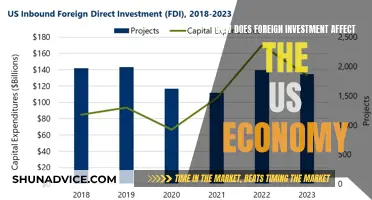

The concept of piggybacking, while often associated with internet usage and technology, can also be explored in the context of international business and finance. In this context, piggybacking refers to the practice of leveraging an existing business or investment to gain access to a new market or opportunity. This can be particularly relevant when discussing direct foreign investment (DFI), which involves a company investing in a foreign country by establishing a physical presence, acquiring assets, or forming partnerships. The question of whether piggybacking can directly contribute to DFI is an intriguing one, as it delves into the strategies and mechanisms through which companies can expand their global footprint while navigating the complexities of international markets.

What You'll Learn

- Piggybacking and FDI: How piggybacking services facilitate foreign direct investment

- Tax Incentives: Tax benefits for piggybacking companies attracting foreign investors

- Regulatory Framework: Legal and regulatory considerations for piggybacking in FDI

- Market Access: Piggybacking's role in providing foreign investors with market entry

- Risk Mitigation: How piggybacking reduces risks for foreign investors in new markets

Piggybacking and FDI: How piggybacking services facilitate foreign direct investment

Piggybacking, a practice where individuals or businesses gain access to a network or service by leveraging an existing connection, has become an increasingly relevant concept in the realm of international business and foreign direct investment (FDI). While it might seem counterintuitive, piggybacking services can indeed facilitate FDI, especially in today's interconnected global economy. This is particularly true for small and medium-sized enterprises (SMEs) and startups that often lack the resources and infrastructure to establish their own international presence.

In the context of FDI, piggybacking can take various forms. One common approach is for companies to utilize shared infrastructure and platforms that facilitate cross-border transactions. For instance, a company might partner with a local business in a target country to use their established supply chain or distribution network, thereby bypassing the need to invest in building these systems from scratch. This strategy can significantly reduce the time and cost associated with entering a new market, making it an attractive option for foreign investors.

Piggybacking services can also provide a pathway for FDI by offering a range of value-added services. These services might include market research, legal and regulatory compliance assistance, and even local market entry strategies. By providing these services, piggybacking platforms can help foreign investors navigate the complexities of entering a new market, thereby increasing the likelihood of successful FDI. This is especially beneficial for investors who are new to international business, as it provides them with the necessary support to make informed decisions.

Furthermore, piggybacking can foster a collaborative environment that encourages FDI. When companies or individuals piggyback on existing networks, they often gain access to a community of like-minded individuals or businesses. This community can provide a platform for knowledge sharing, networking, and even potential partnerships. Such a collaborative ecosystem can be a powerful magnet for FDI, as it creates a supportive environment where investors can exchange ideas, share risks, and collectively address challenges.

In summary, piggybacking services play a crucial role in facilitating FDI by providing a cost-effective and efficient way to enter new markets. Through shared infrastructure, value-added services, and collaborative communities, piggybacking platforms enable foreign investors to overcome the initial hurdles of international business. As a result, this practice can significantly contribute to the growth of FDI, particularly for SMEs and startups, by providing them with the necessary tools and support to succeed in the global marketplace.

Schwab Investment Strategies: A Beginner's Guide to Getting Started

You may want to see also

Tax Incentives: Tax benefits for piggybacking companies attracting foreign investors

Piggybacking, a strategy where a company leverages an existing infrastructure or platform to gain access to a market or service, can indeed be a powerful tool for attracting direct foreign investment. When it comes to tax incentives, governments often offer various benefits to encourage foreign investors to engage in piggybacking arrangements. These incentives are designed to stimulate economic growth, foster innovation, and create a favorable environment for international collaboration.

One of the primary tax benefits for piggybacking companies is the provision of tax credits or deductions. Governments may grant tax credits to foreign investors who establish or expand their operations through piggybacking. These credits can significantly reduce the tax liability of the investor, allowing them to retain more of their profits. For instance, a foreign investor might receive tax credits for research and development expenses incurred while setting up their piggybacked venture, which can be a substantial incentive, especially in knowledge-based industries.

Incentive programs often include tax breaks for the initial years of operation, providing a much-needed financial boost to new businesses. This initial tax relief can help piggybacking companies stabilize and grow, making them more attractive to foreign investors. Additionally, governments may offer tax deductions for expenses related to the establishment of the piggybacked venture, such as setup costs, licensing fees, and initial marketing expenses. These deductions can further enhance the financial viability of the investment.

Another aspect of tax incentives is the potential for reduced corporate tax rates. Governments might offer lower corporate tax rates specifically for companies engaging in piggybacking, especially if these companies meet certain criteria, such as creating a significant number of local jobs or contributing to specific economic development goals. Lower tax rates can make the overall cost of doing business in the country more competitive, encouraging foreign investors to choose this route.

Furthermore, tax incentives can also include the ability to claim tax credits for foreign-source income. When a piggybacking company generates revenue from international markets, it may be eligible to claim tax credits on the foreign-source income, which can help offset the tax burden in both the host country and the investor's home country. This aspect of tax incentive programs can be particularly appealing to foreign investors, as it provides a direct financial benefit and encourages the expansion of their global reach.

QuickBooks Owner Investment: Where Does Cash Fit?

You may want to see also

Regulatory Framework: Legal and regulatory considerations for piggybacking in FDI

The concept of piggybacking, in the context of foreign direct investment (FDI), involves a host country allowing a foreign investor to access its market or resources through an existing investment or partnership. While this approach can facilitate FDI, it also presents unique legal and regulatory challenges that need to be carefully navigated. This is especially true when considering the potential for abuse, the protection of domestic industries, and the enforcement of environmental and labor standards.

In many countries, the legal framework for FDI is designed to attract foreign capital while also ensuring that the host country's interests are protected. For piggybacking, this means that the host country's regulations must be flexible enough to accommodate the unique nature of this investment strategy while also providing a clear and consistent set of rules for all investors. This often involves a detailed understanding of the specific industries and partnerships involved, as well as the potential impact on the local economy and society.

One key consideration is the legal status of the piggybacking arrangement. In some cases, it may be treated as a subsidiary or extension of the primary investment, while in others, it could be considered a separate entity. The classification can significantly impact the regulatory obligations, including tax, labor, and environmental laws. For instance, if the piggybacking arrangement is treated as a separate entity, it may be subject to different regulations compared to the primary investor, which could affect the overall investment strategy.

Environmental and social regulations are also critical in the FDI context. Piggybacking projects may have unique environmental impacts or social considerations that need to be addressed. The host country's regulations should provide a clear framework for assessing and managing these impacts, ensuring that the investment contributes positively to the local community and environment. This might involve specific permits, impact assessments, and compliance monitoring.

Finally, the enforcement of regulations is essential to ensure that piggybacking arrangements adhere to the legal and ethical standards set by the host country. This includes mechanisms for monitoring, reporting, and addressing any non-compliance. Effective enforcement not only protects the host country's interests but also maintains investor confidence, which is crucial for attracting FDI. Therefore, a robust regulatory framework should be accompanied by a well-resourced and efficient enforcement system.

Cash Flow Notes: A Smart Investment Strategy

You may want to see also

Market Access: Piggybacking's role in providing foreign investors with market entry

Piggybacking, a form of shared hosting, plays a significant role in facilitating market access for foreign investors, especially those looking to enter new markets. This method allows multiple websites or applications to share the resources of a single server, providing an affordable and efficient way to establish an online presence. For foreign investors, this can be a crucial strategy to gain a foothold in a new market without the hefty initial costs associated with setting up their own infrastructure.

When a foreign investor piggybacks, they essentially rent server space from a hosting provider, sharing it with other websites. This arrangement is particularly beneficial for small and medium-sized enterprises (SMEs) that might not have the financial resources to invest in their own data centers. By doing so, they can focus their efforts on developing their core business offerings while leveraging the existing infrastructure to establish a presence in a new market.

The primary advantage of piggybacking for market entry is the cost-effectiveness. Traditional methods of setting up a local server and data center can be prohibitively expensive, especially for foreign investors who are not yet familiar with the local market dynamics. By sharing resources, investors can significantly reduce their initial investment, making it more feasible to enter new markets. This is particularly important for startups and SMEs, who often have limited capital and rely on strategic partnerships to expand their reach.

Moreover, piggybacking provides a level of flexibility and scalability. As the investor's business grows, they can easily upgrade their hosting plan to accommodate increased traffic and data storage needs. This adaptability is crucial in the fast-paced digital landscape, where market conditions and consumer behavior can change rapidly. With a piggybacking strategy, investors can quickly respond to market demands without the long-term commitments and costs associated with traditional hosting models.

In addition, piggybacking often comes with built-in security and performance enhancements. Reputable hosting providers offer robust security measures, regular backups, and performance optimization tools. These features are essential for maintaining a reliable and secure online presence, which is critical for building trust with local customers and partners. By leveraging these services, foreign investors can ensure their market entry is smooth and secure, contributing to a successful and sustainable business expansion.

Cash Investments: What Does "I Invest in Cash" Mean?

You may want to see also

Risk Mitigation: How piggybacking reduces risks for foreign investors in new markets

Piggybacking, a strategic approach to market entry, offers a unique and effective method for foreign investors to mitigate risks when venturing into new and unfamiliar territories. This concept involves leveraging the existing infrastructure, resources, and local connections of a host company to gain a foothold in a new market, rather than starting from scratch. By doing so, foreign investors can significantly reduce the risks associated with direct investment in foreign markets.

One of the primary risks in foreign direct investment (FDI) is the lack of local knowledge and understanding of the market dynamics. Piggybacking addresses this challenge by providing a local partner or a host company that has already established a strong presence and a deep understanding of the market. This local partner can offer valuable insights into consumer behavior, cultural nuances, and regulatory requirements, which are essential for a successful market entry. Through this collaboration, foreign investors can avoid costly mistakes and reduce the risk of misinterpreting local preferences and regulations.

Additionally, piggybacking allows foreign investors to benefit from the host company's established supply chain and distribution network. This is particularly crucial in industries where logistics and distribution are complex and costly. By piggybacking, investors can quickly access these networks, ensuring their products or services reach the target market efficiently. This strategic move minimizes the risk of supply chain disruptions and reduces the time and resources required to establish a robust distribution system from scratch.

Another significant risk in FDI is the potential for cultural and political misunderstandings. Piggybacking helps mitigate this risk by providing a local partner who can act as a cultural bridge. These partners can facilitate effective communication, ensuring that business practices and strategies are aligned with local customs and expectations. Moreover, local partners can navigate political landscapes, helping foreign investors understand and comply with any political or regulatory changes that may impact their operations.

Furthermore, piggybacking can provide a safety net for foreign investors in terms of financial and operational risks. By sharing resources and expertise, the host company and the foreign investor can collectively manage financial risks, such as currency fluctuations and market volatility. This collaborative approach also enables a more efficient allocation of resources, reducing the operational risks associated with market entry.

In summary, piggybacking is a powerful risk mitigation strategy for foreign investors looking to enter new markets. It provides a structured and informed approach, leveraging local knowledge, established networks, and cultural understanding. By partnering with a host company, foreign investors can navigate the complexities of foreign markets, reduce risks, and increase the likelihood of a successful and sustainable investment. This method is particularly valuable for industries where market entry barriers are high and local expertise is essential for long-term success.

Investing Activities: Do Cash Flows Stay Positive?

You may want to see also

Frequently asked questions

Piggybacking is a term used in the context of international business and investment, where a company or individual leverages the success and established market presence of another company to gain a competitive advantage or access to a new market. It often involves acquiring a smaller company that has a strong brand or customer base, allowing the acquirer to benefit from the existing infrastructure and resources without building them from scratch.

Piggybacking can be a strategic approach for foreign direct investment (FDI). When a company piggybacks on another's success, it may lead to FDI as the acquiring company invests in the target company's assets, operations, or market presence. This form of investment can be direct when the acquiring company establishes a physical presence, owns a significant stake, or has a substantial influence on the target company's operations in the foreign market.

Yes, piggybacking offers several benefits for foreign investors. It provides a faster and more efficient way to enter a new market, especially if the target company has already established a solid customer base and brand recognition. This approach can reduce the risks and costs associated with building a business from the ground up, as the acquiring company can leverage the existing infrastructure and gain a competitive edge.

An example could be a technology startup acquiring a smaller software company with a popular app in a foreign market. The startup benefits from the app's user base and market presence, allowing them to rapidly expand their customer reach and avoid the challenges of developing a similar product independently. This strategic move can lead to direct foreign investment as the acquiring company integrates its operations and resources into the target company's existing infrastructure.