Pensco, a leading provider of retirement plan solutions, often collaborates with investment advisors to offer comprehensive financial services. This partnership allows Pensco to provide tailored retirement plan solutions, ensuring that advisors can effectively manage their clients' investments and retirement portfolios. By working together, Pensco and investment advisors can offer a wide range of investment options, financial advice, and retirement planning services, ultimately helping clients achieve their financial goals and secure their future.

| Characteristics | Values |

|---|---|

| Does Pensco Work with Investment Advisors? | Yes, Pensco offers services that can be utilized by investment advisors. They provide tools and resources to help advisors manage client portfolios and offer retirement plan services. |

| Pensco's Role | Pensco acts as a recordkeeper and administrator for retirement plans, including 401(k), 403(b), and 457 plans. They also provide investment management services and can work with investment advisors to manage these plans. |

| Advisor Benefits | Investment advisors can benefit from Pensco's expertise in plan administration, investment management, and compliance. Pensco's platform allows advisors to efficiently manage multiple client accounts and provides access to a range of investment options. |

| Collaboration | Pensco facilitates collaboration between investment advisors and plan participants. Advisors can communicate with plan participants through Pensco's platform, providing updates and educational resources. |

| Compliance and Reporting | Pensco ensures compliance with regulatory requirements and provides comprehensive reporting. This helps advisors stay informed about plan performance and participant data. |

| Technology | Pensco offers advanced technology solutions, including an online portal, to support investment advisors. The portal enables advisors to access client information, manage accounts, and monitor plan performance. |

| Customer Support | Pensco provides dedicated customer support to assist investment advisors with any queries or issues they may encounter. |

What You'll Learn

- Pensco's Role: Facilitating advisor-client communication and compliance

- Advisor Benefits: Access to Pensco's tools and resources for efficient portfolio management

- Pensco's Expertise: Providing investment advice and tax-efficient solutions for advisors

- Collaboration: Pensco and advisors work together to optimize client portfolios

- Regulatory Compliance: Pensco ensures advisors adhere to investment regulations and tax laws

Pensco's Role: Facilitating advisor-client communication and compliance

Pensco, a leading provider of retirement services, plays a crucial role in facilitating effective communication and ensuring compliance between investment advisors and their clients. This is particularly important in the complex world of retirement planning and investment management. Here's how Pensco contributes to this process:

Streamlining Communication Channels: Pensco understands that efficient communication is vital for advisor-client relationships. They provide a dedicated platform or interface that connects advisors and clients, ensuring that all relevant information is exchanged securely and promptly. This platform might include features like secure messaging, document sharing, and real-time updates, allowing advisors to provide timely advice and clients to stay informed about their retirement plans. By centralizing communication, Pensco reduces the chances of miscommunication and ensures that advisors can deliver personalized services.

Compliance and Regulatory Support: Investment advisors must navigate a complex web of regulations to ensure they act in their clients' best interests. Pensco offers a comprehensive suite of compliance tools and resources to assist advisors in meeting these obligations. This includes automated reporting systems, compliance training materials, and regular updates on regulatory changes. By providing these resources, Pensco helps advisors stay informed about legal and ethical requirements, reducing the risk of unintentional non-compliance.

Client Data Management: Effective advisor-client communication relies on accurate and up-to-date client data. Pensco's platform enables advisors to manage and update client information efficiently. This includes personal details, financial goals, risk tolerance, and investment preferences. By having a centralized database, advisors can quickly access relevant information, ensuring that advice is tailored to each client's needs. Moreover, Pensco's data management system can help advisors identify clients who may require additional support or those who have not engaged in a while, fostering a proactive approach to client care.

Educational Resources: Pensco also contributes to advisor-client communication by providing educational resources. These resources can include webinars, articles, and tutorials on various retirement planning topics. By offering such content, Pensco empowers advisors to educate their clients, helping them make informed decisions. Additionally, Pensco's resources can assist advisors in staying updated on industry trends and best practices, further enhancing their ability to provide valuable advice.

In summary, Pensco's role in facilitating advisor-client communication and compliance is essential for maintaining trust and ensuring the best possible retirement outcomes for clients. Through their communication platforms, compliance support, data management, and educational resources, Pensco empowers investment advisors to deliver exceptional service while adhering to the highest standards of professionalism and regulatory compliance. This collaborative approach benefits both advisors and clients, fostering a more secure and efficient retirement planning process.

Strategic Investing: Unlocking the Key to Mortgage Freedom

You may want to see also

Advisor Benefits: Access to Pensco's tools and resources for efficient portfolio management

Pensco, a leading provider of retirement plan solutions, offers a range of tools and resources specifically designed to support investment advisors in efficiently managing their clients' portfolios. These resources are tailored to meet the unique needs of advisors, ensuring they have the necessary support to deliver exceptional service. Here's an overview of the benefits advisors can gain from Pensco's comprehensive platform:

Streamlined Portfolio Management: Pensco's platform equips advisors with a user-friendly interface, enabling them to efficiently manage multiple client portfolios. Advisors can easily track and analyze investment performance, identify trends, and make data-driven decisions. The platform's real-time data and analytics provide a comprehensive view of each client's holdings, allowing advisors to stay informed and responsive to market changes. This streamlined approach saves advisors valuable time, enabling them to focus on strategic planning and client engagement.

Comprehensive Research and Education: Pensco understands the importance of knowledge in the investment world. They provide advisors with access to an extensive library of research materials, market insights, and educational resources. This includes industry reports, economic forecasts, and in-depth analysis of various investment strategies. By staying informed, advisors can offer valuable insights to their clients, helping them make well-informed investment choices. Pensco's commitment to education ensures that advisors can continuously enhance their skills and provide the highest level of expertise.

Automated Compliance and Reporting: Compliance with regulatory requirements is a critical aspect of investment advisory. Pensco's platform automates many compliance tasks, ensuring advisors can focus on their core responsibilities. The system generates accurate and timely reports, helping advisors stay on top of their legal obligations. This automation reduces the risk of errors and saves advisors significant time and effort in maintaining compliance documentation.

Personalized Client Portfolios: Pensco's tools allow advisors to create customized client portfolios tailored to individual needs. Advisors can select specific investments, set performance targets, and define risk tolerances. This personalized approach ensures that each client's portfolio aligns with their unique financial goals and objectives. By offering tailored solutions, advisors can build stronger relationships with their clients and provide a more comprehensive service.

Real-Time Client Communication: Effective communication is vital for advisor-client relationships. Pensco's platform facilitates real-time communication, allowing advisors to promptly address client inquiries and concerns. Advisors can send and receive messages, share portfolio updates, and provide educational materials instantly. This level of engagement ensures clients feel valued and informed, fostering trust and long-term loyalty.

In summary, Pensco's collaboration with investment advisors is designed to empower advisors with efficient portfolio management tools, comprehensive research, compliance support, and personalized client services. By leveraging Pensco's resources, advisors can enhance their capabilities, deliver exceptional client experiences, and achieve their professional goals.

Investment: The Spark to Ignite Employee Engagement

You may want to see also

Pensco's Expertise: Providing investment advice and tax-efficient solutions for advisors

Pensco, a leading provider of retirement plan solutions, has established itself as a trusted partner for investment advisors seeking to enhance their clients' financial well-being. With a comprehensive understanding of the investment landscape, Pensco offers a unique value proposition to advisors, enabling them to provide tailored and tax-efficient solutions to their clients.

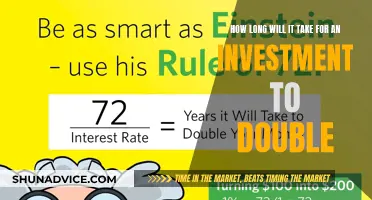

The company's expertise lies in its ability to offer a wide range of investment options, catering to diverse client needs. Pensco provides access to a vast array of investment vehicles, including mutual funds, ETFs, and individual stocks, allowing advisors to construct customized portfolios aligned with their clients' financial goals. By leveraging Pensco's extensive investment platform, advisors can offer their clients a comprehensive suite of investment choices, ensuring they can build portfolios that suit various risk tolerances and objectives.

One of Pensco's key strengths is its focus on tax-efficient strategies. The company understands the importance of minimizing tax liabilities for investors, and it provides advisors with the tools and resources to implement effective tax-saving techniques. Pensco's tax-efficient solutions include tax-deferred growth, tax-free withdrawals, and strategic investment timing, all designed to help advisors optimize their clients' investment returns while minimizing tax impacts. By incorporating these strategies, advisors can enhance the overall performance of their clients' portfolios.

Pensco's commitment to providing investment advice goes beyond just offering investment options. The company offers comprehensive support and resources to help advisors educate and guide their clients. Pensco provides access to financial planning tools, market research, and educational materials, enabling advisors to deliver informed and personalized advice. Additionally, Pensco's team of experienced professionals is readily available to offer guidance and support, ensuring that advisors have the necessary resources to make well-informed decisions on behalf of their clients.

In summary, Pensco's expertise lies in its ability to provide investment advice and tax-efficient solutions tailored to the needs of investment advisors and their clients. With a comprehensive investment platform, a focus on tax-efficient strategies, and a commitment to supporting advisors, Pensco empowers financial professionals to deliver exceptional service. By partnering with Pensco, advisors can enhance their ability to meet client goals, optimize investment returns, and provide a comprehensive financial planning experience.

CSGO: Invest in Player Autographs

You may want to see also

Collaboration: Pensco and advisors work together to optimize client portfolios

Pensco, a leading provider of retirement plan solutions, understands the importance of collaboration when it comes to optimizing client portfolios. By working closely with investment advisors, Pensco aims to deliver exceptional service and help clients achieve their financial goals. This partnership approach is a key differentiator for Pensco, as it allows for a more tailored and comprehensive approach to retirement planning.

The collaboration between Pensco and investment advisors begins with a shared understanding of the client's needs and objectives. Pensco's team of experts works with advisors to gather detailed information about the client's financial situation, risk tolerance, and retirement goals. This comprehensive assessment forms the foundation for creating a customized portfolio strategy. By involving investment advisors in this process, Pensco ensures that the advice and recommendations are aligned with the advisor's expertise and the client's specific requirements.

Together, Pensco and advisors can leverage their combined knowledge and resources to make informed investment decisions. Pensco's platform provides advisors with access to a wide range of investment options, including mutual funds, ETFs, and alternative investments. This extensive selection allows advisors to construct diversified portfolios that are tailored to the client's risk profile and objectives. Pensco's technology and research capabilities also enable advisors to stay updated on market trends, regulatory changes, and investment opportunities, ensuring that the client's portfolio remains optimized over time.

Regular communication and performance reviews are essential components of this collaborative process. Pensco and advisors schedule periodic meetings to assess the client's portfolio performance, discuss any adjustments or rebalancing needs, and address any concerns or questions. This proactive approach ensures that the client's portfolio remains on track and aligned with their evolving circumstances. Additionally, Pensco provides advisors with comprehensive reporting and analytics tools, enabling them to provide transparent and detailed updates to their clients.

Through this collaborative effort, Pensco and investment advisors can deliver a high level of service and client satisfaction. By combining Pensco's retirement plan expertise with the advisors' investment knowledge, clients benefit from a comprehensive and integrated approach to retirement planning. This partnership model empowers advisors to provide their clients with the best possible guidance and support, ultimately leading to more successful and optimized investment outcomes.

Boyfriend's Priorities: Others First

You may want to see also

Regulatory Compliance: Pensco ensures advisors adhere to investment regulations and tax laws

Pensco, a leading provider of retirement services, understands the critical importance of regulatory compliance in the investment industry. They recognize that investment advisors must navigate a complex web of regulations and tax laws to ensure their clients' assets are managed ethically and legally. Here's how Pensco facilitates this crucial aspect of their partnership with investment advisors:

Comprehensive Regulatory Knowledge: Pensco's team is well-versed in the ever-evolving regulatory landscape surrounding investments. They stay updated on the latest rules and guidelines set by financial authorities, such as the SEC and IRS. This knowledge is crucial for advisors who need to make informed decisions and provide compliant advice to their clients. Pensco offers resources and training to keep advisors informed about regulatory changes, ensuring they can adapt their strategies accordingly.

Compliance Monitoring and Reporting: Pensco employs robust compliance monitoring systems to track advisors' activities and ensure they remain within legal boundaries. They provide advisors with the necessary tools and platforms to record and report their investment activities accurately. This includes transaction tracking, performance reporting, and client communication documentation. By doing so, Pensco helps advisors maintain transparency and accountability, reducing the risk of regulatory breaches.

Tax Law Expertise: Tax compliance is a critical aspect of investment advisory services. Pensco offers specialized knowledge in tax laws and provides advisors with resources to ensure their clients' investments are structured optimally while adhering to tax regulations. They assist in calculating and reporting tax-related information, helping advisors avoid potential penalties and legal issues. Pensco's tax expertise also includes staying updated on tax code changes, ensuring advisors can provide the most accurate and compliant advice.

Regular Audits and Reviews: Pensco conducts regular compliance audits and reviews to identify and rectify any potential issues. These audits involve examining advisors' practices, policies, and procedures to ensure they meet the required standards. By proactively identifying and addressing compliance gaps, Pensco helps advisors maintain a robust and compliant investment practice. This process also includes providing feedback and recommendations to improve overall compliance.

Pensco's commitment to regulatory compliance is a cornerstone of their partnership with investment advisors. By providing the necessary tools, knowledge, and support, Pensco empowers advisors to navigate the complex regulatory environment with confidence. This ensures that advisors can focus on delivering exceptional investment advice while maintaining the highest ethical and legal standards.

Investment Firm Etiquette: Dinner and a Deal?

You may want to see also

Frequently asked questions

Pensco, a leading provider of retirement plan solutions, offers a seamless partnership with investment advisors. They provide a comprehensive platform that enables advisors to offer tailored retirement strategies to their clients. Pensco's technology allows advisors to manage and monitor their clients' retirement accounts efficiently, ensuring a personalized and proactive approach to wealth management.

Absolutely! Investment advisors can leverage Pensco's extensive investment menu, which includes a wide range of mutual funds, ETFs, and other investment vehicles. Pensco's platform provides advisors with the tools to research, select, and recommend suitable investments for their clients' retirement portfolios. This collaboration empowers advisors to deliver informed advice and help clients make well-informed decisions.

Working with Pensco offers investment advisors several advantages. Firstly, Pensco's user-friendly interface simplifies account management, making it easier for advisors to track client performance and provide regular updates. Secondly, Pensco provides access to a diverse set of investment options, allowing advisors to create customized portfolios aligned with their clients' financial goals. Additionally, Pensco's retirement plan expertise and resources enable advisors to offer comprehensive retirement planning services, enhancing their overall client offering.