For example, if you want to double your money in 3 years, you will need a 24% rate of return on your investment.

The Rule of 72 can also be applied to debt. For example, if you have credit card debt with an annual interest rate of 20%, the amount you owe will double in 3 and a half years, even if you make the minimum monthly payments.

Compound interest can work for or against you, depending on whether you are investing or in debt. When you have money invested, compound interest works in your favour, helping you to grow your wealth over time. However, when you are in debt, compound interest works against you, increasing the amount you owe over time.

The effect of compound interest on debt can be significant, especially when it comes to high-interest debt such as credit cards. Even if you are only making the minimum monthly payments, the interest will continue to accrue, causing your debt to grow larger over time. This can make it difficult to get out of debt, as the longer you take to pay it off, the more you will end up owing.

It is important to understand how compound interest works with debt so that you can make informed financial decisions. By knowing the potential impact of compound interest, you can prioritise paying off high-interest debt and avoid taking on more debt than you can afford to repay.

Interest Rates: Impacting Investment Strategies and Returns

You may want to see also

How to double your investment in a savings account

The Rule of 72 is a formula used by investors to estimate the amount of time it will take to double their investment. The formula is: 72 / r = number of years to double investment. For example, if you want to double your money in 3 years, you will need a 24% rate of return on your investment (72 / 3 = 24).

The Rule of 72 is most accurate for rates of return of 5% to 10%. The formula can be adjusted for rates outside this range by adding or subtracting 1 from 72 for every 3 points the interest rate diverges from 8%. For example, if the interest rate is 14%, you would use 70 instead of 72 in the formula (72 - 2 = 70).

It's important to note that the Rule of 72 only provides an estimate and does not account for the impact of taxes, fees, or other factors that may affect the actual time it takes to double your investment.

To double your investment in a savings account, you can use the Rule of 72 to determine the rate of return you need to achieve your goal. For example, if you want to double your money in 5 years, you will need a 14.4% rate of return (72 / 5 = 14.4). You can then shop around for savings accounts that offer this rate of return or close to it. It's important to consider the risks and fees associated with different savings accounts and to remember that past performance is not a guarantee of future results.

Foreign Investments: Interest Rates and Their Intricate Relationship

You may want to see also

Frequently asked questions

This depends on the interest rate. You can use the Rule of 72 to estimate the amount of time it will take to double your investment. Divide 72 by the interest rate to get the number of years it will take to double your investment. For example, if you have an interest rate of 8%, it will take 9 years to double your investment (72/8=9).

The Rule of 72 is a formula used by investors to estimate the amount of time it will take to double their investment. It is most accurate for rates of return of 5% to 10%.

You can reverse the Rule of 72 equation. For example, if you want to double your money in 3 years, divide 72 by 3 to get 24. You will need a 24% rate of return on your investment.

Compound interest works against you when you have debt. For example, if you have credit card debt with an annual interest rate of 20%, the amount you owe will double in 3 and a half years even if you make the minimum monthly payments.