Drip investing, also known as dollar-cost averaging, is a long-term investment strategy where investors regularly invest a fixed amount of money at regular intervals, regardless of the asset's price. This approach allows investors to buy more shares when prices are low and fewer when prices are high, potentially reducing risk and increasing returns over time. By consistently investing, drip investors benefit from the power of compounding, where their initial investment grows exponentially as they continue to add to their portfolio. This method is particularly effective for long-term goals like retirement, as it provides a disciplined approach to investing and helps investors stay committed to their financial plans.

What You'll Learn

- Definition: Drip investing is a strategy where you invest a fixed amount regularly

- Frequency: Set a schedule, like monthly, to invest a set sum

- Dollar-Cost Averaging: This method reduces risk by spreading out investments over time

- Long-Term Benefits: Drip investing can lead to significant gains over time due to compounding

- Diversification: It encourages investing in a variety of assets to minimize risk

Definition: Drip investing is a strategy where you invest a fixed amount regularly

Drip investing, also known as dollar-cost averaging, is a long-term investment strategy that involves investing a fixed amount of money at regular intervals, regardless of the asset's price. This approach is particularly popular among investors who want to build a diversified portfolio over time without the stress of market volatility. Here's a detailed definition and explanation of how it works:

In drip investing, investors commit to investing a predetermined sum, often a set percentage of their income or a fixed amount, at regular intervals. For example, an investor might choose to invest $100 every month in a stock market index fund. This strategy is designed to smooth out the impact of market fluctuations, as it allows investors to buy more shares when prices are low and fewer when prices are high. Over time, this regular investment pattern can lead to a substantial accumulation of shares, providing a cost-effective way to build wealth.

The key principle behind drip investing is the removal of the emotional aspect of market timing. Instead of trying to predict the market's peaks and troughs, investors simply invest a fixed amount regularly. This disciplined approach ensures that investors buy more shares when the market is down, which can be advantageous in the long term as it provides an opportunity to purchase shares at a lower average cost.

This strategy is often associated with mutual funds and exchange-traded funds (ETFs), which offer the option to invest a fixed amount regularly. Investors can choose to invest in a single fund or diversify their portfolio by investing in multiple funds. Drip investing is a long-term strategy, and it is recommended to maintain this approach for several years to benefit from the power of compounding and to potentially overcome short-term market volatility.

By investing a fixed amount regularly, drip investors can benefit from the average cost principle, where the overall cost of their investments is reduced over time. This strategy is particularly effective for those who may not have a large sum to invest initially but can contribute a smaller amount consistently. It encourages a disciplined investment approach and can be a powerful tool for long-term wealth creation.

Pay Down the Mortgage or Invest: Where Should Your Money Go?

You may want to see also

Frequency: Set a schedule, like monthly, to invest a set sum

Drip investing, also known as dollar-cost averaging, is a long-term investment strategy that involves investing a fixed amount of money at regular intervals, such as monthly. This approach is particularly appealing to investors who want to build wealth over time without the stress of trying to time the market. Here's how it works and why setting a frequency is crucial:

When you choose to drip invest, you set a specific date and amount to invest each month. For example, you might decide to invest $500 every 30th of the month. This consistency is key to the strategy's success. By investing a fixed sum regularly, you buy more shares when prices are low and fewer when prices are high, which can help smooth out the market's volatility. Over time, this approach can lead to significant gains as the power of compounding takes effect.

The beauty of this strategy is its simplicity and the fact that it removes the emotional aspect of investing. Many investors make the mistake of trying to time the market, which often leads to poor decisions. Drip investing takes the emotion out of the equation by automating the process. You simply set your schedule and let the strategy work its magic.

To implement this strategy, you can start by choosing a suitable investment vehicle, such as a mutual fund, exchange-traded fund (ETF), or a brokerage account that offers fractional shares. Many online brokerage platforms now offer drip-investing features, allowing you to set up automatic transfers on a regular basis. This makes it easy to stick to your investment plan and build wealth over the long term.

The frequency of your investments is a critical component of this strategy. By investing monthly, you are averaging out the market's performance over time. This means that you are less likely to experience significant losses during market downturns, as your investments are spread out. Additionally, this approach encourages a long-term perspective, which is essential for building wealth in the stock market.

In summary, drip investing is a powerful tool for anyone looking to build wealth over time. By setting a regular schedule to invest a fixed sum, you can take advantage of the market's long-term growth potential while minimizing the impact of short-term volatility. This strategy is particularly well-suited for beginners who want a simple, automated approach to investing.

Oregon's Investment Hotspots

You may want to see also

Dollar-Cost Averaging: This method reduces risk by spreading out investments over time

Dollar-cost averaging is a strategy that can help investors manage risk and build wealth over time. This method involves investing a fixed amount of money at regular intervals, regardless of the asset's price. By doing so, investors can avoid the pitfalls of market volatility and emotional decision-making.

The core principle behind dollar-cost averaging is simple: instead of trying to time the market, you invest a set amount of money at regular intervals. For example, an investor might choose to invest $100 every month in a particular stock or fund. This approach is particularly effective when the market is volatile, as it smooths out the impact of price fluctuations. When the market is high, your investments will buy fewer shares, and when the market is low, you'll purchase more shares, thus averaging out the cost per share over time.

This strategy is often compared to buying a gallon of milk every day at a different price. If you buy milk when it's on sale, you save money, but if you buy it when it's more expensive, you pay more. Dollar-cost averaging works similarly; you invest more when prices are low and less when prices are high, which can lead to significant savings over time.

One of the key benefits of this approach is its simplicity. It removes the stress and complexity of trying to predict market movements. By investing a fixed amount regularly, investors can focus on their long-term financial goals without the anxiety of market fluctuations. This method is particularly appealing to those who prefer a more passive investment approach, allowing them to build a diversified portfolio without constant monitoring.

Additionally, dollar-cost averaging encourages investors to remain committed to their investment strategy. By investing regularly, investors are more likely to weather short-term market downturns and benefit from the long-term growth potential of their investments. This disciplined approach can lead to substantial wealth accumulation over time, making it a valuable tool for long-term investors.

California's Cap and Trade Success: A Green Revolution?

You may want to see also

Long-Term Benefits: Drip investing can lead to significant gains over time due to compounding

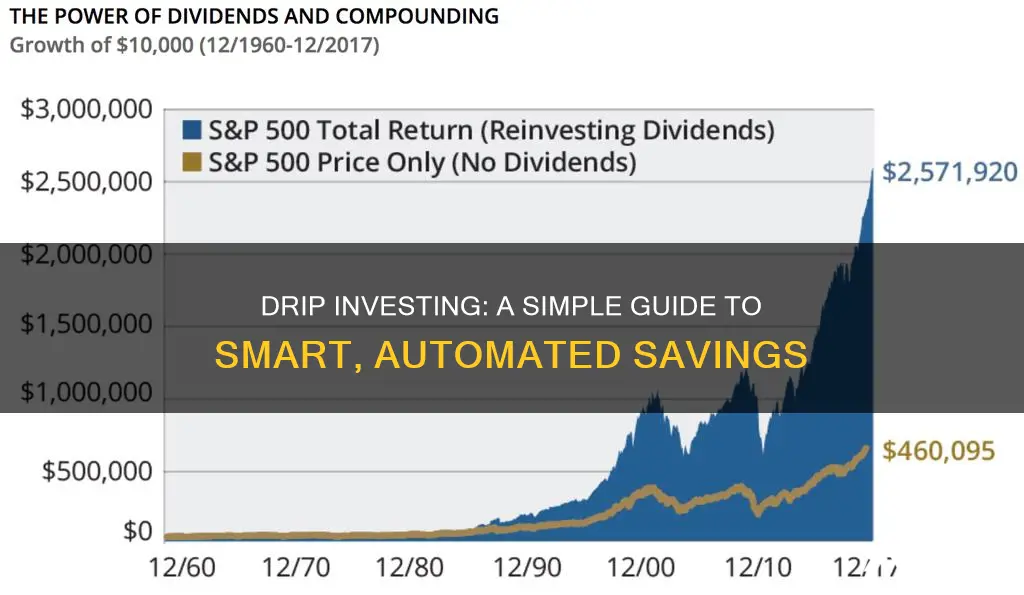

Drip investing, also known as dollar-cost averaging, is a long-term investment strategy that involves investing a fixed amount of money at regular intervals, regardless of the asset's price. This approach is particularly effective for long-term investors as it offers several advantages, especially when it comes to long-term wealth accumulation. One of the key benefits of drip investing is the power of compounding.

Compounding is the process where the interest or returns earned on an investment are reinvested, generating additional returns over time. In the context of drip investing, this means that as you consistently invest small amounts, these investments earn returns, and the subsequent investments are made with the newly accumulated wealth. As a result, your initial investment grows exponentially. For example, if you invest $100 every month in a stock index fund, and the fund has an average annual return of 7%, after 10 years, your total investment could be worth approximately $23,000, assuming no withdrawals. Over 20 years, this strategy could lead to a substantial amount, demonstrating the power of compounding.

The beauty of drip investing lies in its ability to smooth out market volatility. When the market is high, your regular investments buy fewer shares, and when it's low, you purchase more. This strategy ensures that you're buying more shares when prices are low, which can be advantageous in the long run. Over time, this approach can lead to a higher average cost per share, but it also means that you're acquiring a larger number of shares at a lower average cost, potentially increasing your overall returns.

Additionally, drip investing encourages a disciplined and patient approach to investing. By investing regularly, you avoid the temptation of trying to time the market, which can often lead to poor decisions. This strategy is particularly beneficial for long-term goals like retirement planning, where consistent contributions can result in substantial growth over several decades.

In summary, drip investing is a powerful tool for long-term wealth creation. Its ability to harness compounding returns, smooth out market volatility, and promote disciplined investing makes it an attractive strategy for those looking to build significant wealth over an extended period. By consistently investing a fixed amount, investors can take advantage of the market's long-term growth potential and achieve their financial goals.

Factors Fueling Investment Rise: Unlocking the Secrets to Financial Growth

You may want to see also

Diversification: It encourages investing in a variety of assets to minimize risk

Drip investing, also known as dollar-cost averaging, is a strategy that promotes a diversified investment approach, which is a key principle in managing risk. This method involves investing a fixed amount of money at regular intervals, regardless of the asset's price. By doing so, investors can avoid the pitfalls of market volatility and emotional decision-making.

The core idea behind diversification is to spread your investments across various assets, sectors, and industries. This strategy is often associated with mutual funds, exchange-traded funds (ETFs), and index funds, which offer instant diversification by pooling money from multiple investors. For instance, a mutual fund might invest in stocks, bonds, and real estate, providing investors with a well-rounded portfolio. This approach ensures that the impact of any single asset's poor performance is mitigated by the overall stability of the diversified portfolio.

In the context of drip investing, this diversification becomes even more critical. When you invest a fixed amount regularly, you buy more shares when prices are low and fewer when prices are high. This practice naturally leads to a more diverse holding, as the average cost of your investment changes over time. As a result, you're less likely to be heavily impacted by any one asset's decline, as your overall position is a mix of various investments.

This strategy is particularly effective in long-term wealth-building, as it allows investors to benefit from the power of compounding returns over time. By consistently investing, you're buying into the market's overall growth, and the diversification aspect ensures that your portfolio can weather various economic cycles. It's a strategy that encourages investors to remain committed to their investment plans, even during market downturns, as it provides a more stable and secure approach to building wealth.

In summary, drip investing, combined with diversification, offers a robust strategy for risk management and long-term financial growth. It encourages investors to take a disciplined approach, investing regularly and in a variety of assets, which can lead to more consistent and stable returns over time. This method is a powerful tool for those seeking to build a robust financial portfolio.

Smart Places to Invest $2K Right Now

You may want to see also

Frequently asked questions

Drip investing, also known as dollar-cost averaging, is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of the asset's price. This approach allows investors to buy more shares when prices are low and fewer when prices are high, potentially reducing risk over time.

Imagine you invest $100 every month in a stock or index fund. If the market is volatile, your $100 will buy more shares when the price is low and fewer when it's high. Over time, this strategy can lead to a more consistent investment performance and potentially better long-term returns.

Drip investing offers several advantages. Firstly, it removes the emotional stress of trying to time the market. Secondly, it provides a disciplined approach to investing, ensuring regular contributions. This strategy is particularly effective for long-term goals, such as retirement planning, as it allows investors to benefit from compounding returns over an extended period.