Whether an investment is a debit or a credit has been a source of confusion for many investors. In accounting, a debit is an entry on the left side of an account ledger that increases assets or expenses and decreases liabilities, equity, or revenues. On the other hand, a credit is an entry on the right side of an account ledger that increases liabilities, equity, or revenues and decreases assets or expenses. In double-entry bookkeeping, every financial transaction affects at least two accounts, with debits and credits ensuring that the accounting equation—assets = liabilities + equity—remains balanced.

In the context of investments, it is generally considered a debit because it is an asset to the investor, who could be an individual or a business. When an individual or firm purchases an investment, the intent is not for immediate consumption but rather to utilise it in the future for wealth creation. Therefore, an investment involves the outlay of some resources, such as time, effort, money, or an asset, with the expectation of a greater payoff in the future.

| Characteristics | Values |

|---|---|

| Definition of debit | An accounting entry that results in either an increase in assets or a decrease in liabilities on a company's balance sheet |

| Definition of credit | An accounting entry that increases liabilities or revenue and reduces assets or expenses |

| Placement in journal entry | All debits are placed as the top lines, while all credits are listed on the line below debits |

| Placement in T-accounts | Debit is on the left side of the chart while credit is on the right side |

| Placement in double-entry bookkeeping | All debits are made on the left side of the ledger and must be offset with corresponding credits on the right side of the ledger |

| Placement on the balance sheet | Assets usually have a debit balance and are shown on the left side. Liability accounts and owners' equity accounts typically have a credit balance and are shown on the right side |

| Cash investment | If an individual or business invests in anything, it is equivalent to purchasing a physical asset, so it is a debit |

What You'll Learn

Cash investments are a debit entry as they are assets to the investor

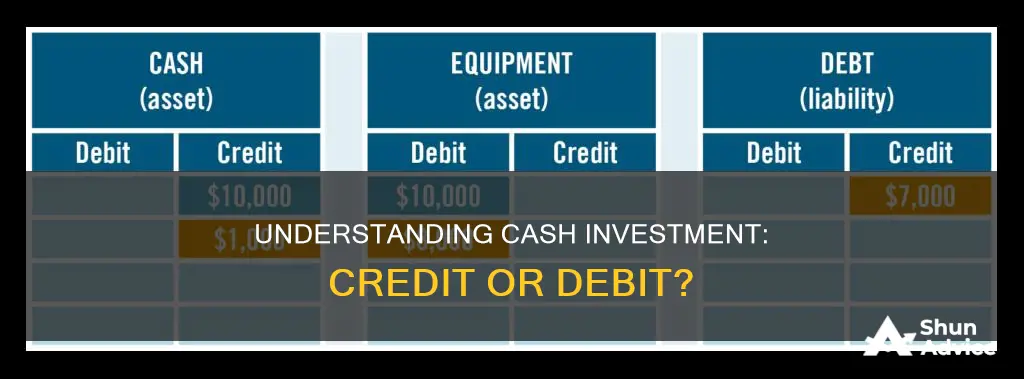

When an individual or business makes an investment, they are acquiring an asset that they hope will generate income in the future. This could include purchasing shares, bonds, or investing in education to improve their skills and increase their earning potential. In this context, the investment is the asset, and the cash used to make the investment is the liability. Therefore, the investment account is debited, and the cash account is credited.

For example, if an individual invests $10,000 in stocks, the investment account is debited by $10,000, and the cash account is credited by the same amount. This reflects the fact that the individual's assets have increased by $10,000 worth of stocks, while their cash on hand has decreased by the same amount.

The concept of debits and credits is fundamental to double-entry bookkeeping, where every financial transaction affects at least two accounts. This system ensures that the accounting equation (assets = liabilities + equity) remains balanced, providing a clear and accurate picture of a business's financial position. By using debits and credits, accountants can track the flow of money and assets, ensuring that the business's books are balanced at the end of each period.

In summary, cash investments are considered a debit entry because they represent an increase in the investor's assets. This is a fundamental principle of accounting, helping businesses and individuals track their financial transactions and maintain accurate records.

Cash Flow Notes: A Smart Investment Strategy

You may want to see also

A debit increases expenses, assets, and dividends

In accounting, a debit is an entry made on the left side of a ledger that increases expenses, assets, and dividends. It is the opposite of a credit, which is an entry made on the right side of a ledger that increases liabilities, revenues, and equity. Debits and credits are fundamental to double-entry bookkeeping, ensuring that a company's financial records and reports are accurate and comply with accounting standards.

When a company makes a sale, it debits its cash account and credits its sales revenue account. For example, if a company sells $20,000 worth of books, it would debit its cash account by $20,000 and credit its books or inventory account by the same amount. This double-entry system shows that the company's cash has increased and its inventory has decreased by the same amount.

In the context of expenses, a debit increases an expense account in the income statement. For example, if a company pays $3,000 in rent, it would debit its rent expense account and credit its cash account. This records the increase in expenses and the decrease in cash.

Assets are also increased by debits. For instance, if a company purchases $10,000 worth of equipment with cash, it would debit the equipment account (an asset account) and credit the cash account. This reflects the increase in equipment (an asset) and the decrease in cash (also an asset).

Dividends are another type of account that is increased by debits. Dividends are a portion of a company's profits that are paid out to shareholders. When dividends are paid, the retained earnings account (an equity account) is debited, and the dividend account is credited. This records the decrease in equity and the increase in dividends.

To summarise, a debit increases expenses, assets, and dividends, while a credit increases liabilities, revenues, and equity. These fundamental principles of accounting ensure the accuracy and integrity of financial statements, providing a clear picture of a company's financial position.

Transferring Cash to Fidelity Investments: A Step-by-Step Guide

You may want to see also

A credit increases liabilities, equity, and revenues

In accounting, a credit is an entry made on the right side of a ledger. It increases liability, equity, or revenue accounts and decreases asset or expense accounts. Credits are the opposite of debits, which are entries made on the left side of a ledger and increase assets or expenses and decrease liabilities or equity.

Credits and debits are equal but opposite entries in accounting. For every debit, there must be a corresponding credit to balance it out. This is known as double-entry bookkeeping, which is the foundation of accurate accounting. The accounting equation, assets = liabilities + equity, must always be balanced.

Increasing Liabilities

When a company buys inventory on credit, it debits the inventory account and credits the accounts payable account (the liability). The credit increases the liability, reflecting the company's obligation to pay for the inventory.

Increasing Equity

When a company posts a profit, it credits a retained earnings account (equity). This credit increases the equity account, reflecting the company's increased ownership value.

Increasing Revenues

When a company sells goods or services, it credits the sales revenue account. This credit increases the revenue account, reflecting the income earned from the sale.

In summary, credits play a crucial role in accounting by increasing liabilities, equity, or revenues and decreasing assets or expenses. They help maintain the accuracy and integrity of financial statements, ensuring that the accounting equation remains balanced.

Investments, Cash Flows, and the Impact of Gains

You may want to see also

A credit entry increases liability, revenue, and equity accounts

In accounting, a credit entry increases liability, revenue, and equity accounts. This is in contrast to a debit entry, which increases assets or expenses and decreases liabilities, revenue, and equity.

Credits and debits are the two sides of every financial transaction recorded in an accounting system. They are recorded in two columns in a ledger, with credits on the right and debits on the left. In every transaction, the total debits must equal the total credits to keep the accounting equation balanced: assets = liabilities + equity. This equation reflects that everything a company owns (assets) is financed either by borrowing (liabilities) or by investments from owners (equity).

- Increase in accounts receivable: When a company sells goods or services on credit, the customer's account receivable increases. This is recorded as a credit to the accounts receivable account.

- Decrease in accounts payable: When a company pays a bill, its accounts payable decrease. This is recorded as a credit to the accounts payable account.

- Increase in revenue: When a company sells goods or services, it records revenue. This is registered as a credit to the revenue account.

- Decrease in expenses: When a company incurs an expense, it reduces its expenses. This is recorded as a credit to the expense account.

Credits and debits are not inherently "positive" or "negative". Instead, they represent account changes based on predefined accounting rules. Understanding how these movements affect a company's financial statements is crucial for informed decision-making, compliance, and maintaining stakeholders' trust.

Investing: Negative Cash Flow's Impact and Insights

You may want to see also

A debit entry is made on the left side of an account ledger

A debit increases assets or expenses and decreases liabilities or equity, showing how a company uses its resources. In other words, a debit entry creates a decrease in liabilities or an increase in assets.

In a standard journal entry, all debits are placed as the top lines, while credits are listed below. When using T-accounts, a debit is on the left side of the chart, and a credit is on the right.

For example, if a company receives $5,000 in cash from a sale, it debits cash (the asset) and credits sales revenue. The company's cash assets increase, while its sales revenue decreases.

In double-entry bookkeeping, all debits must be offset with corresponding credits to maintain the integrity of financial statements. This ensures that the accounting equation—assets = liabilities + equity—remains balanced.

Cash Flow and Investing: What's the Real Relationship?

You may want to see also

Frequently asked questions

A debit is an accounting entry that results in either an increase in assets or a decrease in liabilities on a company's balance sheet. A credit increases liabilities or revenue and reduces assets or expenses, reflecting incoming value or new obligations.

Investments are assets that an enterprise holds for earning income by way of dividends, interests, and rentals, for capital appreciation as well as other benefits to the enterprise.

Investment is a debit and not a credit entry. This is because investment is an asset to the investor. So, if one makes an investment with the hope of generating higher returns in the future, the investment account will be debited while the cash account or bank account will be credited.